Avalanche in the 4th quarter of 2023

1. What is Avalanche?

Avalanche is a Layer 0 blockchain where developers can build decentralized applications and deploy other blockchain networks.

What is Avalanche?

2. Overview

Avalanche experienced remarkable growth in Q4. Specifically, market capitalization increased by 344%, revenue by 2,874%, daily average transactions by 182%, DeFi Total Value Locked (TVL) by 78%, daily average DEX volume by 245%, and daily average NFT volume by 1,490%. Avalanche emerged as a leading platform for Inscription, resulting in quarterly revenue reaching $56.5 million, an all-time high. Daily transactions on Subnets increased by 48% in Q4, partly due to the launch of new Subnets like Beam and Hubble Exchange. J.P. Morgan and Citi are building on Evergreen Subnets, potentially enhancing future enterprise adoption. The Avalanche Codebase accelerator program for projects on Avalanche commenced in November and concluded on February 12, 2024.

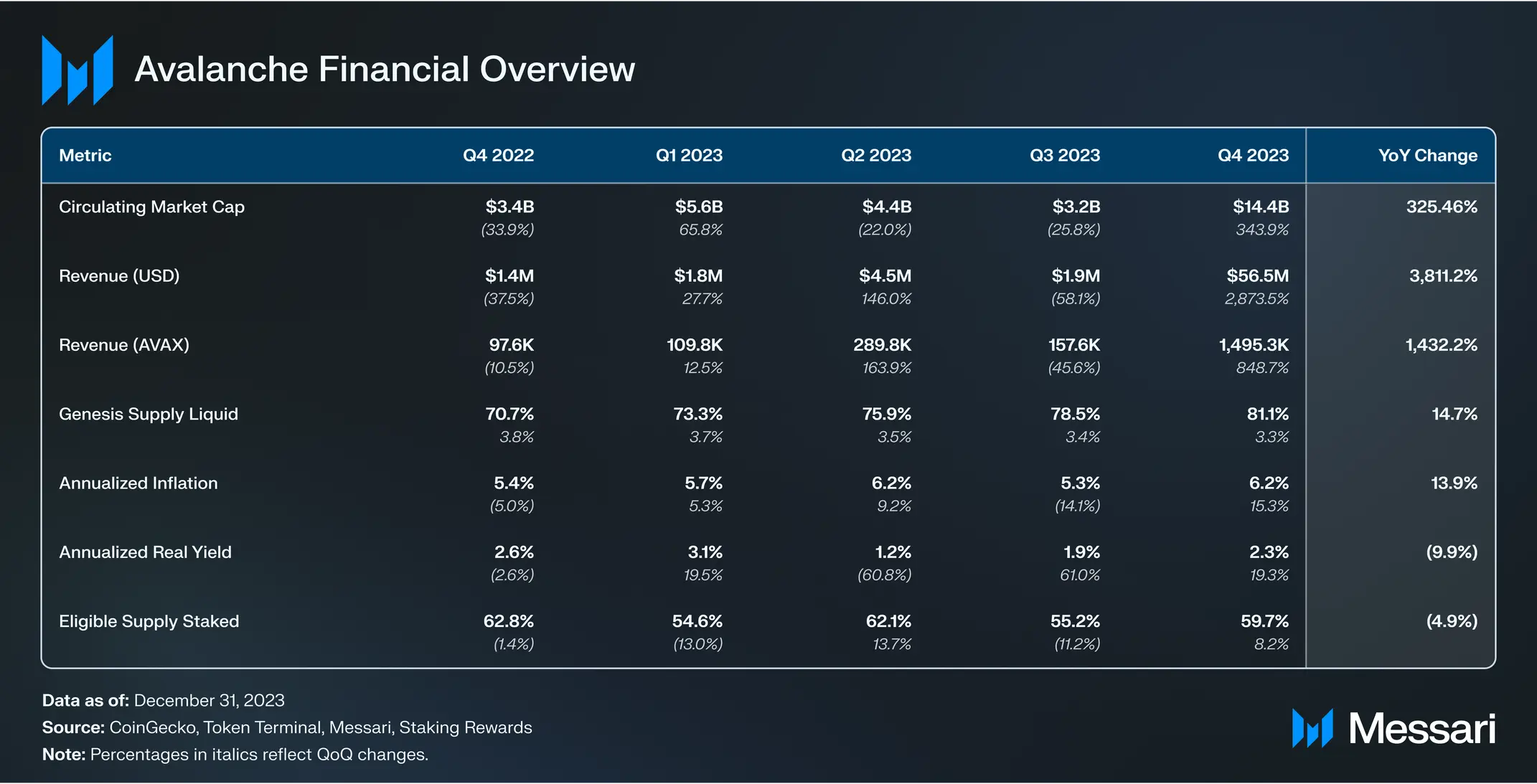

3. Financial Overview

Avalanche's financial overview in 2023

AVAX's market capitalization reached $14.4 billion in 2023.

In the last quarter, AVAX performed as one of the best-performing tokens among large-cap tokens in the crypto market recovery phase. By the end of 2023, AVAX's market cap reached $14.4 billion, up 344% quarterly and 326% annually. By the end of Q4, AVAX's market capitalization rank rose 11 places from 20th to 9th. Revenue, including all gas fees collected, significantly surpassed AVAX's market capitalization growth, increasing by 849% QoQ from 157,600 AVAX to 1.5 million AVAX. In USD terms, this difference is even clearer as quarterly revenue increased by 2,874% from $1.9 million to $56.5 million. Similar to many other Layer 1 networks, Avalanche witnessed a surge in revenue due to Inscription. Inscription is calldata sent in a transaction. Inscription began appearing on Avalanche in November. From November 19 to November 23, Avalanche generated $2 million in revenue, primarily due to Inscription. Even after this surge, Inscription still hadn't fully appeared on Avalanche until December. From December 14 to December 22, Avalanche generated $47.9 million in revenue. December 20 marked Avalanche's highest daily revenue ever, reaching $10.6 million. Overall, during these 9 days, the network's revenue accounted for 85% of the revenue for the entire Q4. All revenue on Avalanche is burned. Instead, validators and stakers receive rewards in newly minted tokens.

4. Chain Overview

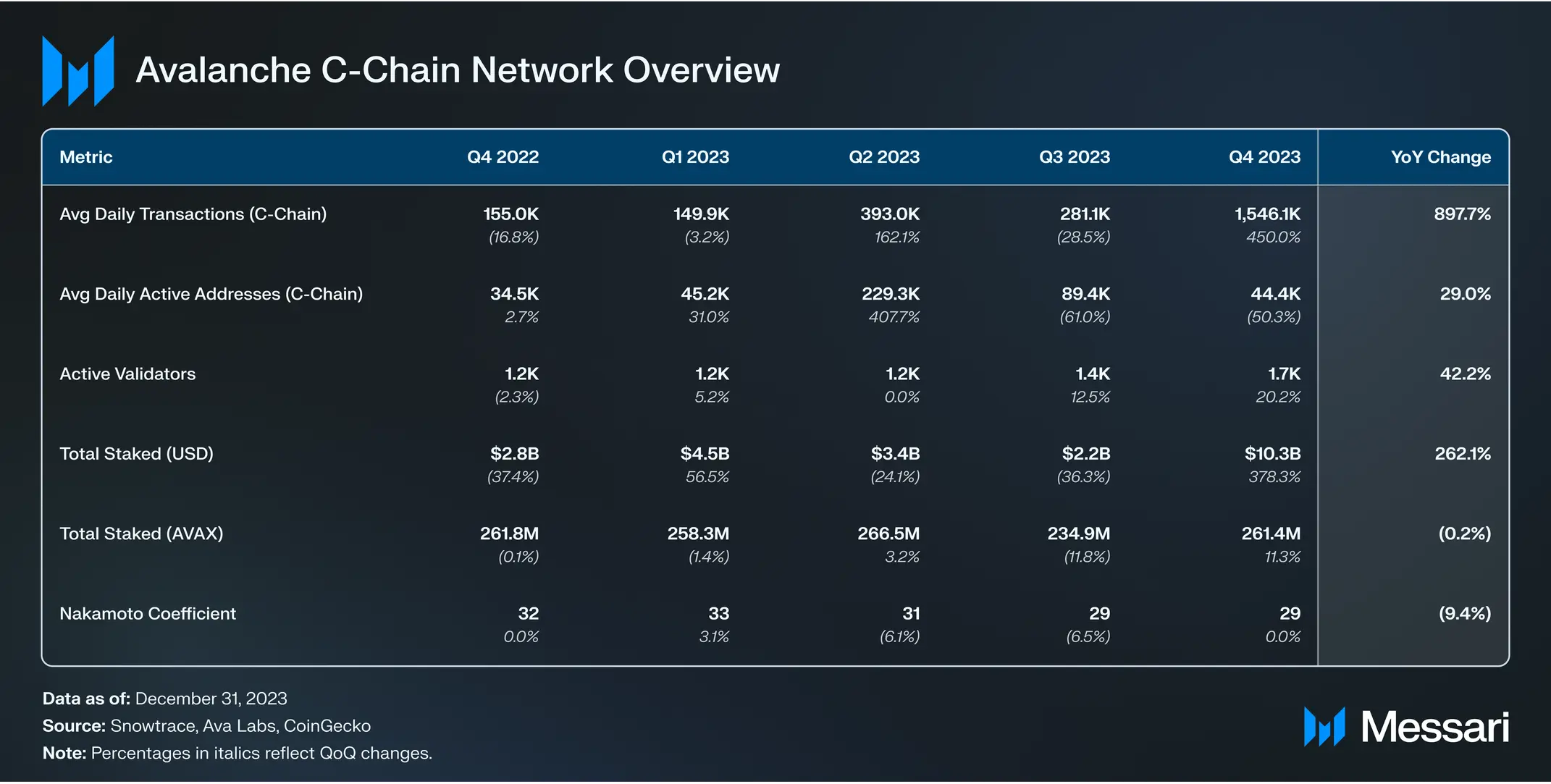

4.1. C-Chain

Overview of C-Chain, Avalanche

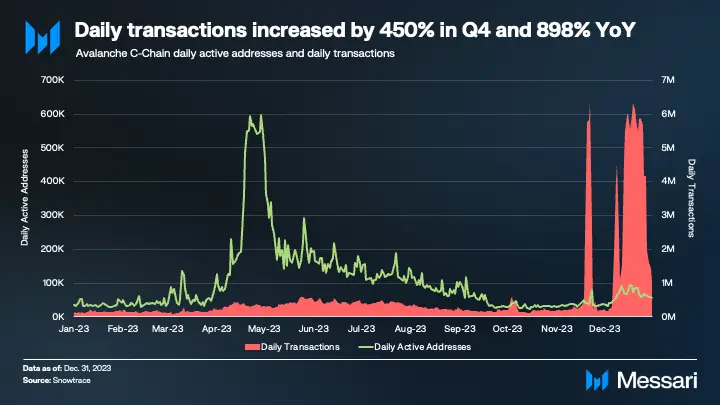

Avalanche's daily transaction volume increased 450% in the fourth quarter

The daily transaction volume on Avalanche surged in Q4, mainly due to the emergence of Avascriptions. C-Chain reached an all-time high of 6.3 million transactions on November 22, surpassing the previous all-time high of 1.1 million on January 27, 2022. Out of these 6.3 million transactions, nearly 6.1 million were inscription transactions. Additionally, in December, C-Chain averaged 3.4 million transactions per day, the highest to date.

Although the number of transactions increased, the daily active addresses on C-Chain decreased by 50% quarterly from 89,400 to 44,400. This is mainly due to decreased LayerZero activity. In Q2, increased activity on Avalanche and other networks could have been driven by user activity "airdropping" on LayerZero.

4.2. Technical Development

Avalanche released a series of upgrades for validators in Q4, including:

Cortina 12 (10/10) - Consensus optimization, dual-alpha support, and configurable MerkleDB branch factors.

Cortina 13 (17/10) - Memory optimization in MerkleDB path creation and added preloading interface.

Cortina 14 (26/10) - Validator management redesign, PebbleDB deployment addition, and optimization improvements.

Cortina 15 (1/11) - Testing support for PebbleDB and memory optimization.

Cortina 16 (22/11) - Optional indexing for C-Chain transactions and Subnet tracking improvements.

Cortina 17 (1/12) - Fixed synchronization errors related to C-Chain, improved wallet-related speeds, and added Avalanche Warp Messages (AVM) verification support on C-Chain.

4.3. Subnets

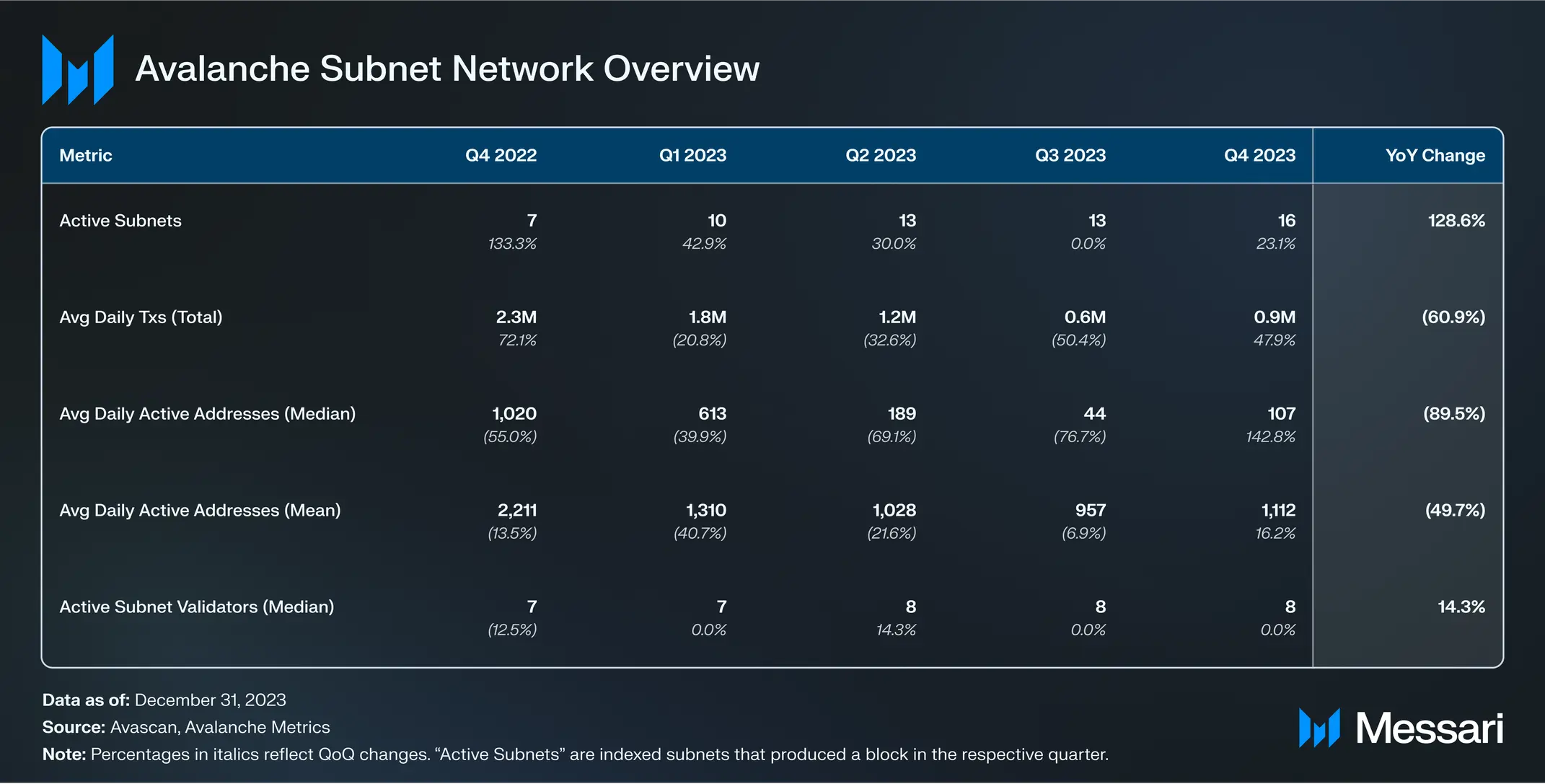

Overview of Avalanche Subnet

To participate in building on Avalanche, each Subnet must provide at least one validator for the Main Network (by staking 2,000 AVAX). To achieve consensus, each subnet uses from three to all P-Chain validators. In Q4, 16 indexed subnets created a block, including:

- Beam (Q4 Launch)

- Blitz (Q4 launch)

- Cloudverse (Q4 launch)

- DFK

- Dexalot

- Hubble Exchange (Q4 launch)

- Green Dot (Q4 launch)

- MELD

- NUMBERS

- ONIGIRI (Q4 Launch)

- PLAYA3ULL Games

- Shrapnel

- Step Network

- UPTN

- XANA

Subnets that were active in Q3 but not Q4 include Mintara and XPLUS.

5. Ecosystem Overview

Avalanche Ecosystem Overview in 2023

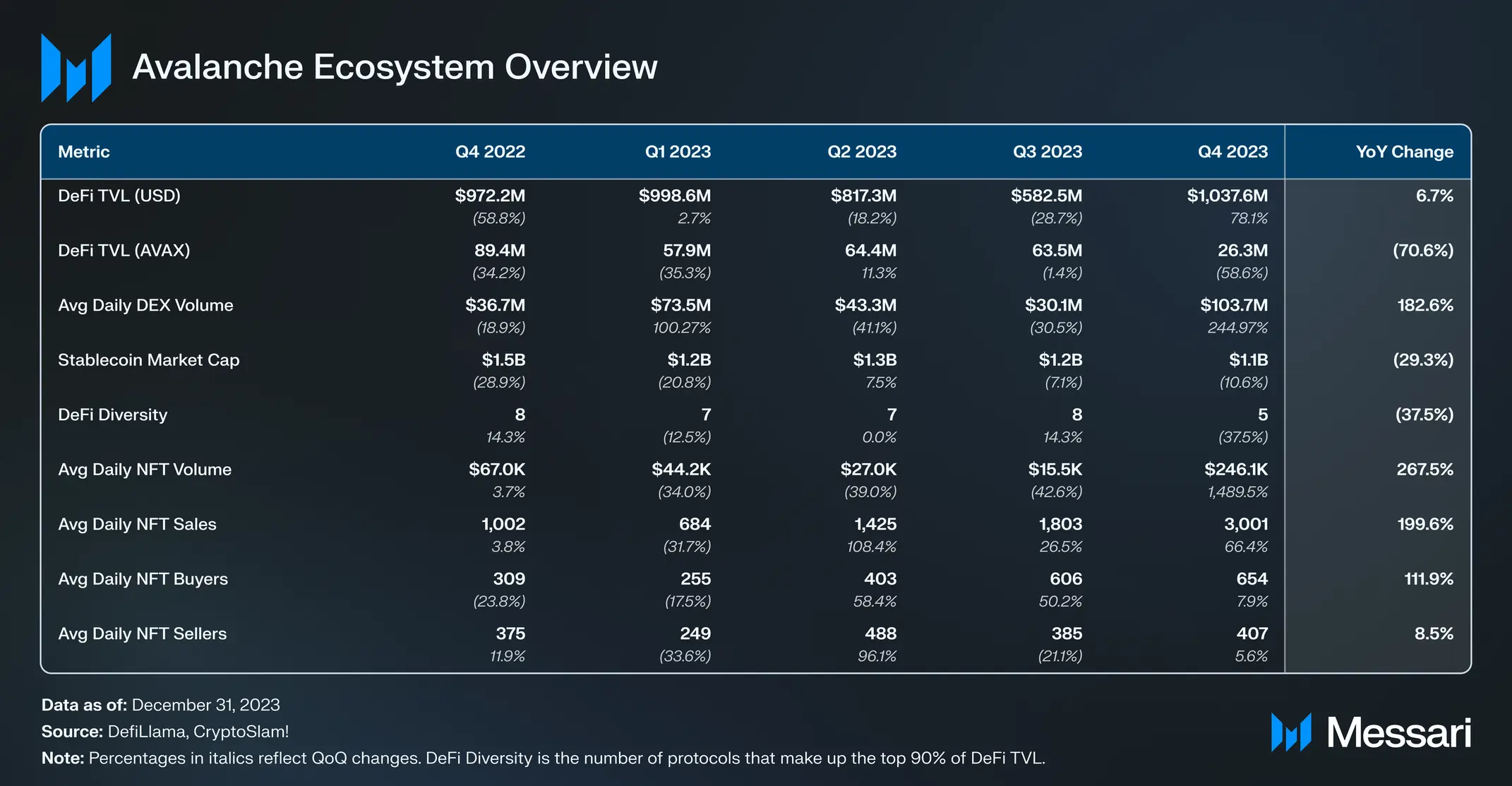

DeFi

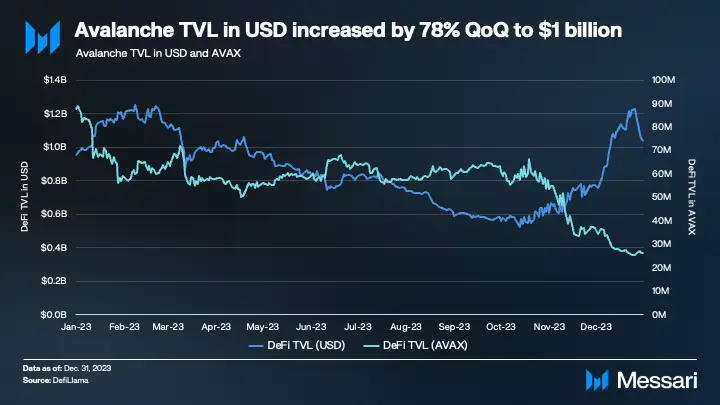

Avalanche's TVL increased by 78% in Q4

Avalanche's TVL in USD increased from $582.5 million in Q3 to $1.03 billion in Q4, a 78% increase quarterly. This propelled Avalanche to the 7th chain by USD TVL at the end of 2023. However, TVL measured in AVAX decreased by 71% from the previous quarter, from 63.5 million AVAX to 26.3 million AVAX. This indicates that the increase in TVL in USD was partly due to the increase in the price of AVAX.

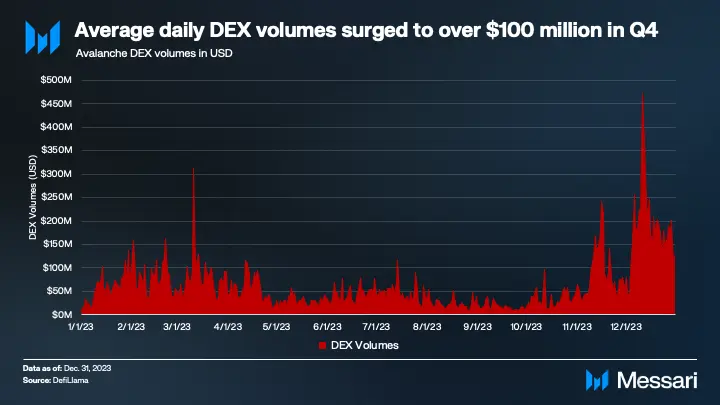

Daily DEX trading volume increased to $100M in Q4

Daily DEX volume increased in Q4, specifically by 245% quarterly from $30.1 million to $103.7 million after two consecutive quarters of decline. Throughout the year, daily DEX volume increased by 183% from $36.7 million. The top 5 DEX platforms by trading volume in Q4 were:

- Trader Joe - $6.84 billion (72% of Avalanche DEX volume)

- WOOFi - $1.01 billion (11% of Avalanche DEX volume)

- Uniswap - $438.6 million (5% of Avalanche DEX volume)

- Pangolin - $330.8 million (3% of Avalanche DEX volume)

- Dexalot - $291.7 million (3% of Avalanche DEX volume)

Business and RWAs

One of Avalanche's highlights in 2023 is bringing organizations and businesses into the network. In Q2, the Evergreen subnet launched, allowing anyone to create a subnet with customizable KYC/AML requirements and unique security capabilities. In Q4, Avalanche announced Evergreen-related partnerships such as:

J.P. Morgan: In November, J.P. Morgan announced that bank-led blockchain platform Onyx will use LayerZero to connect to the Evergreen Subnet. The collaboration is part of an initiative called Project Guardian - a partnership between the Monetary Authority of Singapore (MAS) and the financial industry.

Citi: Also in November, Avalanche announced that Citi was using licensed Evergreen subnets to execute foreign exchange swaps as part of Project Guardian. The subnet was built in collaboration with AvaCloud, a project that provides custom blockchain services. The application under construction can be used to trade any currency pair.

In addition to Evergreen, Republic launched Republic Note, a yield-sharing digital asset representing investments in more than 750 different companies, on INX Group's Avalanche-powered trading platform.

NFTs, Gaming and culture

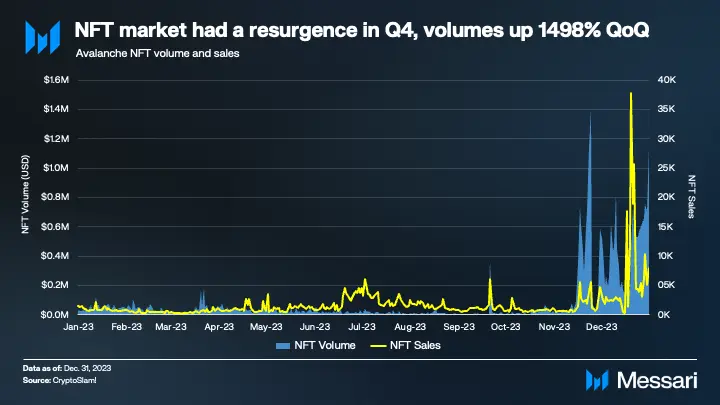

NFT trading volume on Avalanche increased 1498% in Q4

Avalanche's NFT market saw a resurgence in Q4, with related metrics improving markedly. Average daily NFT trading volume increased 1,498% quarter-on-quarter and 270% year-over-year to $247,400. Additionally, there has been impressive growth in both the number of sales and the number of people buying NFTs. Average daily sales increased 200% quarter-over-quarter from 1,800 to 3,000, while average daily buyers increased 112% from 606 to 654.

The biggest catalyst for Avalanche's NFT revival was the launch of Hyperspace, a multi-chain NFT marketplace. In October, the Avalanche Foundation announced an incentive program for Hyperspace, which will reward users of the marketplace with AVAX tokens. In the first season alone, more than 50,000 AVAX were rewarded to users.

The most popular NFT collection in Q4 was Dokyo. Dokyo NFTs achieved $13.6 million in sales in the fourth quarter, accounting for nearly 60% of Avalanche's fourth-quarter NFT volume ($22.8 million).

Q4 is also the time when Gaming on Avalanche thrives with notable events such as:

Merit Circle has launched a gaming-focused subnet on Avalanche called Beam.

Solert Games launches the Solert subnet on Avalanche with the aim of bringing various aspects of the Law of Kingdoms game to Play-to-Earn (P2E) mobile devices.

Mirai Labs launches Mirai subnet on Avalanche. Mirai Labs' full suite of products, including “F2E racing game Pegaxy, Petopia with new SocialFi esports-style integration, $PGX token, Mirai ID, Mirai App, and Mirai Pay.”

T1, a popular esports team has partnered with UPTN to launch NFT collectibles on the UPTN subnet.

Neon Machine has completed a $20 million Series A fundraising round to further fund the development of Shrapnel.

Tiltyard announced the launch of the Avalanche subnet to support the onchain mechanics of its upcoming strategy game Midnight Heist.

Q4 brought a “memecoin season” that took place across various networks. And Avalanche is no exception with many different memecoins, especially in December when the project announced a $100 million investment in memecoins.

Ecosystem growth

Avalanche continued to support and grow its ecosystem in Q4 through Codebase. This is a 12-week Accelerator program to support building early-stage Web3 projects on Avalanche.

A total of 15 different projects were selected for the program. Each selected project will receive a grant worth 50,000 USD and the opportunity to receive a prize from an investment fund worth 400,000 USD. In addition, projects will receive support, advice and services from partners such as:

Web2 Partners: Amazon Web Services (AWS), Google Cloud, Carta, deel and Brex.

Web3 Partners: Chainlink, Circle, Chainstack, OpenZeppelin, Fireblocks, BitGo and Biconomy.

February 12, 2024 is the deadline for developers to register. The winning projects will be announced on March 18.

6. Conclusion

Overall, Avalanche finished an impressive 2023 despite the prolonged downtrend market. This ecosystem has made progress on many fronts, from gaming, DeFi businesses, and many other fields.

Prominent gaming subnets such as DFK, Beam, and Shrapnel will increasingly drive Avalanche adoption in 2024. At the same time, Avalanche's partnership with J.P. Morgan and Citi are also contributing to greater corporate adoption and real-world growth of tokenized assets in the near term.

Avalanche Codebase played a key role in the growth of the Avalanche ecosystem in Q1, with winning projects to be announced in March.

English

English Tiếng Việt

Tiếng Việt