1. Overview of NFTs

1.1. What are NFTs?

NFT (Non-Fungible Token) is a unique type of digital asset that is represented and stored on a blockchain

NFTs can be understood as a type of "digital certificate" for artworks, videos, music, or even social media content. Unlike other cryptocurrencies like Bitcoin, which can be easily replaced and exchanged for value, NFTs are "non-fungible," meaning they cannot be equally replaced with another.

When you purchase an NFT, you are essentially buying the unique ownership of a digital version of an artwork. The information about the NFT is recorded on the blockchain, ensuring the accuracy and uniqueness of ownership, which anyone can verify.

1.2. Who created NFTs?

NFTs can be created by various entities or individuals, including creators, artists, collectors, and more. The process of creating an NFT is very simple and accessible, with NFTs coming from all walks of life. However, there are some prominent entities primarily involved in the creation of NFTs, including:

- Artists: Currently, artists are selling NFTs of paintings, drawings, photographs, or other visual media works on NFT marketplaces such as OpenSea or SuperRare.

- Musicians: Many musicians are leveraging NFTs to sell their music directly to fans.

- Celebrities: Numerous celebrities, from Paris Hilton to Snoop Dogg, have created NFT projects over the past two years.

- Game Developers: We are seeing many games and platforms selling in-game assets and characters as NFTs.

- Entrepreneurs: Many business owners and entrepreneurs are selling fractional ownership of assets through NFTs.

NFTs are created by various individuals and entities, contributing to the diversity and expansion of the NFT market. However, it's important to note that the creation of NFTs is not limited to platforms and celebrities. Anyone with access to blockchain technology can create and sell their own NFTs.

As a result, NFTs are continually evolving, opening up a world of opportunities for digital creators, photographers, musicians, and online game developers. NFTs are supported and traded on NFT marketplaces with stable liquidity, enabling creators and issuers of NFTs to profit from their products. Access to NFTs has become easier, allowing more people to benefit from investing in NFTs, which helps to further expand the NFT niche.

2. Benefits of Investing in NFTs

2.1. High profit potential

Many people are attracted by the high profit potential when investing in NFTs, and as the community of NFT investors grows, these profit opportunities increase. In fact, there have been several classic cases of successfully earning profits from NFTs, creating a significant wave of interest in this model. Specifically

CryptoPunks:

- CryptoPunks is a collection of 10,000 unique pixel art images representing punk-style characters.

- Many CryptoPunks have been sold for millions of dollars, with members of the blockchain community and celebrities participating in the purchases.

Beeple's "Everydays: The First 5000 Days":

- Beeple is a renowned artist in the NFT space, and his artwork 'Everydays: The First 5000 Days' was sold for $69 million in an auction at Christie's

Jack Dorsey's "Valuables":

- Twitter CEO Jack Dorsey sold his first tweet as an NFT through the Valuables platform.

- The tweet was purchased by an investor for $2.9 million.

Nyan Cat:

- The 'Nyan Cat' animated image has been sold as an NFT and fetched a significant amount in auctions.

However, it's important to note that the NFT market is highly risky and volatile. The value of NFTs can fluctuate rapidly based on market dynamics and changes in community interest. Investing in NFTs should be approached cautiously with a solid understanding of the risks and potential involved.

2.2. Blockchain technology provides high security

NFTs are created using blockchain technology, which helps mitigate risks such as hacking and theft by malicious actors. All NFTs are recorded on the blockchain, ensuring transparency regarding details like quantity, ownership, rarity, and more. Investors in NFTs can find reassurance in the security provided by this asset class.

2.3.Investing in NFTs does not require a large amount of capital.

Currently, investing in NFTs has become easier and notably does not require investors to commit large sums of money to own them. The value of NFTs varies widely, ranging from a few dollars to hundreds of thousands of dollars for different NFT collections. Users can choose an investment amount that suits their personal circumstances.

Moreover, you can also own NFTs with zero initial investment through programs like freeminting, airdrops, game testing, etc. These are investment opportunities with nearly zero risk, offering significant benefits to NFT investors. However, they require users to carefully monitor projects, actively participate in activities, and complete tasks from the projects.

2.4. Fractional ownership of physical assets

In reality, some assets in the physical world, such as artworks, real estate, and high-end jewelry, are difficult to divide and have extremely limited ownership. However, NFTs can serve as digital copies of these assets and can be easily fractionated. For instance, an artwork can be released in multiple smaller editions across the entire collection, or jewelry can be divided into multiple parts.

Digital technology expands the market for these types of assets, providing flexibility for users and stimulating price increases. NFT investors themselves can diversify their financial portfolios and establish suitable positions when participating in this investment category.

2.5. Benefits of Investing in NFTs

A trend among NFT collection issuers is to always attach additional benefits for their NFT holders. An NFT owner not only gains profit when the NFT appreciates in value but also receives additional perks from the project.

Some common benefits that NFT owners may receive include:

-

For NFT collections like PFP (Profile Picture) NFTs, holders typically have the rights to use the IP (image rights) associated with their NFTs for personal business endeavors.

-

NFT holders may receive a share of revenue generated by the project itself.

-

They also enjoy perks such as discounts on project-provided products, for example, travel vouchers or free movie tickets.

3.Risks of NFT investing

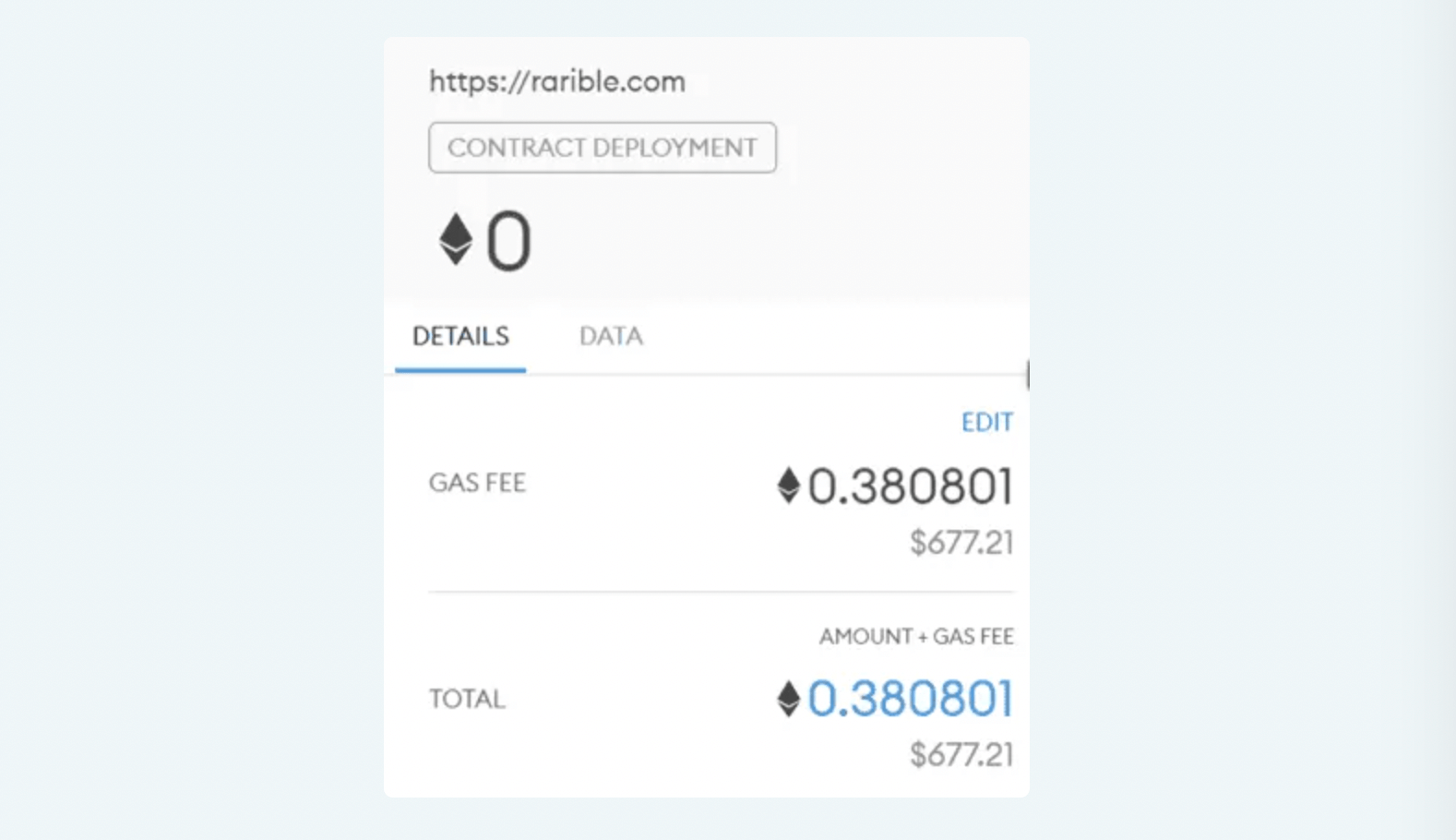

3.1. The cost of minting NFTs is very expensive

All NFTs are minted on blockchain networks, and the costs incurred by issuers to use these networks can be quite expensive.

For instance, creators or collectors wishing to mint NFTs on popular blockchains like Ethereum must pay a fee known as gas fees. In some cases, gas fees can be prohibitively high, making the investment risks in NFTs relatively high as well.

3.2. The NFT market is highly volatile

The cryptocurrency market itself is highly volatile due to its much smaller scale compared to traditional financial markets. Within this realm, the NFT market is a newly emerging subset, exhibiting even greater volatility.

It's not uncommon to witness NFTs skyrocketing in value by 3 or 4 times in just a few days or even hours. Conversely, many NFT collections can lose their entire value in minutes due to speculative trading. The market capitalization of NFTs is still small, making it susceptible to manipulation by large financial entities or individuals. These parties can directly influence NFT prices and the market, posing a risk of manipulation to small-scale investors.

3.3.High risk of fraud

With highly valuable NFT collections like CryptoPunks, BAYC, and others fetching tens of thousands of dollars per NFT, there's a significant risk of counterfeit copies being created and sold at lower prices. If buyers are unfamiliar with how to choose and transact NFTs on reputable platforms, they can easily fall victim to these fraudulent NFTs.

Moreover, there are bad actors who create NFT projects with the sole intention of "taking the money and running," without fulfilling any of the promises outlined in their roadmap or whitepaper. Once they attract some buyers who feel they've earned some profit, these creators may abandon the project, leading to a lack of liquidity and potential buyers for the NFT collection. As a result, investors can lose their entire investment.

3.4.NFT can impact the environment.

Because NFTs are created on blockchain, they can lead to environmental concerns. The issue stems from some blockchains using a method called 'proof of work' to verify smart contract transactions.

Operating the proof of work mechanism requires blockchain to consume a significant amount of energy, which can be harmful to the environment.

4. Notes when investing in NFTs for newbies

4.1. Research on the NFT Market

Before investing in NFTs, users must thoroughly research for NFTs operation, the minting process, popular trading platforms, and market trends. This is crucial to ensure investment decisions are based on accurate and detailed information.

4.2. Diversify your investment portfolio to reduce risks

Investing in NFTs is similar to any other type of investment; diversifying investments helps reduce the risk of loss with a specific asset type while optimizing profit opportunities.

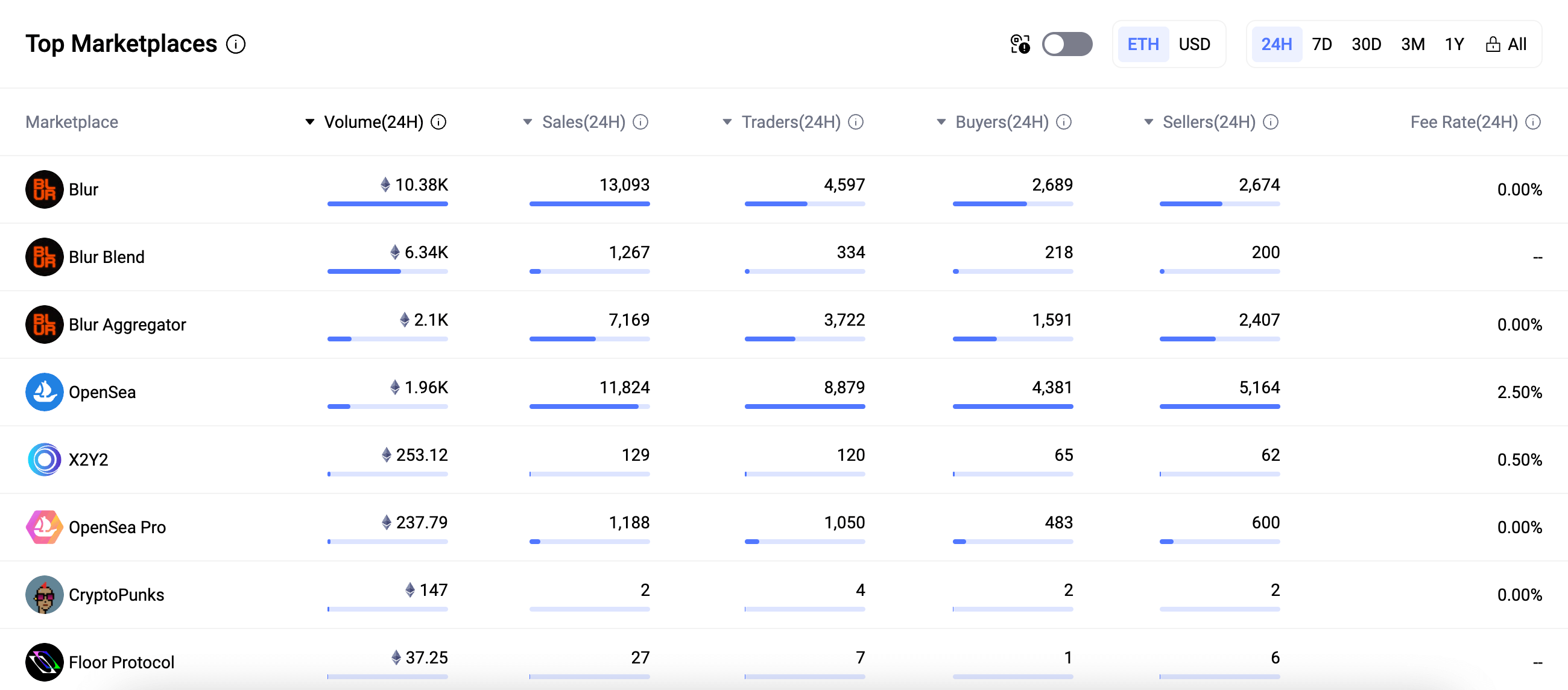

4.3. Choosing a reputable NFT exchange

Choosing to buy NFTs from reputable exchanges and established artists helps protect against fraud and counterfeit copies. Checking the provenance is crucial to ensure the accuracy and uniqueness of NFTs. Currently, some popular NFT trading platforms on blockchain networks provide good user support, such as Blur (Ethereum), Tensor (Solana), Hyperspace (Avalanche), and others.

4.4. Follow the market

Staying updated on trends and the latest information about the NFT market helps make informed decisions and understand how NFTs are impacting the digital art market.

4.5. Use a secure digital wallet to store NFTs

Using a secure digital wallet is crucial to safeguard passwords and authentication information. Protecting your wallet is essential to prevent asset loss, especially with NFTs.

It's important to know which types of wallets support the NFTs you own and make an appropriate choice. Once you've selected a storage wallet, learn how to maintain security and enhance wallet protection to avoid undesirable incidents such as hacking or private key exposure.

4.6. Understanding the Gas Fee mechanism and transaction fees when buying and selling.

Pay attention to gas policies and transaction fees when minting and purchasing NFTs, as they can impact your profitability. Optimizing costs ensures that your investments are not overly affected.

In cases where gas fees are pushed excessively high, sometimes peaking at $100-200 per transaction, you need to make appropriate decisions and strategies. You can choose to wait until gas fees stabilize or accept minting at higher fees to enhance competitiveness and transaction speed, seizing the opportunity to mint NFTs from a project. In summary, understanding gas mechanisms and transaction fee structures empowers you to make more informed investment decisions.

5. Conclusion

Investing in NFTs presents significant profit opportunities but also comes with considerable risks, especially for newcomers to the market. The creative factors and uniqueness of NFTs can generate impressive profits for developers and investors. However, it's essential to note that the market is highly volatile and can change over time, posing potential risks of losses if not swiftly adapted to.

The risks of investing in NFTs include uncertainty about value, potential financial loss, and security risks. To avoid these situations, continuous research and learning are crucial for making informed decisions. As a new investor, it's important to adhere to basic principles such as risk reduction through diversification and investing only what you can afford to lose.

Read more:

English

English Tiếng Việt

Tiếng Việt

.jpg)

.jpg)