1. NFTFI market overview

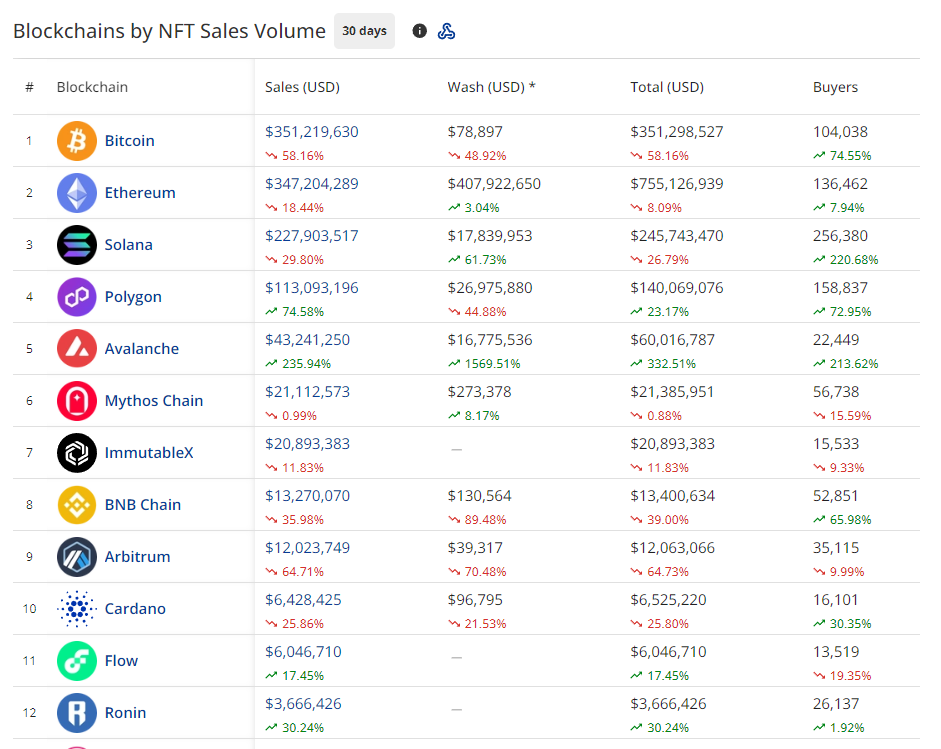

Regarding the general market in the past 30 days, it shows that the NFT trading volume on BTC is declining quite sharply since the explosion of NFT projects related to Scription. Up to now, the transaction volume has decreased by 58%, while Ethereum has not had too many changes with the total transaction volume only slightly decreasing by 8%.

As for Solana, it is showing signs that Wash Trading is quite large and is causing the trading volume on this platform to decrease by more than 26%. In contrast to Solana, we are seeing three emerging blockchains growing in transaction volume such as: Polygon, Avalanche and Ronin.

Especially for Avalanche, there is strong growth in AAA gaming projects, and for Ronin, the integration of large game projects like Pixel is leading to the number of users and cash flow being poured into this platform.

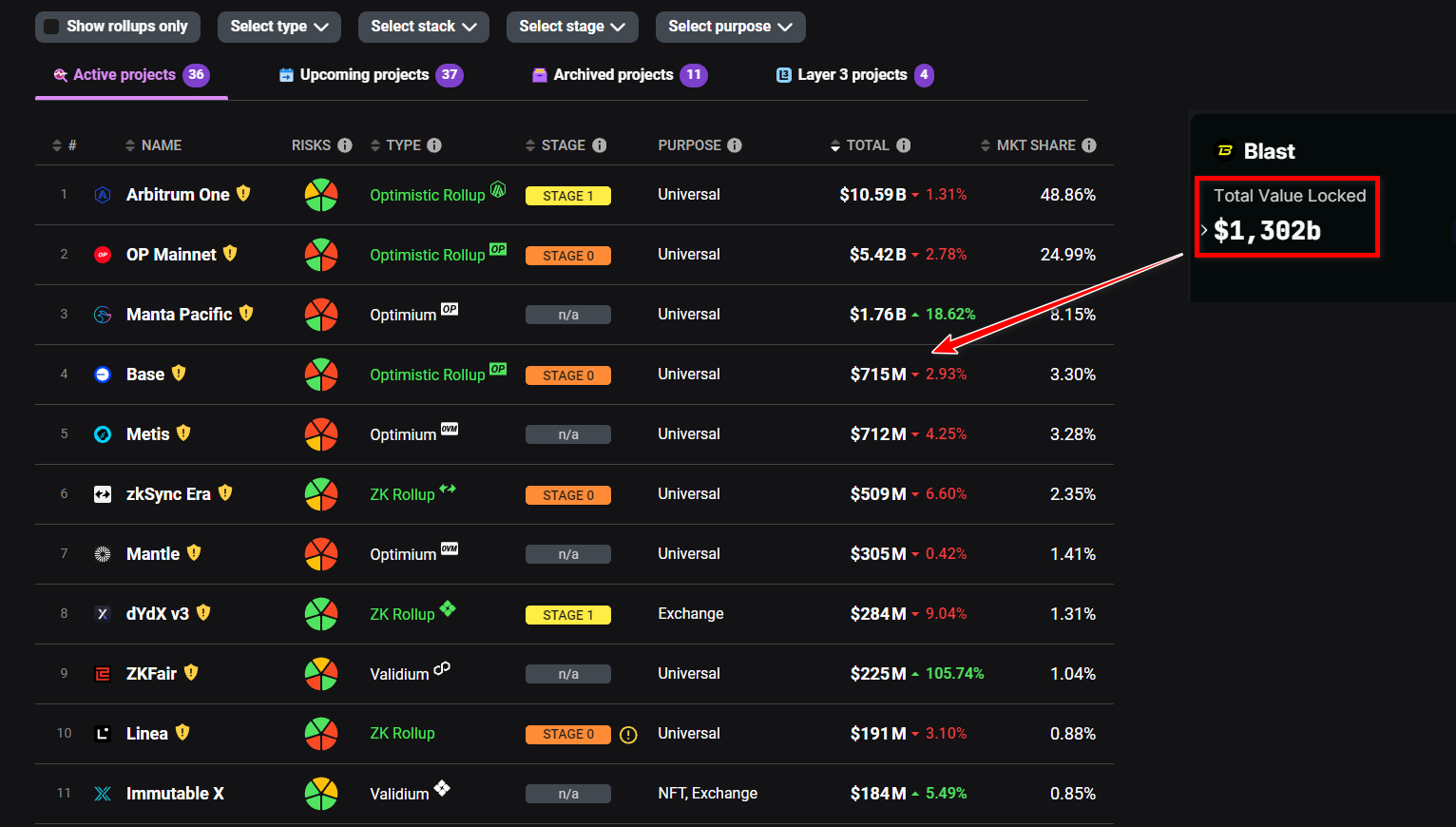

According to DefiLlama statistics, we see that the TVL market has returned to prosperity after a decline in August 2023, this is largely related to the event Blur launched the Blast platform , creating attraction on the market. The market and the project also grew strongly, helping the TVL of the project increase sharply and causing NFTFI projects to also grow stronger.

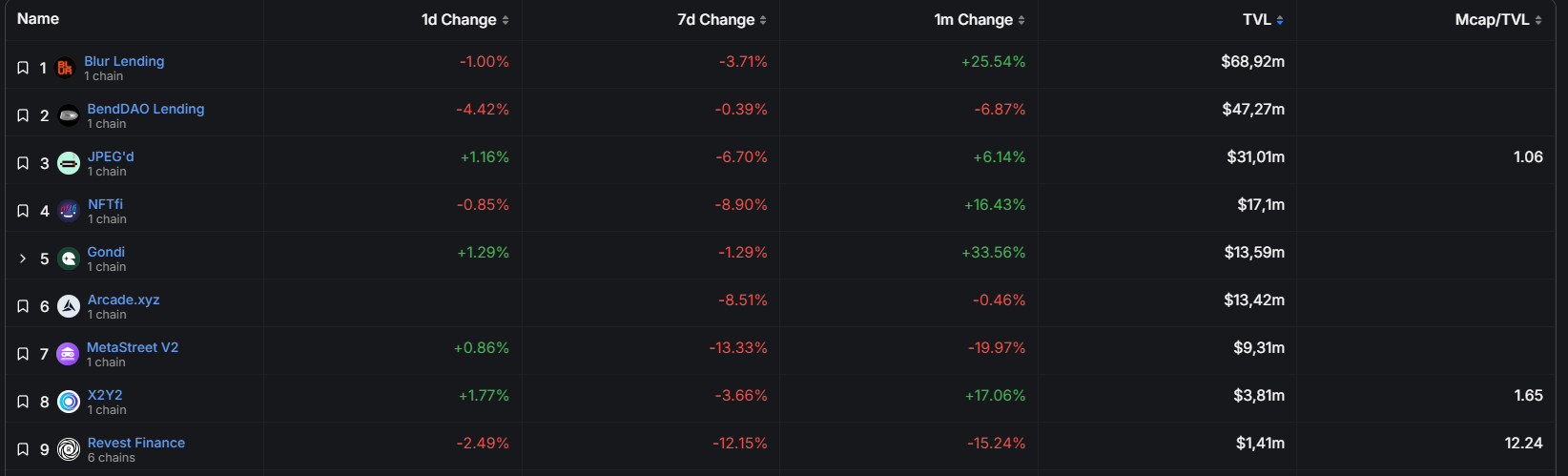

However, when looking at the TVL rankings of NFT lending projects on DefiLlama, we can easily see that most of the cash flow is concentrated in the top 5 projects including: Blur, BendDao, JPEG' d, NFTfi, Gondi account for 84% of the total TVL of the entire market.

This shows that the majority of cash flow is only strongly concentrated in top projects with reputations and proven products. In the current Lending segment, 3 projects: Blur, BendDao, JPEG'd are still the top leading projects and other projects have not had any special breakthroughs in the recent development period.

Up to now, Blur's Blast is the most potential project in the group of NFTFI projects at the current stage. It is expected that in the coming February, Blast will start airdropping tokens, so the number of users and the amount of ETH will increase. posted on the platform is extremely large, as of the time of writing TVL is reaching $1.3B. This is the largest number recorded among NFTFi-related projects to date.

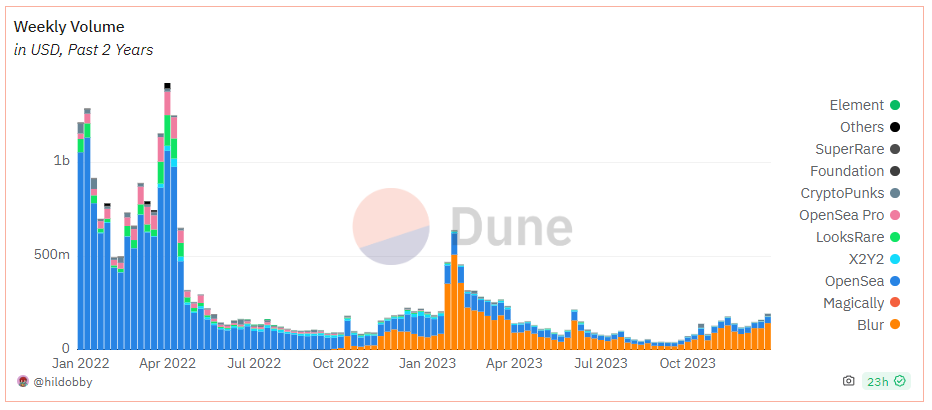

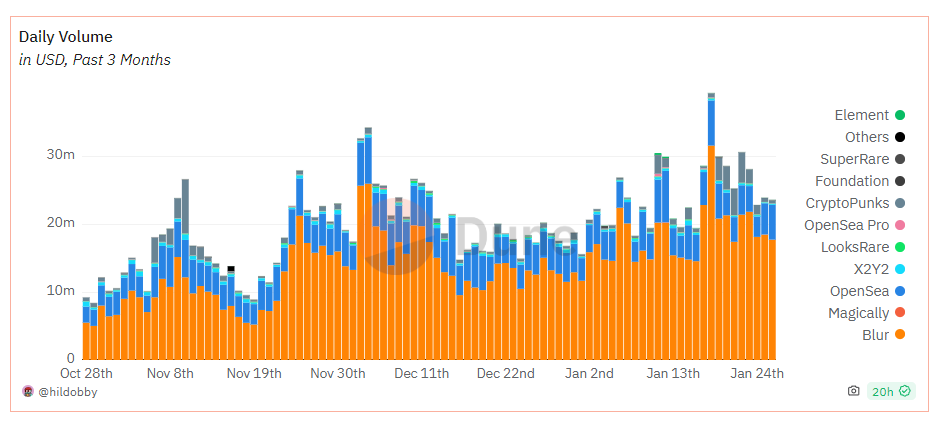

Looking at other contexts related to Marketplace platforms also shows that the NFTFi market is experiencing a slight recovery from late 2023 to early 2024. After the sharp decline of blue chip collections, trading volume suddenly decreased and continuously bottomed out in August, September, and October 2023.

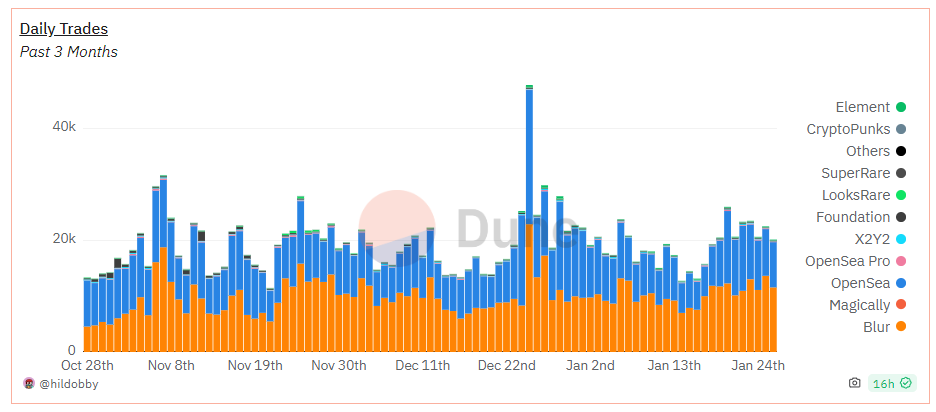

Currently, in the first months of 2024, there is a slight development in the 3 months of Q4 2023 and early 2024. The average monthly trading volume within the last 30 days is $200m, recovering nearly equal to 1/3 of the trading volume in June and July 2023.

The number of users is still divided equally between the two platforms Opensea and Blur and both of these platforms have almost 90% of the number of users compared to all other Marketplace platforms on the market.

2. New updates of NFTFI projects

2.1. Blur

Blur is considered the project with the most positive changes in the group of NFTFI projects. In addition to developing the marketplace, the project has had two outstanding updates: the Blend and L2 Blast platforms.

After its launch, Blur's Blend quickly dominated the Lending segment in the group of NFTFI projects, TVL was 2 times higher than BendDao ranked top 2 and accounted for 32.8% of the market.

For Blast, the TVL is $1.3B and if compared to current L2 projects on the market, it can rank in the top 4 on the rankings. However, Blast is currently only in the farming point stage similar to the way Manta was in the previous stage before its launch, so the current comparison is only relative.

We can see that Blur is still leading the NFTFI project niche and project changes or updates will create a positive impact on the NFTFI market.

2.2. BendDao

The last time BendDAO had product changes took place in July 2023 when BendDAO officially supported a new product, USDT, which meant that users could mortgage NFT to borrow USDT. Additionally, users can deposit USDT into the protocol to receive interest.

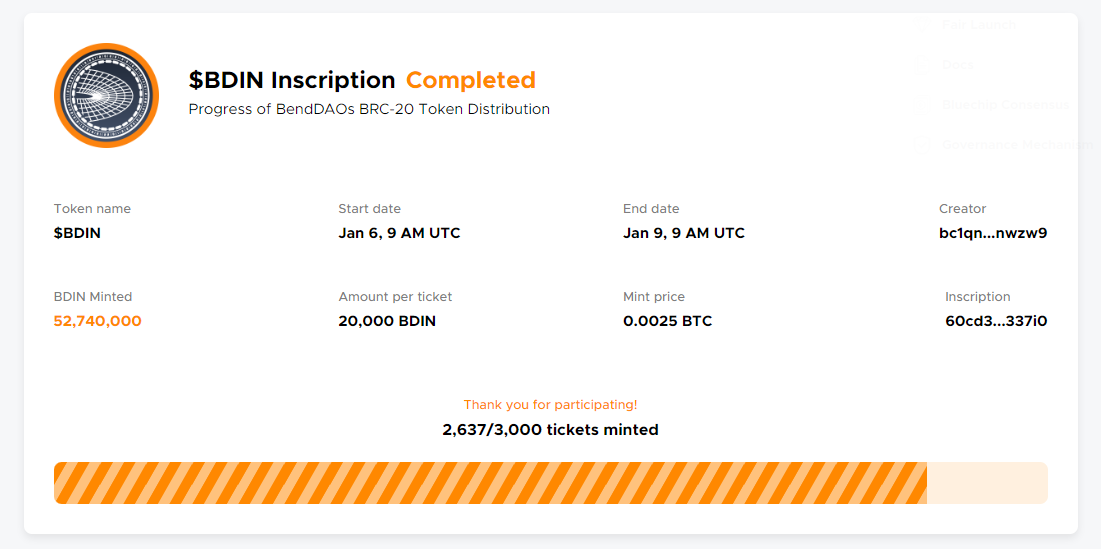

However, after launching the product, the NFTFI and NFT market officially entered a strong Downtrend, so despite bringing great attraction, the project is still under the general influence of the market. In the early days of January 2024, the project launched its new product marking its participation in the BTC Inscription market through the launch of BDIN.

Currently, the $BDIN token is traded on the Gate exchange and Inscriptions are traded on Okex Web3 and Unisat. The current price of BDIN is increased by x10 compared to the price in the mint round, however it is currently unclear what role $BDIN will play in BendDao's ecosystem.

In addition to BDIN, the project is making announcements about its V2 version and updating the roadmap in 2024. These will be good signs and are expected for the project ranked top 2 in the NFTFI Lending segment.

2.3. JPEG'd

For JPEG'd, there is not too much change in its product. The project continues to build its project according to the original roadmap, allowing users to mortgage NFTs to mint pETH. This also causes the token price and platform's attraction to decline quite sharply compared to other NFTFI projects on the market.

2.4. Flooring Protocol

Flooring Protocol is an emerging platform in the NFTFI market that allows users to purchase μTokens at a rate of 1/1000000 of the NFT Floor price. This contributes to increasing liquidity for NFT collections in the market, thereby solving liquidity problems during downtrend periods.

However, contrary to the positive liquidity issue for the market, the project has unintentionally created strong social pressure on Bluechip NFT collections supported on the platform. After being launched, a large number of users bought $FLC tokens, causing the price of $FLC to increase sharply by x2 x3 in a short time. After the price increased these people sold $FLC in exchange for μTokens representing Bluechip NFT sets and exchanged μTokens for BlueChip NFTs then sold immediately on Blur. This has caused the prices of NFT collections to drop sharply such as MAYC, BAYC, etc.

Currently, there have not been too many changes to the project in the current context, so the project's $FLC token price has not recovered too much. In addition, the token also includes trading pairs with μToken of Bluechip NFT projects, so there will be a lot of social pressure if the NFT price of these collections increases sharply.

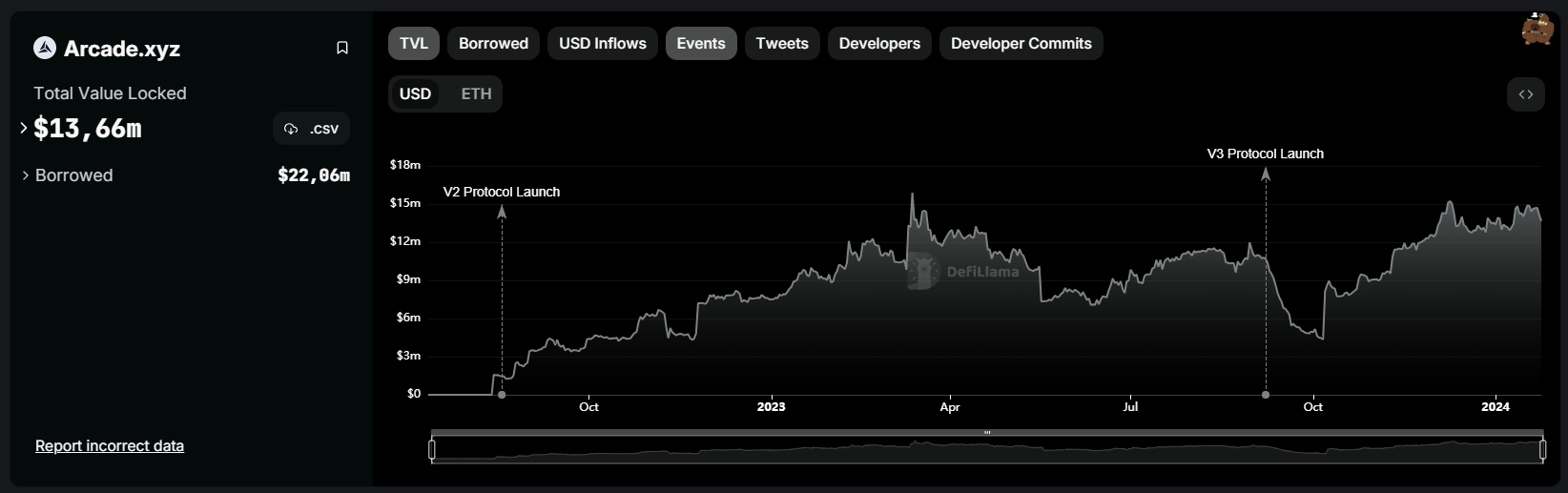

2.5. Arcade

Arcade is the 4th largest lending platform on the market, the platform has been experiencing certain developments recently, especially after launching the token airdrop program for users on its platform.

Looking at TVL, we can see that the platform after new version updates brings positive growth. However, this happens largely because the project spends 6% of the total supply to airdrop to users.

Currently, you can still participate and accumulate airdrops through lending and borrowing activities on the platform.

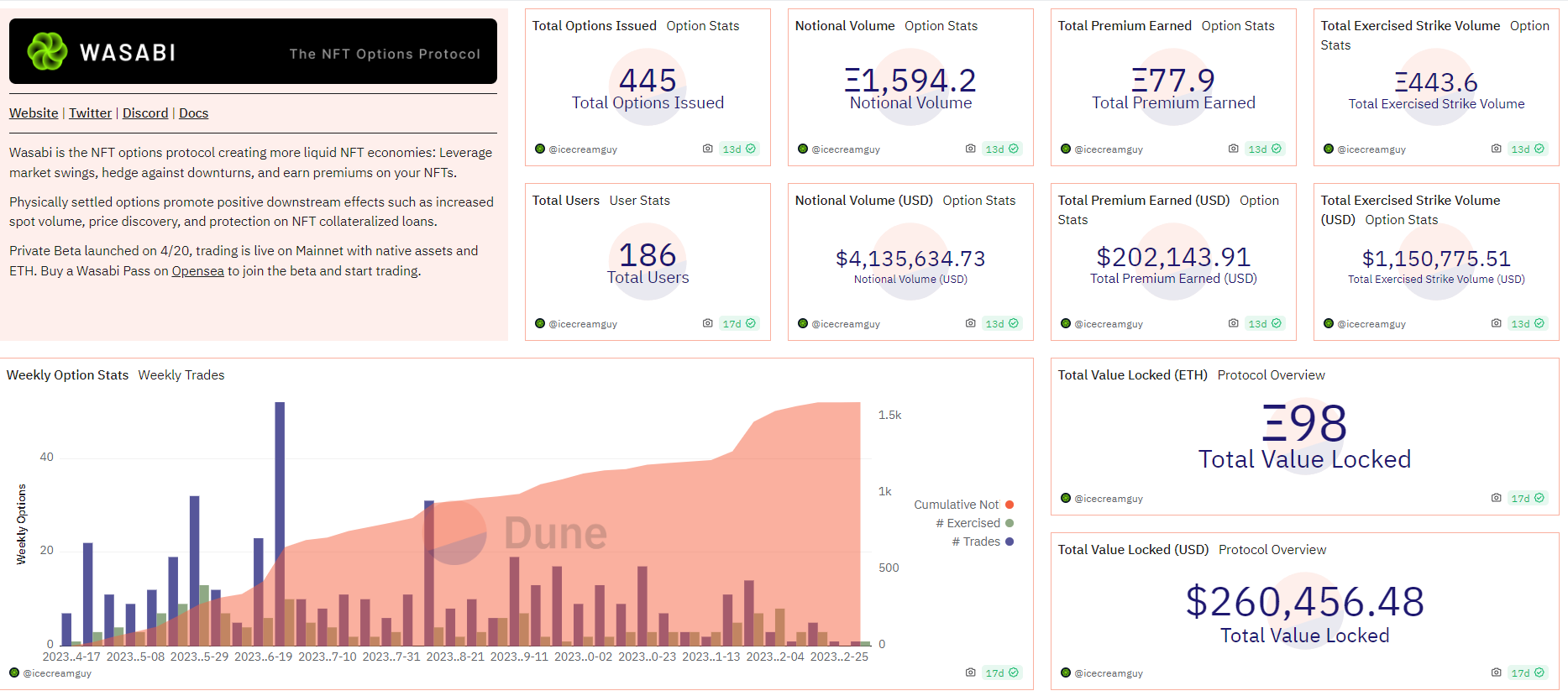

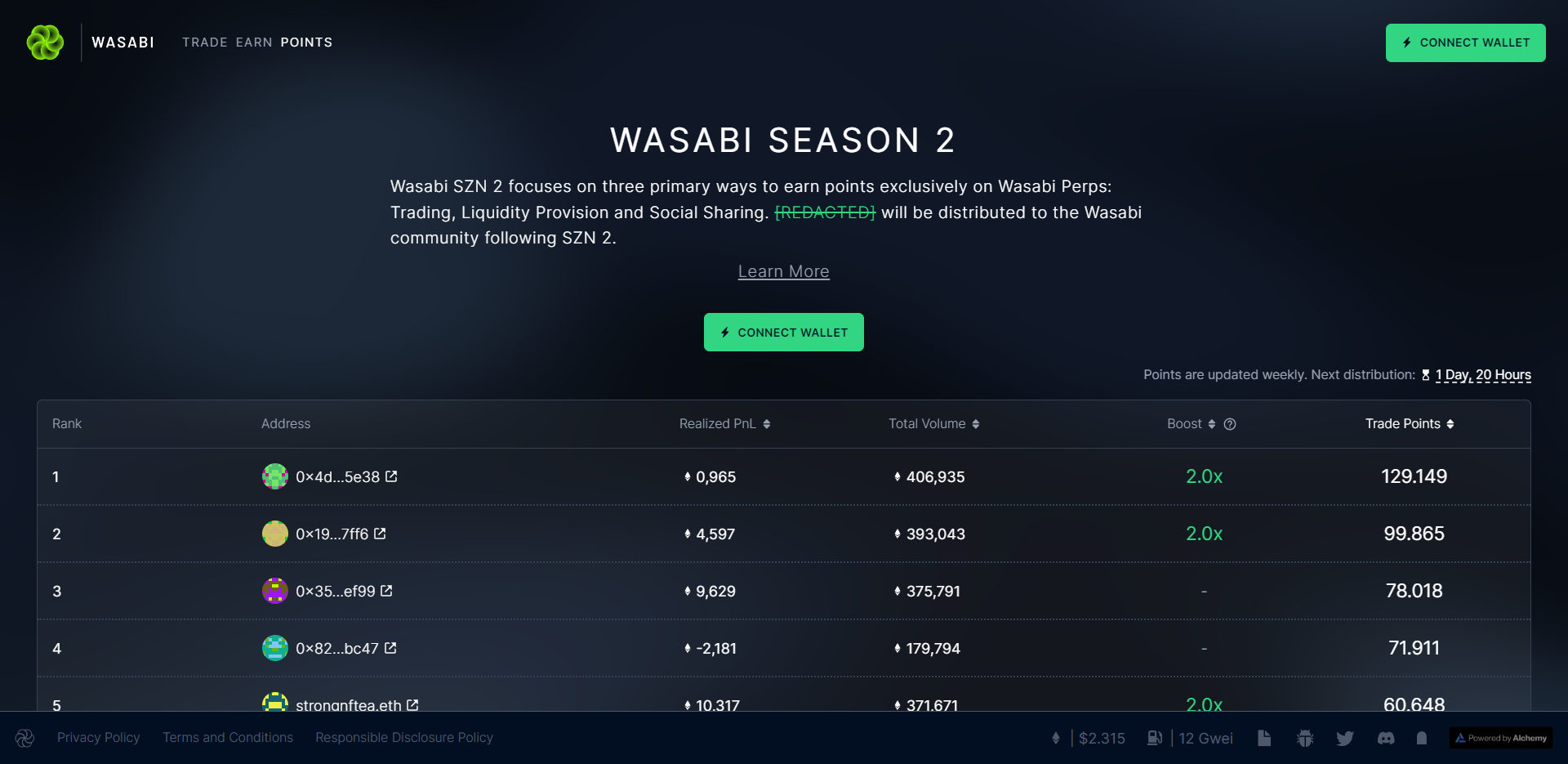

2.6. Wasabi Protocol

Wasabi Protocol is a recently emerging NFT derivatives trading platform that has attracted market attention as the number of transactions, users, and trading volume on the platform has increased sharply. . However, towards the end of this year, the platform is gradually losing its users, as of now the project's TVL is at $260k, down 1/2 compared to Q3 2023.

Similar to other platforms, the project is launching a Point accumulation program to receive air on its platform, however currently the project does not support too many NFT collections and mainly focuses on Bluechip collections. This also somewhat limits its appeal to investors.

2.7. Nftperp

In contrast to Wasabi, Nftperp is having a recent change when the project launched its V2 version. This includes a combination with Elixir in providing liquid for trading activities on the platform.

The project was also successful in its capital raising phase at the end of December 2023, when it raised $3m in a series A round led by 1k(x) with the participation of mechanism Capital, Maven 11 and others. Other investors include: Spencer of Spencer Ventures, Gmoney, David Choi of MetaStreet, Nick Emmons of Upshot, Jonathan Gabler of NFTfi.

This great support will help the project create a major turning point in the early part of 2024 when NFT projects are having a resurgence. However, the project's biggest need right now is to expand its support for offering more tradable NFT collectibles on its platform.

3. Summary

In general, the NFTFi market in the current period is not having too much outstanding growth, especially Lending projects or there are not too many new products launched on the market. However, with the return to growth of NFT as well as the cash flow being poured into active NFT Gaming projects recently, there will be a recovery of this NFTFi market in the near future.

The above is a summary of the NFTFi market in its current stage. I will have further updates on upcoming potential projects in this niche in the near future and will look for small opportunities in the future. this niche. If you have any further discussions, you can join the Bigcoin Vietnam group to find better investment opportunities.

Read more:

English

English Tiếng Việt

Tiếng Việt