1. What Is a Solana Rug Checker?

A Solana Rug Checker is a specialized tool or service crafted to assess the safety and legitimacy of tokens built on the Solana blockchain, with a primary focus on identifying rug pulls. A rug pull occurs when project developers hype up a token, draw in investment, and then abandon it—often by draining liquidity pools or offloading their holdings—leaving investors with worthless assets.

These tools scrutinize on-chain data, smart contract specifics, and other indicators to flag potential risks before users commit their money. In Solana’s decentralized ecosystem, where no central authority vets projects, rug checkers serve as a vital shield. Their importance has grown alongside Solana’s popularity, which saw it become the top blockchain for rug pulls in 2024, according to a Hacken report, driven by its low-cost token creation and rapid transaction capabilities.

2. How does a Solana Rug Checker work?

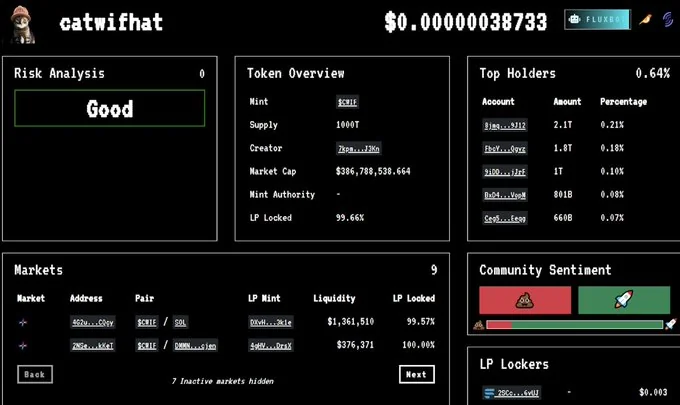

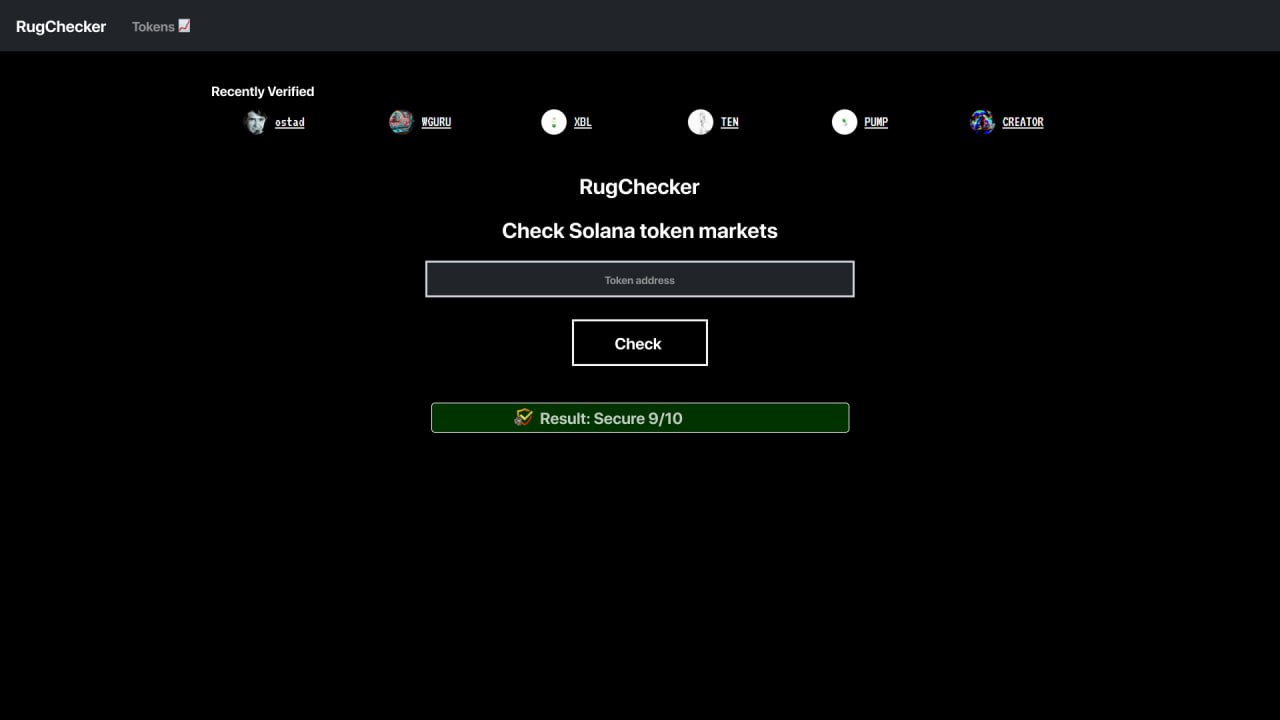

Solana Rug Checkers function by extracting and analyzing data from the blockchain and related sources, offering users a clear picture of a token’s risk profile. The process begins with smart contract analysis, where the tool inspects the token’s code for vulnerabilities or malicious features. It checks for mint authority—whether developers can create new tokens at will—or freeze authority, which could lock user funds, as well as hidden fees that might trap investors. Platforms like Solscan or open-source scripts on GitHub, such as solana-token-scanner, often power these insights.

Next, the tool evaluates liquidity pools on decentralized exchanges like Raydium or Orca. It confirms whether liquidity is locked through services like Team Finance or Unicrypt and assesses the lock duration—unlocked or short-term locked pools (less than six months) signal danger, as developers could withdraw funds at any moment. Token distribution analysis follows, revealing how tokens are spread across wallets. If the top 10 holders control 30-50% or more of the supply, it raises concerns about manipulation or a potential dump, a metric tools like Rugcheck.xyz highlight instantly.

The checker also monitors transaction history, tracking the behavior of major holders and project teams. Sudden large transfers or sales by developer wallets, especially soon after launch, suggest an exit scam—data traceable via Solana Explorer or Birdeye.so. Some advanced tools even venture beyond on-chain metrics, scraping social media platforms like X or Telegram to gauge hype levels, team transparency, or sudden developer silence, though this feature remains less common and harder to automate accurately. Users typically input a token’s contract address, and within seconds, the tool delivers a risk score or detailed report, making it accessible even to crypto newcomers.

3. Why Is a Solana Rug Checker essential in 2025?

Solana’s ecosystem is flourishing, with platforms like Pump.fun fueling daily token launches, but this boom has amplified scam risks. In 2024 alone, presale scams on Solana siphoned over $122.5 million, per Hacken, with meme coins proving especially vulnerable due to their hype-driven nature. A rug checker saves time by automating the hours-long process of manually inspecting contracts, liquidity, and holders, delivering instant insights to prevent costly errors. It also keeps pace with evolving threats—scammers now employ tactics like fake audits or celebrity endorsements, as seen with Jason Derulo’s JASON token in 2024, and rug checkers adapt to catch these ploys.

Beyond practicality, these tools boost investor confidence. With clear risk assessments, users can dive into Solana’s opportunities—like its thriving meme coin market—without constant dread of loss. A Reddit user in 2024, for example, shared their regret after losing everything on $UNICORNFLOKI, a Solana meme coin, noting that a rug checker could have spotlighted its unlocked liquidity and concentrated ownership. In 2025, as Solana’s growth continues, rug checkers remain a cornerstone of safe investing.

4. Key features of an effective Solana Rug Checker

Not all rug checkers are created equal, and the best ones in 2025 share defining traits. Real-time data is non-negotiable—crypto moves at breakneck speed, and tools must pull live blockchain stats to reflect current risks, not outdated snapshots, as seen with Rugchecker.io’s instant liquidity updates. Comprehensive risk scoring goes beyond vague labels like “safe” or “risky,” offering detailed breakdowns—say, 70% risk from low liquidity and 20% from holder concentration—akin to TokenSpy’s 99-point scoring system.

A user-friendly interface is equally critical, presenting complex data through clear visuals like charts or color-coded alerts, ensuring accessibility for beginners and experts alike; Rugcheck.xyz exemplifies this with its intuitive dashboard. Free basic access broadens their reach—many users can’t afford premium tools, so offering core features like liquidity and holder checks at no cost, as Solana Tracker does, levels the playing field. Finally, integration with platforms enhances usability—top tools sync with DEXs like Dexscreener or wallets like Solflare, enabling seamless, in-the-moment checks, such as Dexscreener Rug Checker’s right-click scanning option.

5. Real-World examples of Rug Checker use

To illustrate their value, consider a hypothetical case: a user stumbles across “SuperDApp,” a new Solana DeFi token on Raydium. They input its address into Rugcheck.xyz, which flags a 70% risk score—50% of liquidity is unlocked, and the top five wallets hold 60% of tokens. The user opts out, avoiding a potential $10,000 loss when the team pulls the rug a week later. In a historical example, the HAWK token, hyped by Haliey Welch in 2024, soared to a $490 million market cap before crashing 90% in hours. A rug checker like Solana Tracker could have warned of concentrated ownership and pre-launch transfers, sparing early investors.

Community feedback underscores this impact—a Solana Tracker user on X recounted losing funds to $KOALAKINGS in 2024 but pledged to use rug checks after the tool later flagged its unlocked liquidity and developer wallet dumps. These examples highlight how rug checkers turn risky bets into informed choices.

6. The future of rug checking on Solana

As Solana evolves, so will its scam detection tools. AI-powered predictions are on the horizon—platforms like QuillCheck already use AI to spot patterns, and future iterations could forecast rug pulls by analyzing developer behavior or market trends before they unfold. Wallet integrations promise even greater convenience—imagine Solflare or Phantom flashing a token’s risk score as you prepare to trade, eliminating extra steps. Cross-chain compatibility may also emerge, with rug checkers expanding to Ethereum, Binance Smart Chain, or beyond, creating a unified safety net. Community-driven alerts could further enhance detection, leveraging crowdsourced scam reports for real-time updates. By late 2025, these advancements could redefine how we navigate Solana’s wild ecosystem.

7. Conclusion

Solana’s blockchain offers boundless potential—and equal peril. Rug pulls persist as a formidable threat, but Solana Rug Checkers empower users to fight back. By dissecting contracts, liquidity, and holder patterns, these tools transform blind gambles into calculated decisions. In 2025, whether you’re chasing meme coin windfalls or DeFi profits, running a rug check is a must. Tools like Rugcheck.xyz, Solana Tracker, or TokenSpy are your armor—pair them with diligent research, and you can thrive in Solana’s fast-paced frontier. Don’t let the next rug pull catch you off guard; let a rug checker light the way.

Read more:

English

English Tiếng Việt

Tiếng Việt.png)