1. Polymesh

Polymesh is a permissioned public blockchain built specifically for security tokens.

This is an institutional-grade blockchain platform, built specifically for traditionally managed assets (also known as Real World Assets - RWA ), solving challenges around governance, authentication, ensure compliance and security for those types of assets.

Security tokens are similar to stock codes in traditional financial markets, but will be encoded as tokens for blockchain applications and use in the DeFi market .

Similar to other blockchains, Polymesh also developed its own wallet and native token, $POLYX.

$POLYX will be used as the fuel and transaction fees of the blockchain. Owners can stake to run nodes, validate on-chain transactions to receive rewards. Currently, there are more than 400 million $POLYX tokens being staked on the network with 42 nodes in operation. Because it is a blockchain network that requires licensing, all participants in the Polymesh network, including issuers of security tokens, investors, and those participating in staking or operating nodes, must go through the verification process. identity.

So the current nodes on Polymesh are all licensed financial institutions. This increases the security of the network.

$POLYX's current capitalization is at the top of the RWA niche (based on Coingecko data) with more than 230 million USD.

2. Centrifuge

Centrifuge is also a prominent name in the RWA niche, a platform that uses blockchain technology to bring real world assets onto the chain and create applications, making these types of assets accessible to the market. DeFi by creating a platform that connects borrowers and lenders directly.

Up to now, Centrifuge has supported a total value of supported assets of nearly 500 million USD with a TVL of nearly 250 million USD, growing 3 times from the beginning of 2023 until now.

In terms of capitalization, Centrifuge always ranks top in the RWA niche (based on data on Coingecko) with more than 120 million USD.

$CFG is Centrifuge's governance token, used to administer and operate the network, or provide rewards to LPs and validators of the network.

3. Chainlink

Chainlink is an oracle network that provides and connects off-chain data to the blockchain. In essence, Chainlink is also classified as a project to provide necessary infrastructure for RWA.

If RWA wants to become a reality, it will require meeting the necessary legal conditions, appraisal process, technology to support bringing these types of assets up the chain and third parties to take legal responsibility. monitor,…

Chainlink is an important piece of the puzzle, providing a set of tools to help traditional financial institutions connect their existing infrastructure with blockchains, to put assets on the chain, ensuring accuracy. real property.

Recently, Chainlink successfully tested bringing internal assets of major banks and financial institutions onto the chain, through its CCIP. In the future, all transactions incurred using Chainlink's CCIP will require fee payment in $LINK, expanding the application of the $LINK token.

4. Goldfinch

Goldfinch is listed among the projects increasing the adoption of RWA in DeFi, providing a decentralized credit protocol that allows parties to borrow crypto without crypto collateral.

Unlike other on-chain lending protocols such as MakerDAO, AAVE, Compound, etc., loans will be required to be overcollateralized with cryptocurrency to ensure the safety of the entire protocol. However, with Goldfinch, borrowers can make loans based on their creditworthiness, as assessed by other “backers” and auditors. Or simply understood, it is similar to unsecured loans in the traditional financial market.

Until now, the platform has supported loans with a total value of more than 100 million USD. Goldfinch's current capitalization is at 24 million USD, compared to other lending platforms which are quite modest such as MakerDAO - 1.3 billion USD, Maple - 46 million USD, TrueFi - 40 million USD,...

The project also received support of nearly 38 million USD from famous funds such as: a16z, coinbase, IDEO CoLab,...

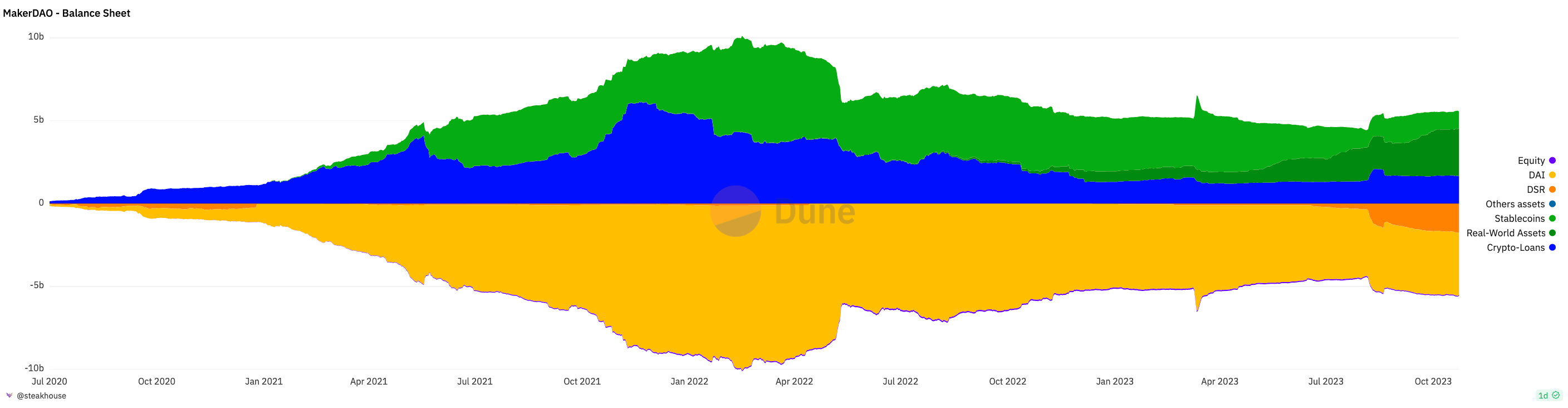

5. MakerDAO

MakerDAO is a veteran, first generation lending protocol on Ethereum. MakerDAO's operating mechanism will rely on lending the platform's $DAI stablecoin by overcollateralizing digital assets.

In 2022, MakerDAO officially entered the broader financial market through RWA, allowing financial funds to mortgage their real assets to access $DAI capital. To date, RWA loans on MakerDAO have amounted to more than 3 billion USD, accounting for nearly 65% of the total loan value on the platform.

Currently, MakerDAO's capitalization is more than 1.3 billion USD, ranking first in the lending niche. As the growth potential of RWA becomes stronger in the near future, RWA application creation projects such as MakerDAO will also take the lead in this niche.

6. Projects that already have other tokens in RWA

- Blockchain layer: Polymesh Network (POLYX), Realio Network (RIO), Dusk Network (DUSK)

- Infrastructure layer: Chainlink (LINK), Centrifuge (CFG), Elysia (EL), Boson Protocol (BOSON)

- Application layer

- Stablecoins: USDC, Tether (USDT), PAX Gold (PAXG),…

- Lending/ Borrowing : MakerDAO (MKR), AAVE (AAVE), Soil (SOIL)

- Private Credit: Maple (MPL), TrueFi (TRU), CreditCoin (CTC), Goldfinch (GFI), Clearpool (CPOOL)

- US Treasury : Ondo Finance (ONDO), Maple (MPL)

7. Conclusion

Above are some outstanding projects that have tokens in each application layer of Real World Assets. Currently, RWA is still a fairly new segment in crypto. Therefore, the number of projects building and developing tools and solutions for RWA is not too much, mainly previous DeFi construction projects and starting to integrate RWA.

Hope the article provides useful information for readers. This article is only intended to provide information to investors, not investment advice.

Tiếng Việt

Tiếng Việt