1.What is Coinbase Ventures?

Coinbase Ventures is the venture capital of the cryptocurrency exchange Coinbase. Established in April 2018, Coinbase Ventures was created with the purpose of investing in blockchain and cryptocurrency startups at the seed-stage.

Coinbase Ventures may invest in projects in the fields of blockchain technology, digital wallets, fintech applications, and various other areas related to the cryptocurrency market.

2. Coinbase Ventures development team

2.1 Brian Armstrong

Brian Armstrong - CEO and Co-Founder of Coinbase

He is the CEO and Co-founder of Coinbase, the leading cryptocurrency exchange in the United States. Brian Armstrong is responsible for all operations related to the exchange with the goal of introducing cryptocurrencies to every citizen in the United States. Prior to running Coinbase, he worked at several technology companies such as IBM, Airbnb, and served as a consultant at Deloitte while pursuing his three degrees (2 Bachelor's and 1 Master's).

In February 2021, his name appeared at the top position on Forbes' "Crypto Rich List" with a net worth of $6.5 billion.

2.2 Emillie Choi

Emillie Choi is the President and COO at Coinbase. Previously, she has worked at several major corporations in significant roles such as Vice President of Corporate Development at LinkedIn and Director of Business Development and Strategy at Warner Bros. Entertainment.

2.3 Shan Aggarwal

He is the Vice President of Business Development and Operations at Coinbase Ventures. Aggarwal is responsible for sourcing and providing insights on investment deals for Coinbase.

He has extensive experience in investing and has previously worked as an investor at Greycroft, specializing in early-stage investments in internet startups. Additionally, he was a Co-founder and Vice President at Bruin Consulting.

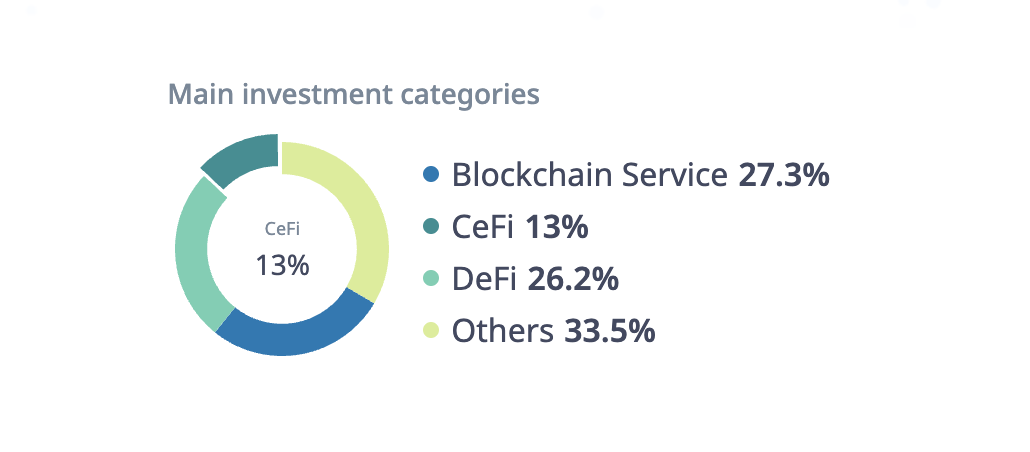

3. Overview of Coinbase's investment categories.

The main investment categories of Coinbase Ventures are allocated as follows:

1. Blockchain Services: 27.3%

2. CeFi (Traditional Finance on Cryptocurrency Platforms): 13%

3. DeFi (Decentralized Finance): 26.2%

4. Others: 33.5%

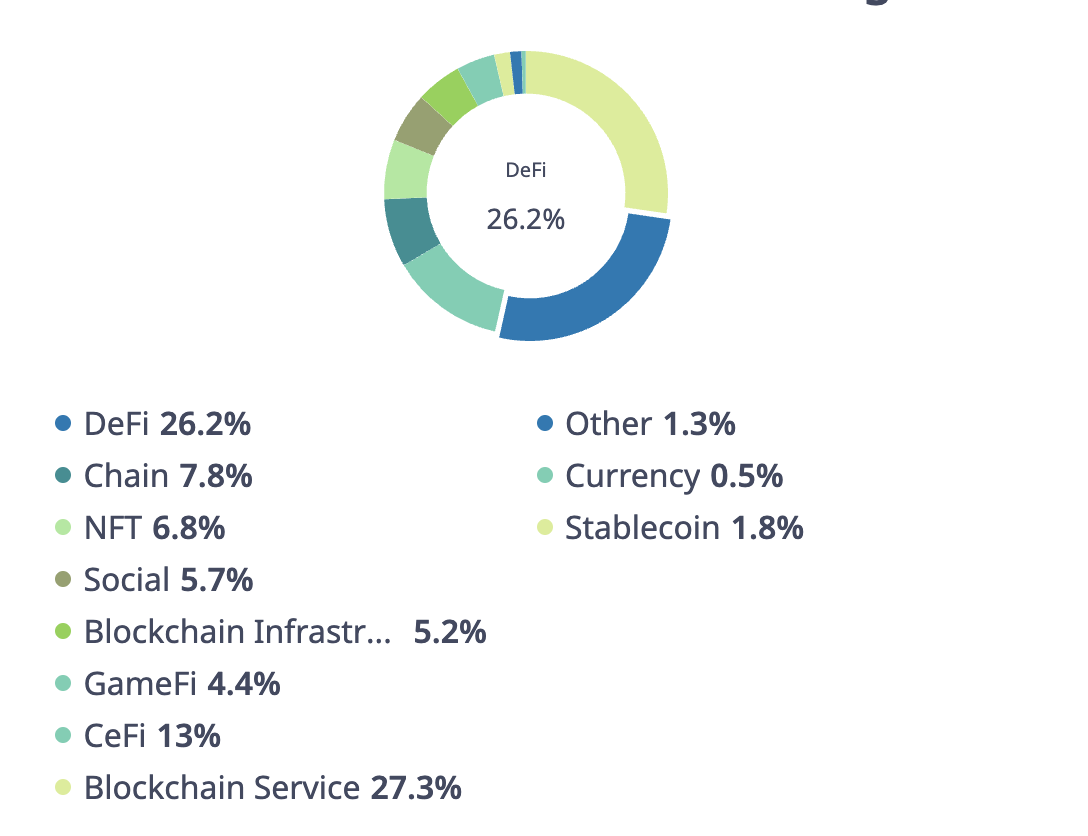

Within the Others category, specific areas include:

The details of Coinbase Ventures' investment categories:

1. Chain: 7.8%

2. NFT (Non-Fungible Tokens): 6.8%

3. Social: 5.7%

4. Blockchain Platforms: 5.2%

5. GameFi: 4.4%

6. Currency: 0.5%

7. Stablecoin: 1.8%

8. Others: 1.3%

Since the inception of the investment fund until now, Coinbase Ventures has invested in a total of 385 different projects.

4. The main investment portfolio of Coinbase Ventures

4.1. Overall

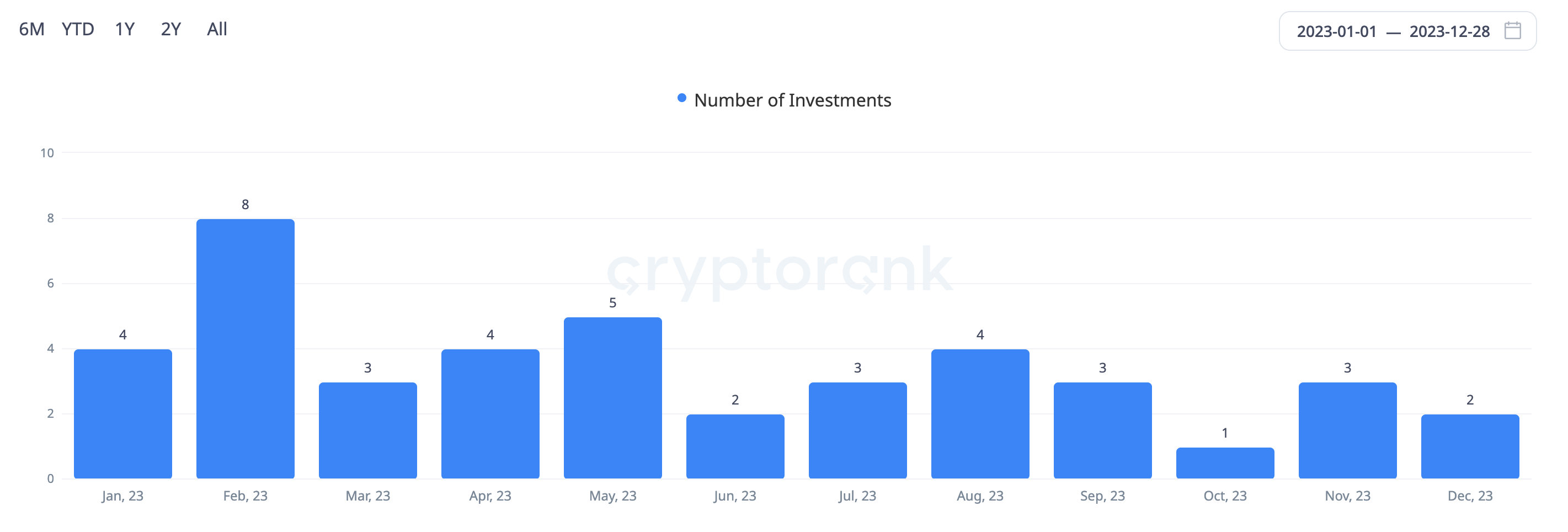

In 2023, Coinbase Ventures invested in 43 projects and led investments in 5 of them. The majority of these projects were from the United States, while the remaining few were from Australia, Singapore, India, the UK, and Canada.

4.2. 20 notable projects that Coinbase invested in during 2023

Coinbase manages approximately $1.5 billion with a focus on projects providing blockchain and DeFi services. Here are 20 notable projects Coinbase invested in during 2023:

1. Affine DeFi: A cross-chain DeFi project allowing users to invest in diverse assets simultaneously and earn profits through the platform's automated investment strategies.

2. Maverick Protocol: Provides infrastructure to support optimal liquidity markets for traders, liquidity providers, DAO treasuries, and developers.

3. Connext Network: Provides fast and censorship-resistant transfers on EVM-compatible chains and L2.

4. Socket: Supports cross-chain interoperability, offering SDKs, APIs, and plugins.

5. MSafe: Offers safe and non-custodial digital asset management solutions.

6. Obol Labs: Focuses on developing Distributed Verifiable Technology (DVT) to address staking infrastructure vulnerabilities.

7. zkLink: A DEX integrated with ZK-Rollup technology, facilitating multi-chain trading.

8. Azra Games: Creates combat and collection games, backed by notable supporters such as a16z, NFX, Play Ventures, Franklin Templeton, and Coinbase Ventures.

9. Mauve: A decentralized AMM protocol ensuring compliance with AML regulations.

10. Hourglass: A pioneering DeFi protocol designed to enhance liquidity for time-locked assets.

11. Architect: A DeFi platform supporting financial organizations through trading technology, market data, and white-label solutions.

12. Dolomite: A DEX built on Arbitrum offering swap, lending, and borrowing products.

13. DFlow: A wallet solution optimizing revenue and providing features like swapping, auctions, and reporting.

14. Credora: An organizational credit project offering asset and risk management features.

15. Alluvial: Develops liquid staking solutions, promoting staking across various blockchains.

16. Alkimiya: An open-source, license-free protocol enabling miners and validators to receive upfront payments for future network activities.

17. Alongside: A crypto index platform where users can invest together.

18. Rocket Pool: A liquid staking protocol described as the leading liquidity staking network on Ethereum.

19. Terms Labs: A lending protocol utilizing a separate auction model to support loans with specific interest rates and terms.

20. EigenLayer: A restaking protocol built on Ethereum, enabling users to "unlock" locked tokens for Ethereum validation, enhancing security across protocols.

5. Conclusion

This article provides an overview of Coinbase Ventures and its investment portfolio in 2023. Overall, Coinbase Ventures primarily focuses on investing in projects within the DeFi and blockchain service sectors.

Whether Coinbase Ventures generates significant ROI through these projects depends not only on market fluctuations but also on the development of the projects in the future.

You can explore Coinbase Ventures' investment portfolio through the portfolio section on the following website: https://cryptorank.io/funds/coinbase-ventures

Read more:

English

English Tiếng Việt

Tiếng Việt