1. Base introduction

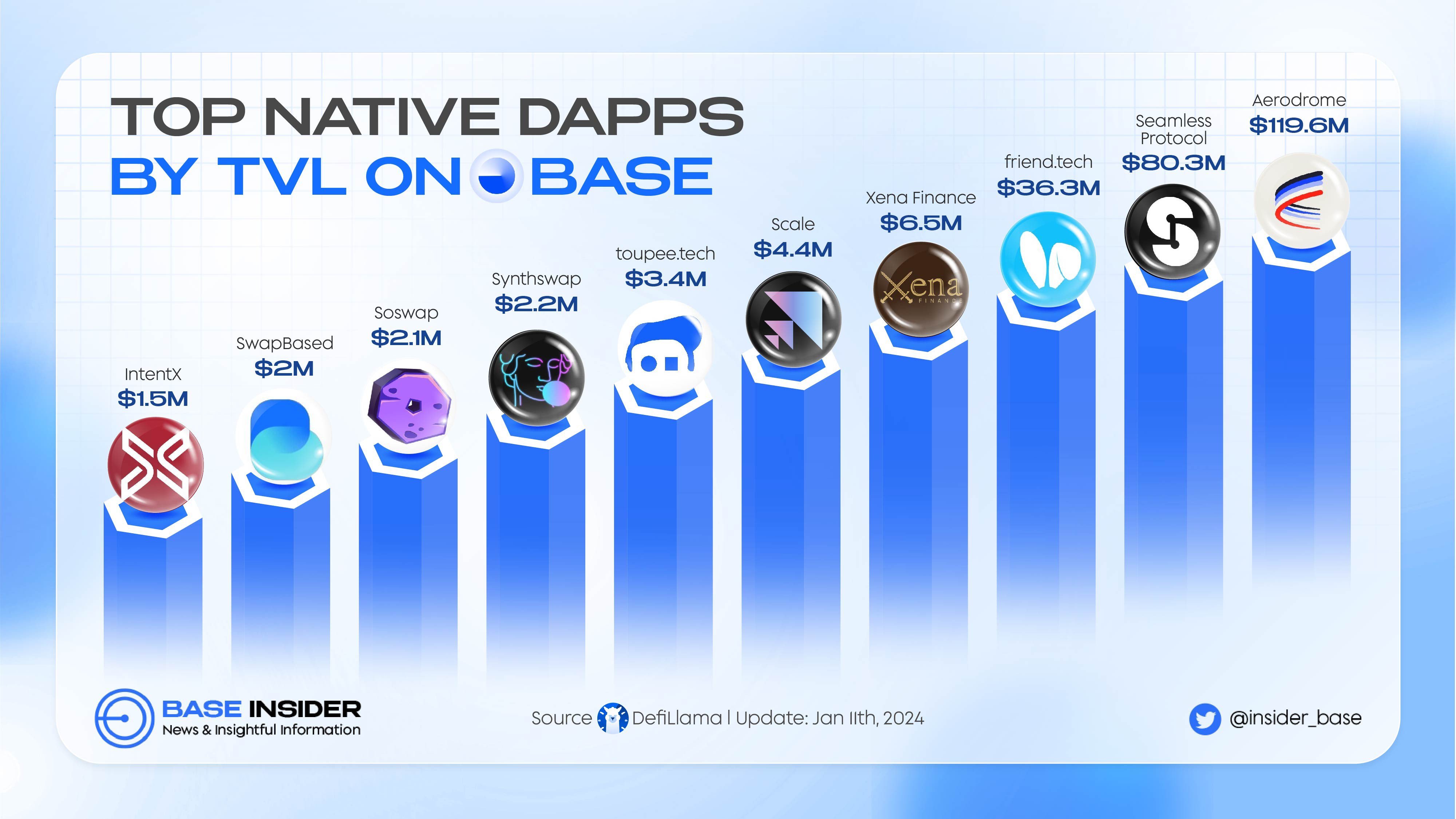

Over the past year, Base has emerged as one of the fastest-growing blockchain ecosystems, particularly in terms of Total Value Locked (TVL). While it still lags behind Solana in many areas, Base's growth trajectory is unparalleled, and it is on track to surpass Solana within the next 1-2 years if this growth continues. By January 2025, Base's daily transactions and active addresses had grown exponentially, while its TVL had skyrocketed, outpacing even Solana in this critical metric.

Base's story is one of rapid ascension, with massive capital inflows, an aggressive growth strategy, and a highly competitive ecosystem. Let’s explore how the numbers reflect Base’s significant progress and what this could mean for the future of the blockchain space.

2. Base ecosystem: A year of unprecedented growth

When comparing Base's metrics from a year ago to January 2025, the changes are staggering. As of one year ago, Base had around 338,000 daily transactions, 61,200 daily active addresses, and a TVL of about $830 million. At that time, Base's numbers were just a fraction of Solana’s, with Base's TVL equaling only 1.48% of Solana’s.

Fast forward to January 10, 2025, and Base has seen an explosive surge in all key metrics:

-

Transactions: 11.1 million daily transactions (a 3184% increase)

-

Active Addresses: 811,200 daily active addresses (a 1225% increase)

-

TVL: $14.2 billion (a 1610% increase)

At this point, Base’s TVL has surpassed Solana’s, and its transaction volume and daily active addresses are rapidly catching up. Specifically, Base now holds 17.59% of Solana’s transaction volume, 12.88% of its daily active addresses, and 167.06% of Solana’s TVL.

These dramatic growth rates showcase that, while Base is still smaller in overall size, its aggressive development and capital inflows have placed it on a path to outpace Solana, potentially becoming one of the leading blockchains in the near future.

3. The growth rate: Base outpaces Solana in all aspects

One of the most striking aspects of Base’s rise is its remarkable growth rate. As mentioned earlier, Base has outperformed Solana in terms of the annual growth rates of transactions, daily active addresses, and TVL:

-

Base’s TVL growth: 1610.84% (compared to Solana’s 553.85%)

-

Base’s transaction growth: 3184.02% (compared to Solana’s 176.75%)

-

Base’s active address growth: 1225.49% (compared to Solana’s 1062.36%)

This significant outperformance is a clear indication of Base’s ability to attract capital and grow its ecosystem. The exceptional growth rate is likely to continue as more decentralized finance (DeFi) projects, NFTs, and dApps migrate to Base’s platform, drawn by its scalability, low fees, and fast transaction processing.

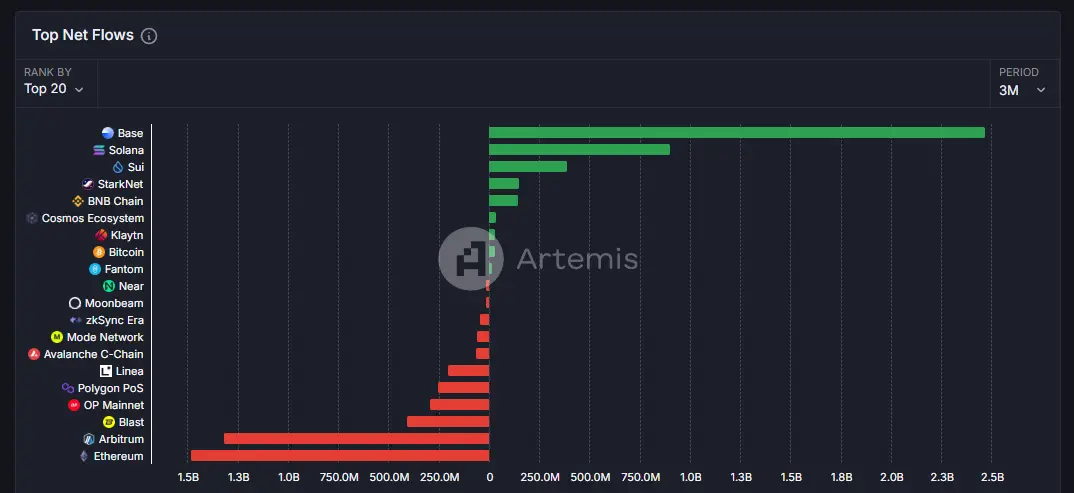

4. Capital inflows

Another key indicator of Base’s burgeoning success is its capital inflow. Historically, Solana has been the network with the highest inflow of funds among public blockchains. However, recent data shows that Base has now surpassed Solana in this regard, with a net inflow of $2.5 billion over the past three months alone. Solana, by comparison, saw a net inflow of just $900 million.

The total net inflow to Base for the entire year is estimated at $3.8 billion, meaning that the recent three-month surge accounts for a staggering 65% of that total. This dramatic increase in capital inflows demonstrates that investors are increasingly confident in Base’s long-term potential, contributing to its rapidly growing TVL.

5. Memecoin mania and AI: A new catalyst for growth

In addition to the general market growth and ecosystem development, Base has gained significant attention from emerging trends such as memecoins and artificial intelligence (AI). The platform has become a major player in the MEME space, a category where it directly competes with Solana. Products like Virtuals Protocol, which combines AI with blockchain, have gained significant popularity on Base, further attracting users and liquidity to the network.

The launch of AI-driven projects on Base, such as Aixbt and GAME, has spurred even more capital influx, making the network a hub for the latest blockchain innovations. With Base being seen as a potential leader in the MEME and AI sectors, its growth momentum is likely to continue.

6. Challenges

Despite Base’s rapid growth, one major challenge it faces is the lack of a native governance token. Unlike many other blockchains, including Solana, Base has yet to introduce its own token, which has led to difficulties in pricing and the market's ability to assign a concrete valuation to the network. The absence of a governance token also means Base doesn’t yet have the same community-driven influence that other blockchains enjoy.

However, there is hope that this issue could be addressed in the near future. On January 4, Base developer Jesse Pollak tweeted that Coinbase, the developer behind Base, is considering providing tokenized COIN stocks to U.S. users of the Base network. If this initiative comes to fruition, it could serve as a proxy for Base’s token, giving the network more market visibility and possibly leading to a more comprehensive valuation of the ecosystem.

7. Base’s potential to surpass Solana

At the rate Base is growing, it may only be a matter of time before it surpasses Solana in several key metrics, especially TVL. The rapid inflows of capital, increased developer activity, and attention from emerging sectors like AI and memecoins make Base a highly attractive platform for both developers and investors alike.

As more projects build on Base and the network matures, it is highly likely that it will solidify its place as a top contender in the blockchain space. If Coinbase successfully tokenizes COIN and integrates it into Base, this could further catalyze Base’s growth and market value, potentially allowing it to challenge Solana’s position as a leading blockchain network.

8. Conclusion

Base's explosive growth in TVL is a testament to the network's impressive development and potential in the blockchain space. While it may still be a few steps behind Solana in certain aspects, the rapid growth of its ecosystem, the massive capital inflows, and its leadership in emerging areas like AI and MEME coins suggest that Base is on track to become a major player in the coming years.

If it continues at this rate, Base could very well surpass Solana in terms of TVL and other key indicators within the next 1 to 2 years, solidifying its place as a dominant force in the world of decentralized finance and beyond.

Read more:

English

English Tiếng Việt

Tiếng Việt.png)