1. What is Solana?

1.1. What is Solana?

Solana is a Layer 1 blockchain technology platform that allows building decentralized applications (DApps) with high throughput, low latency and extremely low transaction costs. The number of real-time transactions per second of Solana can be up to 50000 TPS, nearly 7000 times higher than BTC and 3000 times higher than current Ethereum .

.jpg)

If Bitcoin is considered as the "Digital Gold", Ethereum is regarded as the cradle of Blockchain application development (smart contract platform), then Solana is the blockchain born for "consumers".

1.2 History of formation

- In November 2017, founder Anatoly Yakovenko released a whitepaper, which described Proof of History or Solana's consensus algorithm.

- Witnessing the fact that the Bitcoin or Ethereum blockchain at that time was very slow, only able to process 7-15 transactions/second (TPS) respectively, he thought that why wasn't there another blockchain with a throughput of thousands of TPS?

- A few months later, with the help of Greg, Stephen and 3 other co-founders launched Solana (previously known as Loom), which challenges the entire market with a TPS in a test environment of up to 250.000 transactions/second.

2. Technology

Solana uses a unique technology called Proof-of-History (PoH) to accurately record transaction times, while also using Proof-of-Stake (PoS) to verify transactions.

Different from Proof -of-Work, which uses miners to determine the next block in the chain, or Proof-of-Stake, which uses the number of staked tokens part to specify the next block, Proof-of-History uses timestamps in its definition to identify blocks on the Solana network.

Proof-of-History is a computational sequence that provides a numerical record confirming that an event took place on the network at any point in time.

You can imagine that Solana's PoH is a common clock for the entire Solana Blockchain system, and the time source is before consensus was born. PoH is used to verify the order and flow of time between events, with the goal of encoding the unreliable passage of time into the ledger.

Explain:

(1) Transactions are sent to the Solana network when users create transactions.

(2) The leading node (Leader) will use PoH based on the transaction time and current state to create a hash value (sequence) and then attach it to the transaction chain. In the picture the hash value is “0x23432”.

(3) These transactions will then be transmitted to Verifiers nodes to confirm and create hash values based on the state copy on the node and then transferred back to the Leader.

2.1 Time proof in Solana

The consensus mechanism is a fundamental feature and important difference between blockchains. Solana's consensus mechanism has several new features, especially the Proof of History (PoH) algorithm, which reduces processing time and reduces transaction costs.

Conceptually, how PoH works is not difficult to understand. However, understanding how it increases processing speed and reduces transaction costs can be quite difficult. Solana's white paper goes deep into implementation details, but sometimes it's easy for readers to get lost in the information.

On a conceptual level, Proof of History provides a way to cryptographically prove time and determine when events occurred in that time series. This consensus mechanism is used in parallel with another popular algorithm such as Proof of Work (PoW) or Proof of Stake (PoS). Proof of History makes Proof of Stake more efficient and powerful on the Solana platform.

PoH can be considered as a cryptographic clock. It timestamps transactions using a hash function that ensures the transaction time location is valid. This means that the entire network does not need to verify the timing requirements of the nodes (validators) and can slowly weigh in on the current state of the chain.

We can say that PoH enables fault tolerance in the network by providing a robust mechanism to ensure eventual consistency, even when the network is fragmented. , or fork). Because validators can trust the structure of the system to determine the order of transactions, validators can devote more energy to efficiently processing blocks and getting valid blocks into the ledger. .

Solana also offers a unique approach to the Byzantine error tolerance problem, summarized as handling consistency within a group of members that may contain dishonest errors. This is the double spending problem that initially fueled Bitcoin's growth.

Video about POH

About Block time and PoH: Solana founder Anatoly Yakovenko discusses the Solana blockchain's innovations in the concept of block time and the Proof of History algorithm in the article "How Solana's Proof of History is a Huge Advancement for Block Time".

2.2 Proof of History (PoH) and Proof of Work algorithms

Another way to think about PoH is to think of it as an improvement on block ordering compared to the Proof of Work algorithm .

In Bitcoin's Proof of Work, the mining and block verification process is used to enforce block order. The network is adjusted to generate a valid block approximately every 10 minutes. This is a bottleneck—faster block verification creates more conflicting blocks, leading to diminishing returns. Blockchain also depends on the work of individual validators to ensure block order.

Proof of History proposed the idea: "What if we had a mechanism to create a cryptographic clock that signed transactions as they came in?" Validators still need to ensure that requests arriving as transactions are valid. But with time and arrangement, they can assume that the transactions they are considering are valid. This removes the Proof of Work barrier.

2.3 Proof of Stake and verification delay function

Solana still requires a consensus mechanism for Proof of History, and to do this, the project uses Proof of Stake. Validators perform the job of verifying transactions using what is called a verifiable delay function (VDF).

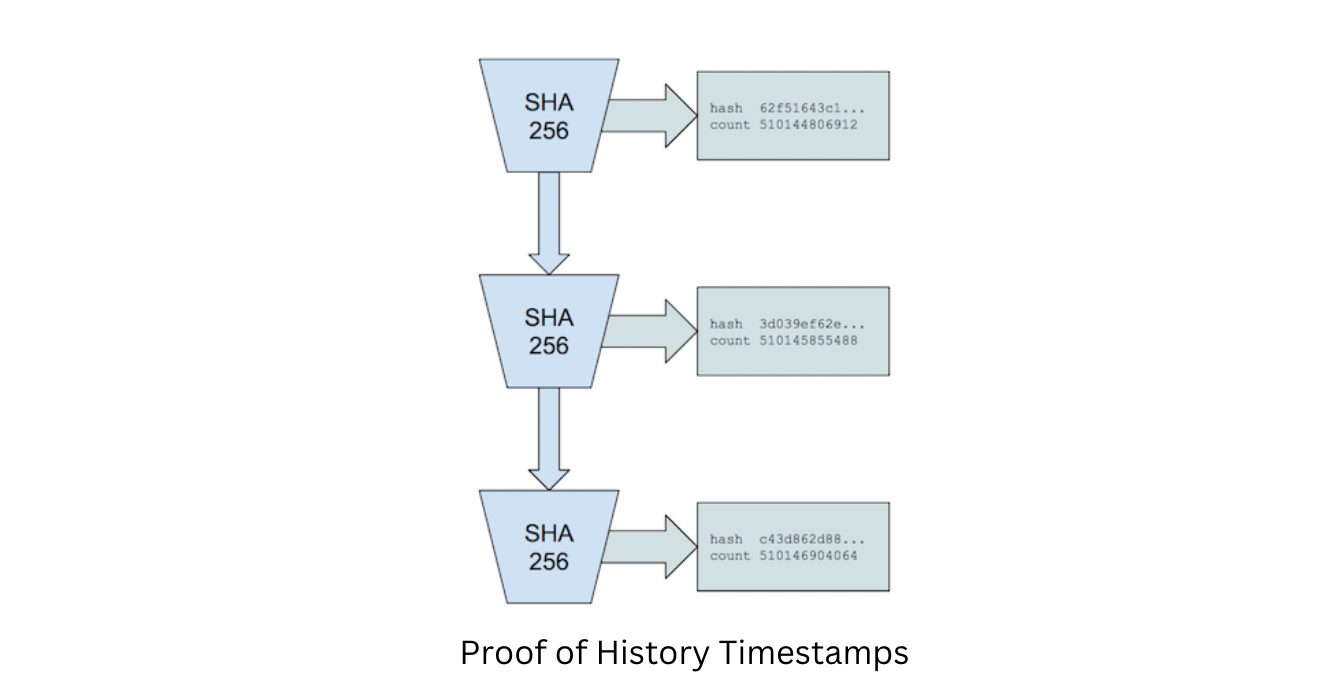

The core idea of VDF is to run a function whose input and output are unpredictable without actually running the function. Then, chain them together => the output of the last function is the input for the next function. (This process is initialized with a random data point.)

Chaining them is done using a cryptographic hash function (Solana uses SHA-256). This creates a never-ending stream of data that can be cryptographically verified. We can easily add additional information by integrating it into the input of the hash function. In the case of the Solana blockchain, we will integrate incoming transactions in each VDF run. All this is shown as in the following.

Some notes about the image above:

- In a real deployment, the network must coordinate a VDF server (also known as a " Leader " or PoH generator) with incoming transactions, a cluster of validators, and the handling of network errors and transfers. between VDF servers.

- Each incoming transaction is "stamped" by the PoH generator, then passed to the cluster of distributed validators to reach consensus. PoH groups transactions into its hash output, allowing validators to trust that the order of transactions is valid.

- The validator network then sends a transaction vote to the PoH generator and the transaction will be considered valid.

- A governance system is implemented to coordinate the election of a new validator for the PoH generator (or Leader) in the event of a problem, along with mechanisms to prevent attacks on the network.

- Most importantly, the use of PoH increases block confirmation times which can reach a spike. But this also implies increased architectural complexity. This complexity is perhaps the source of Solana's larger-than-average disruption rate.

2.4 Technological Advantages of Solana Compared to Other Blockchains

- High processing speed : Solana is capable of processing thousands of transactions per second, compared to other blockchains that usually only process a few dozen to a few hundred transactions per second.

- Low transaction fees : Another important benefit of Solana is its low transaction fees. While many other blockchain networks charge high fees for transactions, Solana's fees are much lower, making it an attractive choice for businesses and developers who need to process large numbers of transactions at a low cost.

- Scalability : One of Solana's biggest advantages over other blockchains is scalability. Unlike many other blockchain platforms that can only process a limited number of transactions per second, Solana is capable of processing up to 65,000 transactions per second (TPS) using Horizontal Scaling. Solana uses multiple PoH generators and then synchronizes the state between the two generators. By synchronizing PoH generators periodically, each PoH generator can then process a portion of the network's requests, which makes it possible for the overall system to handle a large number of transactions, however, this will affect real-time accuracy due to network delays between generators.

- High compatibility : Solana supports a wide range of applications, from decentralized finance (DeFi) projects to decentralized applications (dApps) and decentralized assets (NFTs). This shows its flexibility in supporting many different types of applications.

2.5 Disadvantages of Solana

- Community Development: Due to the smaller user community and shorter operating experience compared to Ethereum, investors may not have confidence in the stability of the network. From 2021 until the end of 2022, Solana's reputation was affected when the Solana Foundation announced that the Solana blockchain was experiencing "intermittent instability".

- Low Decentralization: Solana uses a large number of block producers, which may make some people worried about the level of decentralization of the network.

3. Ecosystem

Considered the most successful Layer 1 (only after Ethereum) in the last bullrun season, Solana has promptly developed an ecosystem of outstanding decentralized applications, bringing its TVL to more than $10 billion, along with more than 12 million active wallet addresses in the system.

3.1. DeFi on Solana

Regarding DeFi, Solana fully develops important pieces of the puzzle including: DEX, lending/borrowing protocol, stablecoin, Yield Farming, derivatives trading and LSD.

From the time of ATH in TVL, Solana decreased from more than $10 billion TVL to just over $1 billion before the FTX collapse, and the day after this event, TVL on the Solana network fell to nearly $300 million.

From a top ecosystem in the market, Solana is currently only ranked 11th in terms of total key value on the network.

The amount of TVL on Solana decreased significantly due to the following reasons:

- DEX: The once famous DEX Serum Dex stopped operating after FTX declared bankruptcy. At its peak, this exchange had a total value locked (TVL) on the floor of nearly $2 billion (accounting for 20% of the entire system's TVL).

- Right at the beginning of the downtrend, the two Macalinao brothers announced to the press that many protocols with huge amounts of TVL on Solana were due to DeFi stacking, not real money flow. They said that they did so because "the community likes to see large TVL numbers). Specifically, the more than 11 DeFi protocols they created have brought in more than $7 billion of the total $10 billion TVL the Solana system had at its peak.

- FTX - the investor sponsoring the Solana ecosystem collapsed, causing the community to suspect that the applications in the ecosystem are no longer safe. The bankrun event not only occurs on FTX exchange but also occurs in Solana system applications.

Although full of DeFi pieces and many famous investors, the collapse of FTX has indeed dragged the Solana system down to "the bottom". This also reflects the potential risk of any “decentralized” blockchain having a relationship with a “centralized” organization.

With over $300 million in TVL, here are the top protocols contributing to this total value:

- Marinade Finance (Liquid Staking)

- Jito (Liquid Staking)

- Lido Finance (Liquid Staking)

- Solend (Lending)

- Orca (DEX)

- Raydium (DEX)

- …

Although DeFi on Solana is fading compared to its peak, the fact that important pieces in the system still exist and develop despite difficulties brings great hope for recovery for the system in the near future.

3.2. NFTs on Solana

Background:

Taking advantage of the speed and transaction costs on the network, Solana has demonstrated great potential when entering the NFT and GameFi niche. NFT collections on Solana have brought a large number of users to this ecosystem:

- StepN: StepN leads the Move-to-Earn trend by providing virtual shoes for users who want to participate in making money with the app. The project has brought nearly 1 million wallet addresses to Solana. Although this application later moved to Binance Smart Chain, this was also the most successful NFT application on Solana at that time.

- DeGods: Born on the Solana network (later transferred to Polygon), DeGods is still a famous NFT project in the market.

- Mad Labs: Currently, Mad Labs is the leading NFT project in the Solana NFT ecosystem. Mad Labs does not simply bring regular PFP NFTs, the project also brings improved xNFT and Backpack technology, making storing and using NFTs more convenient.

Up to now, more than 8.5 million wallets have minted NFTs on the Solana network with a total of more than 32 million NFTs minted and the minting cost of 1 NFT is very low at 0.00012 USD (based on NFT compression technology).

Further explanation about NFT compression technology:

- NFT compression technology is a technology invented by the development team of Solana Labs, providing the experience of mass minting NFTs (up to millions of NFTs) at a low cost (about 113 USD). Meanwhile, the cost of minting 1 million NFTs on the Ethereum network can be up to $33 million and Polygon is $33,000.

- This technology essentially interferes with the Merkle Tree structure in storing data on the blockchain, thereby helping to reduce the cost of on-chain data storage and reduce overall costs.

Solana also contributed to the issuance of millions of NFTs for popular projects such as Helium, Drip or Wordcel thanks to its low cost. It is difficult for these applications to issue NFTs to their millions of users on the Ethereum or Polygon network due to the huge cost.

Featured NFT projects:

- Food Labs

- SMB

- Okey Bears

- Tesorians

4. Tokenomics information

- Project: Solana

- Ticker: SOL

- Token standard: SPL

- Circulating supply: 414,379,402.2536 SOL (74.1%)

- Total supply: 559,508,688 SOL

- Maximum arc: Unlimited

4.1. Tokenomics

Previously, Solana 's coin allocation caused a lot of controversy in the crypto community due to the unlocking period of up to 90% in February 2021.

However, with the support of FTX and the promise of "not dumping coins" from a series of other institutional investors, SOL successfully unlocked the token. At that time, the price of SOL (~2USD) not only did not decrease but immediately grew strongly, reaching a price of ~250 USD/SOL (ATH).

Up to now, SOL price is being traded at 22 USD/SOL (according to CoinGecko).

Since almost 100% of the total supply has been unlocked, SOL's real circulation rate and staking rate, as well as the deflation mechanism, will now receive more attention.

- SOL staked in DeFi applications: 389,207,141.0486 SOL

- Total supply: 559,508,688 SOL

According to the above figure, the number of SOLs being staked is up to 69.5% of the total supply (because the number of locked SOLs can also be staked, the number of SOLs staked may be more than the number of SOLs in circulation. Therefore , calculating proportional correlation with total supply would be more reasonable).

This rate is relatively high, compared to Ethereum's current rate of ~30%.

4.2 Inflation rate over the years

- Inflation percentage over the years: according to the proposed inflation schedule, the inflation rate over each year of SOL will gradually decrease, starting from 8% in the first year. Thus, from 2020 (at the time of SOL mainnet), this is the 4th year and the inflation rate is ~4.5-5%.

.png)

-

Total SOL supply each year: Similarly, the total annual SOL supply will increase simultaneously. Currently, the total supply of SOL in the market is at 560 million SOL .

![Total supply of SOL over the years]()

Total supply of SOL over the years - Is SOL deflationary? Up to now, SOL is still an inflationary coin. However, SOL has developed a mechanism to limit inflation by burning 50% of transaction fees on the network. The remaining portion will be divided among validators.

The current inflation rate of SOL compared to other coins is not much different, so this is not a worrying factor for investors when researching and making decisions to invest in SOL.

5. How to buy and store SOL coins

Currently, SOL is listed on major centralized exchanges (CEX) including: Binance, Coinbase, OKX, Kucoin... You can buy, sell, and trade SOL on these exchanges or on decentralized exchanges. medium (DEX) like Raydium…

To store SOL, you can store it on a centralized exchange (not recommended), or non-custodial wallets like Phantom, Coin98 Super App.

6. Solana ecosystem

After more than 5 years of development, the Solana ecosystem has increasingly improved and developed, especially after the collapse of the FTX exchange.

According to statistics from DeFillama, TVL (Total Value Locked) on the Solana system has grown nearly 100% since the beginning of 2023 until now, despite the gloomy general market situation. The percentage of TVL growth in the Solana ecosystem mainly comes from DeFi and Liquid Staking platforms, including:

- Marinade Finance : The #1 Liquid Staking solution platform on the Solana network with over $400 million in SOL value locked

- Jito : #2 Liquid Staking platform on Solana with over $200 million locked.

- Solend : Leading lending platform in the Solana system with nearly $100 million locked

- MarginFi : The lending platform on Solana does not have a token yet

- ...

The strong growth in TVL of DeFi and Liquid Staking platforms is an important step in the process of helping Solana gradually regain its position and become a liquidity-rich ecosystem that attracts developers. applications for Web3 users.

In addition to DeFi and Liquid Staking, Solana is also known as a "blockchain for NFTs". NFT collections on Solana have grown exponentially not only in price but also in community membership. Popular collections on the Solana network include:

- Food Lads

- Claynosaurs

- Okay Bears

- Tesorians

7. Conclusion

Solana is an ecosystem that has existed and proven its resilience in the volatile crypto market. To be able to grow significantly, in addition to optimizing the platform technology, Solana needs to focus on developing the ecosystem and attracting users. Follow Theblock101 to update more information about Solana and this potential ecosystem.

Read more:

Tiếng Việt

Tiếng Việt.png)