1. Overview of the February 2025 CPI Report

The February 2025 CPI report reflects data collected during the first full month of President Donald Trump’s second term, which began on January 20, 2025. The key findings from the report include:

-

The CPI for All Urban Consumers (CPI-U) rose 0.2% on a seasonally adjusted basis from January to February 2025.

-

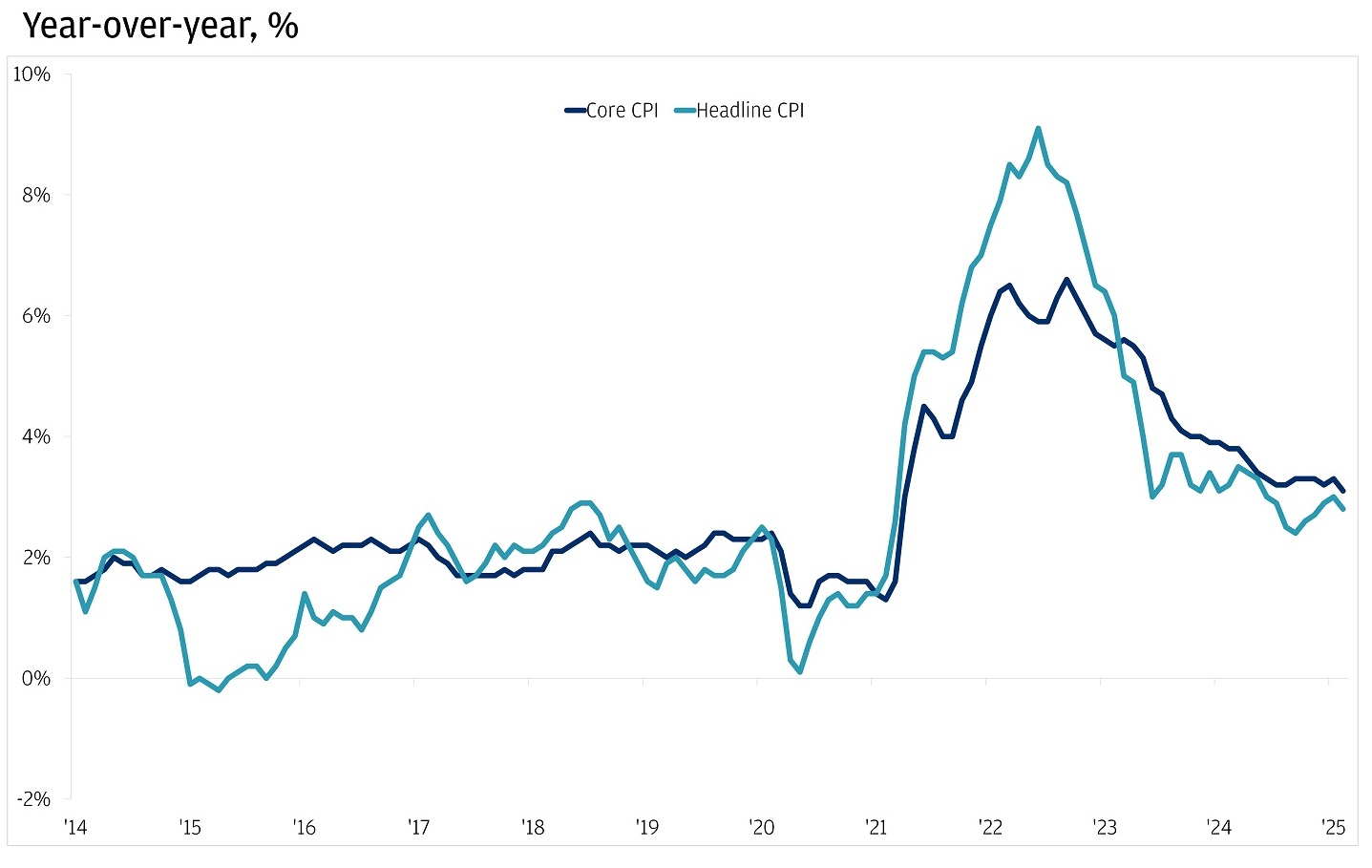

On a year-over-year (YoY) basis, the CPI increased by 2.8%, a decline from January's 3.0%.

-

The core CPI, which excludes volatile food and energy prices, also rose 0.2% MoM and 3.1% YoY, a slight decline from January’s 3.3%.

These figures came in slightly below economists’ expectations, which had forecasted a 0.3% MoM rise for both headline and core CPI, as well as annual rates of 2.9% and 3.2%, respectively.

2. Key Components driving the CPI

The BLS report highlights several key categories that influenced the CPI figures for February:

-

Shelter Costs:

-

Shelter is a major component of the CPI basket and increased by 0.3% MoM, contributing significantly to the overall CPI rise.

-

The YoY shelter index rose by 4.2%, though this increase was smaller compared to recent years, indicating a cooling in housing inflation. This trend aligns with Bloomberg’s analysis that suggests housing inflation is moderating.

-

Food Prices:

-

Food inflation eased somewhat, with the food index rising by 0.1% MoM.

-

Although grocery prices remained stable, egg prices, which had surged by 53% YoY in January due to bird flu concerns, saw a notable drop, falling to an average of $1.85 per dozen by early March. This decline was attributed to the Trump administration's agricultural interventions.

-

Energy Prices:

-

Energy prices saw a mild increase of 0.4% MoM, driven by a 1.2% rise in gasoline prices.

-

However, the YoY energy index was down 1.5%, reflecting a broader deflationary trend in commodity prices over the past year.

-

Core Goods and Services:

-

The core CPI’s 0.2% MoM rise was influenced by increases in categories such as:

-

Medical care (+0.5%)

-

Used vehicles (+0.8%)

-

Recreation (+0.4%)

-

Apparel (+0.3%)

-

Some categories experienced declines, such as airline fares (-1.1%) and new vehicles (-0.2%), which helped temper the overall core increase.

3. Comparison to Expectations and Previous Reports

The February 2025 CPI report came in cooler than anticipated, marking a shift from January’s hotter inflation data:

-

Economists’ expectations (via FactSet) were for a 0.3% MoM rise, which aligns with January’s 0.5% increase, the highest since August 2023.

-

The YoY headline CPI of 2.8% marked a decline from January’s 3.0%, signaling a moderation in inflation.

-

The core CPI increased by 3.1% YoY, the lowest pace since April 2021, further emphasizing the ongoing cooling of inflationary pressures.

When compared to the 9.1% inflation peak in June 2022, February 2025 shows considerable progress in the fight against inflation, though it remains above the Federal Reserve’s target of 2%.

4. Economic Implications

The February CPI report has several important implications for the U.S. economy:

4.1 Inflation Trajectory

The decline from 3.0% to 2.8% YoY in headline CPI and 3.3% to 3.1% in core CPI suggests that disinflationary trends are still ongoing, albeit at a gradual pace. Forbes notes that this continues the cooling trend that began in mid-2024, driven by stabilized supply chains and falling energy prices.

However, shelter and services inflation suggest that price pressures remain persistent in certain areas of the economy.

4.2 Impact on Consumers

For consumers, the 0.2% MoM rise in the CPI offers some relief, particularly with the drop in egg prices. However, CBS News highlights that lower-income households, which spend a larger proportion of their income on food and housing, are still feeling the pinch. Grocery prices remain 1.7% higher YoY, and shelter costs continue to outpace wage growth, putting pressure on these households.

4.3 Tariff Concerns

The CPI report predates President Trump’s proposed 25% tariffs on Canadian and Mexican imports, which are set to take effect on April 2, 2025. Economists warn that these tariffs could push inflation higher later in 2025, making February's data potentially a "calm before the storm."

5. Impact on Monetary Policy and Financial Markets

The Federal Reserve closely monitors CPI data to help guide its decisions on monetary policy. Given the cooler-than-expected CPI data for February, several implications arise:

Monetary Policy:

-

The February CPI report reduces the immediate pressure on the Federal Reserve to hike interest rates in its upcoming March 18-19 FOMC meeting. Bloomberg’s analysis suggests that while a rate cut is unlikely in the near term, the Fed may gain flexibility to ease policy later in 2025 if economic growth slows.

-

Fed Chair Jerome Powell has historically viewed tariffs as one-off price shocks rather than sustained inflation drivers, which could temper the Fed's reaction to future tariff-related price increases.

Financial Markets:

-

The markets reacted positively to the report, with S&P 500 futures rising by 0.8%, and 10-year Treasury yields dipping to 4.15% after the release.

-

In contrast, January’s hotter CPI had caused stock futures to drop by 1.1%, signaling that investors are cautiously optimistic about the Fed's potential to be less hawkish moving forward.

6. Critical Analysis and Limitations

While the February CPI report is encouraging, it comes with some limitations:

-

The seasonal adjustments made by the BLS can distort short-term trends, as noted in the methodology section. For instance, January’s 0.5% MoM spike partly reflected seasonal factors.

-

The CPI-U index covers 93% of urban consumers but excludes rural populations, meaning it does not represent the full U.S. population.

-

Core CPI’s 3.1% YoY rate, although lower, remains sticky above 3%, primarily driven by services inflation. This suggests that underlying inflationary pressures are still present, as noted by Moody’s Analytics.

7. Conclusion

The February 2025 CPI report, released on March 12, signals a moderation in inflation, with a 0.2% MoM rise and a 2.8% YoY headline rate that was lower than expected. While some key components, such as shelter and services, continue to show price pressures, the cooling in food and energy prices offers a positive sign for consumers. As of March 14, 2025, this report provides the Federal Reserve with some flexibility in its monetary policy, but ongoing concerns about tariffs and supply dynamics suggest that inflationary pressures may not be fully behind us.

Overall, the February CPI report is a cautiously optimistic signal that inflation is cooling, but the battle against inflation is far from over. Future developments, including the impact of tariffs and potential economic shifts, will continue to shape the trajectory of U.S. inflation and the Federal Reserve's policy decisions.

Read more:

English

English Tiếng Việt

Tiếng Việt.png)

.jpg)