1. What is a Sell Stop?

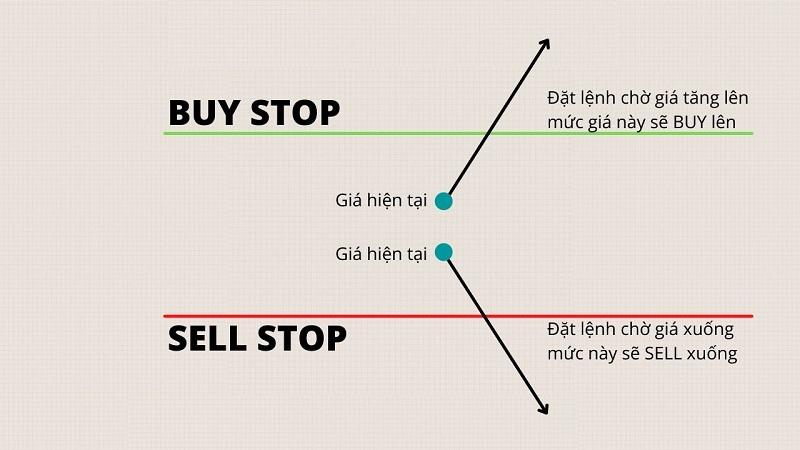

A Sell Stop is a type of trade order placed below the current market price, with the aim of selling an asset when its price drops to a specific level. When the price of the asset falls to or below this level, the Sell Stop order is triggered and becomes a market sell order.

Sell Stop orders are often used to protect profits or limit losses in case the price of an asset declines sharply. This is a useful tool that helps investors manage risk effectively.

2. How does a Sell Stop order work?

The process for placing a Sell Stop order:

Step 1: Determine the Sell Stop price: The investor sets the price at which they want the Sell Stop order to be triggered. This price must be lower than the current market price.

Step 2: Place the Sell Stop order: The investor places the Sell Stop order with the specified price on the trading platform.

Step 3: Trigger the order: When the price of the asset falls to or below the Sell Stop price, the order is triggered and becomes a market sell order.

Example of a Sell Stop order:

Suppose you own 1 Bitcoin (BTC) and the current price is $40,000. You are concerned that the price of BTC could drop significantly and want to protect your investment. You place a Sell Stop order at $38,000. If the price of BTC falls to $38,000 or lower, the Sell Stop order is triggered, and your BTC will be sold at the market price.

3. Benefits and Limitations of Sell Stop Orders

3.1. Benefits of Sell Stop orders

- Protects profits: The Sell Stop order helps protect profits by automatically selling the asset when its price falls to the predetermined level, preventing further price declines from eroding profits.

- Limits losses: By using a Sell Stop order, investors can limit losses if the asset's price falls sharply. The order will be triggered and the asset will be sold before the price declines too far.

- Automates trading: The Sell Stop order automates the trading process, reducing human intervention and preventing emotional decision-making in trades.

3.2. Limitations of Sell Stop orders

- Risk of false activation: In some cases, the price may temporarily drop and then immediately recover, causing the Sell Stop order to be triggered and the asset to be sold at a lower price than intended.

- No guarantee of the sell price: A Sell Stop order does not guarantee that the asset will be sold at the Sell Stop price, especially during periods of high market volatility. The order will be executed at the market price, which may be lower than the Sell Stop price.

4. When should you use a Sell Stop order?

5. Strategies for Effectively Using a Sell Stop Order

6. Key Considerations for Investors Using Sell Stop Orders

To use a Sell Stop order effectively:

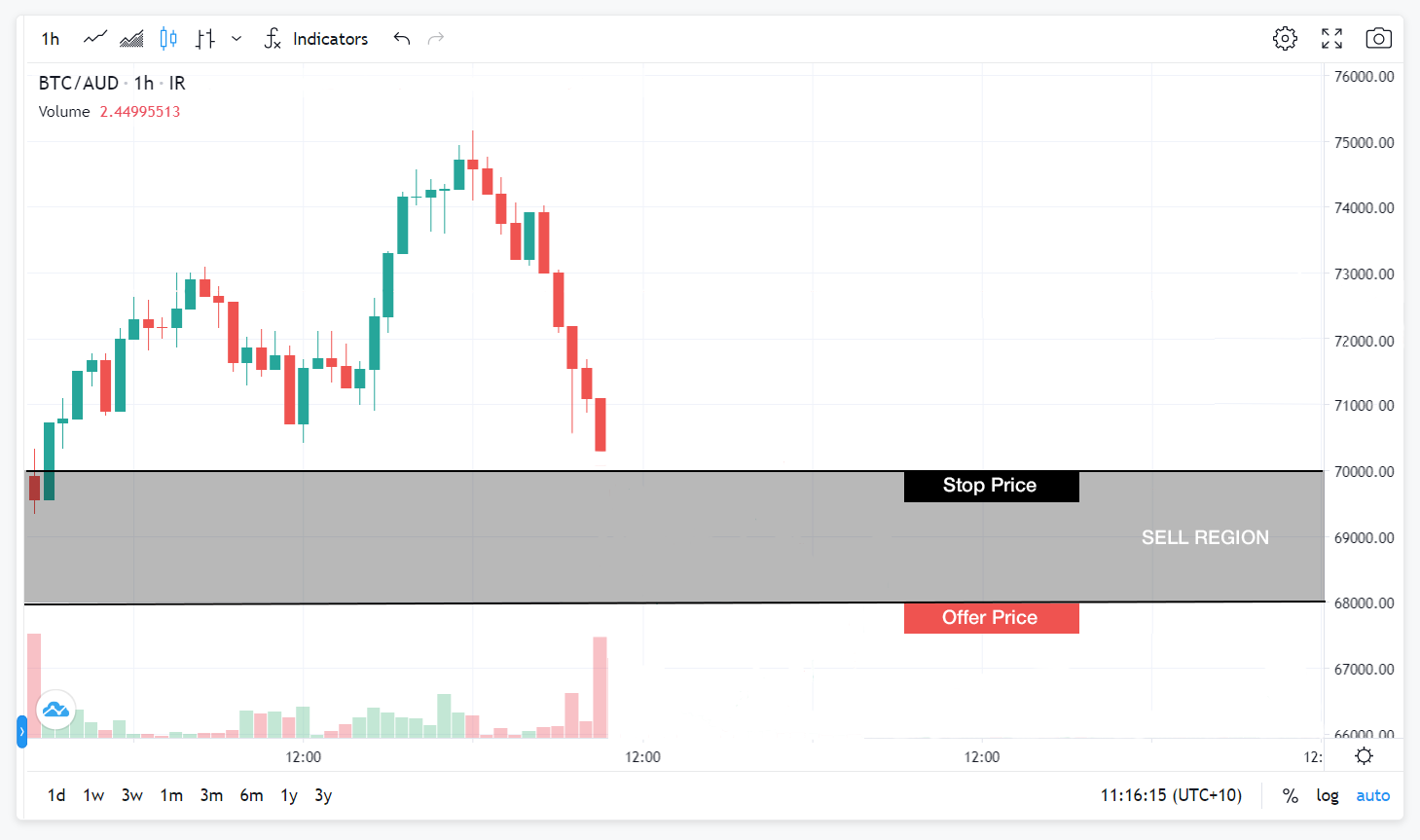

- Place the Sell Stop below key support: Traders should place the Sell Stop below significant support levels to protect their assets in case the price falls sharply below this level.

- Combine with a limit order: Combine the Sell Stop with a limit order to ensure the asset is sold at a minimum acceptable price. This helps prevent selling at too low a price during market volatility.

- Monitor and adjust the Sell Stop order: Investors need to frequently monitor and adjust their Sell Stop orders based on market fluctuations and their investment strategy. Regularly adjusting the Sell Stop ensures it remains aligned with current market conditions.

- Assess market sentiment: Market sentiment is a key factor when placing a Sell Stop order. Investors should evaluate the overall sentiment to set the order at an appropriate level and avoid unexpected situations.

7. Examples of Sell Stop Orders in Crypto Markets

Example with Bitcoin:

Suppose you own 2 Bitcoins (BTC), and the current price is $50,000. You are concerned that the price of BTC might drop due to negative news. You place a Sell Stop order at $47,000. If the price of BTC drops to $47,000 or lower, the Sell Stop order will be triggered and your 2 BTC will be sold at the market price.

Example with Ethereum:

You own 10 Ethereum (ETH), and the current price is $4,000. You want to protect your profits and set a Sell Stop order at $3,800. If the price of ETH drops to $3,800 or lower, the Sell Stop order will be triggered and your 10 ETH will be sold at the market price.

Example with Ripple (XRP):

Suppose you own 5,000 Ripple (XRP) and the current price is $1. You are concerned that the price of XRP may drop due to market volatility. You place a Sell Stop order at $0.90. If the price of XRP falls to $0.90 or lower, the Sell Stop order will be triggered and your 5,000 XRP will be sold at the market price.

8. Difference Between Sell Limit and Sell Stop Orders

Both Sell Limit and Sell Stop orders are important tools in trading, but they work differently and are used for different purposes. Here’s the difference:

| Sell Limit | Sell Stop | |

| Purpose | Used when the trader expects the price to rise to a certain level before reversing downward. A Sell Limit order is used to sell at a price higher than the current market price. | Used when the trader predicts that the price will continue to decline after breaking a key support level. A Sell Stop order is used to sell at a price lower than the current market price. |

| How it works ? | This order is triggered when the market price reaches or exceeds the set price. In other words, you want to sell when the price rises to a level higher than the current price, anticipating that the price will then decline afterward | This order is triggered when the price falls to or below the set price. A Sell Stop order is commonly used in breakout strategies, where the trader wants to enter a sell position after the price has broken below a support level. |

| Example | If the current price is $50, you can place a Sell Limit order at $55. When the price rises to $55, the sell order will automatically be executed. | If the current price is $50, you can place a Sell Stop order at $45. When the price drops to $45, the sell order will automatically be triggered. |

9. Conclusion

The Sell Stop order is a crucial tool in crypto trading, helping investors protect profits and limit losses in case the asset's price drops significantly. By understanding how it works and applying effective strategies for using Sell Stop orders, traders can optimize profits and manage risk more efficiently.

Read more:

Tiếng Việt

Tiếng Việt%20(11).png)