1. What is an ETF?

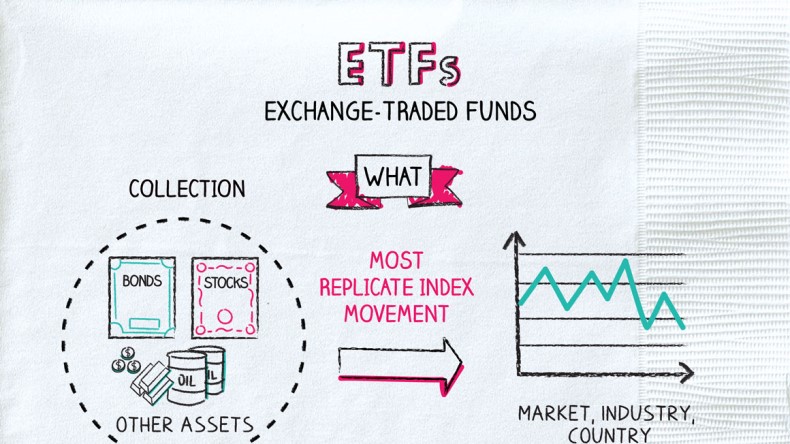

An Exchange-Traded Fund (ETF) is a fund that holds a basket of assets (such as stocks, bonds, or commodities) and divides ownership of those assets into shares, which can be bought and sold by investors on a stock exchange. These shares represent a proportional stake in the underlying assets of the fund. ETFs are designed to track the performance of a specific index, sector, commodity, or other asset classes.

One of the defining characteristics of ETFs is that, unlike mutual funds, they are traded throughout the day like individual stocks. This gives investors flexibility and allows them to react to market movements in real-time.

2. Key characteristics of ETFs

ETFs come with several features that make them attractive to investors. From the ability to diversify across multiple assets to the convenience of trading throughout the day, ETFs offer a range of advantages. Let's explore some of the key characteristics that set ETFs apart from other investment vehicles.

-

Diversification

ETFs provide an easy way for investors to diversify their portfolios. Instead of purchasing individual stocks or bonds, an investor can buy a single ETF that holds a variety of assets. For example, an ETF tracking the S&P 500 will hold shares of the 500 largest companies in the U.S., providing broad market exposure. -

Traded on Stock Exchanges

Like individual stocks, ETFs are listed on major stock exchanges, which means they can be bought and sold throughout the day at market prices. This provides investors with flexibility and liquidity, unlike mutual funds, which are only traded at the end of the trading day. -

Low Fees

One of the significant advantages of ETFs is their low cost structure. Many ETFs are passively managed, meaning they track an index rather than trying to outperform it. This reduces the cost of managing the fund and results in lower expense ratios for investors. ETFs generally have lower management fees compared to actively managed mutual funds. -

Transparency

Most ETFs provide transparency into their holdings. They regularly disclose the assets in their portfolio, which is updated on a daily basis. This allows investors to know exactly where their money is invested, which can help in making informed decisions. -

Tax Efficiency

ETFs are often more tax-efficient than mutual funds due to their unique creation and redemption process. This process helps to avoid triggering capital gains taxes when shares are bought or sold, making ETFs an attractive option for tax-conscious investors.

3. Types of ETFs

There are various types of ETFs available in the market, each designed to cater to specific investment goals. Whether you’re looking for exposure to certain sectors, regions, or asset classes, there’s likely an ETF that fits your needs. Let’s take a closer look at the different types of ETFs available to investors.

-

Stock ETFs

Stock ETFs invest in a collection of stocks, often aiming to track a specific index like the S&P 500 or the NASDAQ-100. These ETFs provide broad exposure to the stock market and are an ideal choice for investors looking to diversify their portfolio across multiple companies and industries. -

Bond ETFs

Bond ETFs invest in a portfolio of bonds such as government bonds, corporate bonds, or municipal bonds. These ETFs are suitable for income-seeking investors who want exposure to the fixed-income market without having to buy individual bonds. -

Commodity ETFs

Commodity ETFs offer exposure to commodities like gold, oil, or agricultural products. These ETFs are perfect for investors looking to gain exposure to the price movements of physical commodities without the need to purchase and store them directly. -

Sector and Industry ETFs

These ETFs focus on specific sectors or industries such as technology, healthcare, or energy. Sector ETFs allow investors to target areas of the economy that are expected to perform well, offering more specialized exposure compared to broader market ETFs. -

International ETFs

International ETFs invest in foreign markets, providing investors with exposure to global economies. These ETFs can focus on specific countries or regions, such as Europe or Asia, and are an excellent choice for investors seeking geographical diversification. -

Thematic ETFs

Thematic ETFs focus on specific investment themes or trends such as clean energy, artificial intelligence, or e-commerce. These ETFs are ideal for investors who want to target a particular trend or innovation that may be poised for growth.

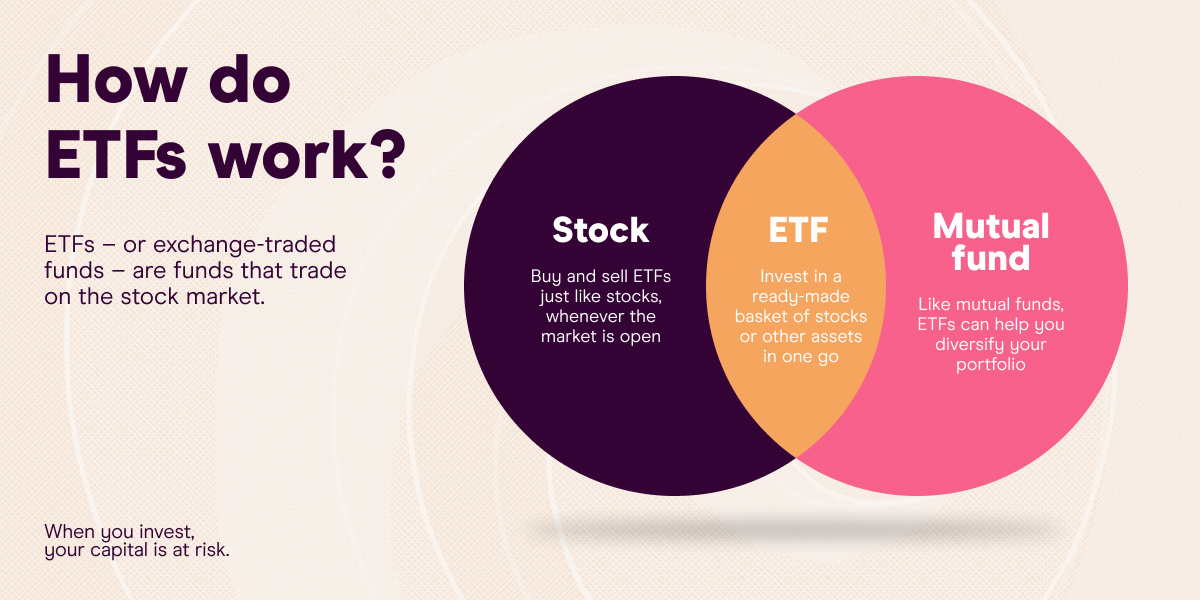

4. How do ETFs work?

Understanding how ETFs work is crucial for any investor looking to add them to their portfolio. Unlike mutual funds, ETFs trade on exchanges throughout the day, and their prices fluctuate based on the underlying assets. Let’s break down how an ETF works and how investors can buy or sell shares.

ETFs pool investor money to purchase a basket of assets. When investors buy shares of an ETF, they are essentially purchasing a portion of the underlying assets held within the fund. The value of the ETF’s shares will fluctuate throughout the day as the value of the assets in the portfolio changes.

There are two primary ways ETFs are bought or sold:

-

On the Exchange

ETFs can be traded like stocks on the exchange. Investors can buy and sell ETF shares throughout the trading day at market prices, which may differ slightly from the ETF’s net asset value (NAV) due to supply and demand. -

Through a Broker

ETFs can also be purchased through a brokerage account, where investors place orders with the help of a broker. This method is similar to buying any other stock or bond through an exchange.

5. Advantages of Investing in ETFs

ETFs offer several advantages that make them an appealing choice for many investors. From the ability to diversify investments to the low-cost structure, ETFs provide unique benefits. Here are some of the key advantages that come with investing in ETFs.

-

Diversification

ETFs allow investors to spread their risk across different assets, industries, or geographic regions. Instead of focusing on individual stocks, investors can gain exposure to a wide range of securities by purchasing a single ETF. -

Low Costs

ETFs generally have lower management fees compared to actively managed mutual funds, making them a cost-effective investment option. Since many ETFs are passively managed, they track an index or sector, which reduces management and transaction costs. -

Liquidity

ETFs are traded throughout the day on stock exchanges, which means they are highly liquid. Investors can buy or sell their shares quickly at prevailing market prices, offering more flexibility than mutual funds, which are only traded at the end of the day. -

Transparency

Most ETFs disclose their holdings regularly, giving investors transparency regarding where their money is invested. This level of transparency helps investors make more informed decisions about their investments.

6. Disadvantages of ETFs

While ETFs offer many benefits, they also have some drawbacks that investors should be aware of. Understanding these disadvantages can help investors make better decisions and manage risk appropriately.

-

Trading Costs

While ETFs generally have low management fees, investors may incur brokerage commissions or trading fees when buying and selling ETF shares. These costs can add up over time, particularly for active traders. -

Market Risk

Like all investments, ETFs are subject to market risk. The value of an ETF can fluctuate based on the performance of the underlying assets. Even though ETFs offer diversification, they are still susceptible to market-wide risks. -

Tracking Errors

An ETF may not perfectly track the performance of the index or asset it aims to replicate. This discrepancy is called tracking error, and it can lead to the ETF underperforming relative to its benchmark.

7. Conclusion

An Exchange-Traded Fund (ETF) is a flexible and cost-efficient investment vehicle that provides investors with exposure to a wide array of assets, from stocks and bonds to commodities and sectors. ETFs allow for easy diversification, low costs, and transparency, making them an appealing choice for both novice and experienced investors alike. However, like any investment, they come with risks, such as market volatility and tracking errors. By understanding how ETFs work and considering their advantages and disadvantages, investors can determine if ETFs align with their financial goals and risk tolerance.

English

English Tiếng Việt

Tiếng Việt.png)

.jpg)