1. What Is the Crypto Fear & Greed Index?

The Crypto Fear & Greed Index is a metric designed to measure the emotions and sentiments of cryptocurrency investors. It provides a score from 0 to 100, where:

-

0 to 24 indicates Extreme Fear

-

25 to 49 indicates Fear

-

50 represents Neutral sentiment

-

51 to 74 indicates Greed

-

75 to 100 indicates Extreme Greed

The purpose of this index is to help traders identify potential buying and selling opportunities. Extreme fear suggests that investors are overly worried, which could indicate a buying opportunity. Conversely, extreme greed signals that the market may be due for a correction.

2. The importance of Fear and Greed index

.jpg)

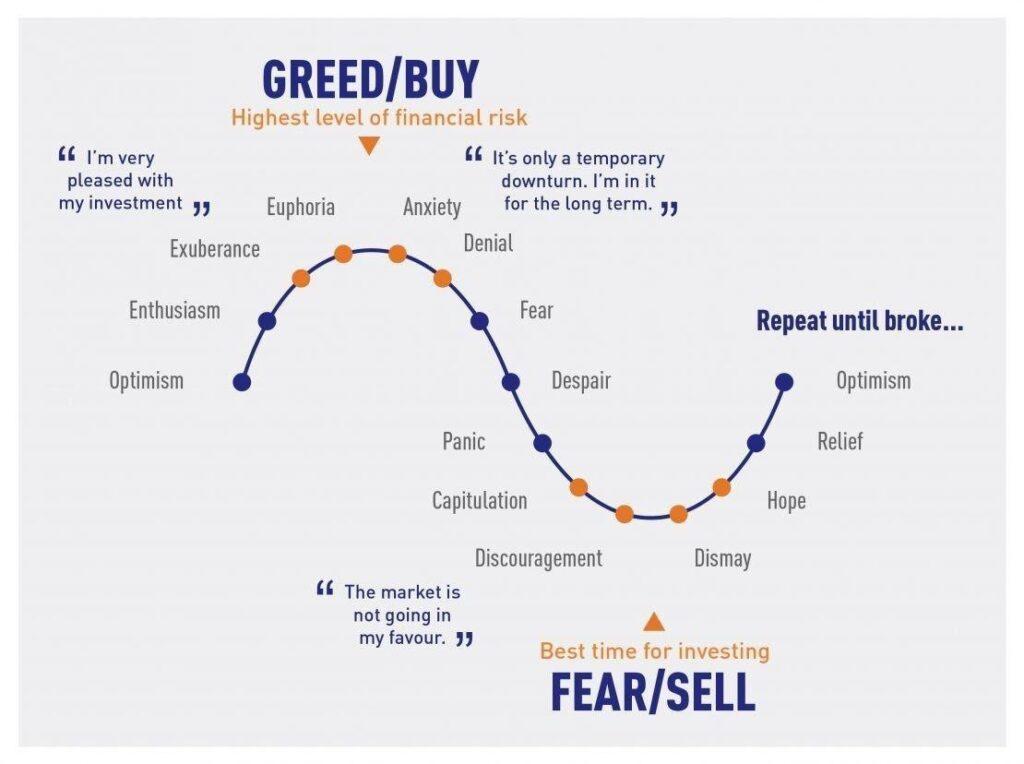

Investor psychology plays a significant role in crypto price movements. Many traders fall victim to FOMO (Fear of Missing Out) when prices rise, leading to buying at inflated values. On the other hand, fear-driven panic selling occurs when markets experience sudden declines.

The Crypto Fear & Greed Index helps traders avoid emotional decisions by providing an objective measure of sentiment. It serves as an early warning system, alerting investors when market conditions are either too optimistic or pessimistic, thereby reducing the risk of making impulsive trades.

3. How the Crypto Fear & Greed Index is calculated?

The index aggregates data from multiple sources to determine the overall market sentiment. The main factors considered include:

-

Volatility (25%)

Market volatility is a key indicator of fear. The index compares current Bitcoin price volatility and maximum drawdowns to the average values from the past 30 and 90 days. An unusual increase in volatility suggests heightened fear among investors.

-

Market Momentum & Volume (25%)

A strong bullish trend with high trading volume signals greed, whereas low volume and declining momentum suggest fear. The index compares current trading volumes to historical averages to determine investor sentiment.

-

Social Media Sentiment (15%)

The index monitors Twitter and Reddit activity, analyzing the frequency and engagement of cryptocurrency-related discussions. A surge in interactions typically indicates growing public interest and greed, whereas declining discussions suggest fear.

-

Bitcoin Dominance (10%)

Bitcoin’s market dominance reflects investor confidence. An increase in Bitcoin’s dominance indicates fear, as investors move funds from altcoins to the relative safety of Bitcoin. A decline in dominance suggests greed, as traders seek higher returns from altcoins.

-

Google Trends (10%)

Search volume trends provide insights into investor curiosity and concerns. For example, an increase in searches related to “Bitcoin price crash” indicates fear, while rising interest in “Bitcoin to the moon” suggests greed.

-

Surveys (15%) - Currently Paused

Previously, weekly investor sentiment surveys were conducted to gauge market outlook. Although this data is currently not factored into the index, it once played a significant role in shaping sentiment analysis.

4. Way to use the Fear & Greed Index

4.1 Identifying Buy and Sell Opportunities

-

Extreme Fear (0-24): Investors are overly worried, which could indicate a good buying opportunity.

-

Extreme Greed (75-100): The market is overbought, increasing the likelihood of a correction.

4.2 Avoiding Emotional Trading

By relying on the index, traders can minimize emotional decision-making, allowing them to follow a more strategic investment approach based on data-driven insights.

4.3 Market Timing Strategy

The index is particularly useful for swing traders and long-term investors looking to time their entries and exits more effectively. A neutral sentiment (index score of around 50) suggests a stable market, while extreme readings indicate potential reversals.

5. The impact of Fear & Greed on Market Trends

Investor sentiment often precedes major market movements. Historically, extreme fear has led to bottom formations, while excessive greed has resulted in market bubbles. Understanding these psychological patterns can help investors anticipate future price trends and adjust their strategies accordingly.

For example:

-

Bitcoin’s crash in March 2020 saw the Fear & Greed Index plummet to 10 (Extreme Fear), marking an excellent buying opportunity before the market recovered.

-

The bull run of late 2021 witnessed the index reaching 90+ (Extreme Greed), foreshadowing the subsequent correction.

6. Limitations of the Fear & Greed Index

While the index is a valuable tool, it should not be used in isolation. Market conditions are influenced by multiple factors, including:

-

Macroeconomic events such as inflation and interest rate changes.

-

Regulatory news that may impact investor confidence.

-

Technological developments and network upgrades.

Traders should combine the index with fundamental and technical analysis for a well-rounded strategy.

Conclusion

The Crypto Fear & Greed Index is a powerful tool for understanding investor sentiment and market psychology. By analyzing factors such as volatility, trading volume, social media trends, and Bitcoin dominance, the index provides valuable insights into market conditions.

By incorporating this metric into their trading strategies, investors can make more informed decisions, reduce emotional biases, and optimize their market entries and exits. However, it’s essential to use the index alongside other analytical tools to maximize its effectiveness in navigating the ever-volatile world of cryptocurrency investing.

As crypto markets continue to evolve, monitoring fear and greed remains crucial for staying ahead of the trends and making smarter investment choices.

Read more:

English

English Tiếng Việt

Tiếng Việt.png)

.jpg)