1. Risks of DeFi from Smart Contracts

Code Errors and Security Vulnerabilities

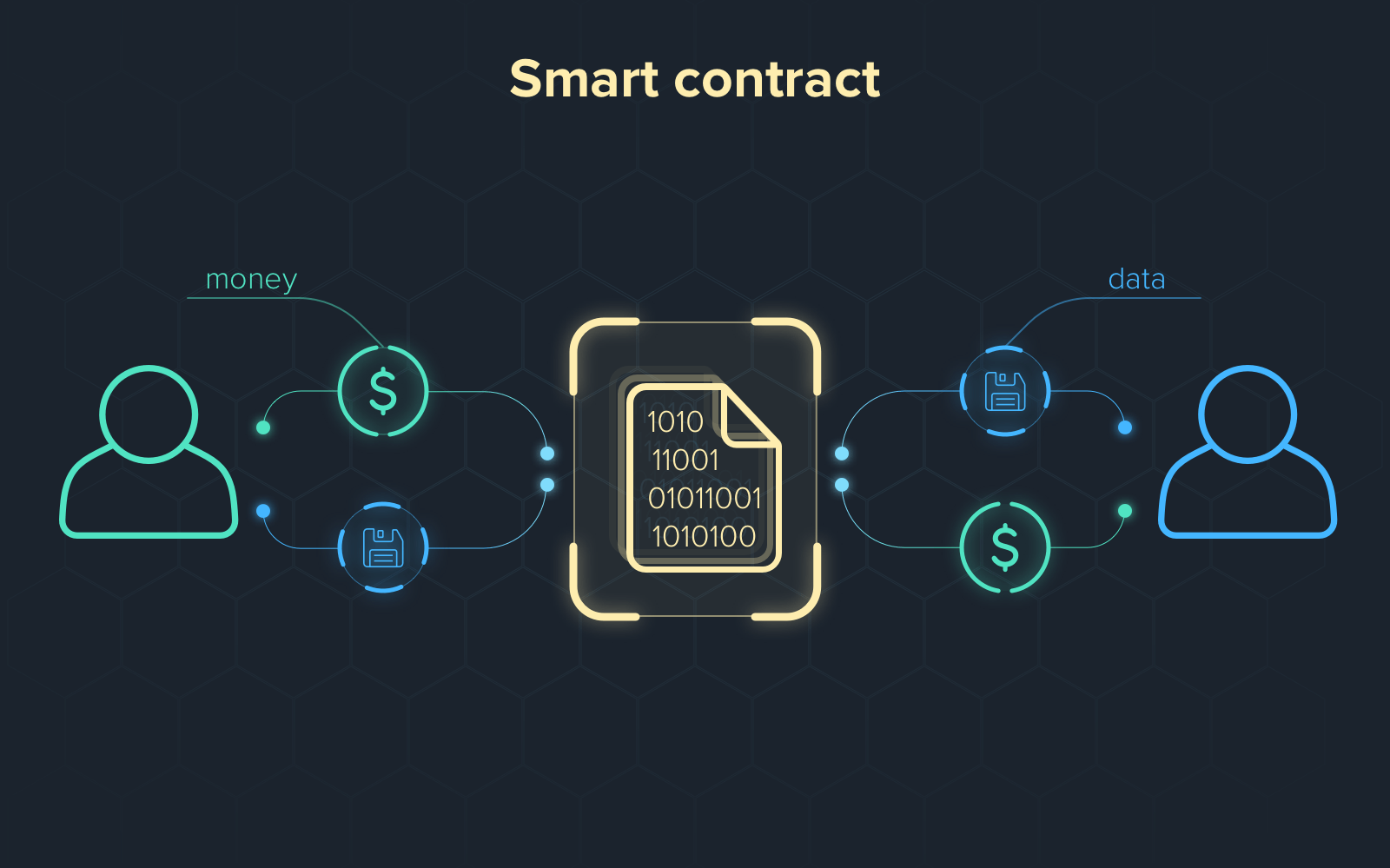

Smart contracts are the backbone of many DeFi protocols. However, these contracts are not always perfect and may contain code errors or security vulnerabilities. If exploited, these flaws can lead to significant asset loss.

Mitigation Measures

To mitigate this risk, investors should choose DeFi projects that have been audited for security by reputable firms and have a proven track record. Additionally, stay updated with announcements and updates from the project development team.

2. Market Volatility Risk

Sharp Price Fluctuations

The cryptocurrency market is known for its high price volatility, and DeFi is no exception. The value of DeFi tokens can rise or fall suddenly, posing significant risks to investors.

Mitigation Measures

To manage price volatility risk, investors should diversify their portfolios and not place all assets into a single project. Use risk management tools such as stop-loss and take-profit orders to protect your investment capital.

3. Liquidity Risk

Lack of Liquidity

Some DeFi protocols may face liquidity issues, especially during periods of high volatility or when many people withdraw funds simultaneously. Lack of liquidity can lead to difficulties in buying or selling tokens or withdrawing funds.

Mitigation Measures

Investors should choose DeFi protocols with high liquidity and carefully examine liquidity pools before investing. Monitor liquidity indicators and engage with communities to stay updated on timely information.

4. System Risks

Network Congestion

When blockchain networks like Ethereum experience congestion, DeFi transactions may be delayed or fail to execute. This can cause financial damage to investors.

Mitigation Measures

Investors should monitor network status and choose times to execute transactions when fees are low and the network is not overloaded. Additionally, use alternative blockchains such as Binance Smart Chain or Solana to reduce congestion.

5. Governance Risks

Lack of Transparency in Governance

Some DeFi projects may lack transparency in governance or be at risk of manipulation by whales (large investors). This can affect the stability and development of the project.

Mitigation Measures

Investors should select projects with transparent and open governance mechanisms. Participate in project communities and monitor governance discussions to ensure your interests are protected.

6. Regulatory Risks

Lack of Clear Regulation

DeFi is still in development and not clearly regulated in many countries. This can create legal risks for investors, especially as new regulations are introduced.

Mitigation Measures

Investors should regularly update themselves on legal regulations related to DeFi in their country. Carefully consider before investing in DeFi projects to avoid legal violations.

7. Victims of DeFi Scam Projects

Risks from Scam Projects

DeFi Scam Projects

Many DeFi projects have been found to be scams, taking investors' assets without providing any real products or services. Common scams include Ponzi schemes, fraudulent projects aimed at siphoning investment funds, and rug pulls.

Mitigation Measures

Investors need to conduct thorough due diligence before investing in any DeFi project. This includes researching the development team, checking the project's transparency, and seeking advice from the community and experts. Always be cautious of projects promising excessively high returns and check smart contracts for security vulnerabilities.

8. Conclusion

DeFi offers many attractive investment opportunities but also comes with significant risks. To optimize returns and minimize risks, investors need to understand and manage these risks carefully. We hope this article has provided you with an overview of DeFi risks and how to mitigate them. If you have any questions, feel free to contact us for further clarification.

Read More:

English

English Tiếng Việt

Tiếng Việt.jpg)