Effective immediately, customers utilizing BitPay's invoice system must undergo a one-time identity verification procedure known as BitPay ID for transactions equal to or exceeding 1,000 euros. This update replaces the previous requirement mandating verification for all transactions made by EU-based customers, irrespective of transaction value.

1. What is BitPay?

BitPay is a leading payment service provider specializing in cryptocurrency transactions. It enables businesses and individuals to send and receive payments in various cryptocurrencies, such as Bitcoin, Ethereum, and others.

BitPay offers tools and solutions that facilitate the seamless integration of cryptocurrency payments into online and retail environments, making it easier for merchants to accept digital currencies as a form of payment.

Additionally, BitPay provides services like invoice processing, payment settlement in fiat currency, and compliance solutions to ensure regulatory adherence in the cryptocurrency space.

1.1. The main advantages of BitPay Wallet

- Multilingual support: It supports most common languages, including Vietnamese.

- Simple user interface.

- Open-source.

- Integration with hardware wallets Ledger and Trezor.

- Multi-signature support.

- Buy and sell bitcoin through an in-house exchange.

- Use of password as an additional security method.

1.2. Understanding BitPay ID Verification

BitPay ID verification, facilitated through Onfido, is an essential process within the BitPay Dashboard. Onfido specializes in Identity Verification Services, ensuring a seamless verification experience. When engaging with BitPay's services, Onfido collects pertinent user information.

This typically includes an image of the user's identity document along with a photo or video of their face. Onfido meticulously verifies the authenticity of the identity document and compares the facial image provided to ensure consistency with the document's photo. Upon successful verification, users gain access to BitPay's suite of features and services, empowered by the assurance of their verified identity.

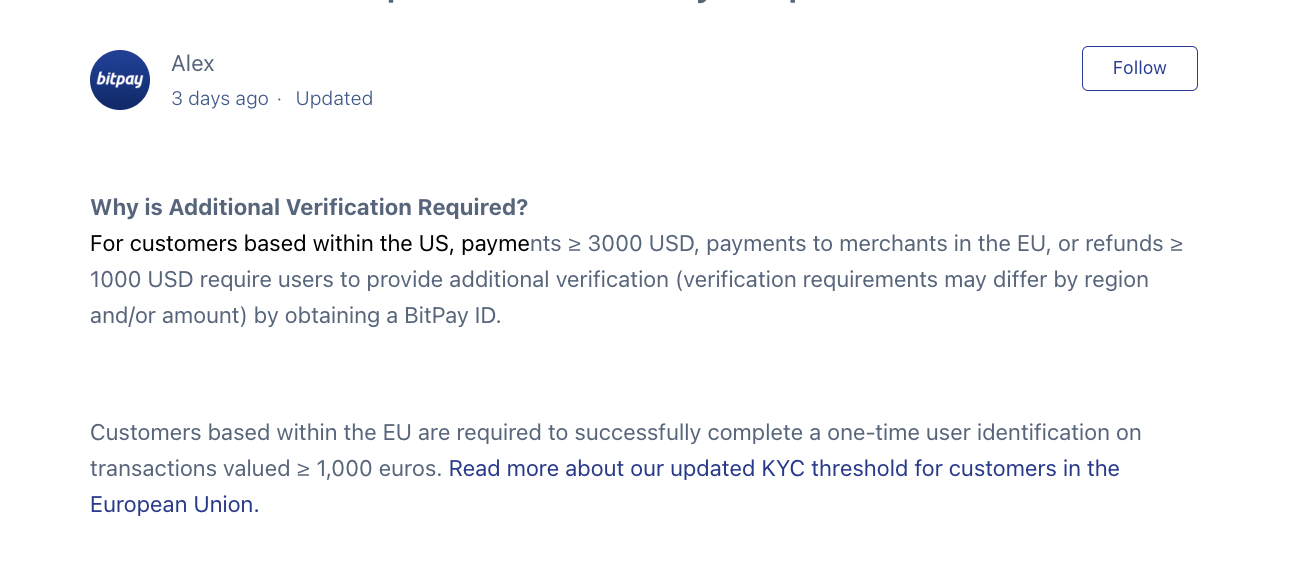

2. Does BitPay have KYC?

BitPay implements a KYC (Know Your Customer) process for its users. This process typically involves verifying the identity of customers who use BitPay's services, especially for certain transaction thresholds or when required by regulatory standards.

The KYC procedure helps BitPay ensure compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, as well as to maintain the security and integrity of its platform.

2.1. Who must KYC on Bitpay?

BitPay requires Know Your Customer (KYC) verification for certain transactions based on specific thresholds. For payments equal to or exceeding 3000 USD or refunds of 1000 USD or more, users are mandated to provide additional verification. The exact verification requirements may vary depending on the user's region or the transaction amount. This verification process entails obtaining a BitPay ID.

Business users intending to conduct transactions or receive refunds falling within these thresholds must undergo ID verification as individual users.

Furthermore, BitPay imposes a mandatory one-time identity verification for its customers situated in the European Union. This verification process, conducted through BitPay ID, is necessary for purchases valued at 1,000 euros or higher.

2.2. What documents are accepted to KYC?

Discover which documents are eligible for identity verification with BitPay. Users have the flexibility to utilize passports for identity verification in more than 195 countries. In addition to passports, certain countries offer alternative documents suitable for identity verification.

Explore the accepted documents for Onfido verification by visiting this site.

Ensure that you submit both the front and back of documents requiring dual-sided presentation.

- Please note that only immigrant visas are accepted for verification within the United States; paper or temporary IDs are not valid.

- For select locations, driver's licenses are also acceptable forms of identification.

3. A step-by-step guide to KYC verification on BitPay

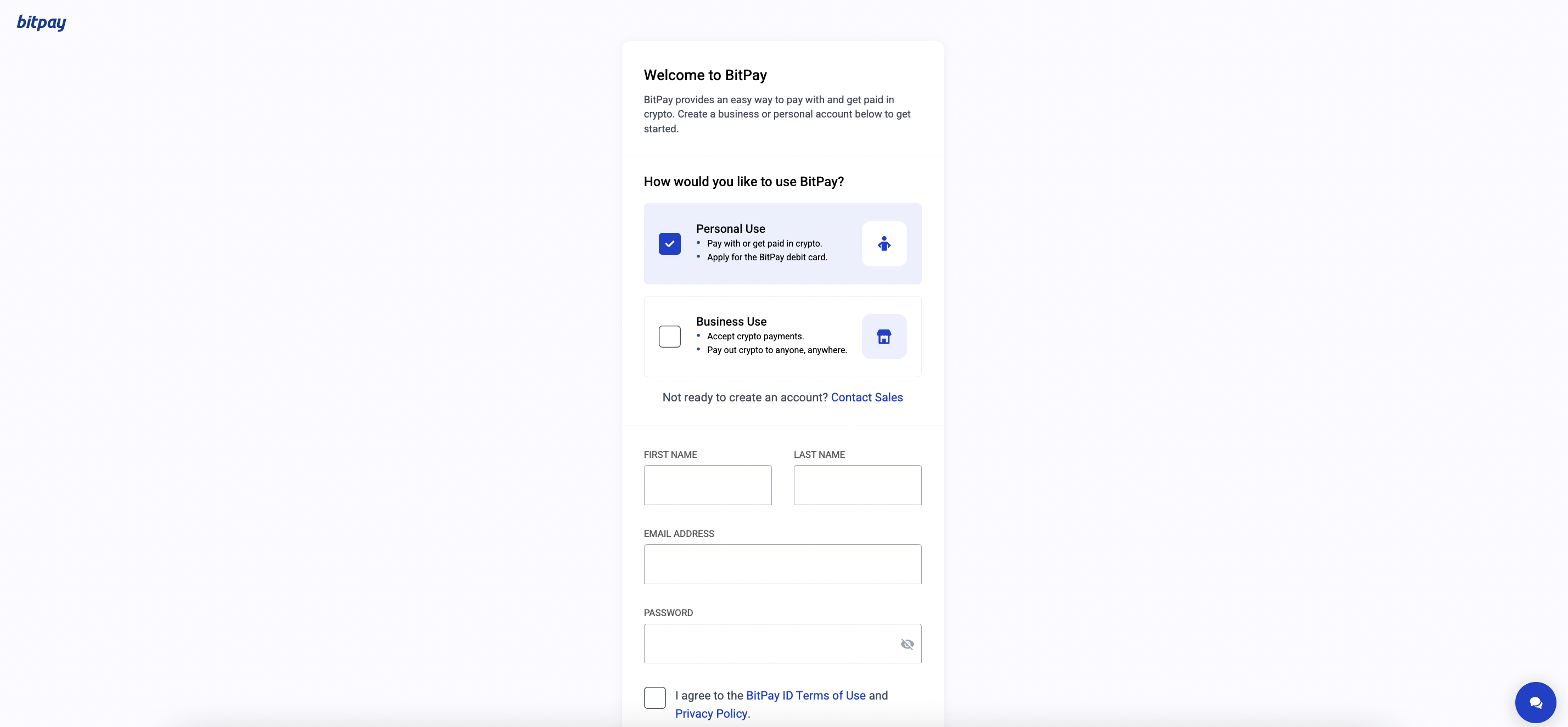

Step 1: Access the BitPay Sign-up Page

- Visit this page to initiate the sign-up process.

- Opt for a Personal Account and click Continue to proceed.

-

Select Personal Use, provide your name and email address, set up a password, agree to BitPay's Terms of Use and Privacy Policy, and then click Submit to proceed.

![BitPay KYC Dashboard]()

BitPay KYC Dashboard

Step 2: Verify Your Email

- If you haven't received the verification email, click the Email Didn’t Arrive button.

- Once received, click on Complete Verification. This action will open a new browser tab and redirect you to the BitPay Dashboard.

Step 3: Unlock Higher Limits

- To access higher limits for purchases exceeding 3000 USD or for refunds over 1000 USD, click on the three lines located in the upper-right-hand corner of the page, then select Settings.

- Within the Settings Page, choose Get Verified.

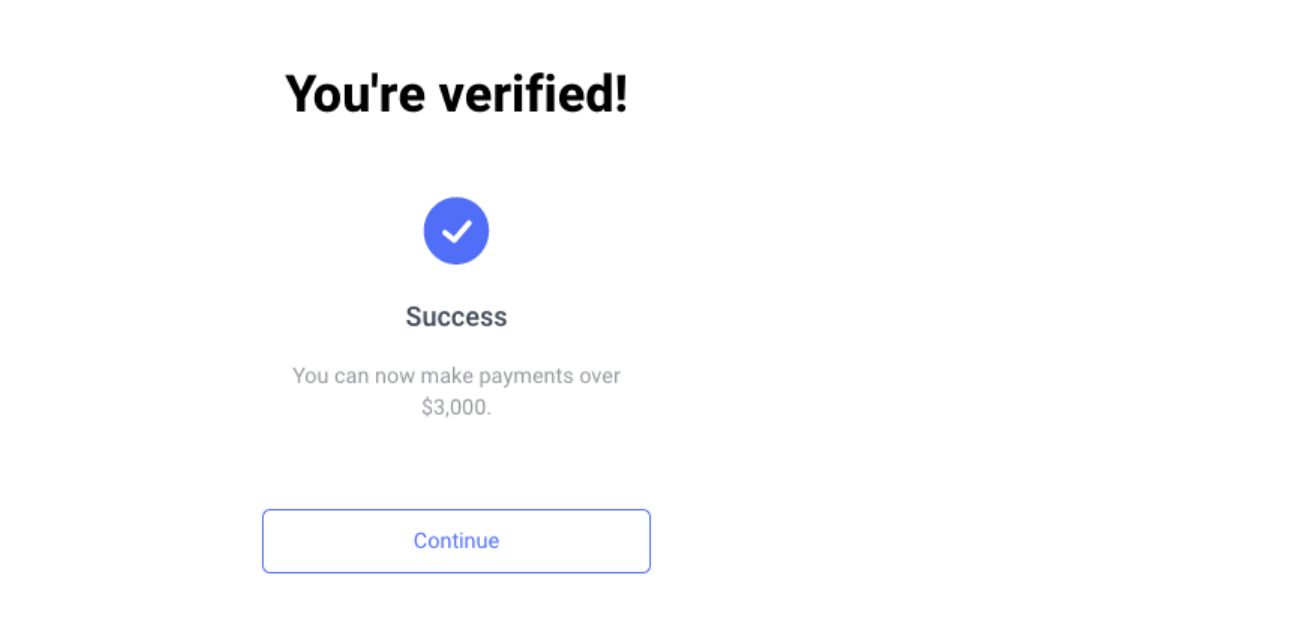

Step 4: Complete BitPay ID Verification

- Click on Continue and follow the instructions to complete the BitPay ID verification process.

- This involves accepting the Onfido privacy statement and Terms of Service, submitting any required documents, taking a selfie, and verifying the submitted information.

- After completing the BitPay ID verification, you may encounter a short delay before seeing a success confirmation page. Click Continue to be redirected to the BitPay Dashboard.

4. Conclusion

In conclusion, completing the Know Your Customer (KYC) process with BitPay marks a significant step towards unlocking additional features and higher transaction limits within the platform.

Upon successful verification, users can expect confirmation and potential upgrades to their accounts. It's imperative to adhere closely to BitPay's instructions during the KYC process, as requirements may vary.

Moreover, exercising caution when sharing personal information and utilizing only official BitPay channels for document submission is essential to safeguarding privacy and security. Stay informed about any changes or updates to BitPay's KYC procedures by regularly checking their official website or reaching out to their customer support for the latest information. This proactive approach ensures a seamless and secure experience with BitPay's services.

English

English Tiếng Việt

Tiếng Việt

.jpg)

.jpg)

.jpg)