1. Recession and Its Signs

1.1 What is a Recession?

An economic recession is a state in which the economy of a country or region declines in terms of production and business activity.

Currently, the world’s largest economy, the U.S., is experiencing a high-interest-rate environment that has persisted for the past two years. This situation is one of the reasons why this economic powerhouse is showing many signs of recession, causing extreme fear in the global financial markets, particularly in the U.S.

What should we do in the recession risks?

1.2 Signs of Economic Recession Risks

Generally, several signs of economic recession risks have become more evident in the U.S. economy, including employment data, GDP indices, and declining corporate profits.

Corporate profits often decrease and are affected by the high-interest-rate environment, which increases the cost of borrowing for businesses beyond the basic level.

Currently, the market is awaiting the Fed’s first interest rate cut, expected to occur in September.

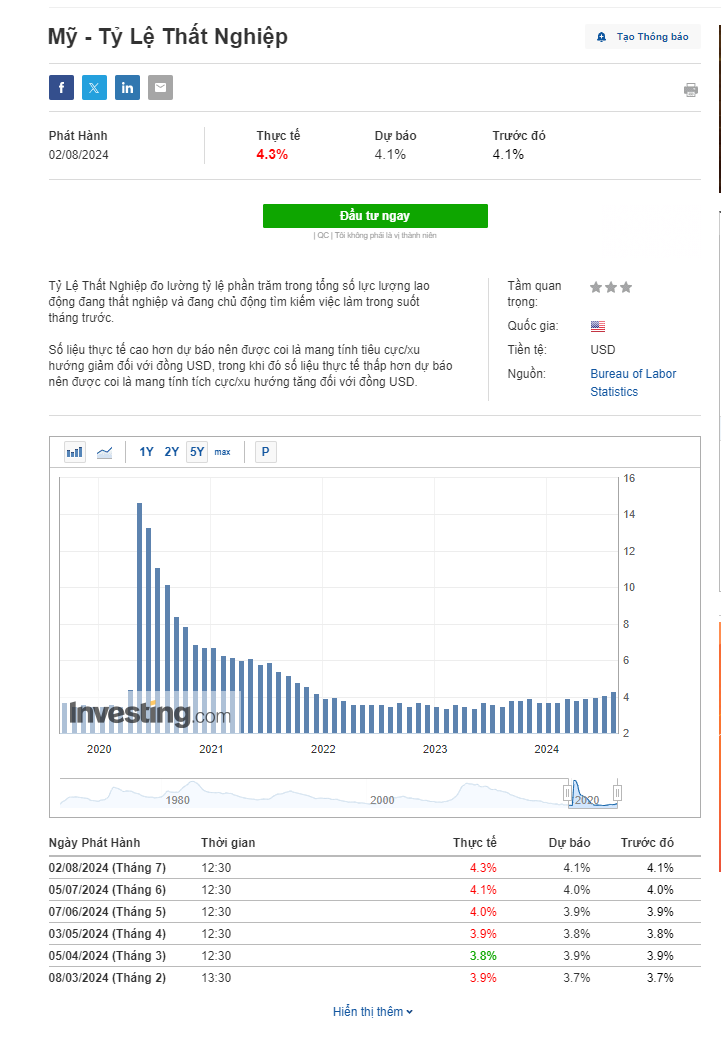

In early August 2024, we experienced alarming employment indicators from the U.S. Department of Labor, heightening fears of a broad recession. Previously, the Fed confidently stated that the U.S. economy would not exceed a 4% unemployment rate until 2025, but in August, the rate surged to 4.3%.

Economic recession risks spiked following the U.S. employment report.

2. Risks of Economic Recession

2.1 Significant Price Volatility

Generally, the risk of an economic recession in the U.S. poses a significant threat to the entire global economy.

In the current context, cryptocurrencies remain a relatively small investment channel globally, and significant price volatility is almost certain if risks materialize.

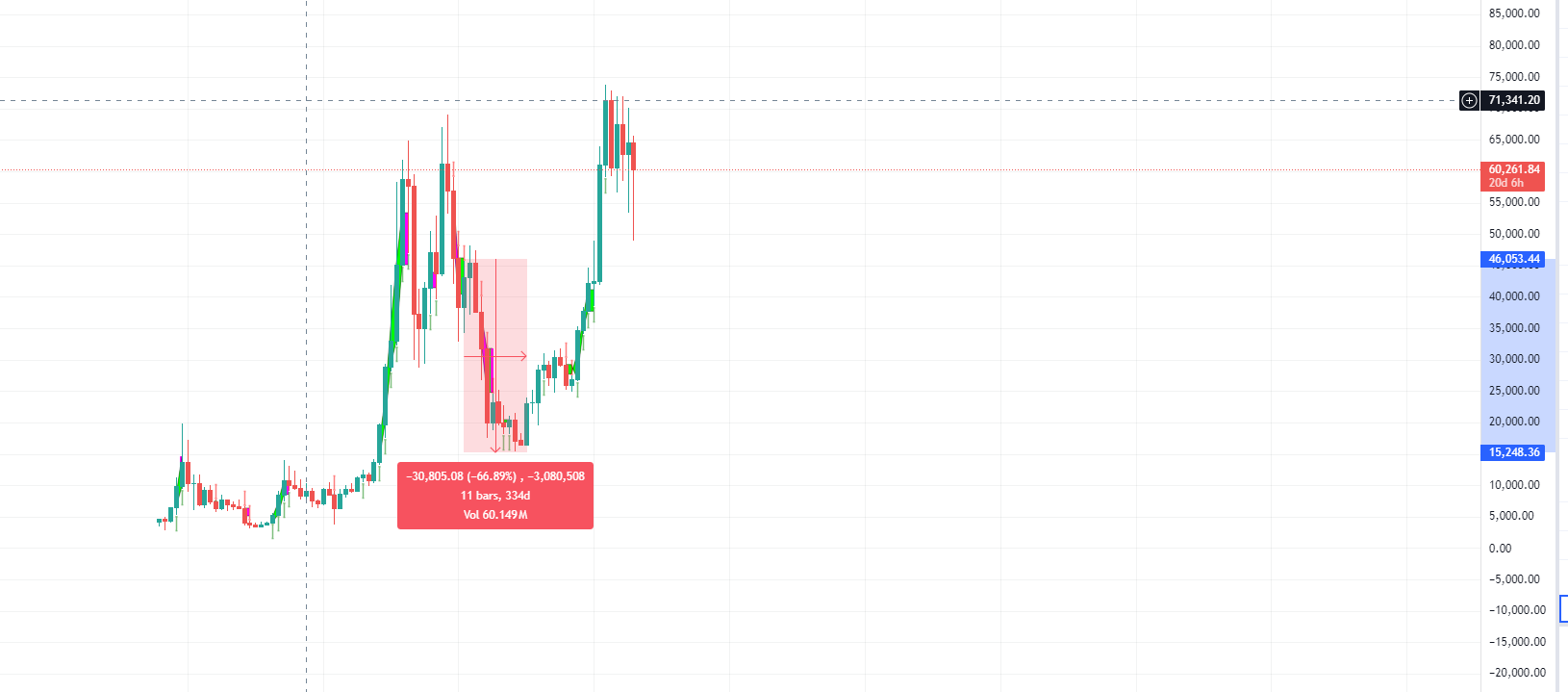

Historically, the crypto market saw a severe decline after Russia officially attacked Ukraine in February 2022. Since then, the cryptocurrency and stock markets have continuously dropped, with Bitcoin falling from $45,000 to $15,000, alongside the collapse of the FTX exchange at the end of 2022.

Although Bitcoin is considered a hedge against inflation and compared to gold, recent history shows that BTC still has significant volatility, especially during high-risk events like the Covid-19 pandemic in 2020 or the Russia-Ukraine War in 2022.

Price Chart of Bitcoin from the Russia-Ukraine War to the End of 2022

2.2 Reduced Market Liquidity

One of the risks causing asset prices to plummet during a recession comes from liquidity. Many people will cut back on investments and spending, leading to decreased liquidity and trading volume in investment channels.

Overall, if an economic recession truly occurs in the U.S. and globally, it could have a profound impact on the entire economy.

However, this also presents an opportunity for everyone to prepare a plan to accumulate valuable assets at significantly discounted prices.

So, what should we do to guard against risks? Especially for investors in the cryptocurrency market?

3. Strategies to against Economic Recession Risks

3.1 Diversify Your Investment Portfolio

Putting all your eggs in one basket is a risk for investors. To guard against general market declines, investors should diversify their portfolios in a way that aligns with their risk appetite.

Specifically, it is advisable to reduce the proportion of low-cap tokens—those with high volatility and small market capitalization—which often face significant difficulties in a depressed market, with some tokens even decreasing 10-20 times in a short period.

Additionally, holding stable tokens with high stability and long-term growth potential that have shown good performance recently, such as Solana, Bitcoin, and Ethereum, is also a notable advantage.

3.2 Hold Stablecoins

Increasing your allocation to stablecoins is often the best way to guard against recession risks. You can use stablecoins to participate in launchpool programs on CEXs, engage in lending to earn profits and good APY.

Furthermore, stablecoins can preserve your asset value during tough times and are key to unlocking attractive opportunities, especially as undervalued assets often emerge during market downturns.

3.3 Maintain Confidence and Invest Long-Term

The entire economy has its own cycles, and fluctuations are inevitable. Humanity has faced numerous economic risks, natural disasters, and severe recessions, but the overall trend has always been upward.

Choosing safe assets helps investors increase their wealth over time despite challenging trends. The global economy has consistently grown, which has raised the value of all “valuable” assets.

Here is the S&P 500 chart—the index of the 500 largest companies in the U.S.

S&P 500 Chart from the 1970s to Present

3.4 Closely Monitor News and Trends

The financial market is highly dynamic, and conditions can change completely within a week. Monitoring trends and news closely is an advantage for all investors to make timely decisions.

4. Potential opportunities during difficult times

4.1 Buy Low

A recession will drive down prices of many assets significantly, and many tokens and projects will be undervalued, providing opportunities for those who remain steadfast.

To be prepared, you need a specific plan and always have a reserve of stablecoins to execute this strategy.

Additionally, tokens that perform well and show good recovery relative to the broader market are advantageous, such as Solana.

4.2 Invest in Sustainable Blockchain Projects

Some sustainable blockchain projects that are undervalued are also worth noting. These are projects building real products, with real users, and are undervalued compared to the general market.

Particularly, projects that have survived and developed through past crises, such as Ethereum, are a positive criterion.

4.3 Opportunities for Airdrop/Retroactive Hunting

In past downturns, we had the opportunity to participate in airdrop/retroactive hunts with optimal costs due to low gas fees.

Users who stayed in the market through tough periods when ETH fluctuated between $1,300-$1,600 and used ETH for airdrop/retroactive hunts with zkSync, Starknet, Eigenlayer, Celestia, etc., achieved impressive results along with compounded gains from ETH.

In a depressed market, the chances of participating in airdrop/retroactive hunts are also significantly better, opening up significant opportunities for diligent and persistent individuals.

5. Conclusion

When facing recession risks, preparation not only helps investors protect their assets but also creates opportunities to take advantage of market fluctuations effectively. The cryptocurrency market, with its high volatility, can be greatly affected by a recession. Therefore, investment strategies need to be carefully crafted to ensure survival and growth during challenging times.

During a recession, calmness and discipline are key to overcoming difficulties. One should not be swayed by short-term fluctuations and negative news. Instead, rely on specific analysis and clear information to make decisions. The above information and perspectives are aimed at preparing for the worst-case scenarios that may occur. Stay tuned to BigcoinVietnam and Theblock101 for more interesting updates.

Read more:

English

English Tiếng Việt

Tiếng Việt

.jpg)

.jpg)

.jpg)