1. What is DeFiLlama?

Before learning how to use DeFiLlama, let’s understand what it is.

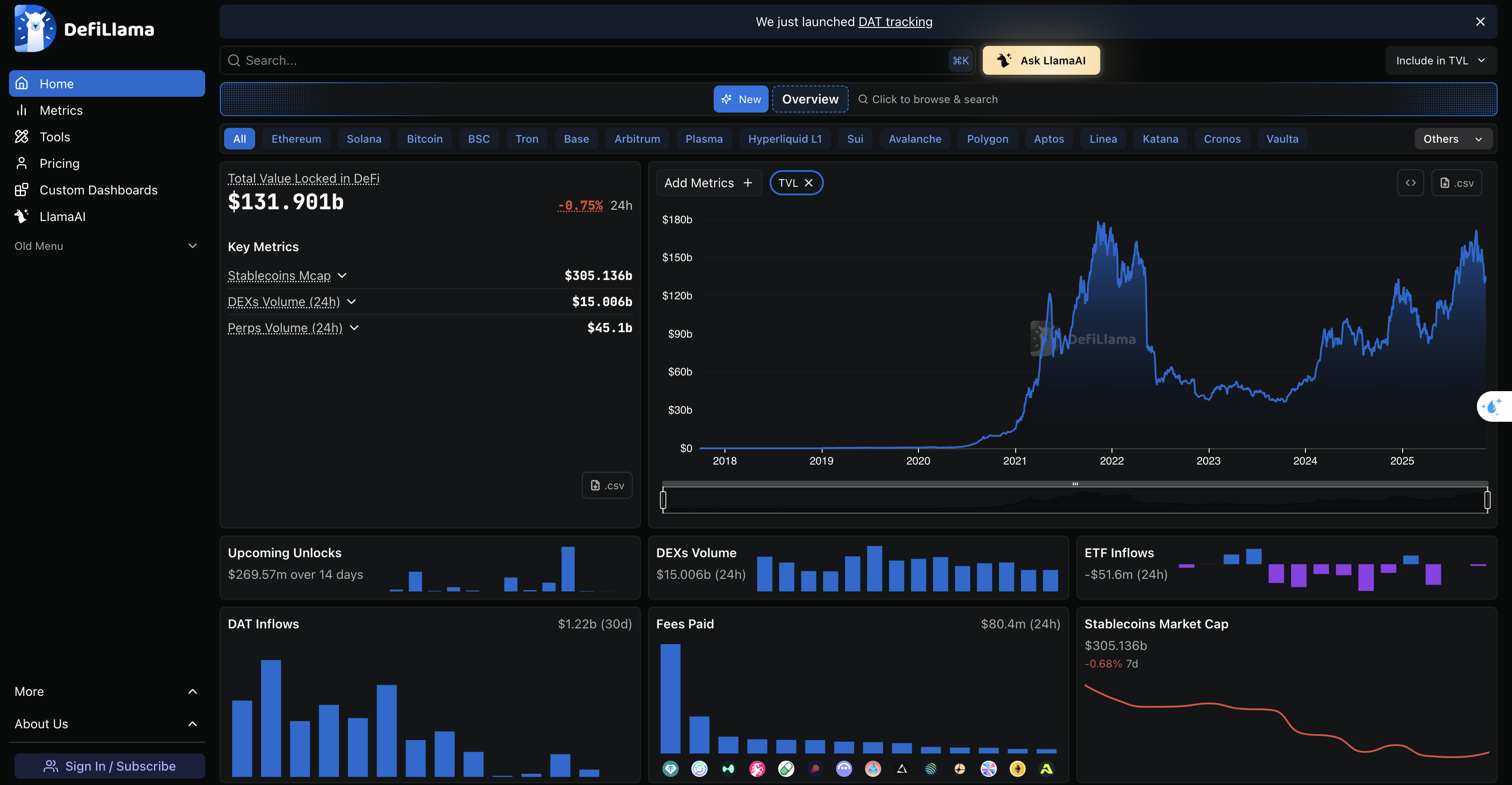

DeFiLlama is an open-source analytics platform that aggregates data from hundreds of decentralized finance protocols across multiple blockchains. Its main metric is Total Value Locked (TVL), which represents the total value of assets staked or locked within a protocol. Beyond TVL, DeFiLlama tracks fees, revenue, yields, airdrops, and blockchain activity, providing a clear and transparent overview of the DeFi landscape.

2. Why Learn How to Use DeFiLlama

Knowing how to use DeFiLlama provides several key advantages:

-

Transparency: It offers unbiased on-chain data, helping you verify claims made by projects.

-

Market insight: You can quickly identify trending categories, like liquid staking or lending based on capital flow.

-

Risk control: TVL and yield changes often signal upcoming volatility, letting you adjust your positions early.

-

Content credibility: If you’re producing crypto content or marketing materials, referencing DeFiLlama data adds authority to your insights.

3. How to Use DeFiLlama: Step by Step

This step-by-step guide shows you exactly how to use DeFiLlama to analyze protocols, chains, and yields like a DeFi pro.

3.1. Accessing the Platform

Start by visiting the official website. You don’t need an account to explore the analytics. The homepage displays real-time statistics, including global DeFi TVL, protocol rankings, and chain distribution.

3.2. Exploring Protocol Rankings

Under the “Protocols” section, you’ll find a list of DeFi platforms ranked by TVL. Click on any protocol to view:

-

Historical TVL charts

-

Supported chains

-

Daily and weekly percentage changes

-

Market share among competitors

This feature helps you monitor protocol growth trends and identify where liquidity is flowing.

3.3. Comparing Blockchain Ecosystems

Switch to the “Chains” tab to analyze the TVL distribution across major blockchains like Ethereum, Arbitrum, Solana, or BNB Chain.

Look for trends such as rapid inflows (indicating rising interest) or outflows (indicating risk or migration). This information is crucial for traders and community managers tracking ecosystem momentum.

3.4. Analyzing Categories and Yields

In the “Categories” section, you can explore protocol types, such as DEXs, lending platforms, derivatives, or liquid staking providers.

Meanwhile, the “Yields” tab shows available farming or staking opportunities with their annual percentage yields (APY). Use these insights to identify high-performing niches or trending DeFi sectors.

3.5. Viewing Historical Trends

Each protocol and chain page includes visual charts showing TVL changes over time. You can use these charts to detect cycles, evaluate market recovery phases, or support long-term strategy building.

3.6. Exporting and Using Data

DeFiLlama allows you to export TVL and yield data as CSV files or access them via API. This makes it easy to integrate analytics into your personal dashboards, Google Sheets, or research reports.

3.7. Tracking Airdrops and New Protocols

The platform also tracks potential airdrops, forks, and upcoming DeFi launches. Monitoring these can help you discover early-stage opportunities or new partnerships relevant to your marketing campaigns.

4. Best Practices When Using DeFiLlama

Before diving into the data, it’s essential to know how to use DeFiLlama responsibly. Here are the key do’s and don’ts that every DeFi analyst should keep in mind.

Do:

-

Filter by chain or category to get precise comparisons.

-

Track weekly and monthly changes for long-term trends.

-

Combine TVL data with qualitative insights like team reputation and audits.

-

Use DeFiLlama visuals or metrics as credible references in research or content.

Don’t:

-

Assume high TVL equals safety, it shows popularity, not protocol security.

-

Rely solely on one metric; check liquidity, token supply, and developer activity.

-

Ignore anomalies - TVL spikes or drops can result from reclassification or bridging events.

5. FAQs

Q1. Is DeFiLlama free to use?

Yes, it’s completely free with no login required for most features.

Q2. Is DeFiLlama data accurate?

It aggregates information directly from smart contracts and public APIs. While generally reliable, always cross-check key data.

Q3. Can I export data from DeFiLlama?

Yes, data can be downloaded in CSV format or fetched via its public API for research or development use.

Q4. Does DeFiLlama give investment advice?

No, it provides neutral on-chain data. Always do your own research before investing or promoting protocols.

6. Conclusion

Learning how to use DeFiLlama is essential for anyone serious about navigating the DeFi ecosystem. Its transparency, depth of data, and user-friendly design make it a cornerstone tool for crypto research, strategy building, and content creation.

By understanding TVL dynamics, chain comparisons, and yield analytics, you can make informed decisions, and if you’re a marketer or community builder, you can turn those insights into compelling stories backed by data.

Read more:

Tiếng Việt

Tiếng Việt

.jpg)

.jpg)

.jpg)

.jpg)