1. Context

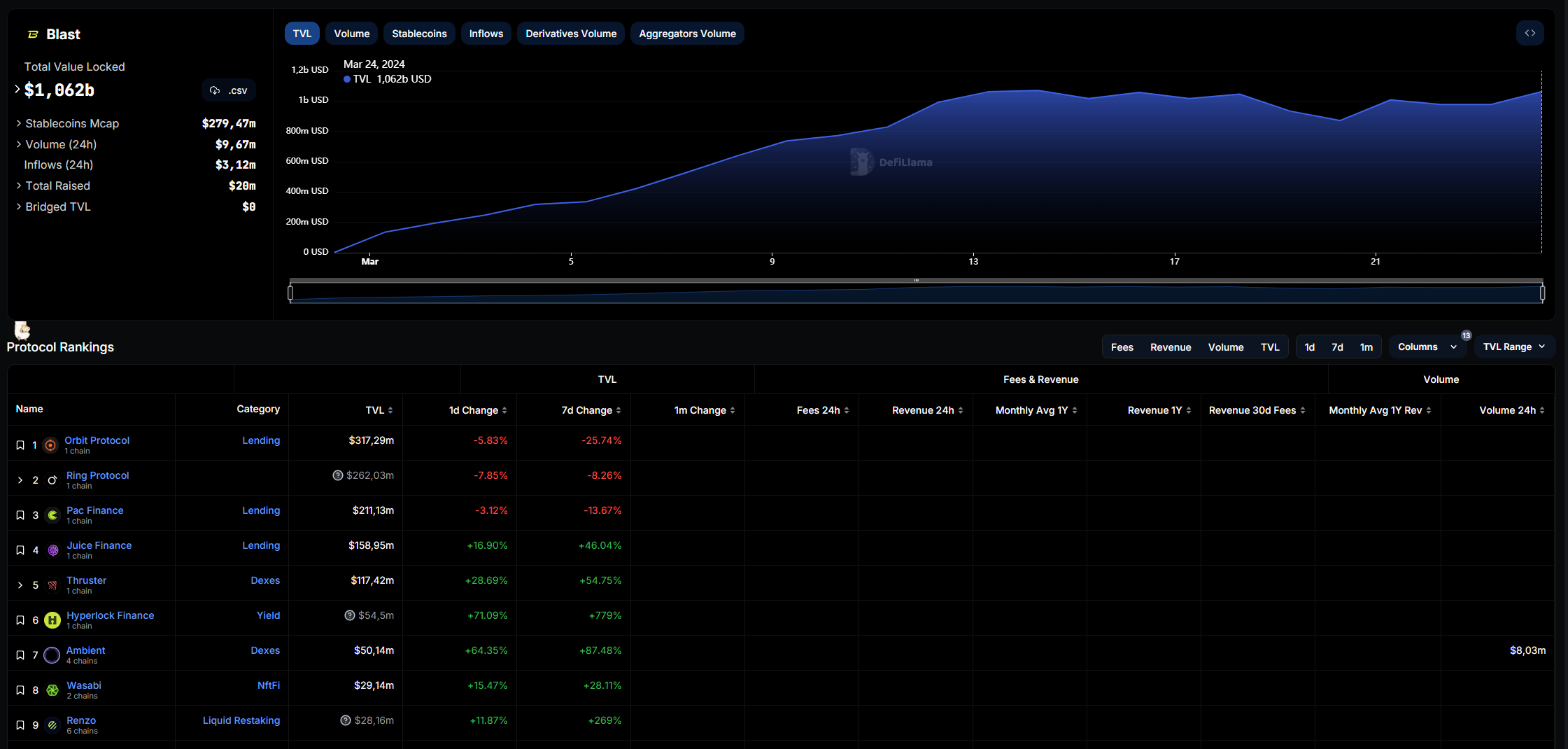

At present, Blast has officially transitioned to its mainnet for approximately three weeks, with the Total Value Locked (TVL) on the platform experiencing not only stability but also a notable increase compared to the Early-Access phase. This growth can be attributed in part to Blast's effective cash flow management strategy.

Expanding on this, Blast currently boasts a TVL of over $1 billion locked across various dApps on the platform, marking a significant achievement that positions Blast as the second-largest Layer 2 network by TVL, trailing only behind Arbitrum.

Despite this substantial liquidity, Blast has not yet fully realized its potential, as there are still relatively few investment opportunities available. What are the underlying reasons for this?

2. Primary Factors Contributing to Limited Investment Opportunities in Blast

2.1 Delayed Token Launches by Key Projects

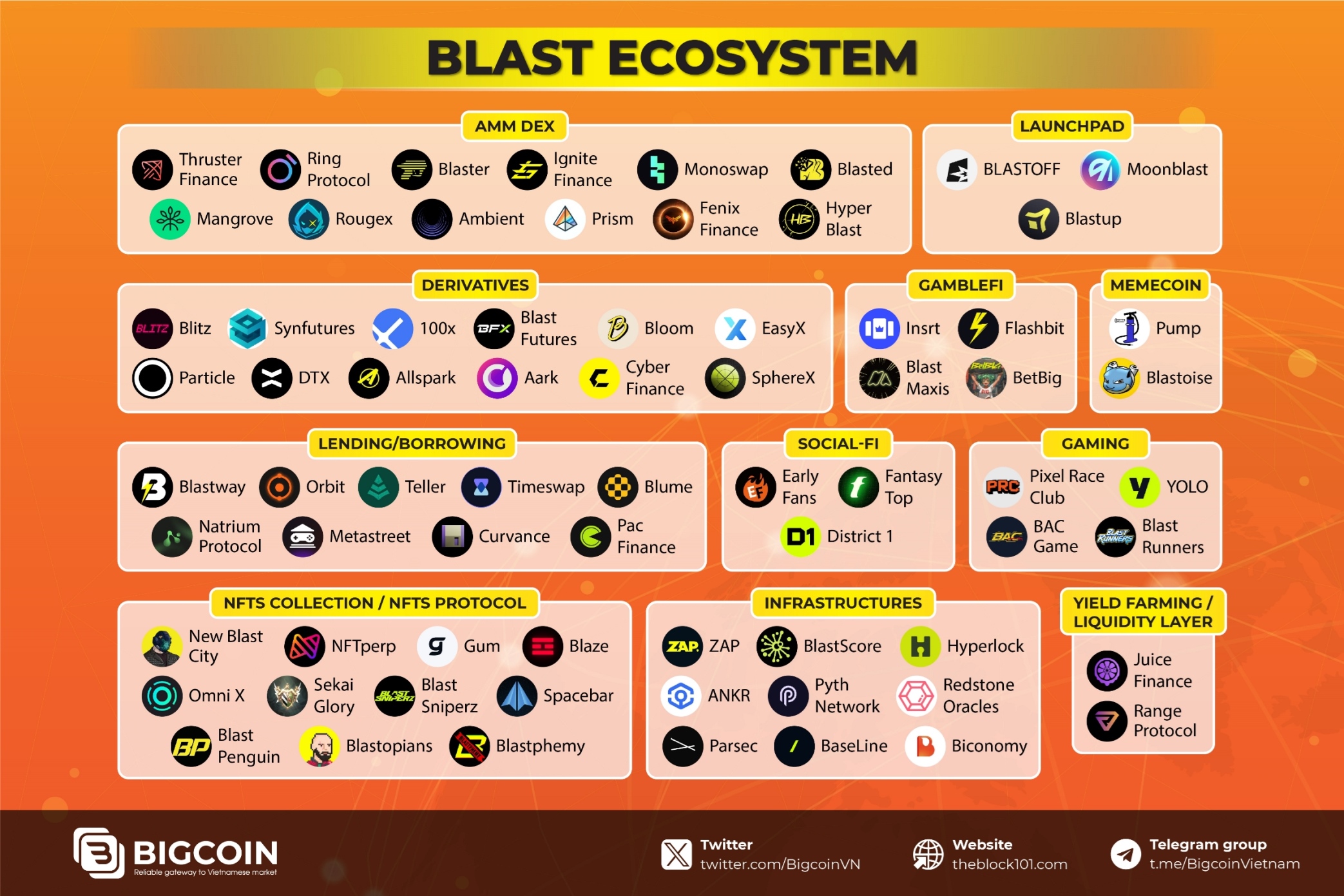

At present, major initiatives within Blast predominantly operate farm points programs, a method enabling users to acquire dual airdrops from Blast and associated projects. Notable projects, such as Thruster Finance, Synfutures, Pac Finance, Metastreet, Ring Protocol, among others, have yet to introduce their tokens.

With many high-quality projects deferring token launches, investment prospects within the Blast ecosystem appear diminished. Additionally, investing in projects lacking transparency regarding their origins and security poses increased risks.

2.2 Significant Unallocated Funds within the Ecosystem

Despite Blast's substantial Total Value Locked (TVL), a considerable portion of these funds remains locked within protocols for airdrop farming. Furthermore, Blast holds a substantial amount of idle capital, with statistics indicating over $2.5 billion USD, yet only approximately $1 billion USD actively flows into protocols.

While Blast has made significant strides since transitioning to its mainnet less than a month ago, challenges persist. Instances of unclear projects engaging in fraudulent activities, such as rug pulls, have raised concerns among users.

Moreover, Blast may benefit from a stronger emphasis on token launches to stimulate FOMO (fear of missing out) among users and attract funds from retail investors. Currently, Blast boasts approximately 600,000 users, primarily comprising early adopters and influential individuals within the ecosystem.

3. Future Projections

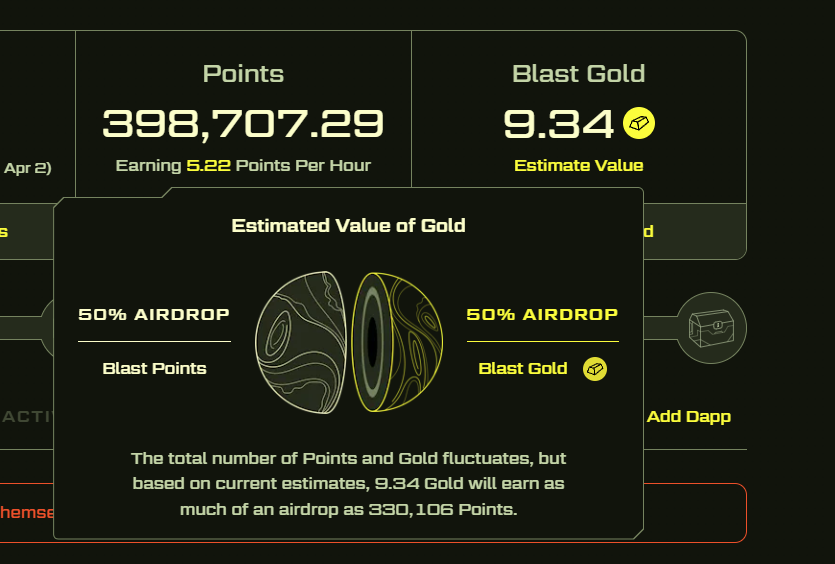

In recent times, Blast has introduced its Blast GOLD airdrop, a crucial element within the Blast ecosystem. Essentially, Blast allocates 50% of its airdrop through Blast GOLD, which is subsequently distributed to protocols and then to users.

What does this mean for the Blast ecosystem?

Presently, many users may not fully grasp the importance of Blast GOLD. These points require user engagement, prompting deeper interaction with dApps within the ecosystem to earn them. Activities such as trading, holding NFTs and tokens, and providing liquidity on the platform contribute to earning Blast GOLD.

Notably, one Blast GOLD currently equates to nearly 35,000 Blast POINTs, offering a highly favorable conversion ratio for users to enhance their airdrop farming rates on Blast.

With this strategy, Blast appears to actively stimulate user activity across dApps, bolstering liquidity flow within the ecosystem and potentially yielding positive outcomes.

Furthermore, a critical juncture for the entire ecosystem may occur in May-June 2024, coinciding with Blast's official token launch (scheduled for 05/24/2024). Typically, projects within an ecosystem aim to launch tokens during this period to capitalize on an anticipated significant airdrop surge from Blast.

At this pivotal juncture in the near future, the Blast ecosystem may experience substantial waves, prompting users to closely monitor for opportunities arising from airdrops or incentives.

4. Conclusion

In general, Blast currently lacks ample investment opportunities in its tokens. However, there are significant prospects for investment in farming airdrops or retroactive rewards within the Blast ecosystem. Noteworthy projects that users should pay attention to include Thruster Finance, Synfutures, Ring Protocol, and Particle Trade.

It is undeniable that Blast has made swift progress and achieved successes that many other Layer 2 platforms aspire to. There is considerable anticipation for numerous opportunities in Blast's near future. Stay updated with Theblock101 for important Blast-related information.

Readmore:

English

English Tiếng Việt

Tiếng Việt

.jpg)

.jpg)

.jpg)