1. What is Impermanent Loss?

%20(1).png)

1.1 Definition of Impermanent Loss

Impermanent Loss, or temporary loss, is a type of risk that occurs when Liquidity Providers (LPs) provide liquidity on Automated Market Maker (AMM) DEXs such as Uniswap, PancakeSwap, SushiSwap, etc. Impermanent loss occurs when you supply liquidity to a pool, and the value of your deposited assets fluctuates compared to their value at the time of deposit.

Impermanent Loss is one of the characteristic defect of AMM DEXes compared to CEXes because they lack an orderbook and operate as pools containing various crypto assets. When users withdraw assets from the pool, they alter the coin/token ratio, leading to Impermanent Loss for LPs.

This loss is not a direct cash loss, but rather reflects a loss of profit compared to holding assets individually without participating in AMMs.

1.2 Why is Impermanent Loss considered temporary?

Impermanent Loss is considered "temporary" because it is a transient phenomenon that may disappear when the market returns to equilibrium.

When there is a change in the ratio of asset values in the trading pair, LPs may loss temporary profit. However, if the market reverses thereafter, they may recover the lost assets or even generate profit.

However, Impermanent Loss can become a permanent loss in cases where the exchange rate never recovers or when liquidity providers decide to withdraw funds from the pool after price fluctuations.

2. How Impermanent Loss Works

.jpg)

To understand how Impermanent Loss operates, let's analyze the example:

Suppose you decide to deposit 1 ETH and 100 DAI into a liquidity pool. In this specific AMM, the initial value of the deposited token pair must be equivalent. This means that at the time of deposit, the price of ETH is 100 DAI, and you have deposited 200 USD into the pool.

At that time, there are a total of 10 ETH and 1,000 DAI in the pool - contributed by other liquidity providers as well. So, you own a 10% share in the pool and have a total liquidity of 10,000.

Now, let's say the price of ETH increases to 400 DAI. When this happens, participants will add more DAI to the pool and withdraw ETH from it until the ratio accurately reflects the price. Remember that in AMM, the price of assets in the pool depends on their ratio in the pool. While the total liquidity remains unchanged (10,000), the ratio of assets in it has changed.

With the current price of ETH at 400 DAI, it means that the ratio between ETH and DAI in the pool has changed. There are now 5 ETH and 2,000 DAI in the pool, due to the intervention of traders creating a price difference.

When you decide to withdraw your funds, having owned a 10% share in the pool, you will receive 0.5 ETH and 200 DAI, with a total value of 400 USD. So, you have earned a significant profit from depositing the initial 200 USD. However, if you had kept 1 ETH and 100 DAI, the total value of this amount would be 500 USD.

In fact, you could have earned more by keeping this amount in your wallet rather than depositing it into the liquidity pool. This is Impermanent Loss. In this case, your profit decrease is not significant because the initial deposit amount is not large. However, it is essential to remember that Impermanent Loss can lead to more significant profit losses (constituting a significant portion of the initial deposit).

3. Estimating Impermanent Loss

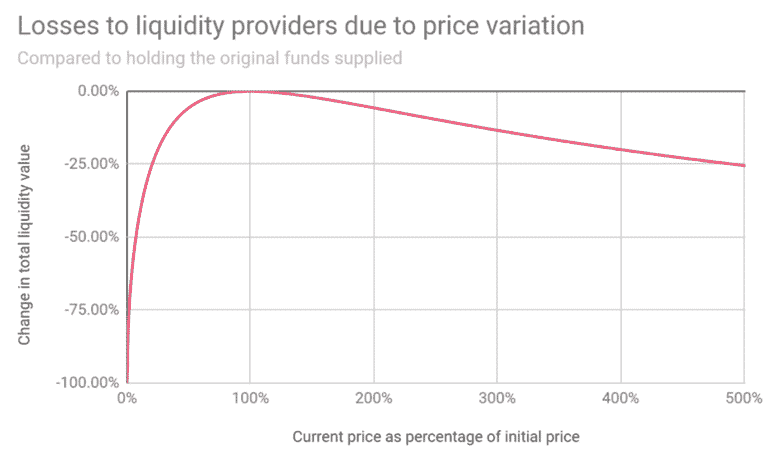

Impermanent Loss occurs when the prices of assets in a liquidity pool fluctuate. So, how much specific profit loss is there? We can represent this on a chart. It is essential to note that this chart does not account for any fees that liquidity providers may earn when providing liquidity.

The most accurate way to calculate Impermanent Loss is by using free online calculator tools. Alternatively, you can estimate Impermanent Loss using the chart below.

- Price change by 1.25x = loss of 0.6%

- Price change by 1.50x = loss of 2.0%

- Price change by 1.75x = loss of 3.8%

- Price change by 2x = loss of 5.7%

- Price change by 3x = loss of 13.4%

- Price change by 4x = loss of 20.0%

- Price change by 5x = loss of 25.5%

Once again, note that these figures do not include any transaction fees earned. Doubling or halving the token's value leads to similar results. Moreover, the larger the wager, the higher the loss.

4. Reduce the impact of Impermanent Loss

%20(1).png)

In market volatility scenarios, impermanent loss is unavoidable because prices will inevitably fluctuate. However, there are several ways to mitigate impermanent loss or at least not be significantly affected by it.

4.1. Use Stablecoin Pairs

By providing liquidity for a pair like USDT/USDC, you won't incur any risk related to impermanent loss. Because the price of stablecoins is stable. This is an effective strategy in bear markets because you still earn profits from transaction fees when other investors use the pool.

However, the main restrict of this way is that you won't benefit in bull markets when holding stablecoins during this period.

4.2. Split Assets into Two Portions

Another way to minimize impermanent loss is split your cryptocurrency assets into two equal portions and only invest one portion into the liquidity pool. This way, you'll reduce 50% of the impermanent loss.

The restrict of this method is that your profits will also be halved because only 50% of your assets are invested in the pool.

- Example: You provide liquidity for the ETH/DAI pool. If the price of ETH increases by 50%, the impermanent loss will be 2.02%.

If you invest a total of $1,000, you will incur approximately $20 in impermanent loss. However, if you only invest half of your ETH and DAI into the liquidity pool, your impermanent loss will decrease to only $10.1.

4.3. Invest in pairs with low price volatility

Some cryptocurrency pairs are more volatile than others, so providing liquidity for them may increase your impermanent loss.

- Example: If you plan to provide liquidity for a cryptocurrency pair and after market research, you believe that one of the assets in this pair will have more potential for price appreciation than the other asset, then refrain from providing liquidity.

The key to avoiding impermanent loss is always to be cautious with volatile assets by carefully analyzing their current and future potential.

4.4. Wait for Asset Prices to Stabilize

When you provide liquidity for a cryptocurrency pair, their exchange rates are often automatically adjusted according to market prices. However, the more the price deviates from the price when you deposited funds, the higher your impermanent loss.

Therefore, you can wait for the asset prices to return to their initial exchange rates and refrain from withdrawing until then. However, this is often challenging as the cryptocurrency market is inherently volatile.

4.5. Provide Liquidity for Single-Asset Pools

Not all AMMs have liquidity pools with two types of currencies. Some popular AMMs, such as Liquidity, only have a single type of asset. In this type of LP, you can provide a stablecoin, such as LUSD, to ensure its liquidity.

In return for providing this liquidity, you'll receive reduced platform usage fees. Since there's only one currency unit and no ratio between two assets, there's no impermanent loss in this case.

5. Conclusion

In reality, impermanent loss is nearly unavoidable when participating in liquidity provision in DeFi. Therefore, think carefully before providing liquidity for any liquidity pool to avoid the risk of impermanent loss. Even if you're an experienced investor, always ensure a balanced investment portfolio to minimize the impact of impermanent loss.

Đọc thêm:

English

English Tiếng Việt

Tiếng Việt.png)