1. What is a Market Order?

A market order in crypto is an instruction to buy or sell cryptocurrency immediately at the current market price.

When you place a market order, you are requesting to buy or sell a certain amount of cryptocurrency at the best available price at that moment, without specifying a particular price. This type of order is executed immediately, ensuring that you will acquire the desired cryptocurrency at the current market price. However, there may be a discrepancy between the price you expect and the actual price at which the transaction is executed due to rapid fluctuations in the cryptocurrency market.

2.Advantages and Disadvantages of Market Orders

Market orders have the following advantages and disadvantages:

2.1. Advantages

-

Quick Execution: Market orders are executed immediately at the current market price, without waiting like other types of orders.

-

Guaranteed Execution: You can be sure that your transaction will be executed, as there is no need to specify a particular price.

-

Simplicity: Using a market order is straightforward; you only need to specify the quantity you wish to buy or sell and submit the order.

2.2. Disadvantages

- Slippage Risk: When a market order buys or sells all available assets at one price, it will continue to execute at the next best price until the order is fulfilled. This process can lead to slippage, where the final execution price may differ from the initially expected price. This often occurs when the amount of cryptocurrency available at the desired price is insufficient, causing the order to be executed at a higher or lower price.Slippage can increase transaction costs and reduce profits or increase losses for traders. This is particularly important when trading large amounts of cryptocurrency, where slippage can significantly impact the final outcome of the transaction.

-

No price control: You cannot control the price of the transaction when using a market order, which can lead to not achieving the optimal profit price or accepting a higher loss price than initially anticipated.

-

Not Suitable in Some Cases: In certain situations, such as when you want to buy or sell an asset at a specific price, a market order may not be appropriate. In this case, you might need to use other types of orders such as limit orders.

-

Higher Transaction Fees: Market orders often incur higher transaction fees compared to other types of trades.

Market orders are a useful tool in commodity and financial markets trading but should be used carefully to ensure you understand their risks and benefits.

3. Differences Between Market Orders and Limit Orders

The main differences between market orders and limit orders in cryptocurrency trading are as follows:

| Market Order | Limit Order |

| A market order is an instruction to buy or sell cryptocurrency at the current market price. | A limit order is an instruction to buy or sell cryptocurrency at a specific price that you set beforehand. |

| When you place a market order, you do not specify the price at which you want to buy or sell but only the quantity of cryptocurrency you wish to trade. | When placing a limit order, you need to specify both the quantity of cryptocurrency you want to trade and the price at which you want the transaction to be executed. |

| Market orders are executed immediately at the current market price, with the possibility that the price may differ from what you initially desired due to market volatility. | Limit orders are only executed when the market price reaches or exceeds the price you have set. This means that the transaction may not be executed immediately, but you can ensure buying or selling at the price you want. |

In summary, the key difference between a market order and a limit order in cryptocurrency trading is price determination: a market order executes immediately at the current market price, while a limit order executes at a specific price you set beforehand.

4. When Should Crypto Investors Use Market Orders?

Market orders are a flexible and convenient tool for cryptocurrency trading, especially in situations where you need to acquire tokens immediately rather than achieving a specific price. By using a market order, you can buy or sell cryptocurrency instantly at the current market price, without having to worry about specifying a particular price.

However, it is important to remember that this convenience comes with a cost: slippage. In a highly volatile market, the execution price of a market order may differ significantly from your initial desired price. This can lead to accepting a higher price and incurring increased transaction fees.

Therefore, market orders are often preferred in situations requiring quick action, such as immediate buying or selling or exiting urgent situations. However, if you can wait and want better control over the execution price of your trade, a limit order might be a better option.

5. Binance Guide to using Market Orders on Binance

Market orders are essential for situations requiring quick buying/selling on the market. Here’s how to execute a market order efficiently on Binance:

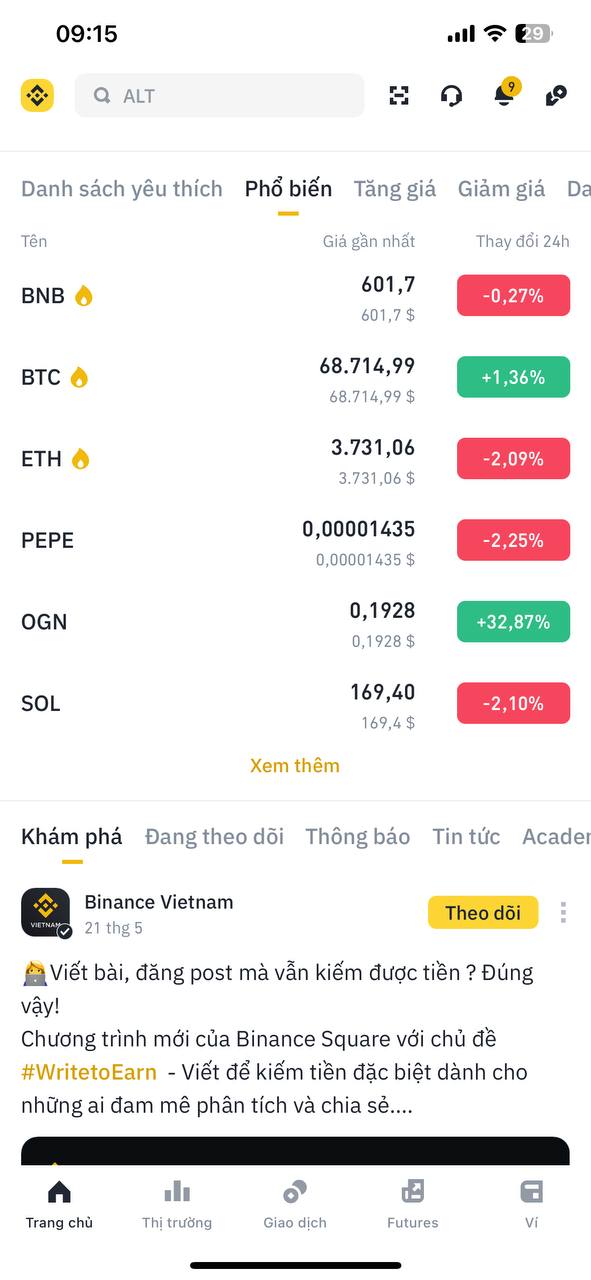

Step 1: Access the Exchange

First, access the cryptocurrency exchange you wish to use. Make sure you are logged into your account.

Step 2: Select the Trading Pair

Choose the trading pair you want to trade.

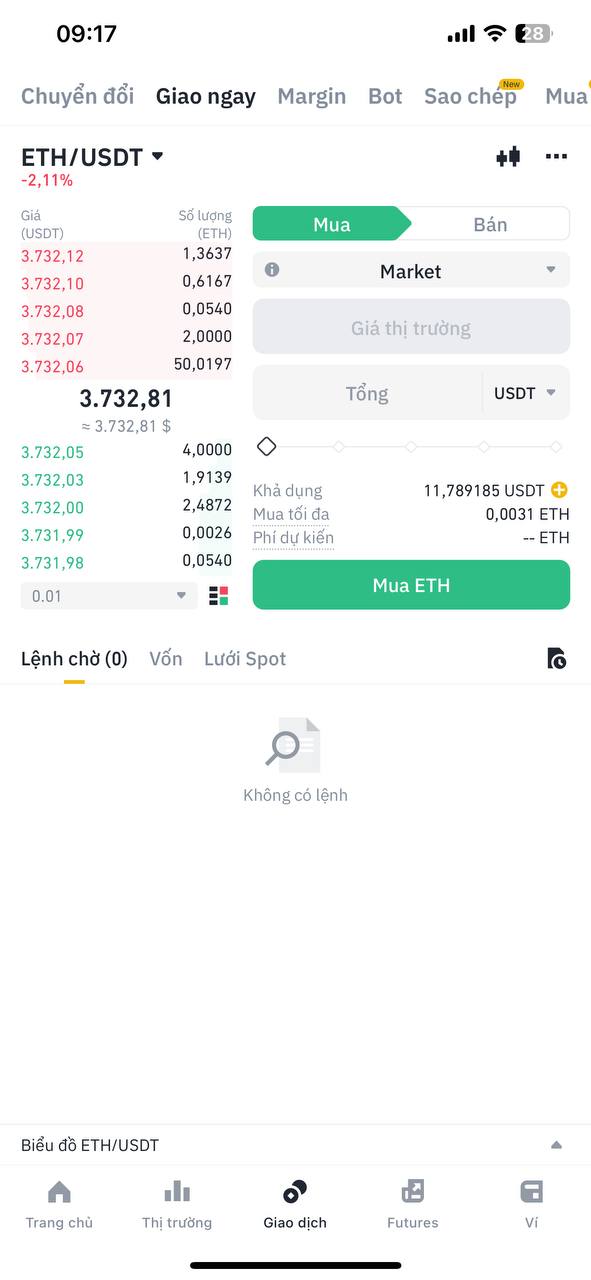

Step 3: Select Order Type

In the trading interface, select the order type as "Market" or "Market Order."

Step 4: Choose Buy or Sell

Select buy or sell depending on your trading goal.

Step 5: Enter Quantity

Enter the amount of cryptocurrency you want to buy or sell. Make sure to input the correct quantity and review it carefully before confirming.

Step 6: Confirm the Trade

- Review the trade details, including quantity and order type.

- After thorough review, confirm your trade.

- Once confirmed, your trade will be executed immediately. You can track the status of your trade in the trade history or order list.

- Check the trade information after execution to ensure everything is as expected.

When using a market order, you will buy or sell cryptocurrency at the current market price and may experience slippage. Ensure you understand the risks and benefits of using this type of order before executing a trade.

6. FAQs

Q1: Are Market Orders Suitable for New Investors?

Market orders can be suitable for new investors, especially in situations requiring quick action. However, new investors should understand the risks of slippage and consider carefully before using them.

Q2: How to Check for Slippage Before Placing a Market Order?

To check for slippage before placing a market order, you can:

- View price charts to understand market volatility.

- Check the amount of cryptocurrency available at the current price.

- Use analysis tools like the Order Book to view detailed information about buy and sell orders.

- Review trade history to assess previous trades.

- Calculate risks and estimate potential slippage before placing a market order.

Q3: Can I Place Both Market and Limit Orders Simultaneously?

Yes, many cryptocurrency exchanges allow you to place both market and limit orders simultaneously on the same trading pair. This enables you to control the price and timing of your trades flexibly. In this case, the market order will execute immediately at the current market price, while the limit order will set a specific price and wait until the market reaches that price before executing the trade.

7. Conclusion

Market orders allow traders to buy or sell immediately at the current market price, making the trading process fast and convenient. However, be aware that using market orders also comes with some risks, such as slippage. For beginners, conducting additional research and testing before executing real trades is crucial to understand how market orders work and their impact.

Read more:

Tiếng Việt

Tiếng Việt

.jpg)

.jpg)

.jpg)

.jpg)