1. What is the Fear & Greed Index?

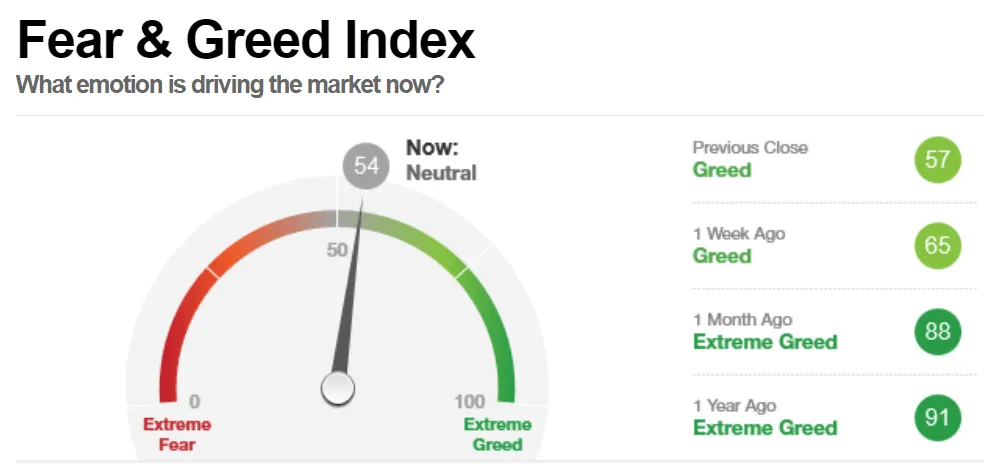

The Fear & Greed Index is a tool used to measure investor sentiment in the cryptocurrency market. This index tracks the emotions of investors and ranges from 0 to 100, where:

- 0 indicates extreme fear.

- 100 indicates extreme greed.

Where to Find Information About the Fear & Greed Index?

You can find the Fear & Greed Index for the cryptocurrency market on several reliable websites:

-

CoinCodex: Provides the current Fear & Greed Index for the cryptocurrency market, including analysis and historical information. You can access it at CoinCodex Fear & Greed Index.

-

Alternative.me: A well-known site offering the Fear & Greed Index for Bitcoin and the broader cryptocurrency market. The index is based on factors such as trading volume, market movement, and social media interactions. Detailed information can be found at Alternative.me Fear & Greed Index (Alternative.me).

-

Binance: The cryptocurrency exchange Binance also provides this index, helping investors understand market sentiment and make smarter trading decisions. Details can be found at Binance Fear & Greed Index.

-

CoinGlass: Another source for checking the Fear & Greed Index, offering detailed data and history about cryptocurrency market sentiment. You can access it at CoinGlass Fear & Greed Index (coinglass).

2. Why is the Fear & Greed Index Important?

-

Measuring Market Sentiment: The Fear & Greed Index helps measure the overall sentiment of the cryptocurrency market, providing insights into the level of fear or greed among investors. This helps investors better understand the current market condition and anticipate potential trends.

-

Supporting Investment Decisions: By monitoring the Fear & Greed Index, investors can make more informed decisions. A high index (greed) might indicate a market bubble, while a low index (fear) could signal a buying opportunity when asset prices are declining.

-

Risk Management: The index aids in managing risk by identifying periods of high market volatility. This allows investors to adjust their investment strategies to protect their assets.

3. How the Fear & Greed Index works?

Components of the Index:

- Volatility: Measures market volatility. High volatility often signals fear.

- Market Momentum/Volume: Assesses current trading volume relative to the average. High volume might indicate greed.

- Surveys: Reflect investor sentiment through surveys.

- Social Media: Tracks investor sentiment on social media platforms.

- Google Trends: Measures public interest through cryptocurrency-related searches.

- Safe Haven Demand: Compares investment in safe assets like bonds with risky assets like cryptocurrencies.

Calculation: Each factor is evaluated and scored based on current data. The scores are then aggregated to form the final Fear & Greed Index. This index is updated frequently to accurately reflect market sentiment.

4. Using the Fear & Greed Index in the Crypto Market

-

Identifying Buying Opportunities: When the index is low (fear), it might indicate a market downturn and present a buying opportunity. Investors can use this time to purchase assets at lower prices.

-

Identifying Selling Opportunities: When the index is high (greed), it might signal a market bubble and potential for a correction. This can be a good time to consider selling or taking profits.

-

Combining with Other Indicators: The Fear & Greed Index should be used in conjunction with other technical indicators for more accurate investment decisions. Indicators such as RSI, MACD, and candlestick patterns can provide additional valuable insights.

-

Adjusting Investment Strategy: Based on the index, investors can adjust their strategies. High levels of greed may suggest reducing risk by shifting some assets to safer investments, while low levels of fear might be a cue to increase exposure to riskier assets for higher potential returns.

5. Limitations of the Fear & Greed Index

- Subjectivity: The index relies on investor emotions, which can be subjective and may not always reflect the true market situation.

- Accuracy of Predictions: While the index provides insights into market sentiment, it cannot predict every market movement accurately. Investors should use it alongside other tools and indicators.

- Vulnerability to Manipulation: The index can be influenced by unexpected events or market manipulation. Investors should be cautious and not rely solely on this index for decision-making.

6. Examples of the Fear & Greed Index in Crypto

-

Cryptocurrency Market in Late 2017: At the end of 2017, the Fear & Greed Index reached high levels as Bitcoin approached $20,000, followed by a significant correction. This high index indicated extreme greed before the price dropped sharply.

-

Crypto Market During the COVID-19 Pandemic: During the COVID-19 pandemic, the index showed extreme fear as the cryptocurrency market was heavily impacted. However, as the market recovered, the index shifted to a high level of greed with significant increases in Bitcoin and altcoin prices.

-

Current and Future Trends: The current Fear & Greed Index can help investors determine whether the market is in a phase of fear or greed, guiding their buy or sell decisions. Monitoring this index over time can provide insights into market sentiment cycles.

7. Investment Strategies Based on the Fear & Greed Index

- Buy When Fearful, Sell When Greedy: Based on Warren Buffett's advice, "Be fearful when others are greedy and greedy when others are fearful," a high index indicates an opportunity to sell, while a low index suggests a buying opportunity.

- Long-Term Investment Strategy: Long-term investors can use the Fear & Greed Index to identify better entry points and maintain their strategy without being swayed by short-term market fluctuations.

- Short-Term Trading Strategy: Short-term traders can use the index to capitalize on market sentiment shifts. Significant changes in the index over a short period can signal upcoming market changes.

- Diversification Strategy: Investors can adjust their risk levels based on the index. In periods of extreme greed, diversifying into safer assets can protect capital, while during periods of fear, investing in riskier assets might offer higher returns.

8. Conclusion

The Fear & Greed Index is a valuable tool for understanding market sentiment and making informed investment decisions in the cryptocurrency market. By combining this index with other technical indicators and strategies, investors can enhance their decision-making process and manage risks effectively. Always consider multiple factors and monitor the Fear & Greed Index to make well-informed investment choices.

Read more:

English

English Tiếng Việt

Tiếng Việt