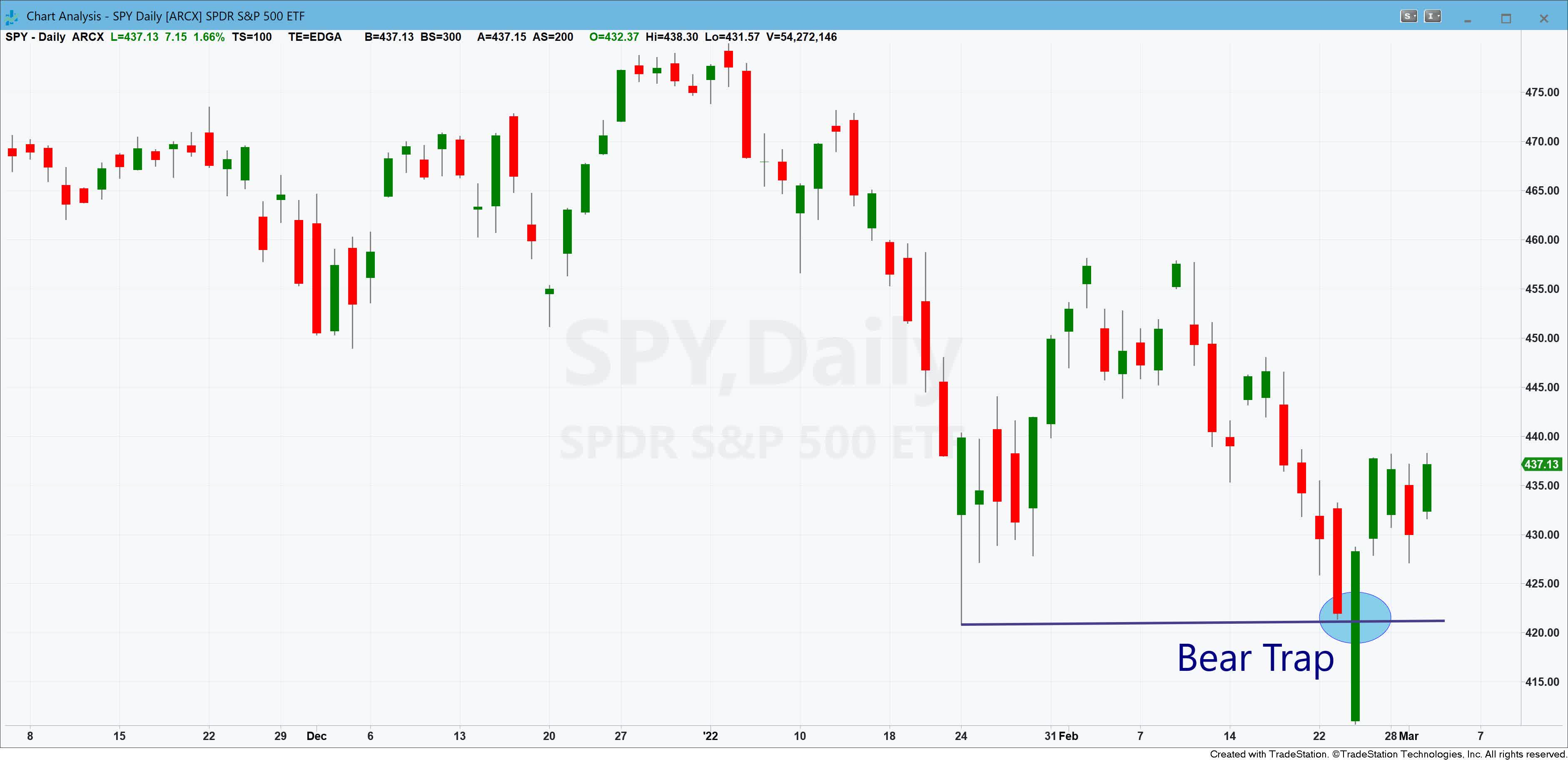

1. What is a Bear Trap?

A bear trap, also known as a false breakdown, is a technical chart pattern in financial markets where the price of an asset declines below a significant support level, leading investors to believe that a sustained downtrend is imminent. However, contrary to expectations, the price quickly rebounds and moves higher, resulting in losses for those who sold during the decline. Bear traps are commonly observed in stock markets, cryptocurrency exchanges, and the foreign exchange market.

2. Causes of Bear Traps

Several factors contribute to the formation of bear traps:

Market Manipulation:

- Large Institutional Investors: Major financial institutions or wealthy individuals can deliberately sell large quantities of an asset to create downward pressure on the price. Subsequently, they can repurchase the asset at a lower price and drive the price back up.

- False Rumors: Spreading false or misleading information about a company or market can induce panic selling, creating opportunities for market manipulators to profit.

Investor Psychology:

- Panic Selling: When the market experiences a significant downturn, many investors may panic and sell their holdings without conducting thorough analysis.

- Herd Mentality: The tendency for investors to mimic the actions of others can lead to a cascade of selling and exacerbate downward price movements.

Unexpected Events:

- Surprise News: Negative news about a company or industry can trigger a sell-off. However, if the news is not severe or has already been priced into the market, the price may quickly recover.

- Geopolitical Events: Unforeseen geopolitical events can cause significant market volatility and create conditions for bear traps.

Technical Analysis Errors:

- Misleading Indicators: Many investors rely on technical indicators to make trading decisions. However, these indicators are not always accurate and can produce false signals, leading to bear traps.

Bear traps are often the result of a combination of these factors. Understanding these underlying causes can help investors better identify and avoid falling victim to these deceptive market patterns.

3. How Bear Traps Work in Crypto

In the cryptocurrency market, a bear trap typically forms through the following steps:

- Breakdown Below Support: The price of a cryptocurrency drops significantly below a key support level, causing many investors to panic and sell.

- Increased Trading Volume: As the price declines, trading volume surges as investors rush to exit their positions.

- Rapid Price Recovery: After the sharp decline, the price rebounds quickly and surpasses the previous support level. Investors who sold at the lower price are caught in the bear trap and incur losses.

Imagine a cryptocurrency, XYZ, trading at a support level of $50. Negative news triggers a price drop to $48, prompting many investors to sell in fear. However, the price quickly recovers to above $50 and continues to rise. Investors who sold at $48 would have fallen victim to the bear trap and suffered losses.

A bear trap is a deceptive market pattern that can catch unsuspecting investors off guard. By understanding the formation process and the psychological factors that contribute to bear traps, investors can better protect themselves from these market anomalies.

4. Identifying Bear Traps in the Cryptocurrency Market

To recognize a bear trap, investors should look for the following characteristics:

- Sharp Decline Below Support: The asset's price falls significantly below a crucial support level.

- Surge in Trading Volume: As the price drops, trading volume typically spikes as investors rush to sell.

- Rapid Price Reversal: Following the decline, the price rebounds quickly and surpasses the previous support level.

Investors can employ technical analysis tools to identify potential bear traps, including:

- Moving Averages: Comparing short-term and long-term moving averages can help identify price trends.

- Relative Strength Index (RSI): The RSI helps determine if an asset is oversold or overbought.

- Candlestick Patterns: Recognizing reversal patterns like hammers, dojis, or bullish engulfing can signal a bear trap.

5. Strategies to Avoid Bear Traps in Crypto

- Identifying Support and Resistance Levels: Before making any investment decisions, traders should carefully analyze support and resistance levels. If the price breaks below a support level but quickly rebounds, it could indicate a potential bear trap.

- Utilizing Stop-Loss Orders: A stop-loss order can limit potential losses if the market moves against you. By setting a stop-loss order below a support level, traders can protect themselves from the adverse effects of a bear trap.

- Evaluating News and Events: Staying informed about market-moving news and events is crucial. If negative news causes a price drop but the price quickly recovers, it may signal a bear trap.

- Analyzing Trading Volume: Trading volume is a valuable indicator of market sentiment. If trading volume surges during a price decline but then diminishes as the price recovers, it could be a sign of a bear trap.

6. Real-World Examples of Bear Traps in Crypto

Bitcoin Bear Trap

For a period, Bitcoin had a significant support level at $30,000. When negative news emerged regarding new regulations from a major country, the price of Bitcoin plummeted to $28,000, causing panic and triggering a sell-off among investors. However, within a few days, Bitcoin's price swiftly recovered and surpassed the $30,000 mark. Investors who sold at $28,000 fell victim to the bear trap and missed out on subsequent price gains.

Ethereum Bear Trap

Ethereum was trading at a support level of $2,000. A report highlighting a security vulnerability caused the price of Ethereum to decline to $1,800, accompanied by a surge in trading volume. After the development team addressed the issue and released positive updates, Ethereum's price rapidly rebounded above $2,000. Investors who sold at $1,800 incurred losses due to the bear trap.

These examples demonstrate how bear traps can occur in the cryptocurrency market, often triggered by unexpected news or events that temporarily spook investors. It's important to note that while technical analysis can help identify potential bear traps, market sentiment and external factors can also play a significant role in their formation.

7. The Psychological Impact of Bear Traps on Investors

- Panic and Loss of Confidence: Bear traps can induce panic and erode investor confidence, especially among newcomers to the market. This panic often leads to selling assets at a loss, missing out on potential growth opportunities.

- Learning from Experience: While bear traps can be detrimental, they also offer valuable lessons. Understanding and identifying bear traps can make investors more cautious and improve their trading strategies.

8. Conclusion

Bear traps are a common occurrence in the cryptocurrency market that investors should be aware of to avoid falling into the trap of selling at a loss. By comprehending the characteristics of bear traps, utilizing technical analysis tools, and implementing sound trading strategies, investors can protect their investments and maximize their returns. This article aims to provide a comprehensive overview of bear traps and how to avoid them.

Readmore:

English

English Tiếng Việt

Tiếng Việt