1. What is Flare?

Flare is a Layer-1 blockchain project like Ethereum, with additional data collection functionality. Flare can thus provide developers with decentralized access to data from other chains and the internet. This enables the creation of dapps with new use cases and monetization models, plus dapps can execute on multiple chains through a single deployment.

Flare is based on the Ethereum Virtual Machine (EVM), meaning any application written in Solidity to run on any other EVM chain can also be used on Flare. Infrastructure providers, acting simultaneously as validators and data providers, enable two root oracles, FTSO and State Connector.

This processing provides developers on Flare efficient access to large amounts of data and data evidence at minimal cost. By providing developers access to the widest range of data, Flare can drive greater blockchain development from data such as: in DeFi, gaming, NFTs, music and social networks.

2. Flare's core products

2.1. Flare Protocols

To ensure the ability to collect data, Flare uses the following two main protocols:

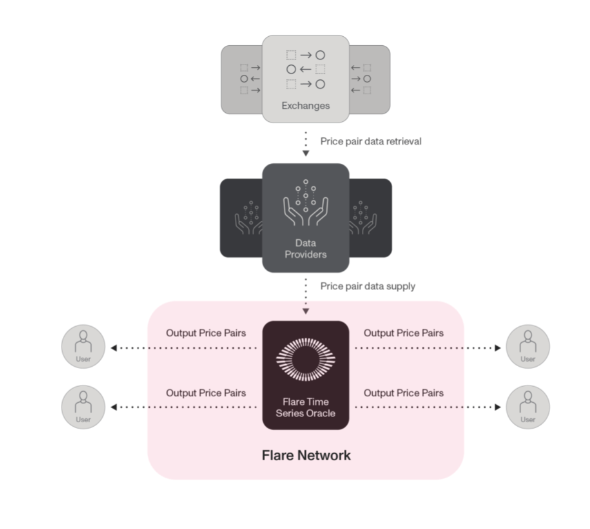

The Flare Time Series Oracle (FTSO): provides data series for dApps on Flare. Currently, FTSO provides exchange rates for asset pairs and updates every 3 minutes.

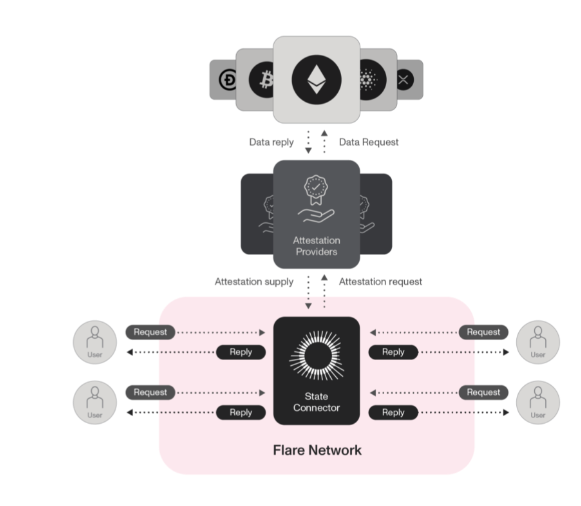

The State Connector: allows Flare to securely and reliably reach consensus on activities taking place outside the network, such as transactions between two blockchains or the content of APIs on the Internet.

2.2. FAssets

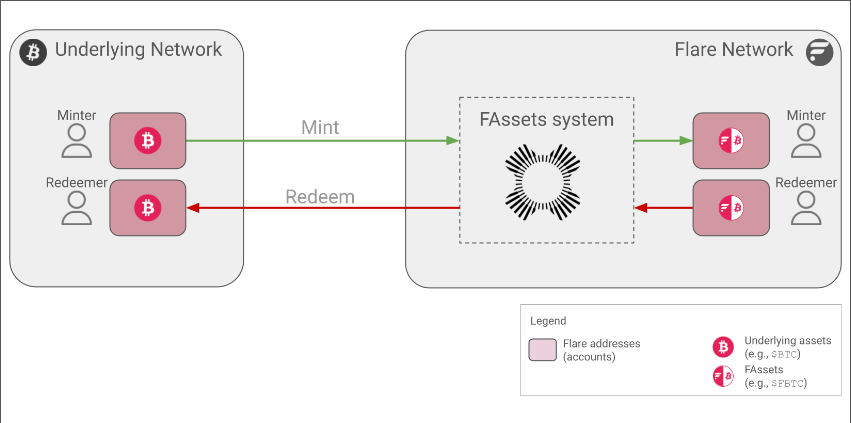

The FAssets system allows tokens on blockchains that do not support smart contracts, to be used reliably with smart contracts on the Flare blockchain. The following diagram summarizes the relationship between the FAssets system, users, and associated networks:

Anyone on Flare Blockchain can mint FAsset as wrapped versions of native tokens from other blockchains, called the underlying network. The initial tokens from these chains, such as $BTC, $LTC, $DOGE, and $XRP, are called underlying assets. For example, the FAsset version of $BTC is $FBTC. FAsset assets can be used in smart contracts and decentralized applications on Flare, and they can be exchanged for the underlying asset at any time.

FAsset is backed by collateral provided by entities that maintain the system's infrastructure and hold Flare's native assets. All of these entities are independent of the Flare Foundation.

The following roles participate in the FAssets system:

- Agents: hold the underlying assets while the generated FAssets are in circulation.

- User

- Collateral Providers: are those who provide $FLR to the Agent’s pool and become collateral providers, the providers will receive a portion of any fees generated by FAssets.

- Liquidators: When a dealer's collateral falls below the required minimum, it enters liquidation status. In this state, the liquidator deposits FAssets into the system in exchange for collateral from the dealer's vault and Collateral Pool. The collateral received is of the same value as the deposited FAssets plus insurance premium. The FAssets deposited by the liquidator will be burned, which reduces the number of FAssets that the dealer's collateral needs to support. When the dealer's collateral exceeds the safety level, the liquidation state will end.

- Challengers: this is the dealer's monitor that detects illegal transactions that reduce the amount of underlying assets below the support coefficient. When challengers detect an illegal transaction, they provide evidence to the FAssets system in exchange for a reward from the agent's vault.

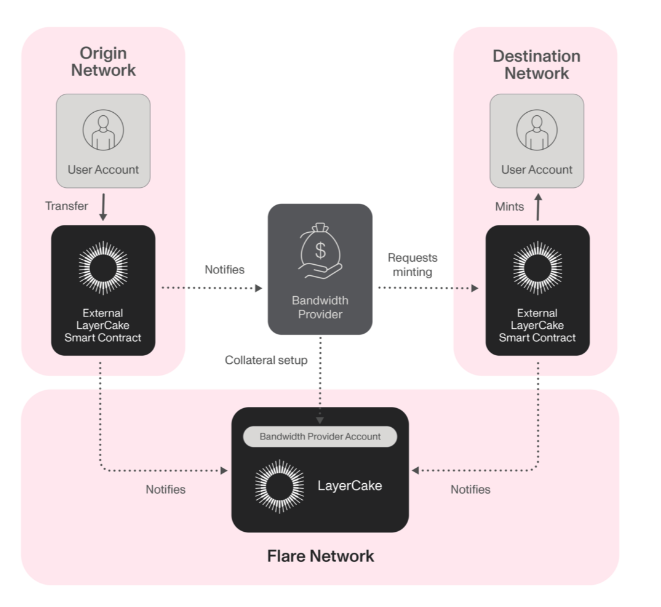

2.3. Flare LayerCake

Flare LayerCake provides a decentralized, trustless bridge system between smart contract networks. Every transfer in LayerCake is insured during the transfer process with one-to-one support using the actual assets transferred. Using collateral in this way allows for trustless transfers with minimal latency, while also providing insurance against operator failure and blockchain reorganizations happen.

Once the transfer is complete and the wrapped asset is in the user's account, the collateral will be unlocked after a short period of time, ready to be used in another Bridge. For this reason, this collateral is called “bandwidth,” because it indicates how much value can move across the bridge at any given time.

3. Tokenomics

$FLR token is the main token of Flare Blockchain and is used with the following functions:

- Make transaction fees

- Make rewards for users when staking.

- As a reward for users when authenticating to the Flare network.

- Supports participation in protocol governance.

- As collateral on dAPPs built on Flare Blockchain.

Basic information about $FLR token:

- Token name: Flare

- Symbol: $FLR

- Blockchain: Flare Network

- Contracts: Update...

- Genesis token supply: 100,000,000,000

- Public token distribution: 28,524,921,372

- Cross-chain incentives: 20,000,000,000

- Inflation rate: 7%/year

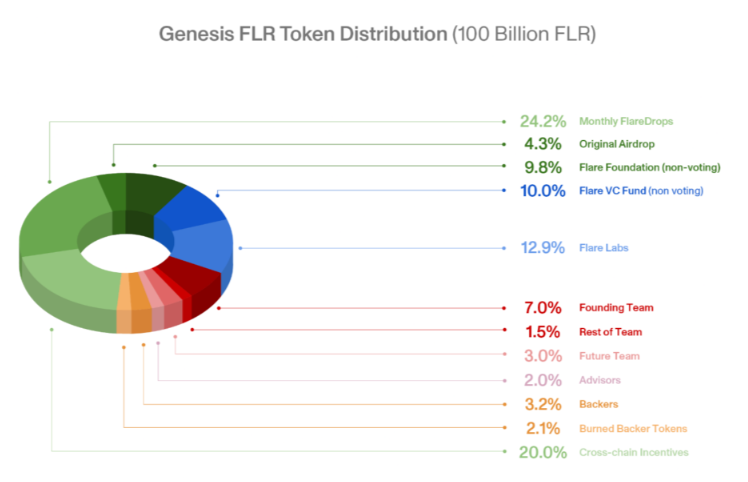

$LFR Token Allocation Rate:

- 24.2%: Monthly FlareDrops.

- 4.3%: Original Airdrop.

- 9.8%: Flare Foundation.

- 10%: Flare VC Fund.

- 12.5%: Flare Labs.

- 7%: Founding Team.

- 1.5%: Rest of the Team.

- 3%: Future Team.

- 2%: Advisors.

- 3.2%: Backers.

- 2.1%: Burned Backer Tokens

- 20%: Cross-Chain Incentives.

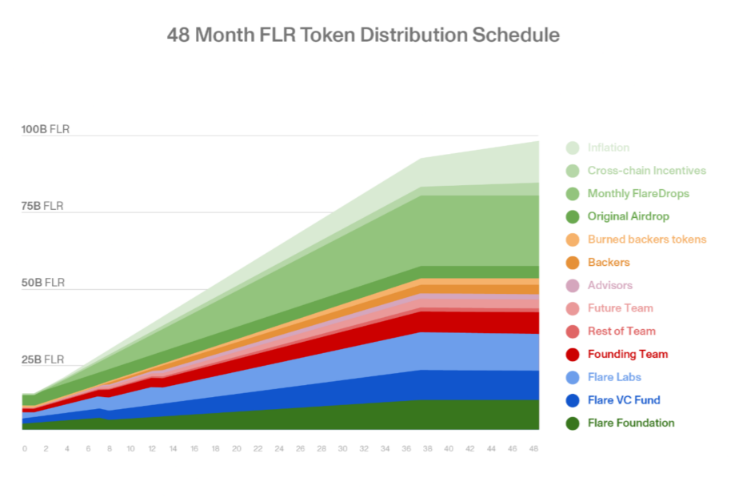

$LFR token allocation time:

After the initial 15% distribution, entities will receive the remaining distribution within 36 months. The January pause for FIP.01 voting was completed to finalize the remaining public token distribution mechanism.

4. Project development team

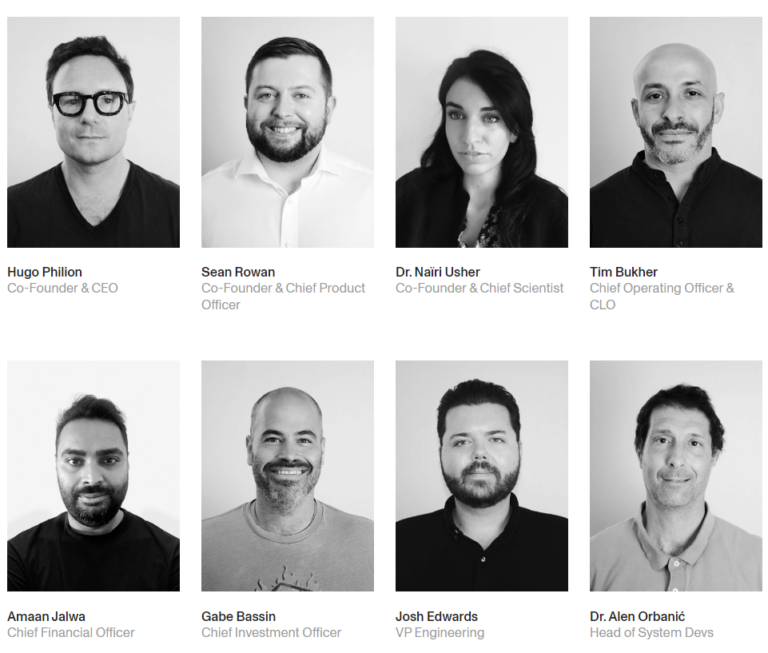

The project is developed by an experienced team with 3 Co-Founders:

- Hugo Philion: he graduated First Class with Honors from Cass Business School and received a Master of Science degree from UCL.

- Sean Rowan: he graduated with a bachelor's degree in electrical and computer science from Trinity College Dublin and received a master's degree in science and machine learning from UCL.

- Dr.Naïri Usher: She studied at the International School of Geneva. Becoming a PhD in quantum computing at UCL and after receiving her PhD, she stayed at the university to continue researching quantum computers for 1 year and 1 month.

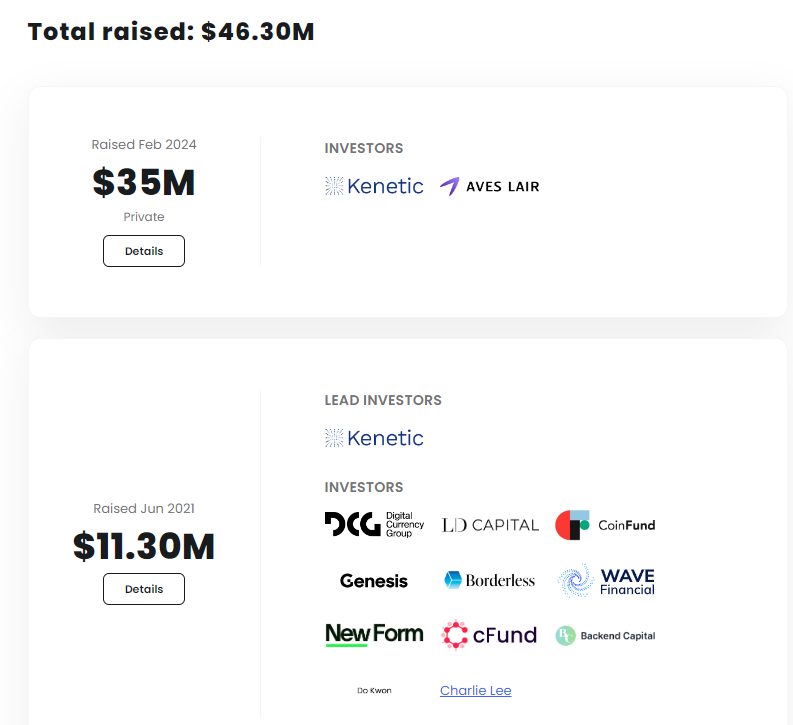

5. Partners and investors

Up to now, Flare has raised capital with a raised amount of $46.3M USD led by Kenetic. There are also other investment partners such as: Aves Liar, DCG Group, CoinFund,...

Partners and investors

6. Conclusion

Flare is a Layer-1 blockchain project like Ethereum, this is a project that provides data to Dapps through fairly new Protocols. In addition, the project also provides asset Bridge solutions to help easily move across chains.

However, Flare's asset wrapping mechanism is quite similar to Bridge projects on the market, so it does not stand out much, especially compared to other Bridge projects like Layer0. So you need to consider carefully before investing. Above is all the information about Flare. If you have any further discussions, you can join the Bigcoin Vietnam group to find better investment opportunities.

Basic information of the Flare project:

Twitter: https://twitter.com/FlareNetworks

Website: https://flare.network/

English

English Tiếng Việt

Tiếng Việt

.jpg)

.jpg)