1. What is Quicksilver?

Interchain Security is a technology developed and introduced by Cosmos, allowing chains to build and develop on Cosmos, with the option to use the same $ATOM security layer of Cosmos Hub without having to build the network themselves its own security net.

This is one of the services provided by Cosmos Hub - the central blockchain of the entire Cosmos ecosystem. In which Cosmos Hub is called the provider chain and chains using Interchain Security are called consumer chains.

What is Quicksilver?

2. Quicksilver core ability

2.1. No authenticator restrictions

Quicksilver aims to build a decentralized blockchain with a high degree of decentralization, so it does not limit too many validators on the chain. Users can delegate to any validator of the chain when using the protocol. This will help prevent delegation from being too concentrated on certain groups of authenticators.

As soon as the project launched mainnet, more than 100 validators joined the network and validated new blocks on the chain.

2.2. Easy scalability

Quicksilver is designed to be scalable to any blockchain connected to the IBC. All token holders will have the right to participate in the governance and proposal of newly supported chains. This means that the Quicksilver community will have the right to decide on the development and expansion of the project.

2.3. Ability to manage using Proxy

Quicksilver has introduced Proxy Governance, which will allow users to retain voting rights even after converting their staking assets into Liquid Staking Tokens.

This makes it possible for Quicksilver users to participate in protocol governance while still benefiting from asset liquidity optimization.

Currently this feature is still in development

2.4. Rewards for network participants

Those who participate in staking to manage the network will receive a portion of the revenue from validation fees on the platform, which also helps delegators (authorizers) when delegating to nodes will also receive rewards. In addition to the native tokens of projects integrating Quicksilver, users will still receive $QCK rewards.

2.5. Potential for Interchain Security integration

Although initially, Quicksilver aims to be a consumer chain using Cosmos Hub's Interchain Security. However, the project later decided to accelerate development by building its own independent chain using the Cosmos SDK.

However, the Quicksilver community is still considering proposing to integrate Interchain Security when version V3 is released. This could bring potential to qATOM holders as all rewards are now distributed to $QCK stakers. But the project is working on a solution that allows ATOM stakers to also receive rewards, bringing additional benefits to qATOM holders, helping the ATOM ecosystem to grow more.

3. Tokenomics

3.1. Token Information

- Token name: Quicksilver

- Token symbol: $QCK

- Blockchain: Quicksilver

- Token contract: ibc/635CB83EF1DFE598B10A3E90485306FD0D47D34217A4BE5FD9977FA010A5367D

- Maximum total supply: 400,000,000 $QCK

- Total supply: 200,000,000 $QCK

- Price: $0.07 (at time of writing)

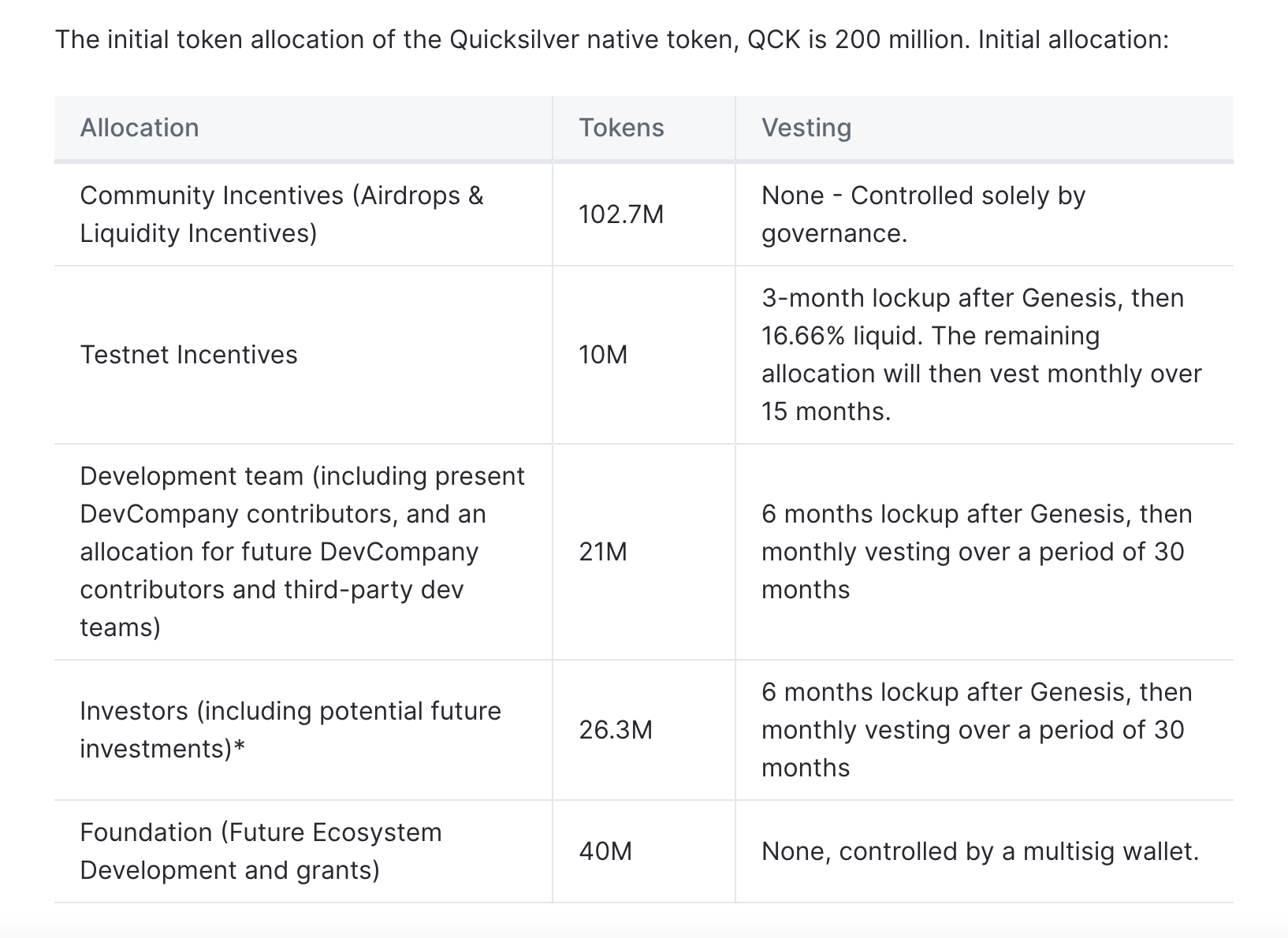

3.2. Token allocation

$QCK token Allocation

$QCK's initial total genesis supply is 200 million tokens, distributed through the following categories:

51.35% (102.7 million tokens) for community incentive fund (airdrop or liquidity provision reward)

5% (10 million tokens) as a reward for Testnet participants: locked for 3 months, then distributed 16.66% initially, remaining distributed monthly for 15 months.

10.5% (21 million tokens) for the development team, including current and future development teams, external engineers: locked for 6 months, then distributed evenly monthly for 30 months.

13.15% (26.3 million tokens) for investors: locked for 6 months then distributed evenly monthly for 30 months.

20% (40 million tokens) for ecosystem development and expansion fund, decided by multisig wallet.

3.3. Token utility

$QCK is Quicksilver's native token, used in 3 main roles:

Governance: $QCK token holders can participate in governance and vote on changes to the platform and network.

Network Security: $QCK holders can stake their tokens to participate in securing and validating transactions on the network, or delegate validators to receive block rewards.

Payment of transaction fees: In addition, $QCK is also used to pay fees for transactions occurring on the network.

3.4. Inflationary

Quicksilver's inflation is set at 25% the first year, then will gradually decrease by 25% each year. This ratio will help $QCK reach a maximum total supply of about 400 million tokens before inflation reaches zero.

Inflation will mainly occur in the following main activities:

As a reward to encourage stakers to participate in network security

Increase chain decentralization through liquid staking

Incentives for integration activities and protocol usage

Support the Quicksilver community

4. Development team

Ingenuity LTD is the development company behind Quicksilver with the vision of creating a system of decentralized financial software to enhance the Interchain ecosystem, in which core members of the board include:

CEO/Joe Bowman

Product Manager/ Viswanadha Modali

Operations Director/ Roea Mortaki

In 2021, after attending the Cosmoverse conference in Lisbon, Joe Bowman decided to build and develop Quicksilver after a long time of researching and learning about liquid staking. At that time, he was the Technical Director at Chorus One - a company focused mainly on staking. After that, he branched out and founded Quicksilver.

Initially, Quicksilver was founded under the name Ingenuity with the participation of two other members of Chorus One.

5. Investor and Partnership

In 2022, Quicksilver completed a Seed round of capital raising with a value of about 3 million USD, with a valuation of 60 million USD. In addition, Chorus One also invested a small portion of this funding round, strengthening the connection between Chorus One and Quicksilver.

Afterwards, Quicksilver also announced that it had received capital support from a number of developers in the Cosmos ecosystem and funds such as Figment Capital, Strangelove Ventures, Zero Knowledge Validator, Interop Ventures, Iqlusion, the Ki Foundation. , Cerulean Ventures, Chorus One, 01node and Moonlet.

6. Some parameters of the project

Current number of validators: 125 validators

Supporting chains: Cosmos Hub ($ATOM), dYdX ($DYDX), Osmosis ($OSMO), Regen($REGEN), Stargaze ($STARS), Sommelier ($SOMM)

Fees: Quicksilver charges 3.5% fees based on staking rewards. This fee will be collected when the protocol automatically pools rewards every 3 days and this fee will be calculated in native tokens of chains such as $ATOM, STARS, DYDX,… and this reward will be redistributed to $QCK staker.

Every time a new chain is integrated and supported by Quicksilver, stakers will have the right to receive an airdrop of $QCK tokens. This helps ensure that the protocol always remains decentralized, decentralized, and ensures the community's governance rights over the protocol.

7. Ecosystem

Website: https://quicksilver.zone/

Twitter: https://twitter.com/quicksilverzone

Discord: https://discord.com/invite/xrSmYMDVrQ

8. Kết luận

Above is all the basic information about the Quicksilver project - the Liquid Staking platform on the Cosmos ecosystem.

Although the project initially intended to develop the project using Cosmos's Interchain Security and become a consumer chain, using the security layer of Cosmos Hub. However, later, Quicksilver decided to develop its own independent chain, using the Cosmos SDK. This will help the $QCK token have more utility when used for project administration, network security or paying fees for network transactions.

Hopefully the above article provides useful information for users about the project. The content is for informational purposes only, not investment advice. Investors need to DYOR themselves and make their own assessments before deciding to invest in any project.

English

English Tiếng Việt

Tiếng Việt

.jpg)

.jpg)