1. What is Sui blockchain?

Sui is a layer-1 blockchain built on the Move programming language, focusing on solving the scalability and speed of the network. This is achieved through SUI's architecture with the use of Byzantine Consistent Broadcast which helps achieve parallel processing of transactions, thereby making efficient use of resources and allowing for speed scalability when trading.

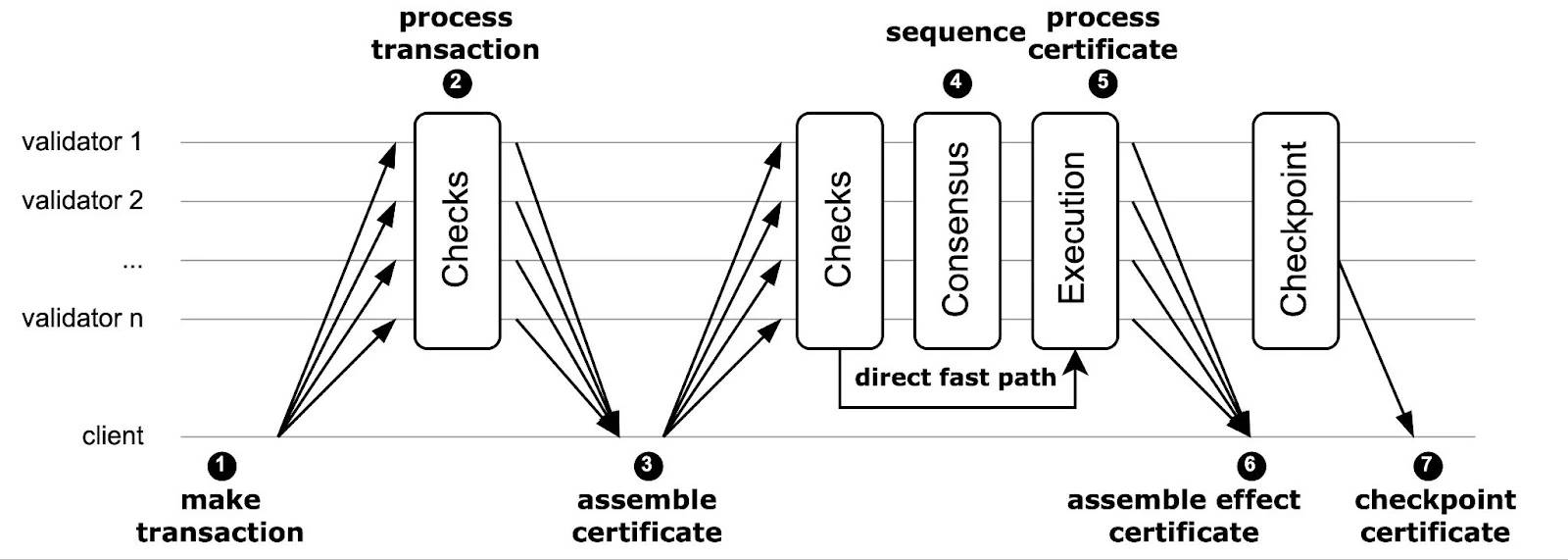

Each transaction on SUI will have the following sequence:

- When a user creates a transaction and confirms it with his key, the transaction is passed to the first element to check its authenticity.

- Transactions will then be transferred to validators (full nodes), where validators will perform checks on validity and safety as well as signatures, and after completion, transactions will be signed and confirmed by validator.

- Next, the user will collect feedback from other groups of validators (accounting for 2/3 of the stake on Sui) to create a valid transaction certificate between 3 parties: the user, the validator that authenticates that transaction and the other group of validators. .

- After having a set of certificates, the user will send them back to all validators for storage and checking.

- Validator will check all certificates and execute its tasks.

- After the validator checks and confirms validity, the user will collect these responses as proof of the transaction.

- Finally, Sui forms checkpoints for consensus commitments, which are also used to drive protocol reconfiguration.

In general, each department will perform its own tasks specifically, thereby helping parallel execution ensure availability as well as improve network speed compared to other blockchains that have to arrange transactions in sequence. .

In addition, in the components that make up Sui Network, there are two important components:

- Move programming language: To understand more specifically the entire structure of Sui, you can refer to the article What is Move language? Special features of the Move programming language .

- Tusk consensus mechanism: Sort and find the order of transactions.

- Narwhal transaction storage layer: Preserves data availability when considered during consensus.

This entire structure helps Sui Network achieve outstanding internal features such as:

- Cheap and stable gas fees:

- High TPS: 100,000 transactions/second

- Low latency: about 3 seconds

However, any layer 1 blockchain that wants to develop will always need to have a strong ecosystem within its blockchain to create attraction for projects, users and investors. To understand what SUI's ecosystem currently has, we will go through the current puzzle pieces available on SUI.

2. Ecosystem

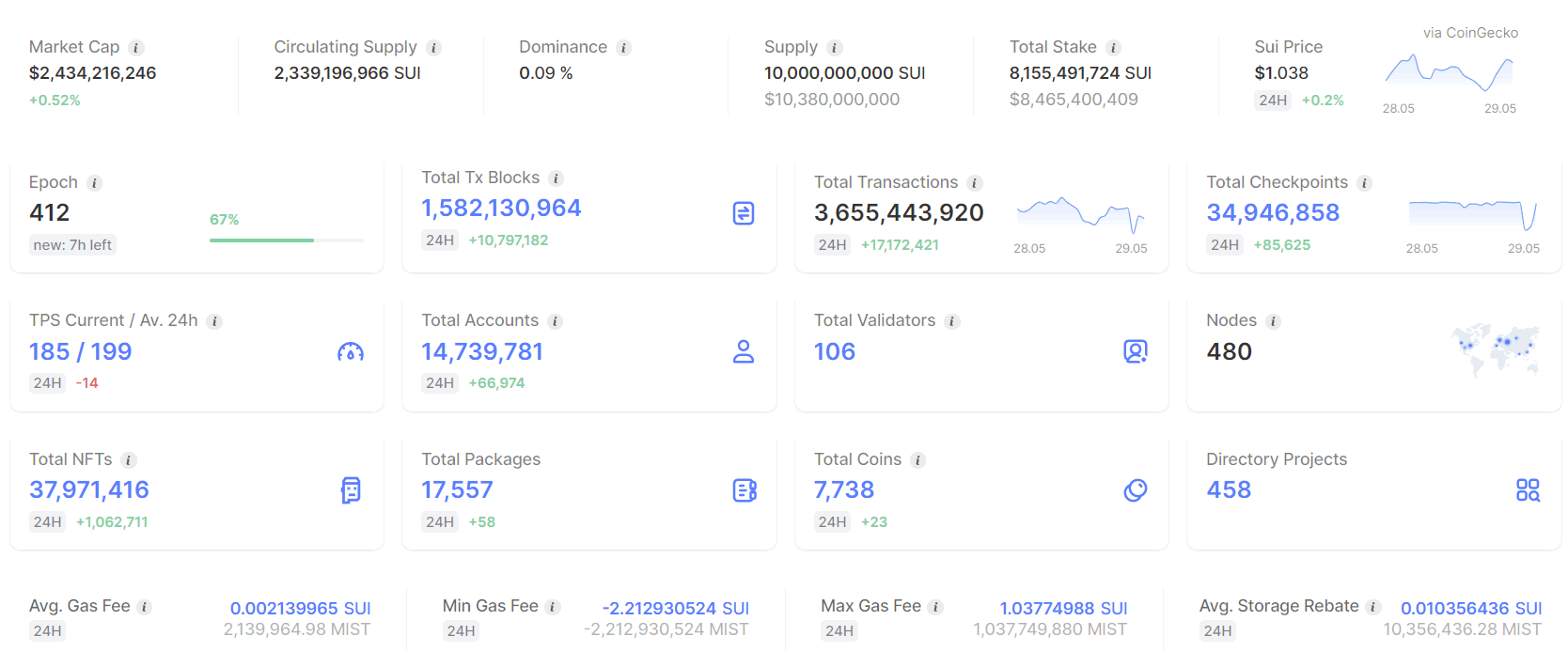

Basic indicators of SUI Network's ecosystem:

- TVL: $730m

- Total number of newly created accounts: 14M (increased by 66k within 24 hours).

- Total Transactions: 3.6B

- Total number of Validators: 106

- Total number of nodes: 480

- Total NFTs: 38M

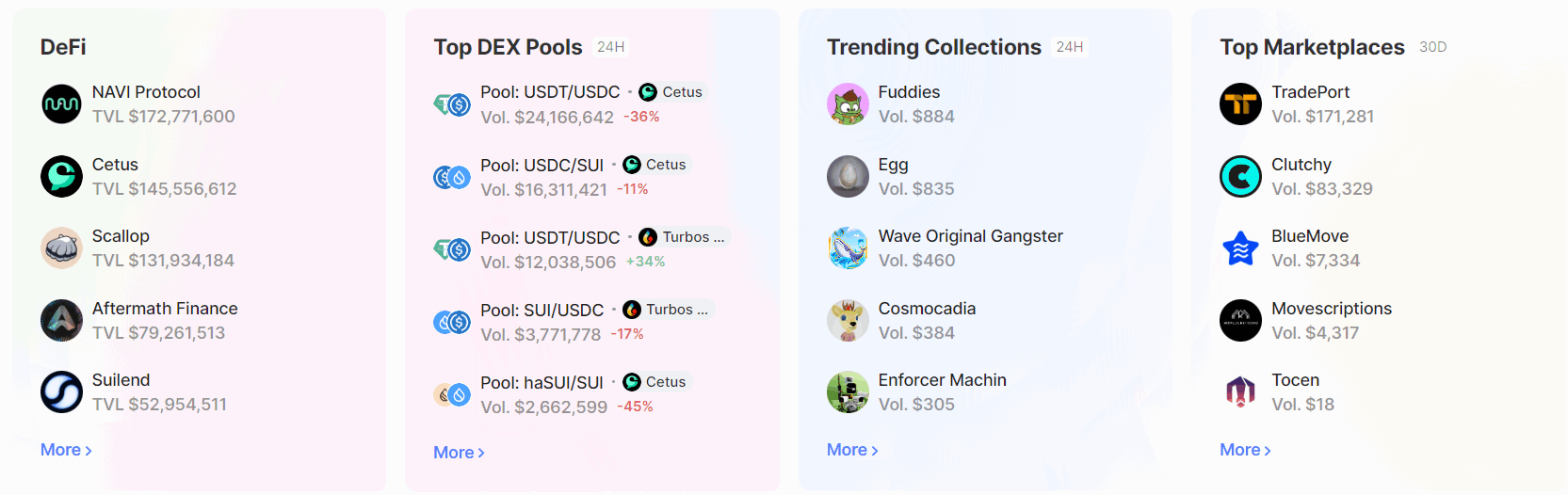

- Currently, SUI's ecosystem has outstanding Defi projects such as: Navi Protocol, Cetus, Scallop Lend, Aftermath Finance, Suilend,...

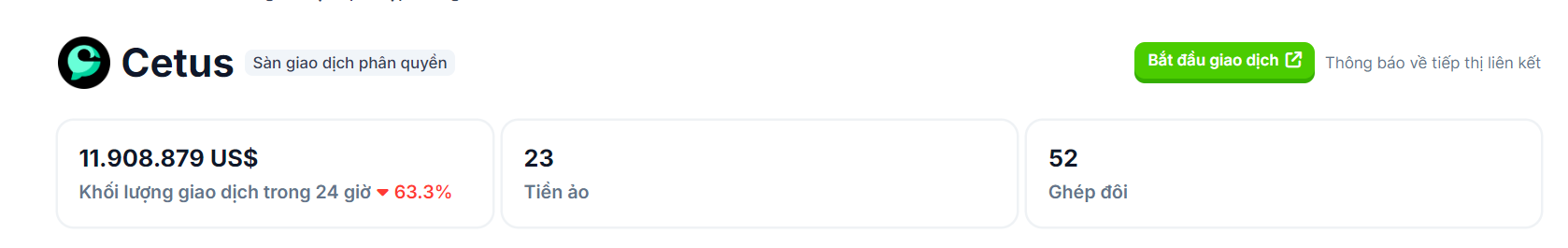

However, looking at SUI's ecosystem, we can see that the Defi segment is not really outstanding when the TVL of the projects is quite low. Backbone projects like Cetus and Navi are not really outstanding at the present time, especially when looking at the trading volume within 23 hours of the Cetus exchange, considered the largest Dex exchange on the system, only reaching nearly $12m within 24 hours.

In addition, projects in the Sui ecosystem have recent outstanding information such as:

- Scallop officially uses ACA as one of its Incentives rewards alongside SUI to reward users and liquidity providers.

- DeepBook - a new DEX platform launched on Sui has many similarities with Serum on Solana which is expected to launch and airdrop for Sui users recently.

- Cetus is actively expanding relationships with many different partners for mutual development.

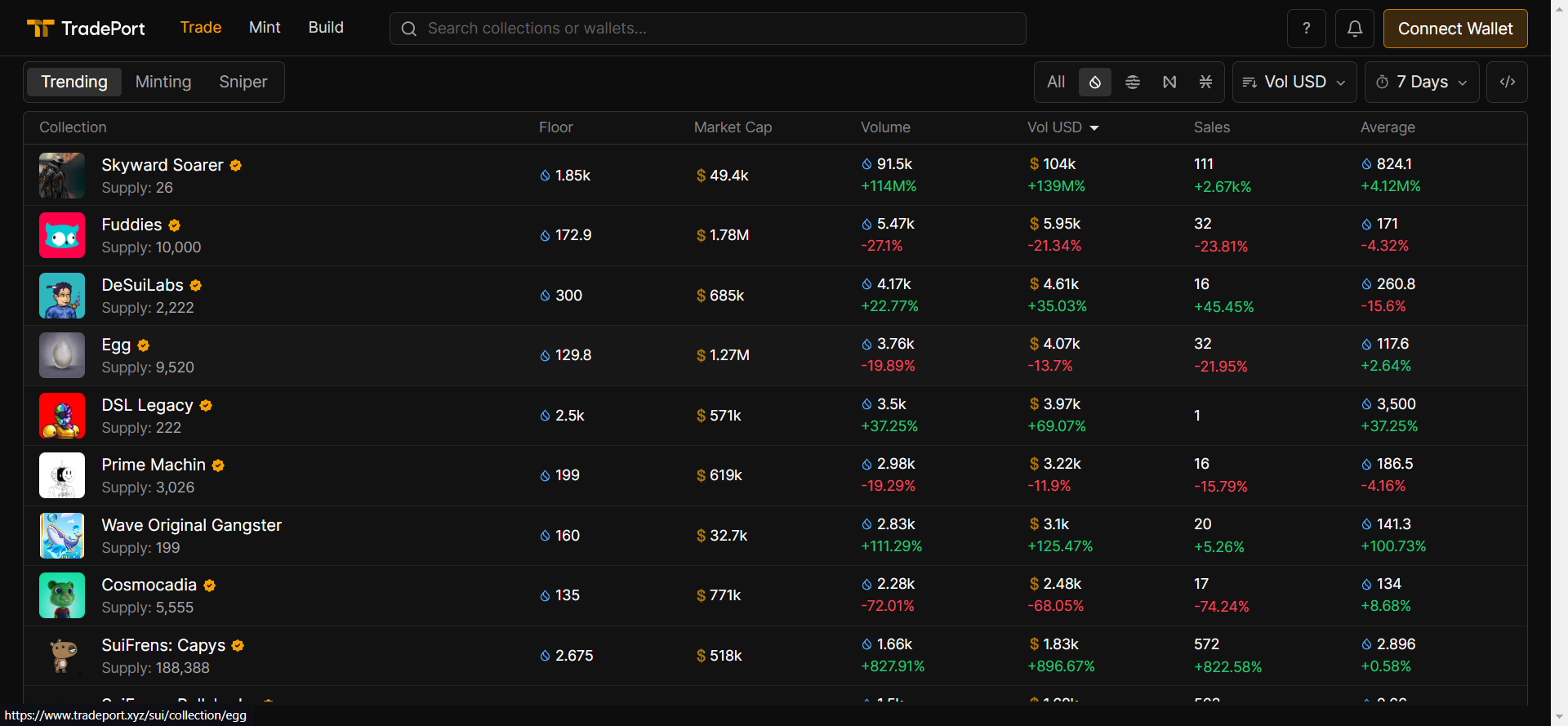

Regarding the NFT and Gaming segment, when SUI was just launched, it also created a lot of buzz, but at the current stage there are not too many highlights in the system, especially the game projects that are considered famous have not yet had any achievements. Any big move for your game.

Looking at the NFT transaction rate through TradePort (the Marketplace with the highest volume in the SUI system) is quite low, only around a few dozen NFTs, if compared to other ecosystems like Aptos, we can see the attraction of the above games. Sui is quite weak and not outstanding.

In general, the Sui ecosystem is quite complete, the basic puzzle pieces have appeared with project groups such as:

- AMM/DEX: Cetus, Kriya DEX, FlowX Finance, DeepBoook, Turbos, BlueMove DEX, Anime Swap, Interrest Protocool.

- Lending & Borrowing: Navi Protocol, Scallop, Suilend.

- Liquid Staking: Haedal Protocol,.

- Stablecoins: Bucket Protocol, Poseidollar,

- Derivatives: Bluefin, Typus Finance , ABEx Finance.

- Yield Farming: Sparkling Finance, Strater, Mole, Sui Pearl, Kai Fiance.

- Wallet: In addition to the Sui wallet developed by Mysten Labs, there are other projects such as: Ethos Wallet, Martian, Suiet, etc.

- GameFi and NFTs: Fuddies, DeSuiLabs, Egg, Cosmocadia, SuiFrens,….

- Marketplace: Clutchy, Tradeport, HyperSpace

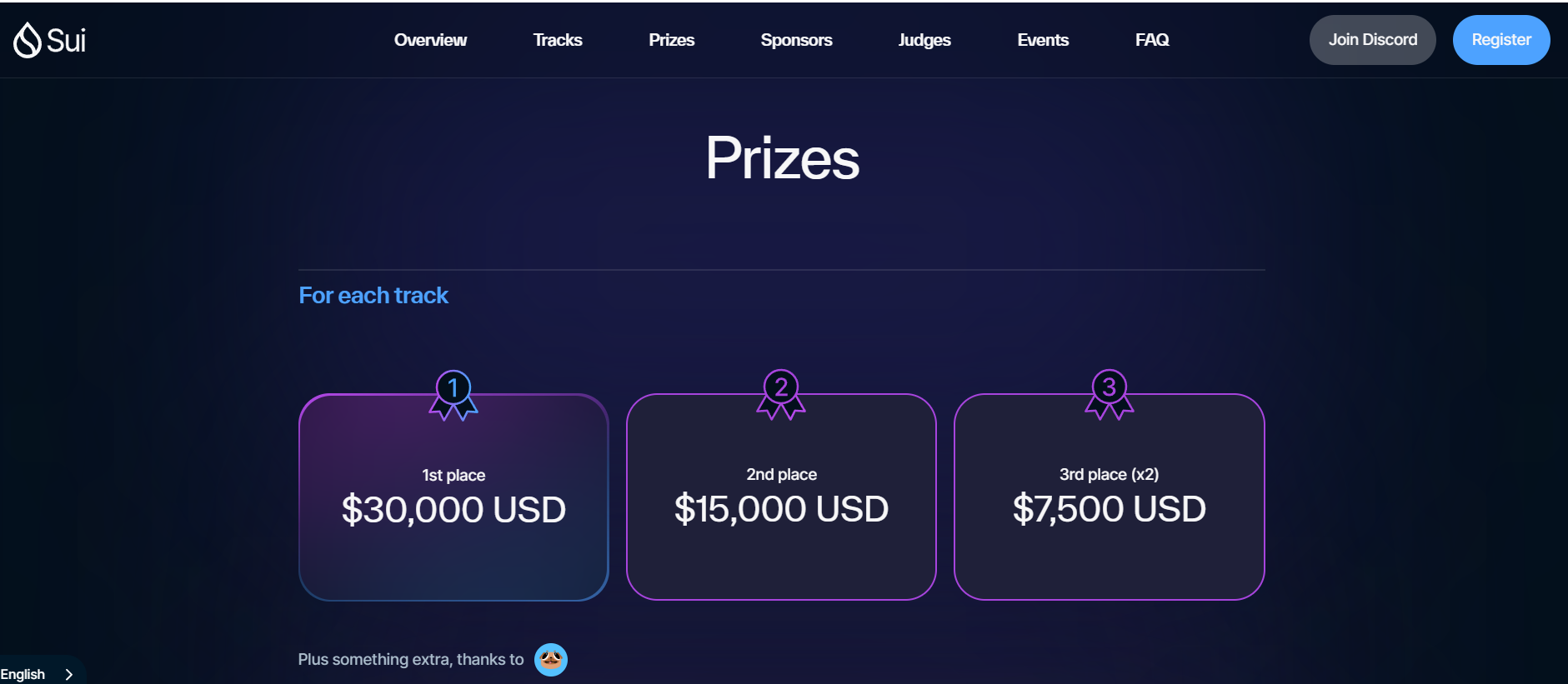

In order to attract users to the ecosystem, SUI is also actively launching programs, the largest of which is the Sui Overflow program with a total prize of $1 million.

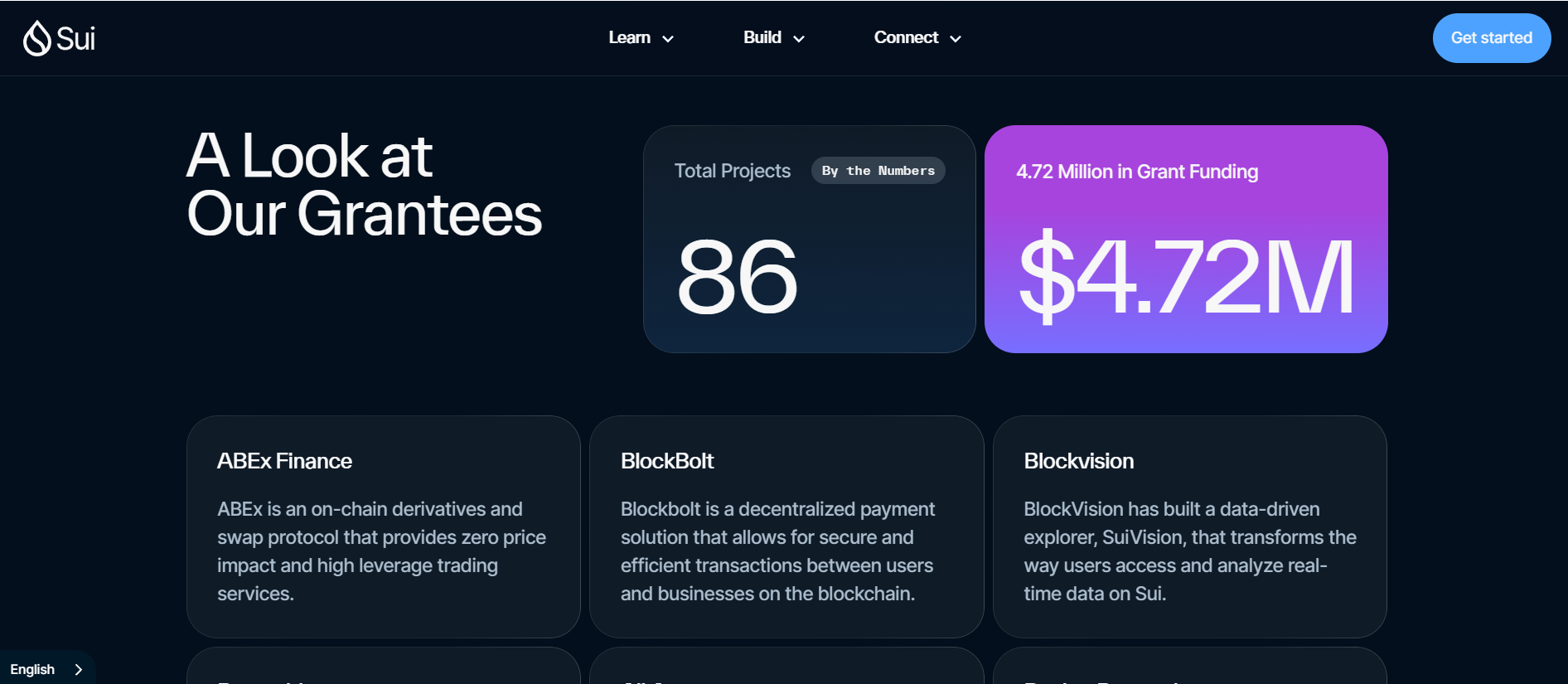

In addition to the Sui Overflow event, Sui also launched a separate Grant for projects that can call for capital from the Sui Foundation itself, currently more than $4.72 million has been awarded to 86 projects built on SUI.

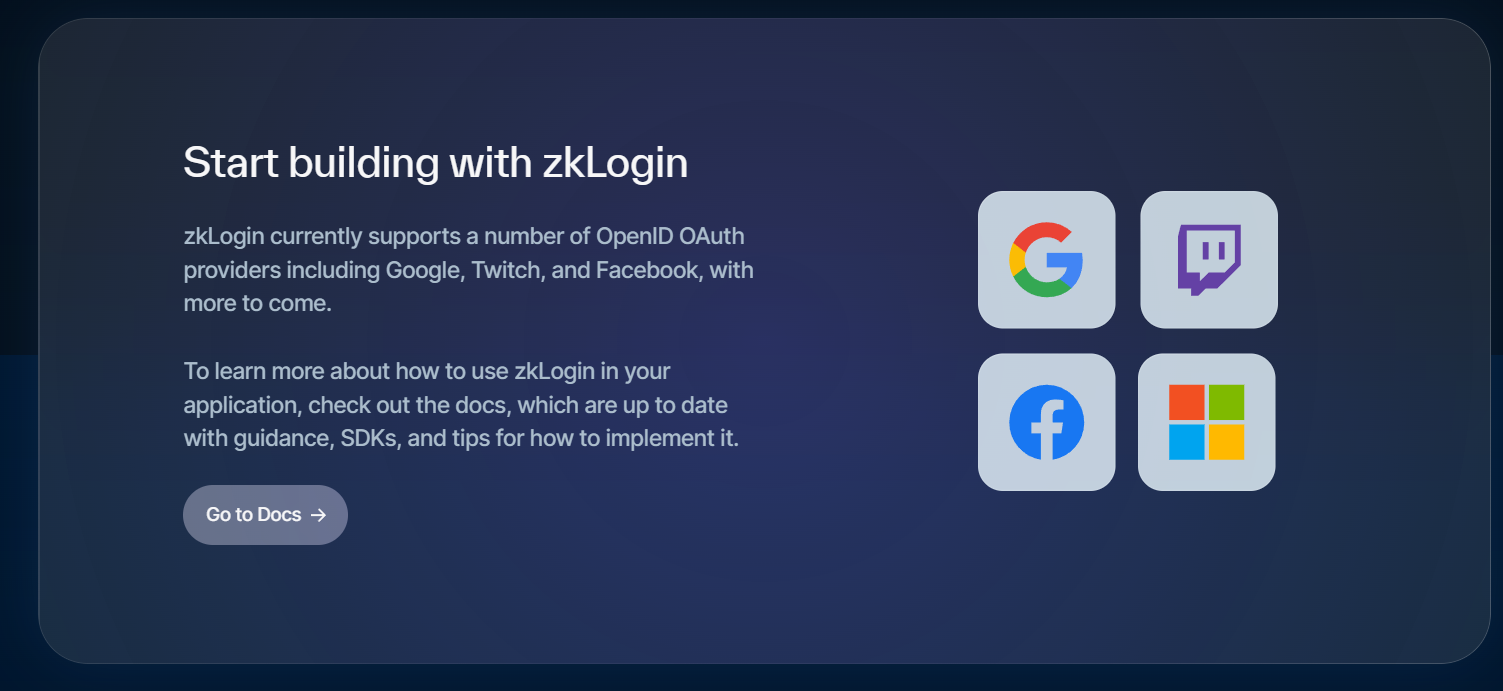

In addition, SUI has just had the latest update in updating zkp into its ecosystem, specifically zkLogin, which helps ensure user privacy even when connecting through social networking platforms such as Gmail. , Facebook, Twitch, Microsoft.

3. Tokenomics

3.1. General information

- Ticker: $SUI

- Total supply: 10,000,000,000

- Current price: $1.03

- FDV: $10.3B

- Marketcap: $2.4B

3.2. Token utility

- Network transaction fees

- Staking

- Governance

3.3 Allocation rate and time

The number of SUI tokens allocated is as follows:

- Sui Foundation: 49.73%

- Community Access Program: 5.88%

- Binance Launchpool: 0.4%

- Investors: 14%

- Mysten Labs Treasury: 10%

- Early Contributors: 20%

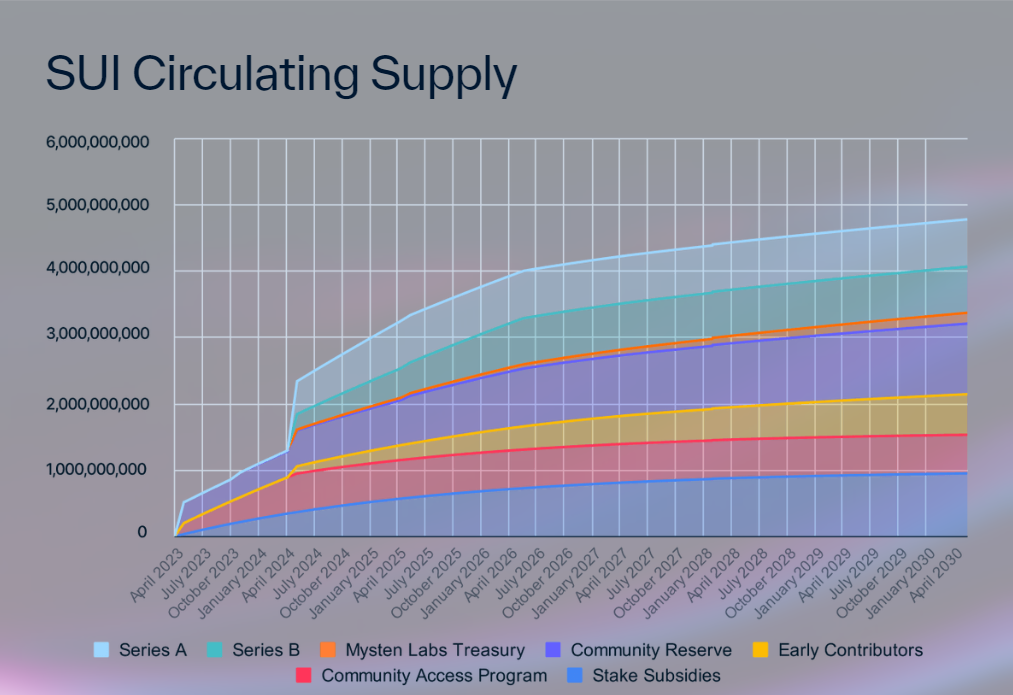

At the current stage, SUI is in the process of unlocking tokens for investors from Series A and B rounds, this is a fairly large amount of tokens that will be continuously unlocked in the near future.

It is expected that by January 2025 SUI's total circulating supply will reach 3B tokens, equivalent to the current market cap of $3B at current prices. According to personal assessment, TVL has not yet reached $1B but has such a Marketcap which is considered quite high. Not only that, SUI's ecosystem has not had too many special and developed developments recently. .

To determine whether to invest in SUI at this stage or not, I see that the ecosystem does not have much appeal to invest in. Hopefully in the near future there will be more big players participating in the system. ecosystem to attract cash flow into the ecosystem to help the project

5. Sui development team

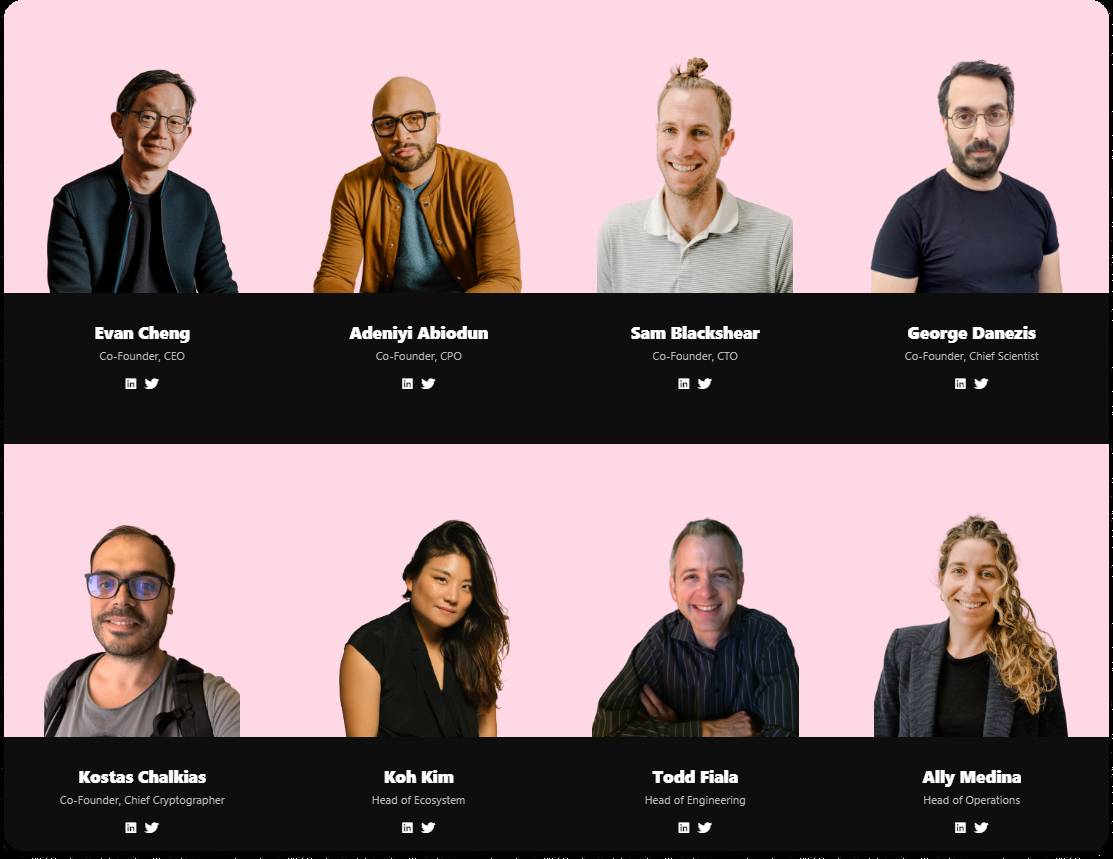

As mentioned, Sui is developed by Mysten Labs consisting of former Meta executives and leading architects of the Diem blockchain.

Mysten Labs CEO Evan Cheng spent 16 years working at technology companies like Apple and Meta (formerly Facebook). Evan Cheng and three other former Facebook employees – Sam Blackshear, Adeniyi Abiodun and George Danezis – worked on Meta's Novi Financial team to help develop the Diem blockchain and the Move programming language.

6. Sui's investors

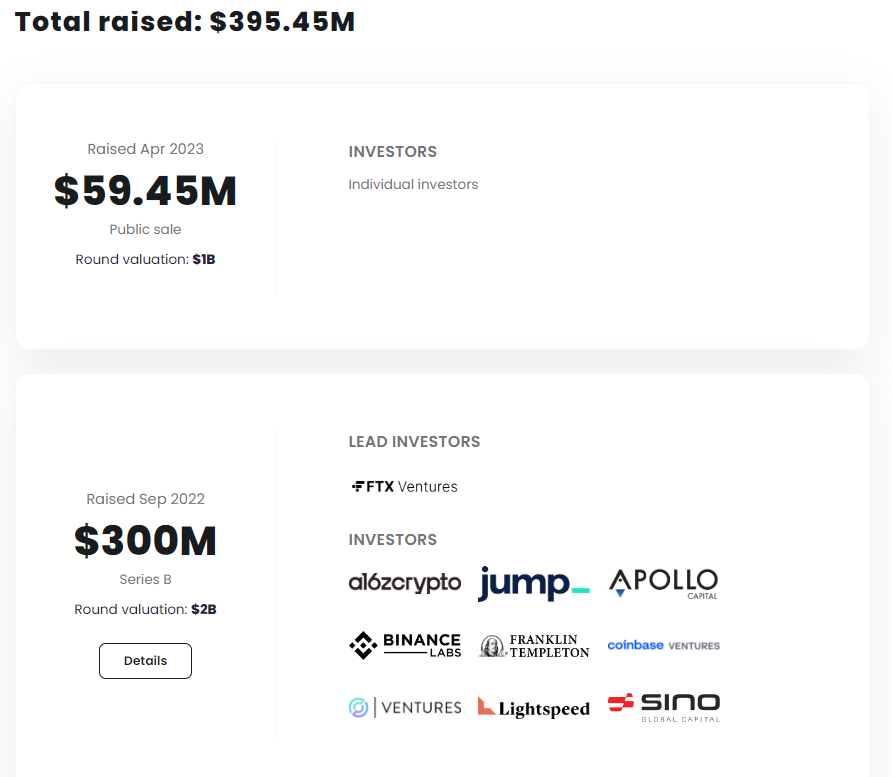

The project has gone through 3 rounds of capital raising with a total capital of $395.45M, including:

- Series A: December 2021 raised $36M capital with participating funds: NFX, Scribble Ventures, Redpoint, Lightspeed Venture Partners, Slow Ventures, Standard Crypto, Electric Capital, Samsung NEXT, Coinbase Ventures...

- Series B: September 2022 raised $300M capital with participating funds: FTX Ventures, a16z, Jump Crypto, Apollo, Binance Labs, Franklin Templeton, Coinbase Ventures, Circle Ventures, Dentsu Ventures, Greenoaks Capital, Lightspeed Venture Partners, Sino Global, O'Leary Ventures,…

- Public Sale: April 2023 raised $59.45M in capital through token sale.

7. Conclusion

Overall, Sui is a new Layer 1 project and has a lot of development potential in the near future. In theory, the project has the ability to solve problems that long-standing blockchains like Ethereum have not been able to solve, but after nearly a year of being launched, Sui's ecosystem has not yet had much outstanding development. turn on. For me personally, as an investor entering the ecosystem, there are not too many "Money games" to be able to participate in this ecosystem. For the project to truly develop, the project needs to create new games about Defi and Yield to attract Whale to the ecosystem in the near future.

Read more

Tiếng Việt

Tiếng Việt

.jpg)

.jpg)

.jpg)

.jpg)