1. Ideas

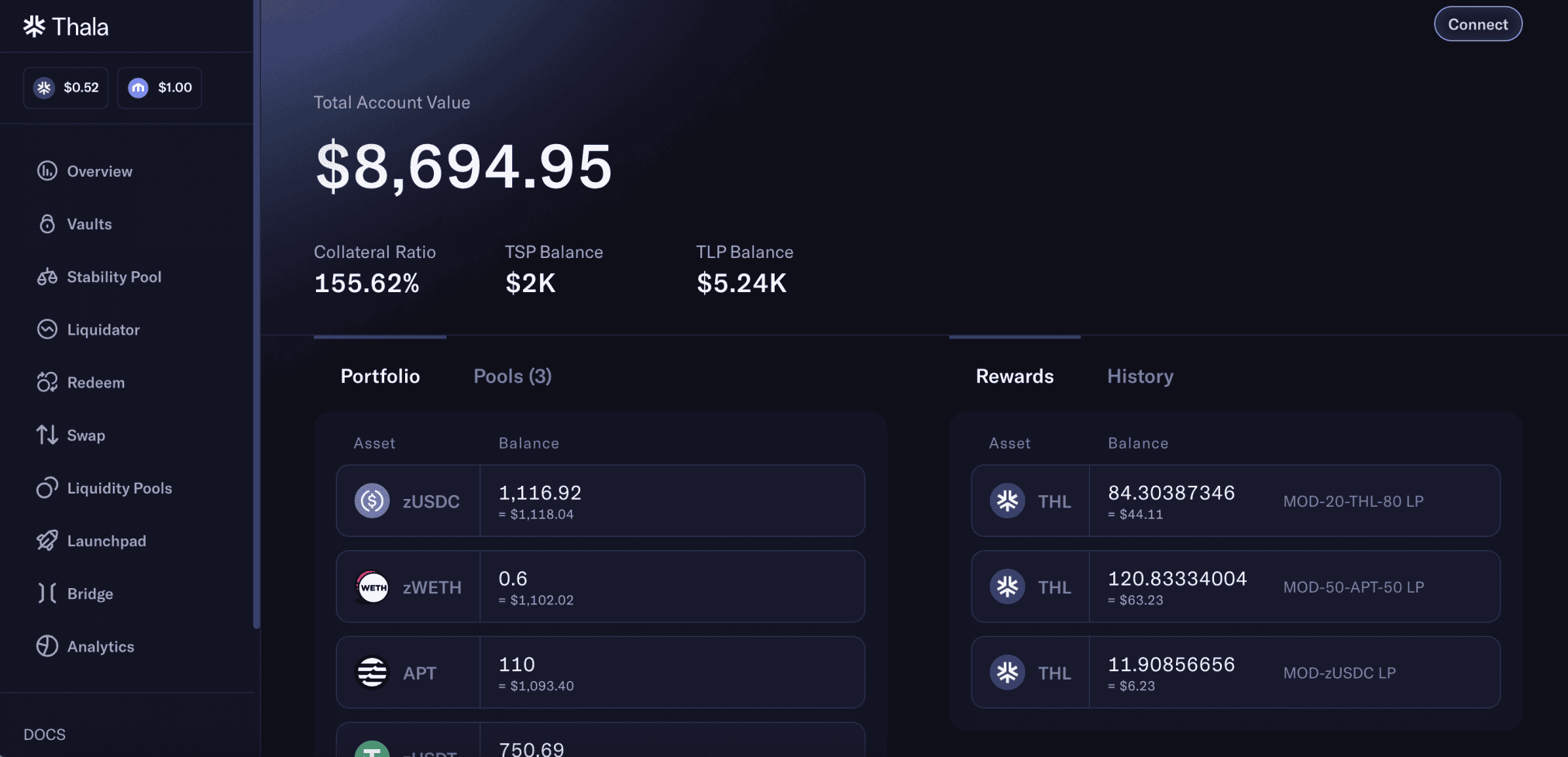

Thala Labs is a DeFi project built on Aptos. Thala has 2 main products including stablecoin MOD & AMM DEX Thalaswap, of which ThalaLaunch is a product built on Thalaswap.

2. Products

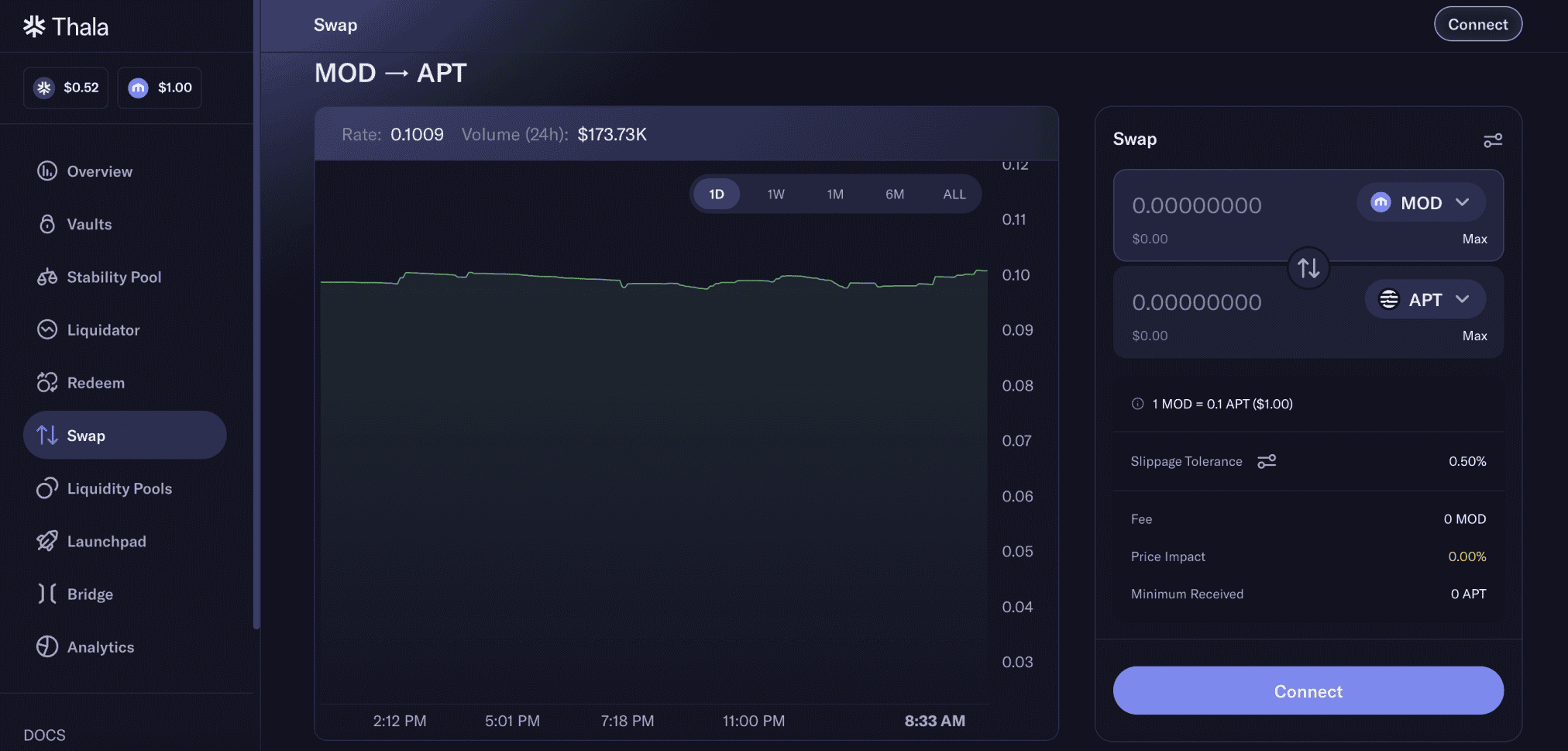

2.1. Move Dollar

Move Dollar (MOD) is a stablecoin backed by both native and multi-chain assets on Thala's platform. As of the time of writing, there have been 8.64M MOD minted.

MOD is designed to always trade at a fixed $1:

-

Users can only mint (“borrow”) the value of the stablecoin below the value of the collateral, such that the value of the collateral in the system always exceeds the value of the stablecoin in circulation.

-

Users with MOD can redeem MOD for $1 worth of collateral (minus the conversion fee), such that the effective floor price is $1.

-

Liquidation will occur when the collateral of a user's vault falls below the level considered safe to support the MOD.

2.2. Thalaswap

Thalaswap is built on a flexible AMM architecture, enhancing productivity, improving capital efficiency, and providing deeper integration for Thala's MOD stablecoin.

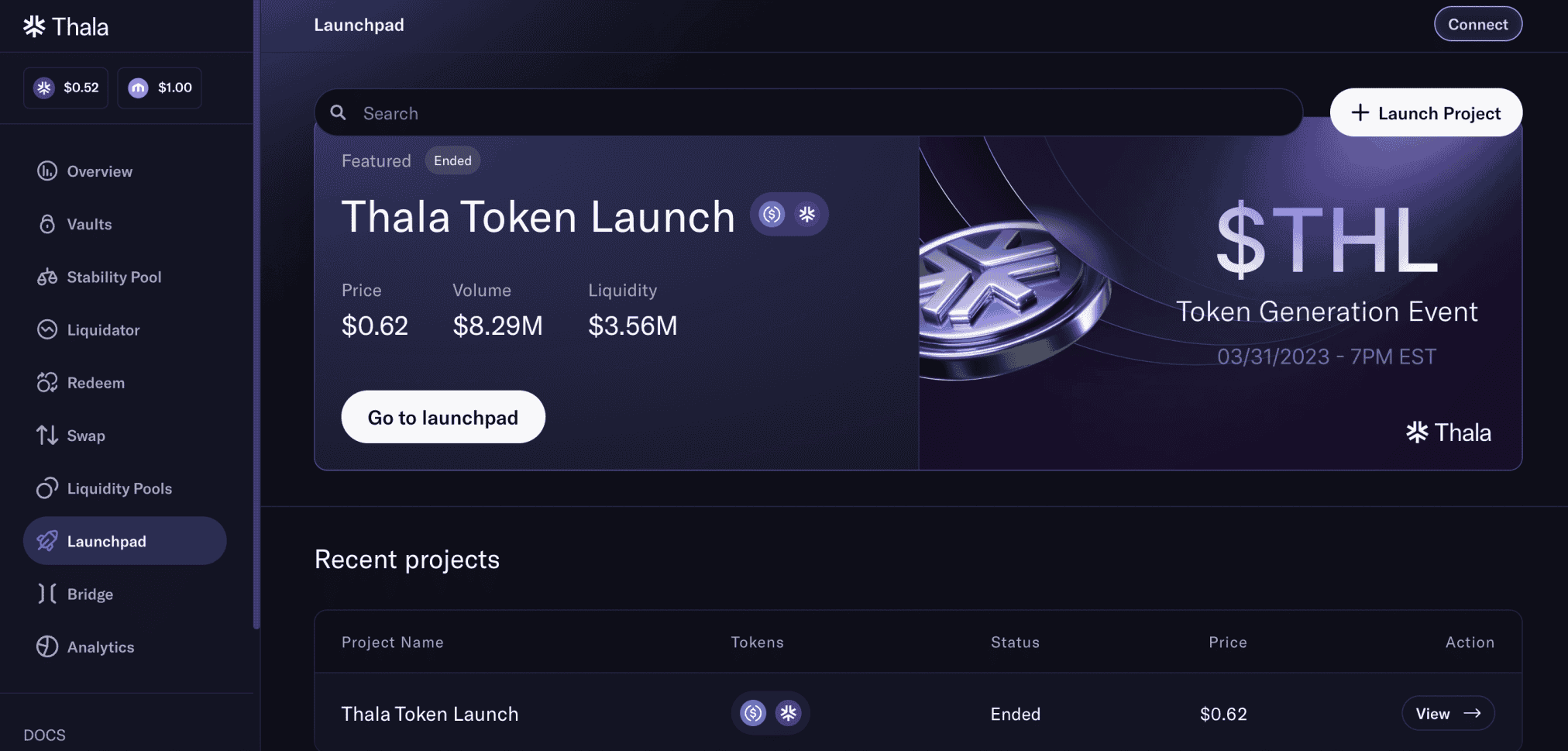

2.3. ThalaLaunch

Built on top of ThalaSwap, ThalaLaunch leverages a special type of pool called Liquidity Bootstrapping Pools (LBP). LBP is a type of pool that automatically changes the weight of pooled assets to create a more equitable distribution rather than simply creating a liquidity pool at an arbitrary price.

3. Team members

Thala Labs team includes experienced builders, researchers, and engineers with diverse expertise.

4. Investors, partners

4.1. Investors

Thala Labs raised $6M co-led by Shima Capital, White Star Capital, and Parafi Capital. There is also the participation of BECO Capital, LedgerPrime, Infinity Ventures Crypto, Qredo, Kenetic, Big Brain Holdings, Karatage, Saison Capital, and Serafund...

4.2. Partner

LayerZero, Zellic, Tortuga, Momentum Safe, OtterSec, Hippo. Regarding the partnership with LayerZero, Thala Labs has integrated Move Dollar (MOD) and Thala governance token (THL) as omnichain fungible tokens (OFT) and enables seamless multi-chain connectivity for both two tokens on all chains supported by Thala in the near future.

Thala's contributors and advisors have backgrounds in both traditional technology and cryptocurrency, including MakerDAO, ParaFi Capital, NEAR, Twitter, Apple, Google and Amazon.

5. Tokenomics

5.1. General information

- Token name: Thala Labs

- Ticker: THL

- Blockchain: Aptos

- Token Type: Governance, Utility

- Circulating Supply: 11,281,308

- Total Supply: 100,000,000

- Max Supply: 100,000,000

THL tokens are used to govern Thala Labs' community through activities such as voting on changes in the ecosystem.

5.2. Token allocation

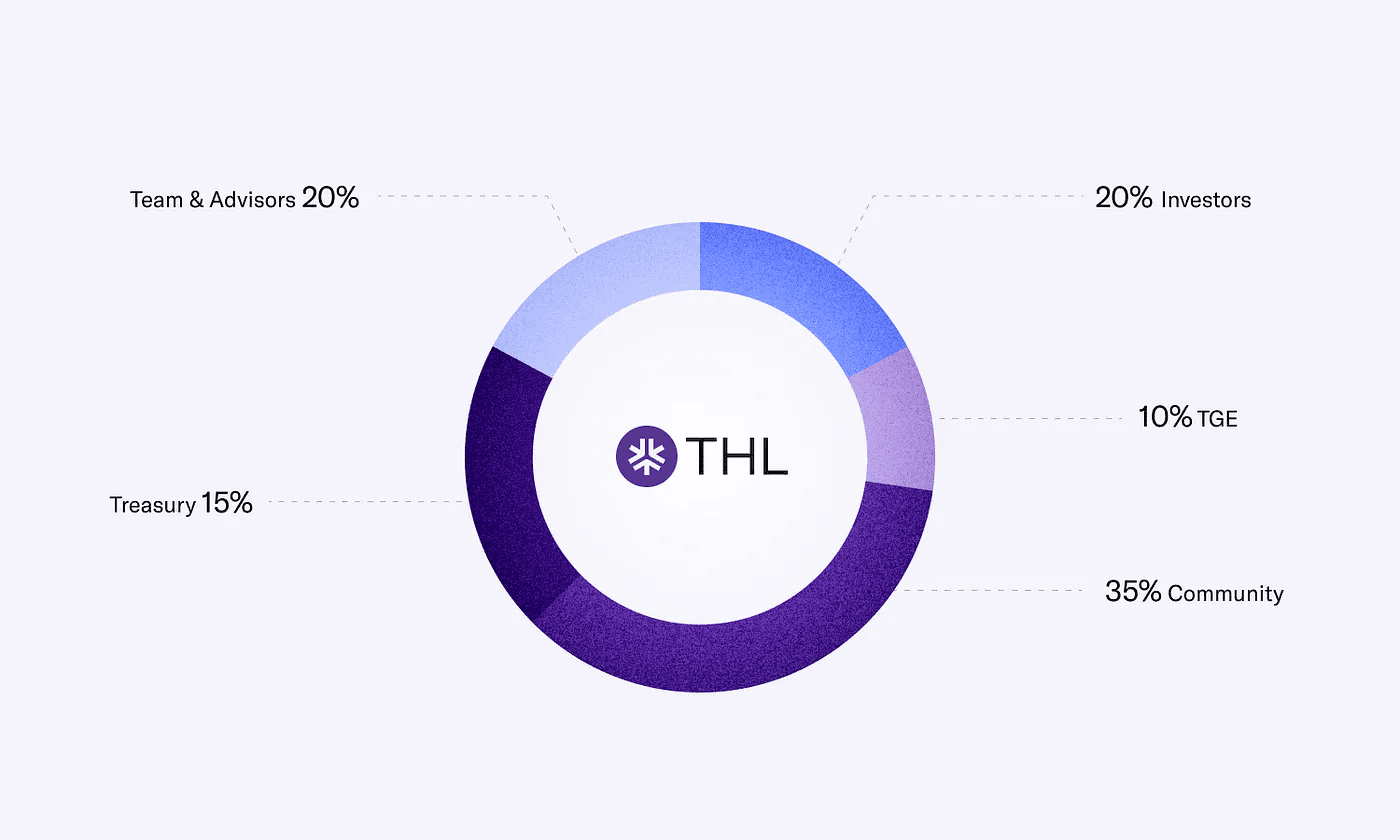

The total supply of THL is limited to 100,000,000 $THL and allocated as follows:

- Community: 35%

- Collaborators and Advisors: 20%

- Investors: 20%

- Treasury: 15%

- TGE: 10%

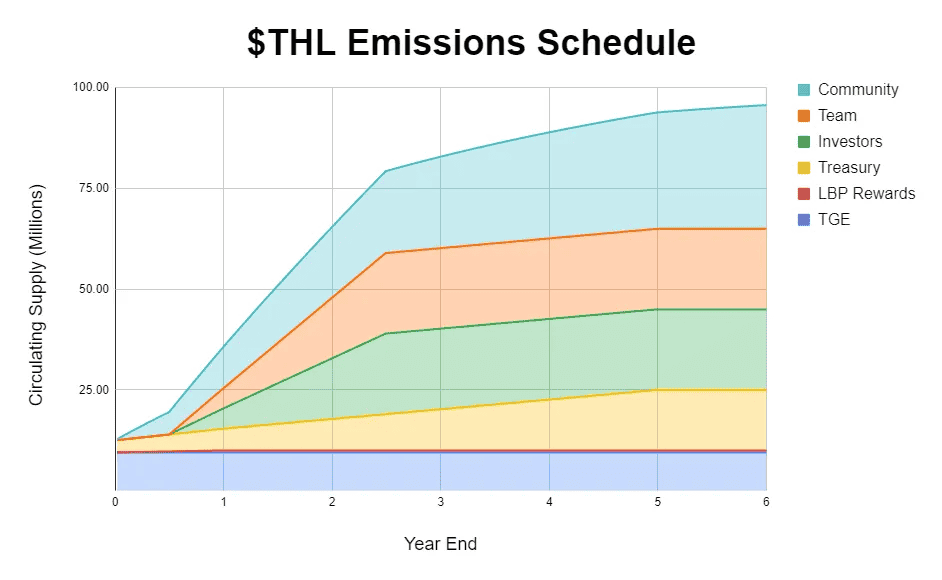

5.3. Token payment schedule

6. Development roadmap

-

Developing the Vote-Escrowed(ve) THL model - (ve)THL model

-

Real world asset (RWA) integration

-

Deploy multichain, expanding the platform's connection range across multiple blockchains.

7. Conclusion

Currently, Thala has launched mainnet, a project focusing on product development and attracting the community. After only 24 hours of mainnet launch, Thala has become the largest native protocol on Aptos with TVL of $12M and transaction volume reaching $3M!

8. Project information

- Website: https://t.co/Y2HFZya455

- Twitter: https://twitter.com/ThalaLabs

- Discord: https://t.co/2z1qIsYJIH

Read more:

English

English Tiếng Việt

Tiếng Việt

.jpg)

.jpg)