1. What Is LayerZero?

LayerZero is an open-source omnichain interoperability protocol designed to enable seamless communication between multiple blockchain networks. This protocol facilitates the transfer of data and assets across different blockchains, eliminating the barriers that typically prevent networks from interacting with each other. In essence, LayerZero connects various blockchains, allowing them to communicate and share information effortlessly.

LayerZero employs a novel approach to interoperability, which overcomes the challenges of liquidity fragmentation and siloed ecosystems in blockchain networks. With LayerZero, blockchains can exchange information securely and efficiently, enabling decentralized applications (dApps) to operate across different networks without needing to be tied to one specific chain.

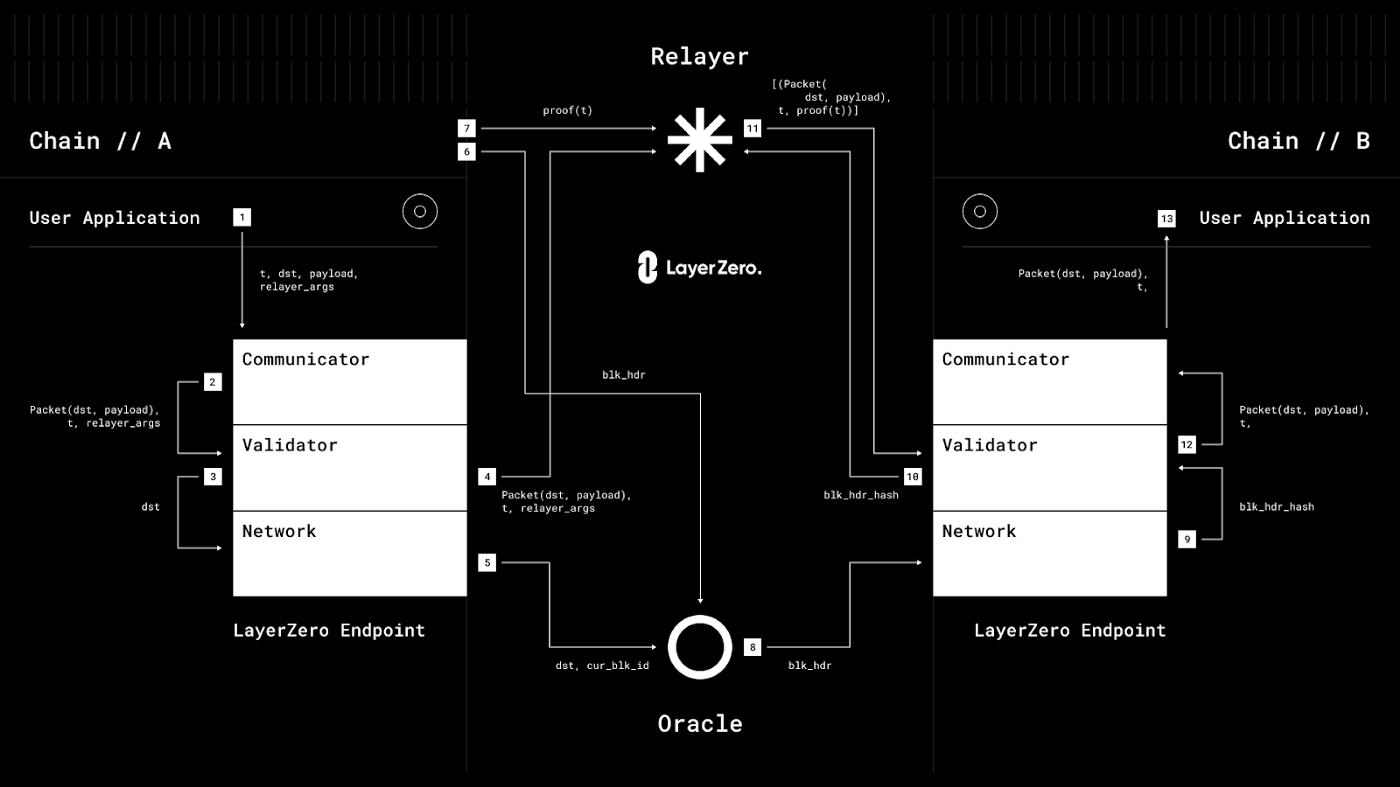

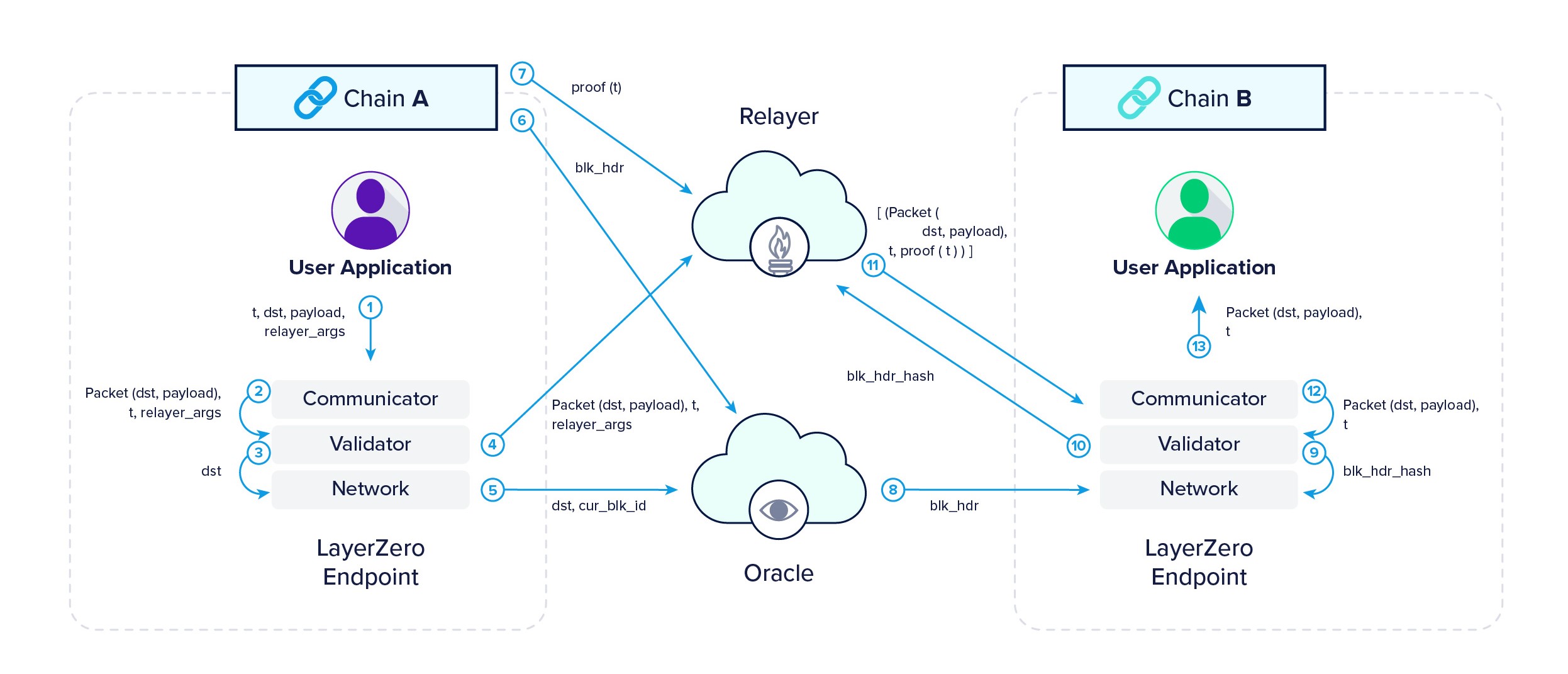

2. How Does LayerZero Work?

LayerZero facilitates communication between blockchain networks using three key components: Ultra Light Nodes (ULNs), decentralized oracles, and relayers.

2.1 Ultra Light Nodes (ULNs)

ULNs are lightweight versions of nodes that help facilitate interoperability between chains. Instead of sequentially adding each transaction to the destination chain (which would be costly), ULNs package multiple transactions and send them together, thus reducing the cost while maintaining security. This process allows for more efficient communication and data transfer between networks.

2.2 Oracles

Oracles act as bridges between blockchain networks and external systems. They provide real-world data to the blockchain or relay information between different decentralized networks. In the context of LayerZero, decentralized oracles such as Chainlink and Band Protocol play a crucial role in transferring messages and data from one blockchain to another securely.

2.3 Relayers

Relayers complete the messaging cycle by sending proof of transactions between chains. Once a message is received by a blockchain's oracle, the relayer sends the proof to the destination chain, enabling it to integrate the data or execute commands based on the received information.

3. Security and Cost-Effectiveness

LayerZero addresses the security vulnerabilities often present in traditional interoperability solutions. Unlike middle chains, which can be costly and risky due to the centralization of validation, LayerZero's decentralized approach using ULNs ensures that the system remains secure while reducing costs. The design minimizes the impact of failures in any part of the system, offering enhanced protection for assets and transactions.

Key Features of LayerZero

-

Improved Security: LayerZero’s architecture prioritizes security by using a decentralized approach, making it harder to compromise the system. The integration of ULNs, oracles, and relayers ensures that the transfer of data between blockchains is resistant to manipulation and failure.

-

Universal Data Exchange: LayerZero enables blockchain applications to interact seamlessly with each other, allowing them to share resources like liquidity and crypto assets. This universal exchange could potentially eliminate the need for separate bridging contracts for different blockchains, simplifying the development of cross-chain applications.

-

Omnichain Applications: LayerZero’s protocol supports the creation of omnichain applications, which can operate across multiple blockchains without needing to adapt their code for each one. This makes it possible to develop applications that can access the unique features of various blockchains while maintaining a unified user experience.

4. Use Cases for LayerZero

- Bridging: Cross-chain bridges enable users to move assets between different blockchains, and LayerZero enhances this process by allowing for the creation of efficient bridges without the need for different codes for each direction of transfer. This reduces the complexity and cost of supporting multiple blockchain networks.

- Cross-Chain Swaps and Unified Liquidity: LayerZero enables more efficient cross-chain swaps by allowing assets to be transferred directly between chains without requiring the bridging of assets to different exchanges. By leveraging a unified liquidity pool, LayerZero ensures that liquidity is readily available across multiple chains.

- Omnichain Tokens and NFTs:LayerZero allows for the creation of omnichain tokens and NFTs, which can be used seamlessly across different blockchains without the need for conversion. This could lead to faster adoption of these assets as they would no longer be restricted to a single blockchain.

5. Tokenomics

.png)

LayerZero’s ZRO tokenomics are structured to facilitate its evolution into a publicly owned, decentralized infrastructure with a fixed supply of 1 billion tokens. Here’s a breakdown of the token distribution:

-

Community and Ecosystem Allocation (38.3%)

38.3% of the total supply is allocated to the community, developers, and users.

On the first day of the airdrop, 8.5% will be made available to eligible participants, with the remaining tokens allocated to future distribution programs and ongoing ecosystem expansion.

-

Strategic Partners (32.2%)

32.2% of the tokens are assigned to strategic partners.

These tokens are subject to a three-year vesting period, which includes a one-year lock and monthly unlocks over the next two years.

-

Core Contributors (25.5%)

25.5% of the tokens are allocated to core contributors who have played a key role in the development of LayerZero.

Like strategic partners, their tokens will be subject to the same vesting schedule: a one-year lock followed by monthly unlocks for the following two years.

-

Future Distributions (15.3%)

15.3% of the supply is set aside for future distributions to users, protocols, infrastructure builders, and community members.

These funds will support programs such as Requests for Proposals (RFPs) to encourage continued growth and engagement in the LayerZero ecosystem.

-

Repurchase and Community Bucket

LayerZero has repurchased 40 million ZRO tokens and placed them in a community bucket to ensure a fair and sustainable distribution.

This initiative ensures that the token distribution remains equitable and prevents any centralized accumulation.

LayerZero's tokenomics are focused on fair distribution, community engagement, and sustainable long-term growth. Additionally, the structure includes safeguards to mitigate the risk of Sybil attacks and promote authentic participation in the network.

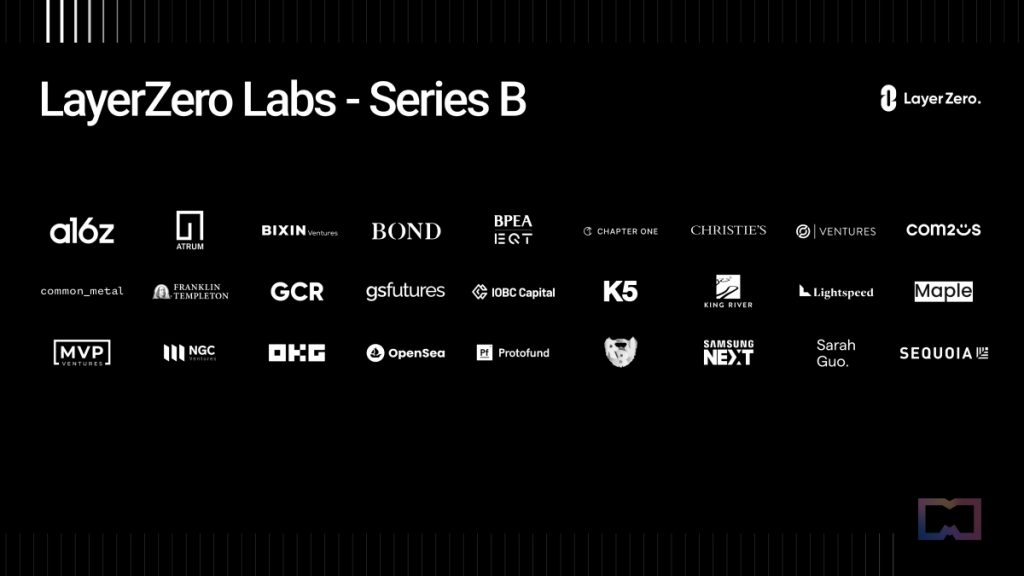

6. Investors

LayerZero has attracted significant investment from some of the most prominent names in the tech and finance sectors, further validating its potential in the blockchain space. Key investors include venture capital firms Sequoia, a16z (Andreessen Horowitz), and Coinbase Ventures, all of which are highly respected in the cryptocurrency and tech investment world.

In April 2023, LayerZero successfully closed a Series B funding round, raising $120 million at a $3 billion valuation. This represents a threefold increase in valuation compared to the previous year, underscoring the growing confidence in the project and its technology.

The funding round also saw participation from more traditional and high-profile investors, including Franklin Templeton (a leading global investment firm) and Christie’s (the renowned art auction house), which highlights LayerZero's appeal beyond just the blockchain and crypto sectors. These strategic backers position LayerZero as a strong player in the blockchain interoperability space, with the potential to drive significant advancements in the way different blockchain networks communicate and operate together.

7. Conclusion

The rise of blockchain interoperability is crucial for the continued growth of the decentralized ecosystem. LayerZero represents a significant advancement in this area, offering a more secure, cost-effective, and scalable solution for communication between different blockchain networks.

Its use cases, such as improved bridging, cross-chain swaps, and omnichain applications, have the potential to unlock new possibilities for decentralized finance (DeFi) and beyond. While still in development, LayerZero could play a pivotal role in shaping the future of blockchain interoperability, making it an exciting project to watch in the coming years.

Read more:

English

English Tiếng Việt

Tiếng Việt.png)