1. What is Token Allocation?

Token Allocation, or Token Distribution, is the process of deciding how to distribute a quantity of tokens from a blockchain project to various stakeholders. This involves determining the percentage allocation of tokens to investors, development team, community, partners, and other purposes.

2. Components of Token Allocation

Allocation to Investors

A portion of tokens is allocated to strategic investors, angel investors, and participants in initial fundraising rounds (ICO, STO, IEO). The goal is to attract capital and financial support for the project.

Allocation to Development Team

To incentivize and retain talent, a certain amount of tokens is allocated to project founders and the development team. Typically, these tokens will have a vesting period to ensure long-term commitment from the team.

Allocation to Community

These tokens are used to incentivize community users and developers to participate in the project's ecosystem. This may include airdrops, bounty programs, and other reward initiatives.

Allocation to Partners and Advisors

A portion of tokens is allocated to strategic partners and advisors in exchange for their support and expertise. This helps the project build networks and strengthen relationships within the industry.

Allocation to Reserves and Future Operations

A reserve of tokens is held for future operations such as product development, marketing, and ecosystem expansion.

Some important terms related to token allocation:

-

Token Generation Event (TGE): This is the moment when initial tokens are released to the market, often when the project is listed on trading platforms. The number of tokens unlocked initially in this event is typically clearly disclosed and is a significant factor affecting the token's value in the market.

-

Cliff: This is the period during which tokens are locked and cannot be traded. The duration of this lock-up period is usually predetermined and lasts for a specific period of time. After the cliff period ends, these tokens will begin to be released.

-

Linear (Time-based distribution): This is a method of gradually distributing tokens over time instead of releasing them all at once. This helps maintain market stability and ensures that a large volume of tokens is not introduced into the market simultaneously, which could impact the token's value.

To check token allocation:

-

Access Official Project Channels: Visit the project's official website, Medium blog, or other social media channels where detailed information about the token allocation plan is often provided. These are reliable and frequently updated sources of information.

-

Use Information Aggregator Platforms: Websites like Cryptorank, ICOdrops, and similar platforms aggregate information about various projects, including details about token allocation. These platforms typically gather data from official sources and provide an overview of token allocation plans across multiple projects.

3. Why is Token Allocation important?

Token Allocation plays a crucial role in ensuring the success and sustainability of a blockchain project. Here are the main reasons why Token Allocation is important:

Impact on Project Success and Sustainability

-

Balancing Benefits Among Stakeholders: A well-planned token allocation strategy ensures that all stakeholders, including investors, development teams, community members, and partners, receive benefits and incentives to support the project. This helps the project achieve sustainable and long-term development.

-

Stable Financial Resources: Allocating tokens to investors helps the project attract capital and ensures financial resources to implement development plans. This helps the project sustain operations and efficiently scale its activities.

Building trust among investors, the development team, and the community

-

Transparency and Clarity: A transparent and clear Token Allocation plan builds trust among investors, development teams, and the community. When stakeholders understand how and why tokens are allocated, they are more likely to trust and support the project.

-

Risk Control and Management Capability: Thoughtful token allocation helps the project better control and manage risks, thereby enhancing stability and safety within the ecosystem.

Ensuring resources for project development and future expansion

-

Encouraging Community Participation: Allocating tokens to the community encourages user engagement and contributions to the ecosystem. Programs like airdrops, bounties, and other rewards incentivize community support for the project.

-

Investment in Research and Development: Reserving a portion of tokens for future use allows the project to invest in research and development, marketing, and other expansion activities. This ensures that the project remains innovative and sustains long-term growth.

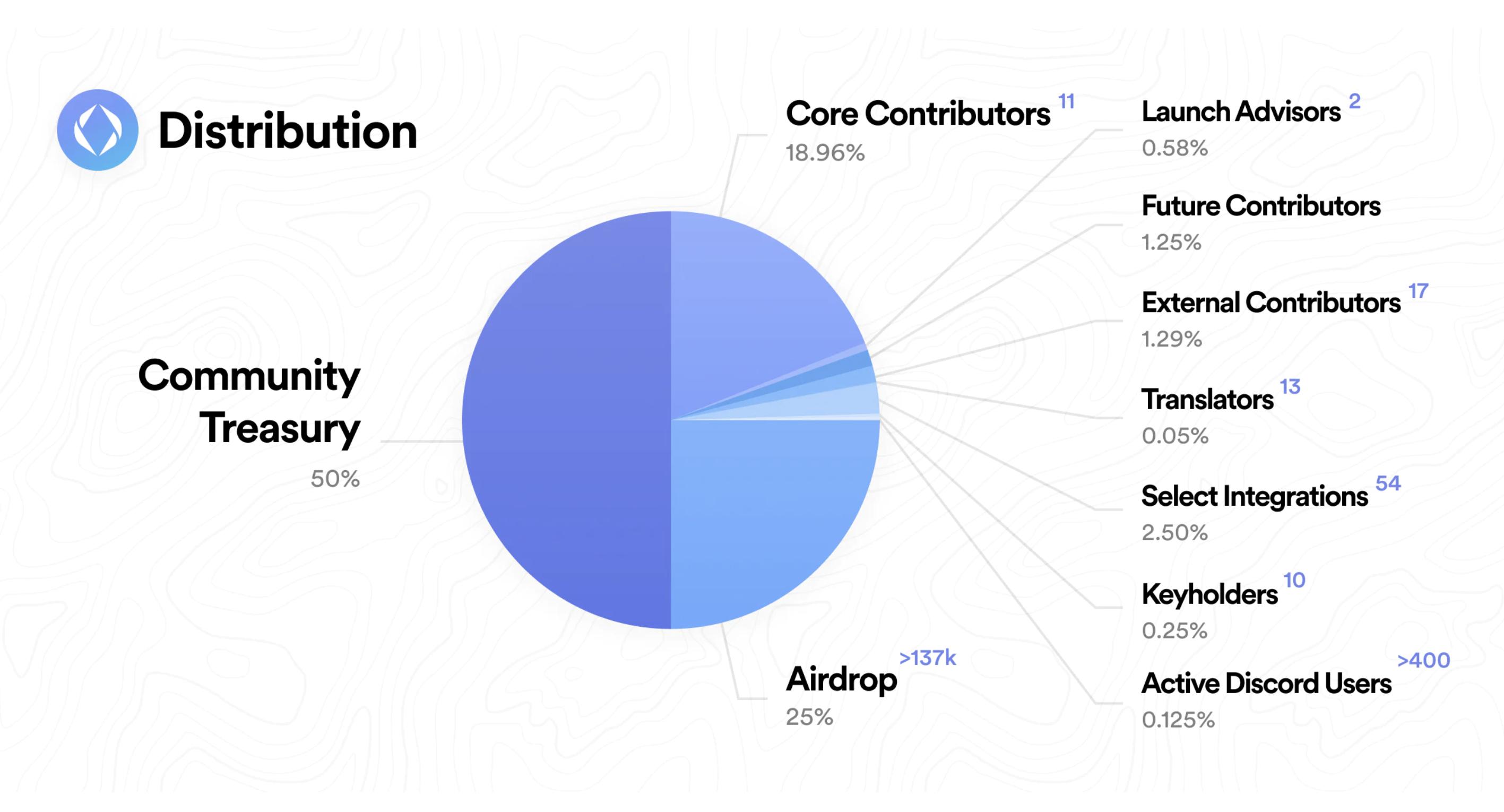

4. Token Allocation in prominent blockchain projects

To gain a better understanding of the importance and effectiveness of Token Allocation, let's examine specific examples from prominent blockchain projects. Below are how these projects have allocated their tokens and why these strategies have been successful.

Ethereum (ETH)

Token Allocation of Ethereum:

-

Pre-sale and ICO: 60 million ETH (83.33%) were sold during the pre-sale and ICO stages to raise initial funding for the project.

-

Foundation and Development: 12 million ETH (16.67%) were allocated to the Ethereum Foundation and core developers.

-

Mining Rewards: The remaining ETH is gradually released through mining rewards.

Analysis of ETH Token Allocation:

Benefits:

-

Encourages early participation: Selling 60 million ETH during pre-sale and ICO stages facilitated rapid fundraising and accelerated project development.

-

Supports long-term development: Allocating 12 million ETH to the Ethereum Foundation and core developers helps sustain and develop the network over the long term.

Drawbacks:

-

Centralization risk: Allocating a large amount of ETH to a few entities could lead to centralization of power.

-

Inflation pressure: Issuing ETH through mining rewards may create inflationary pressure if not well managed.

Binance Coin (BNB)

Token Allocation of Binance Coin (BNB):

-

ICO: 50% (100 million BNB) was sold during the ICO stage to raise initial funding.

-

Team Allocation: 40% (80 million BNB) was allocated to the development team.

-

Angel Investors: 10% (20 million BNB) was allocated to angel investors.

Analysis of BNB Token Allocation:

Benefits:

-

Strong fundraising: Selling 100 million BNB during the ICO raised a substantial amount of capital, providing strong support for Binance's initial development.

-

Motivation for development team: Allocating 40% of the tokens to the development team ensures long-term motivation and commitment from core members.

-

Early investor attraction: Allocating 10% to angel investors helped attract interest and financial support from influential investors.

Drawbacks:

-

Centralization of power: Allocating 40% of BNB to the development team could lead to centralization of power and significant influence from a small group.

-

Token supply pressure: Large allocation in the early stages could create pressure on token price if not managed well.

Polkadot (DOT)

Token Allocation of Polkadot (DOT)::

-

Pre-sale and Public Sale: 50% of DOT was sold during pre-sale and public sale stages to raise funds.

-

Foundation: 30% of DOT was allocated to the Web3 Foundation to support development and research.

-

Team Allocation: 20% of DOT was allocated to the development team and strategic partners.

Analysis of DOT Token Allocation:

Benefits:

-

Strong fundraising: Selling 50% of DOT during pre-sale and ICO stages provided significant capital for initial development.

-

Long-term support: Allocating 30% to the Polkadot Foundation and development team ensures necessary resources for continuous maintenance and growth of the network.

-

Community engagement: Allocating 20% for reward programs and incentives helps motivate and enhance community participation.

Drawbacks:

-

Centralization risk: Allocating a large portion of tokens to the Foundation and development team may lead to centralization of power within a small group.

-

Sell pressure: Selling a large number of tokens in the early stages could create selling pressure on the token price if not managed effectively.

5. Conclusion

Token Allocation is a critical factor in assessing the potential and value of blockchain projects. A transparent and reasonable token allocation plan not only fosters trust and motivation among stakeholders but also ensures resources and sustainable development for the project in the future. Understanding the mechanics of token allocation will provide you with a deeper insight into the project's strategy and goals, enabling you to make smarter investment decisions.

Read more:

Tiếng Việt

Tiếng Việt.jpg)

.jpg)

.jpg)

.jpg)