1. General information about Bitcoin Dominance

1.1. What is Bitcoin Dominance?

Bitcoin dominance (abbreviated btcd or btc.d) is the percentage of Bitcoin's market capitalization over the total cryptocurrency market capitalization.

Formula to calculate Bitcoin dominance:

BTC.D = Bitcoin market capitalization (BTC) ÷ Entire coin market capitalization

For example: We have a total market capitalization of 2000 billion USD and a BTC market capitalization of 900 billion USD

=> BTC.D = 900 ÷ 2000 ≈ 45 %

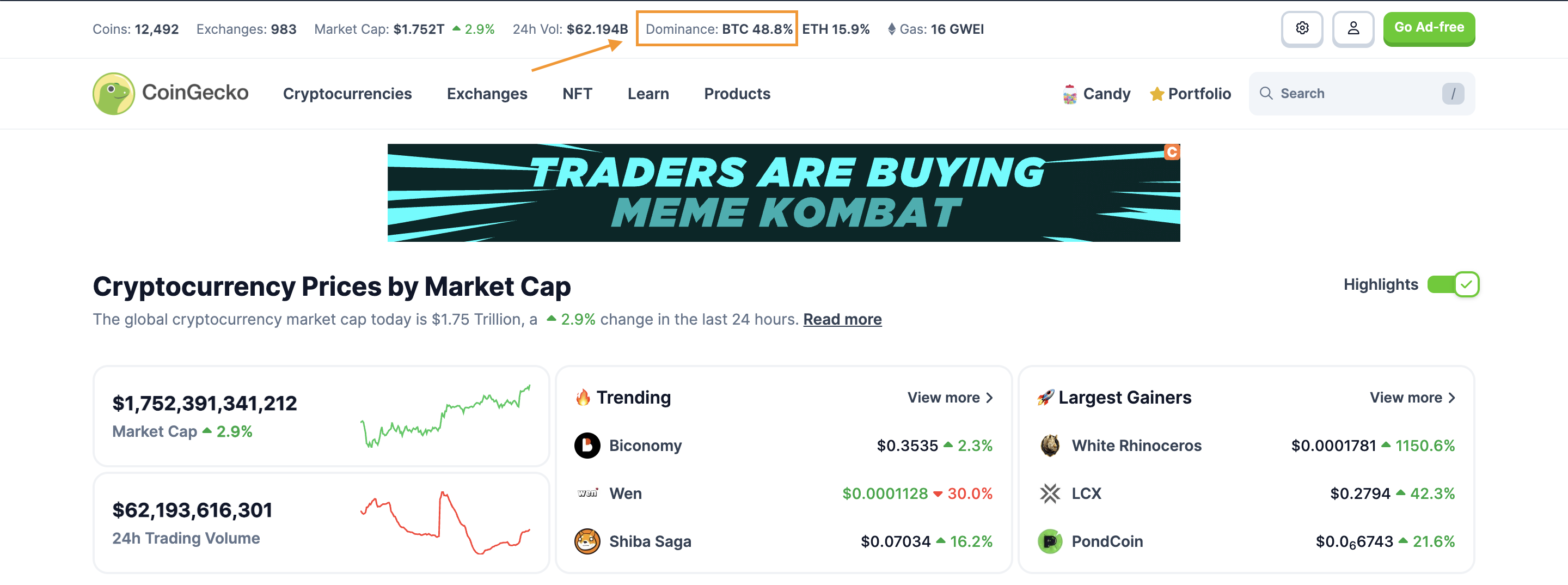

Follow Bitcoin dominance at Coingecko:

Currently, users do not need to manually calculate Bitcoin dominance as above but can check directly on Coingecko. The BTC.D index is displayed as shown below:

1.2. Meaning of Bitcoin dominance in crypto

Bitcoin dominance stems from Bitcoin's relationship with the rest of the cryptocurrency market. It serves as a metric that can be used by cryptocurrency traders to take the pulse of the market, manage risk, and help spot trends and possible trading opportunities, often combined with other datasets.

Since Bitcoin dominates the majority of the total cryptocurrency market capitalization, it has historically had a high and positive correlation with the majority of Altcoins, which in turn react strongly to its price movements. Given this correlation, some argue that Bitcoin dominance can also help understand trends in the Altcoin market.

2. Fluctuations of Bitcoin Dominance index over time

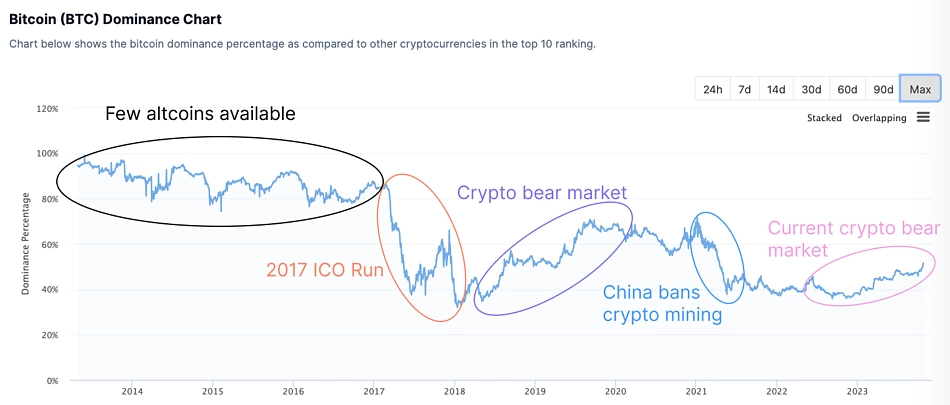

Bitcoin held about 99% of the crypto market when it was first launched in 2009. Four years later, Bitcoin has a dominance rate of 94%, as there are only a handful of altcoins competing with it in the market. Even when Ethereum entered the space in 2015, Bitcoin dominance remained at around 90%.

2.1. Domination in 2017

Bitcoin dominance dropped from 96% in February 2017 to a low of 37% in early 2018. During this period, Ethereum enjoyed early success, bolstered by the initial coin offering craze. (ICO) and the birth of coins and tokens. Growing enthusiasm for altcoins and high levels of market participant speculation have caused Bitcoin dominance to plummet.

This ICO craze didn't last long, however, as Bitcoin prices temporarily hit a new all-time high in late December 2017 before plummeting in the following months. While Bitcoin price continues to slide, its dominance remains low. The decreasing confidence and growing negative sentiment of the entire market eventually led to the 2018 cryptocurrency crash and the subsequent bear market that lasted about 1 year.

2.2. Domination 2019-2020

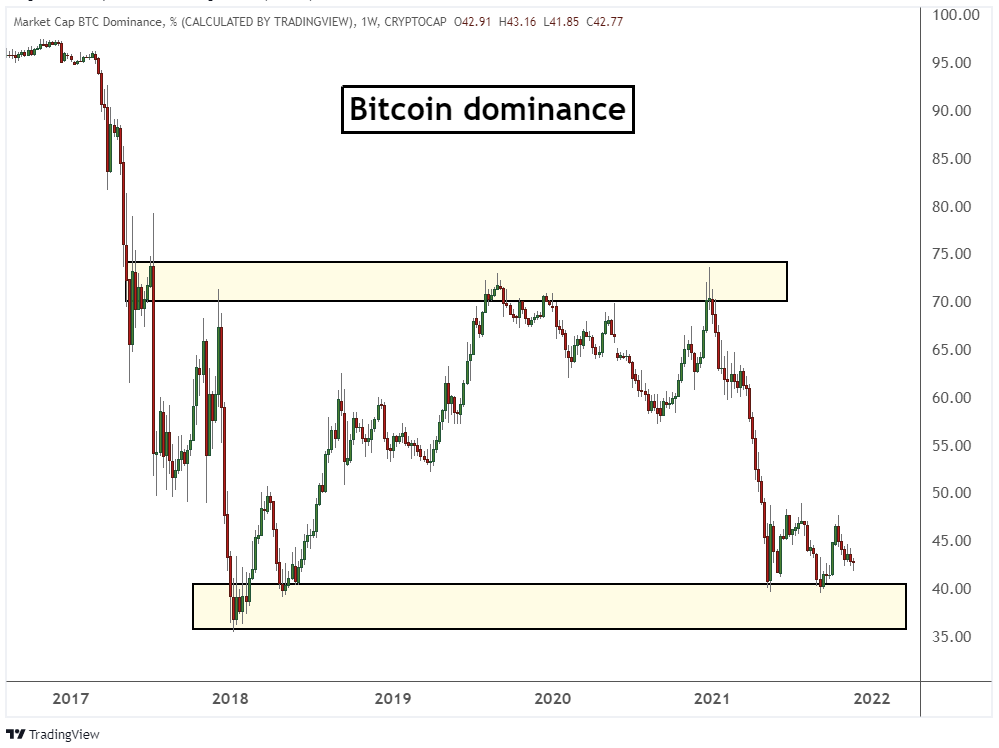

Around 2019, the cryptocurrency market calmed down and corrected, and Bitcoin price continued to recover in tandem with its dominance. Ahead of the 2020 Bitcoin Halving, its dominance skyrocketed 60%–70%.

Although the halving pushed Bitcoin dominance to a high in May 2020, its dominance dropped significantly from ~66% to ~55% due to DeFi Summer, when more DeFi tokens emerged and gained traction.

2.3. 2021 Domination

Bitcoin price began to rise rapidly again in 2021, as its market capitalization skyrocketed by an unprecedented 700% since March 2020, surpassing the previous all-time high by a significant amount .

During this period, interest in cryptocurrencies increased. New innovations have given way to the growth of DeFi and non-fungible tokens (NFTs), and retailers are getting into altcoins. Confidence in the cryptocurrency market increased again but relative decline in Bitcoin. This resulted in Bitcoin gradually losing more market share to altcoins and its dominance remaining below 40%.

3. Bitcoin dominance chart and market trend

Before 2017, Bitcoin recorded a market dominance of over 80% – sometimes up to 95%. This is because there are very few altcoins with a solid competitive advantage. However, after the initial coin offering (ICO) in 2017, altcoins led by Ethereum (ETH) began to attract significant investment, reducing Bitcoin's dominance.

At first, when there were very few altcoins, Bitcoin dominance averaged over 80%. However, when ICOs began in 2017, altcoins gained investor attention, bringing Bitcoin dominance to a low of 32.3% as more investors began to exchange their bitcoins. they take altcoins (hence the term "Altcoin season").

In 2018, when the “bear market” began, Bitcoin dominance began to increase again as investors returned to accumulating bitcoin as altcoins declined and disappeared. However, in early 2021, China's crypto mining ban and cryptocurrency price surge (and subsequent interest in new altcoins) caused Bitcoin's dominance rate to drop.

Soon after, 2022 saw a crypto bear market and Bitcoin dominance continued to decline until 2023, when users started accumulating bitcoins again and the number reached a high of 51.5 % on October 26, 2023, surpassing 50% for the first time since April 2021.

4. Factors affecting Bitcoin dominance

Market trends are the biggest factor influencing Bitcoin dominance. Here are some trends influencing Bitcoin dominance:

Competition with Bitcoin: Although there are more than 13,000 cryptocurrencies, Bitcoin has emerged as one of the most stable digital currencies. However, with so many options including low market cap tokens with potential and new “narratives,” Bitcoin investors may choose to diversify their holdings to include these tokens. , which could also cause a decline in Bitcoin dominance.

Stablecoin Popularity: Since 2018, demand for stablecoins has been increasing - putting constant pressure on Bitcoin's dominance. Stablecoins such as USDT and USDC also offer users an alternative to conventional cryptocurrency exchanges, and with the rise of new funds entering the market via stablecoins instead of bitcoin , the total value of the cryptocurrency market will increase and dilute BTC dominance. Traders tend to convert their bitcoin and altcoin investments to stablecoins to maintain their profits, especially are during bear markets (periods of extended bearish trends) and periods of high volatility. Additionally, to make it easier to enter and exit trades, traders often convert their profits to stablecoins during bull markets (periods of extended price uptrends) instead of withdrawing profits as currency. identification.

Introducing new revolutionary coins: Bitcoin is “fighting” more than 13,000 cryptocurrencies. Therefore, introducing multiple altcoins with huge potential at the same time could affect its market dominance. Sometimes, these altcoins lose popularity after the hype ends. When this happens, investors will move their money from those coins back into bitcoin, causing it to regain its position.

5. How to read the BTC dominance chart

The Bitcoin dominance chart is a visual representation of Bitcoin dominance as an index. Cryptocurrency traders started using the BTC dominance chart after the 2017 ICO. But the chart gained more attention in 2021 during the altcoin boom. Currently, Bitcoin dominance is one of the most popular trading support indicators in the cryptocurrency space.

Let's learn how to read Bitcoin dominance:

-

In addition to showing BTC's market dominance, the chart also shows the dominance of 10 altcoins, each with a different color for easy identification.

-

Click on the "Max" bar to see Bitcoin's market dominance since its inception.

-

Go to the bottom of the chart and uncheck the boxes of all altcoins to remove their charts from view. This way, you will only maintain Bitcoin's market dominance.

-

You can zoom in on a specific time period to get a closer look at Bitcoin dominance during that period.

-

Additionally, you can compare Bitcoin dominance with any altcoin by checking its box. For example, click on the ETH box to compare its dominance with bitcoin.

6. How to use the Bitcoin dominance chart

You can use the Bitcoin dominance chart to spot “altcoin season” and track BTC price.

.png)

6.1. Detecting “Altcoin season” with Bitcoin dominance

With the growing number of altcoins in the crypto market, Bitcoin's dominance is gradually decreasing. There were several periods where these altcoins became more popular, causing their total market capitalization to surpass BTC. Such periods of time are called “altcoin seasons” or “altseasons”. Investors tend to shift their investments from BTC to altcoins during these times.

Since altcoins typically outperform BTC during “altseasons,” BTC dominance may shrink. Therefore, if you invest in Bitcoin and altcoins, you can monitor Bitcoin dominance to adjust your investment accordingly.

6.2. Track current Bitcoin prices with Bitcoin dominance

You can use Bitcoin dominance to track bitcoin prices and make investment decisions. Here are some possible scenarios where using BTC dominance in tracking BTC price signals a certain trend:

-

There could be an impending BTC bull run as Bitcoin dominance and price trend upward.

-

When BTC price is trending up but its dominance is shrinking, it could indicate a potential altcoin season.

-

As BTC price is trending down while its dominance is increasing, this could indicate the formation of a bearish altcoin market.

-

“Bear markets” can appear when the price and dominance of BTC declines.

While these factors do not signal a clear bullish or bearish market, past trends signal a strong correlation.

7. Trading strategy with Bitcoin dominance

Trading strategies with Bitcoin dominance are often built based on an assessment of the state of the crypto market and thinking about the relationship between Bitcoin and altcoins. Bitcoin dominance measures the percentage of the crypto market that Bitcoin occupies, compared to the total global market capitalization.

When Bitcoin dominance increases

If Altcoin prices increase, the crypto market often receives an influx of new money, increasing overall market capitalization and sending a positive message of recovery and investor confidence. Conversely, if Altcoin prices decrease, it may be a sign of money flowing from Altcoins to Bitcoin. Investors may decide to take profits from Altcoins and convert to Bitcoin, or there may be new money flowing into the market but only to buy Bitcoin, viewing Bitcoin as a safer asset in times of uncertainty. Altcoin price movements are often an important indicator of the direction of money flow in the crypto market.

When Bitcoin dominance decreases

If Altcoin prices increase, Bitcoin often goes through an accumulation phase, preparing for a new price increase. Therefore, Bitcoin price may decrease or be less volatile. On the contrary, if Altcoin prices decrease, it could be a sign of a downturn in the market. In this situation, negative information can cause investors to lose confidence in the crypto market and decide to withdraw capital.

8. Frequently asked questions

8.1. When will Bitcoin dominance change?

Bitcoin dominance may be facing a continued decline as the number of altcoins increases and the cryptocurrency market diversifies over time. However, depending on how the overall altcoin market performs, Bitcoin dominance may fluctuate over time. It is these intermediate changes and fluctuations that are of interest to traders as they can serve as indicators of the current stage of the market, which can help traders decide, when watching Considering a number of different metrics, how do they want to position accordingly.

8.2. Why does Bitcoin dominance still matter today?

Bitcoin dominance is one of the data sources that feeds the Crypto Market Sentiment Index - a key market sentiment indicator that measures whether certain markets or assets are trading on or off the market. below their intended value due to general market sentiment. In some cases, this ratio can also signal the start of an altcoin season, which refers to a period where several altcoins rapidly increase in price against the dollar and Bitcoin at the same time. Bitcoin dominance is one of the most relevant metrics for altcoin season, where popular altcoins gain market favor and their performance often outperforms Bitcoin, thereby reducing market share and dominance. Bitcoin's value in the cryptocurrency market.

9. Conclusion

Tracking Bitcoin dominance and bitcoin prices can indicate a potential altcoin season, while also potentially indicating when a bull or bear market is imminent. However, while the Bitcoin Dominance Index can be used as an indicator, it should not be used as a standalone indicator. Instead, it is better used in conjunction with other indicators and combined with market trends.

Read more:

English

English Tiếng Việt

Tiếng Việt

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)