1. Typus Finance

What is Typus Finance?

Typus Finance is a platform providing Options products at the top of the DeFi ecosystem on Sui Blockchain. Additionally, the platform combines swap, lending and derivatives protocols to create an options market for long-term investment assets. Typus Finance becomes one of the platforms providing large amounts of liquidity to the DeFi application landscape on Sui.

The project's goal is to improve onchain liquidity market share. In fact, many current DeFi protocols still face many limitations when providing DeFi services to users. To improve user experience, platforms need to provide a variety of long-term assets with sufficient liquidity, while ensuring that LPs can mitigate their risks.

Options are the missing piece to solve this problem.

2. Product

2.1. Typus Vanilla Options

Options products at Typus are designed in European style, where orders can only be executed at the option's expiration date. Options at Typus will be 100% guaranteed by collateral.

In Typus Finance, there are two roles that users need to know: Vault Depositor (or Option Seller) and Vault Bidder (Option Buyer). In each strategy, these two roles will be in charge of different actions.

There are 3 strategies users should keep in mind:

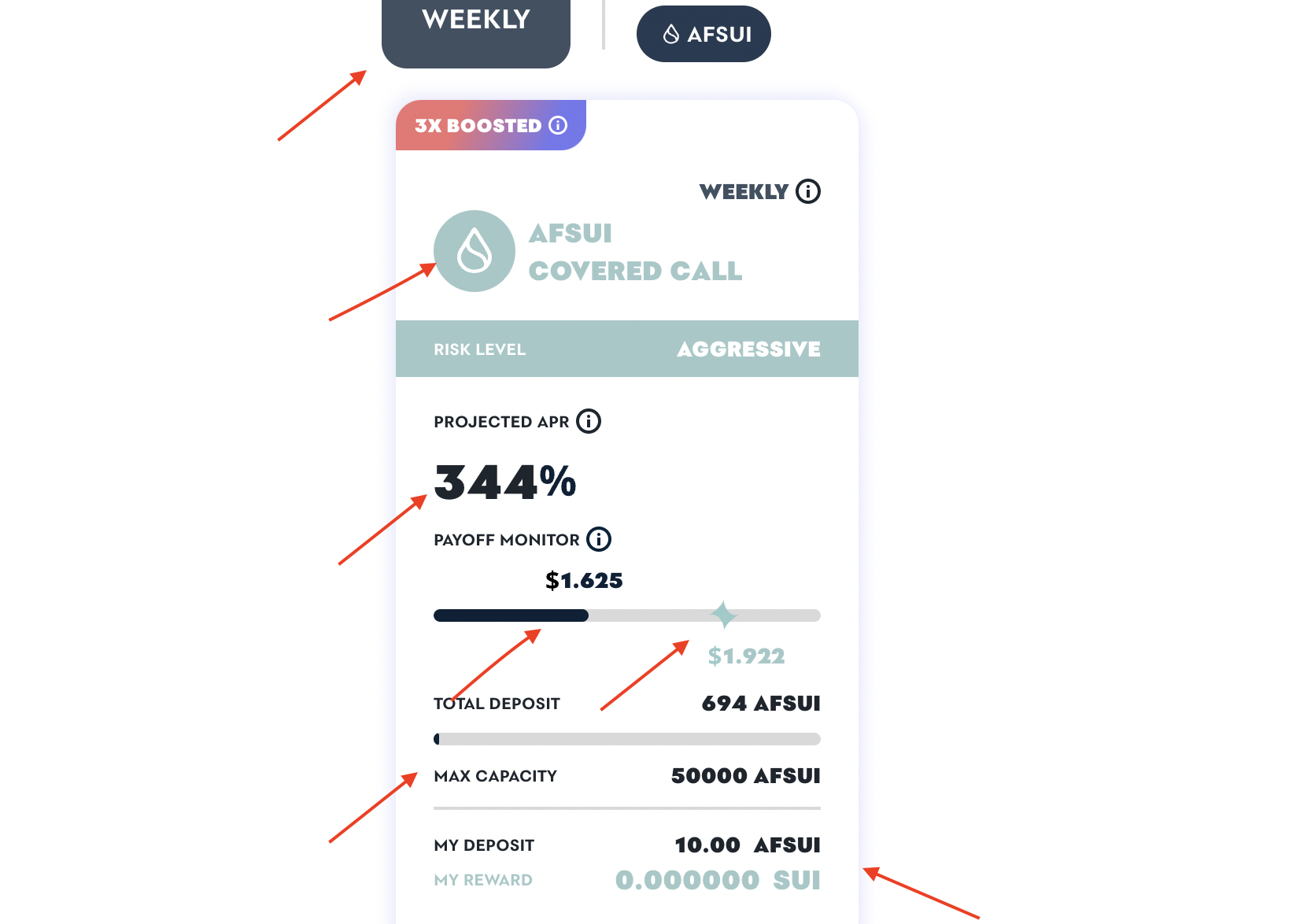

Covered Call: In the Covered Call strategy, vault depositors are those who sell call orders and vault bidders are those who buy call orders at the expiration date. If the market price of that asset is higher than the Strike Price at the expiration date, the vault depositor will need to sell the deposit to the vault bidder. Because the asset has increased in price, profits will be calculated according to the difference between the Market Price and the Target Strike Price. For this strategy, Vault Depositors will have a lot of profit when the market goes sideways or down, while Vault Bidders will profit when the market increases strongly.

The items in the image represent the parameters that users need to keep in mind when choosing this strategy. According to the information in the image, this strategy expires weekly, the deposit asset is AFSUI, the 1-year APR is 344%, the current SUI price is 1,625 USD, the Strike Price is 1,992 USD. In addition, the total pool is 50,000 AFSUI (currently the pool only has 694 AFSUI) and the amount deposited into My Deposit is 10 AFSUI.

The above strategy is considered extremely risky with the risk level being at Agressive level. The main reason is because the current price difference with Strike Price is quite low, while the expiration time is in weeks.

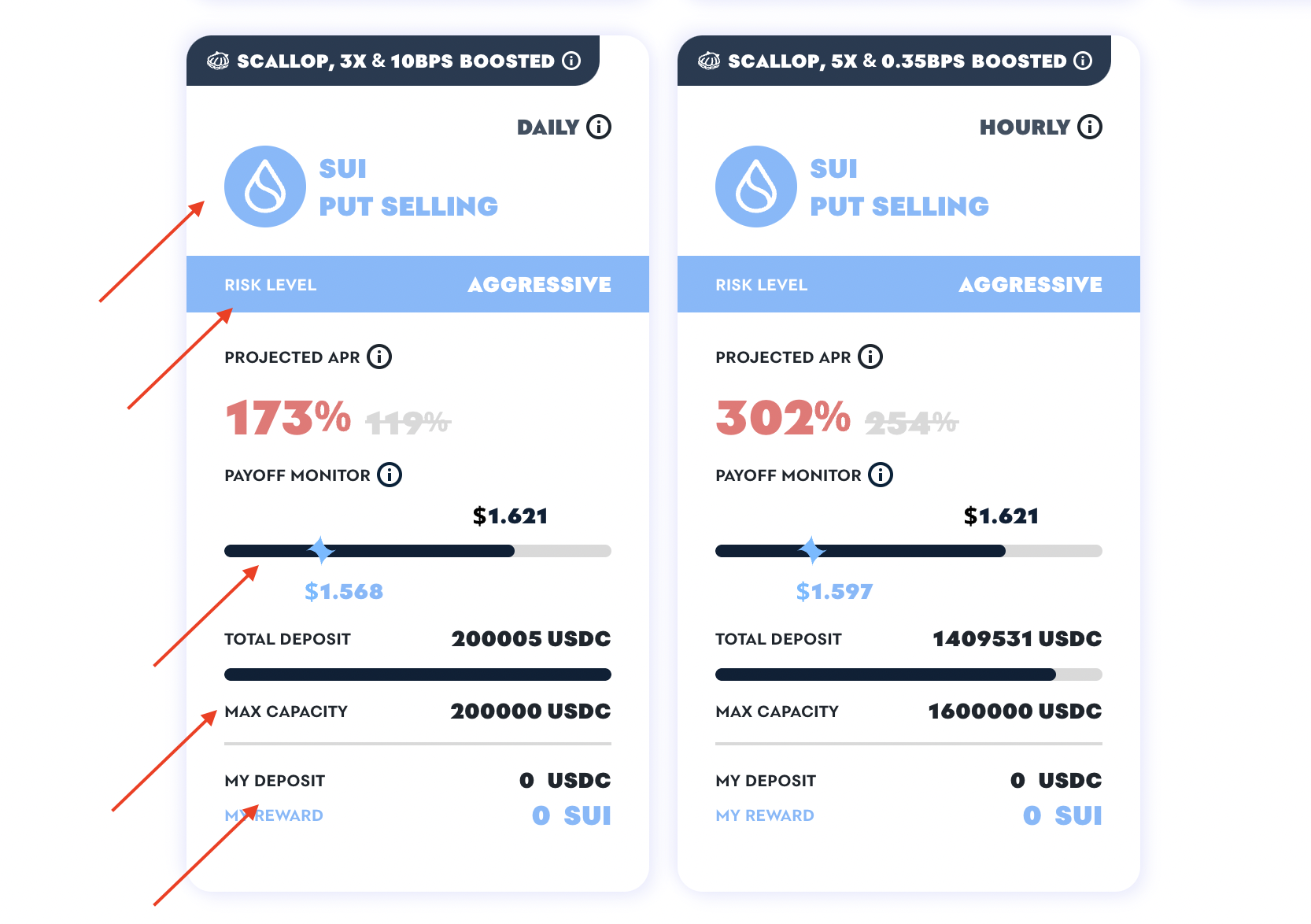

Put Selling: In the Put Selling strategy, the Vault Depositor plays the role of selling the put option (sell the Put Option) while the Vault Bidder buys the put option (Buy the Put Option). In fact, when the market price of the trading asset is lower than the target price, Vault Bidder will have the right to buy the existing option at the market price, thereby making a profit from the difference. Thus, when the market has a neutral or upward trend, Vault Depositors will earn a lot of profit, while Vault Bidders will profit when the market goes down.

Put Selling Strategy on Typus Finance

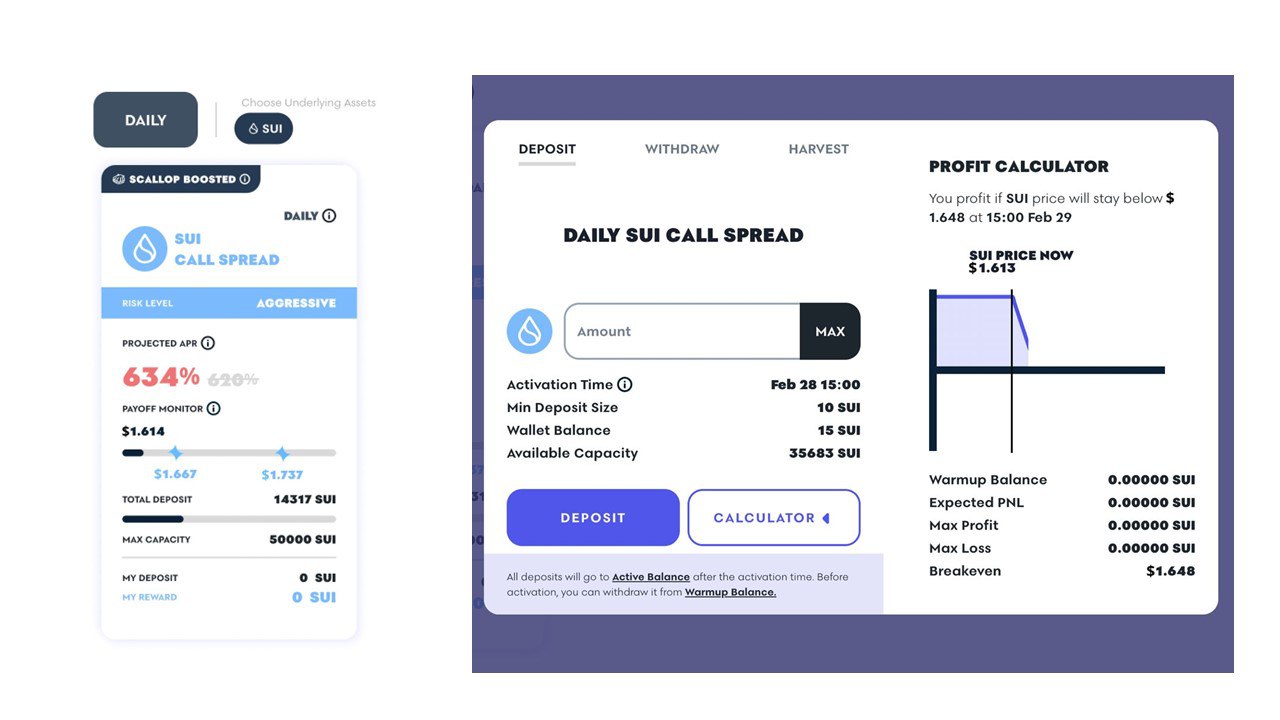

Call Spread: In this strategy, Vault Depositor will sell a call option at a price lower than the Strike Price and buy another call option at a price higher than the Strike Price). Understanding this strategy in detail is also relatively difficult, users can access the platform and use the calculator on the platform.

Example of Call Spread

According to the information on the photo, the current price of Sui is 1,614 and the two Strike Price prices that users need to pay attention to are SUI at 1,667 and 1,737 USD. If SUI is below the price of 1,648 at 15:00 on February 29, the user will make a profit.

2.2. Costs required when using the platform

Cost parameters the user needs to have:

Deposit fee: 0%

Withdrawal Fee: 0%

Claim fee: 0%

Harvest and Compound Fee: 10% bonus

Transaction fee: 10% of options price (Vault Bidder pays this).

Staking and Switch: 0.05 Sui (for NFT Tails by Typus)

Transfer Fee: 0.01 SUI (for NFT).

3. Tails by Typus

Tails by Typus is an NFT collection of 6666 NFTs from Typus Finance in association with Studio Mirai. This collection of NFTs in the form of Dynamic NFTs enhances interactivity and provides a unique user experience. Specifically, each NFT will need to be upgraded to Level 2 to begin updating and receiving many exclusive benefits.

Tails By Typus NFT collection image

Daily Feed: 10 EXP/day

First deposit to the platform: 100 EXP

First bid: 500 EXP

Bid 1 USD: 200 EXP

Deposit 1 USD: 0.01 EXP/hour.

Play Dice: numbers depend on the player's win/loss.

First of all, users need to stake the NFT at https://typus.finance/portfolio/. When upgrading the level of Tails by Typus, players will receive rewards from the platform's Dice game profits. The higher the level, the greater the profit.

Besides, holders of this NFT will have the opportunity to receive TYPUS token rewards and airdrops from partner projects. In the future, users can have more games with these NFTs, such as collecting more TEXPs to play minigames, merging 2 NFTs to create higher level NFTs, or trading on the market to get more TEXPs. …

Overall, Tails by Typus NFT is one of the important products that helps Typus Finance build a community and launch many good campaigns for users.

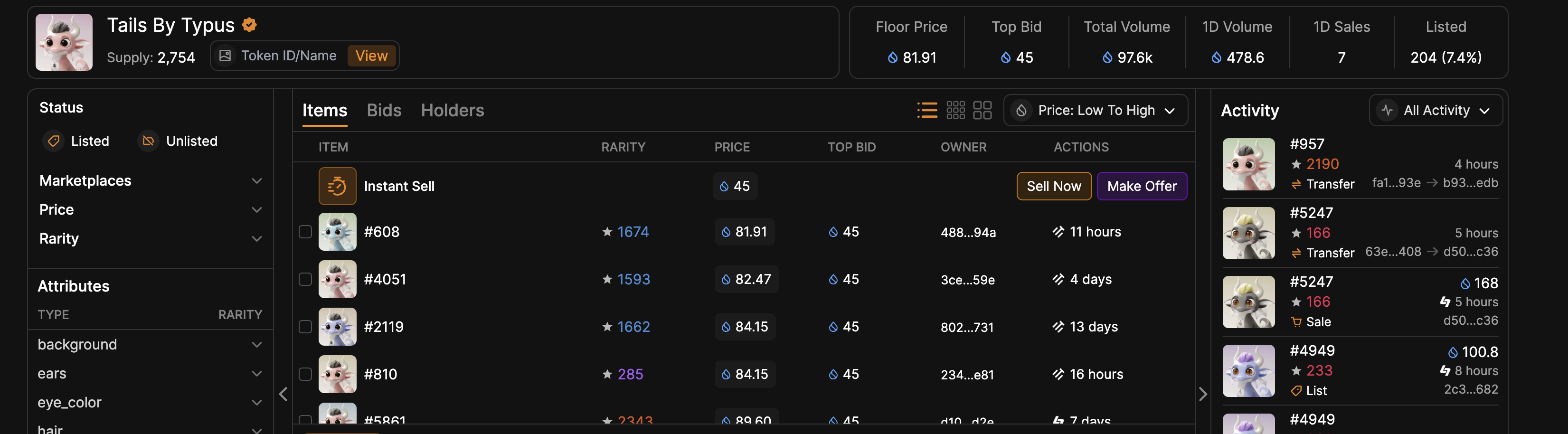

Currently, Tails by Typus NFT is being traded at the floor price of 82 SUI on the Tradeport market.

Tails by Typus NFT on Tradeport

4. Partnership

Typus Finance cooperates directly with many strong partners in the Sui ecosystem such as MystenLabs, OtterSec (for audit), MoveBit, Hyperithm, Studio Mirai, Ethos Wallet...

Typus Finance partnership

5. Project information

Website: https://typus.finance

Twitter: https://twitter.com/TypusFinance

6. Conclusion

Typus Finance is an important DeFi piece in the Sui Network ecosystem. To date, the project has attracted nearly $70 million in TVL with thousands of active users. Typus Finance is expected to grow even stronger in the near future. Follow Theblock101 to update more information about the project.

Tiếng Việt

Tiếng Việt

.jpg)

.jpg)

.jpg)

.jpg)