%20(20).png)

1. Understanding Crypto Arbitrage

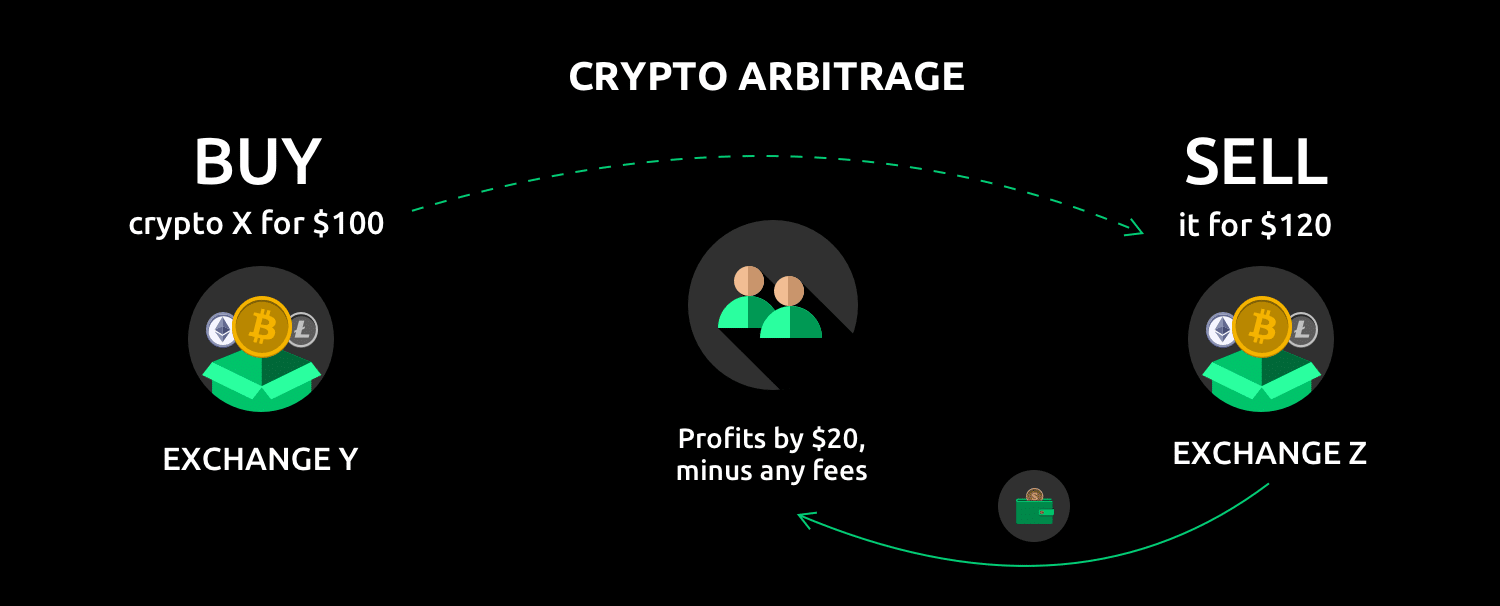

Arbitrage involves buying a cryptocurrency at a lower price on one exchange and selling it at a higher price on another, profiting from the price differential. Common types include:

-

Spatial Arbitrage: Exploiting price differences between exchanges.

-

Triangular Arbitrage: Trading between three currencies within a single exchange to profit from price inefficiencies.

-

Cross-Chain Arbitrage: Taking advantage of price discrepancies across different blockchains.

-

DeFi Arbitrage: Utilizing decentralized protocols for yield farming or liquidity pool inefficiencies.

The new strategy combines elements of spatial, cross-chain, and DeFi arbitrage, enhanced by automation for efficiency.

2. The New Crypto Arbitrage Strategy: Hybrid Automated Arbitrage (HAA)

2.1. Overview

The Hybrid Automated Arbitrage (HAA) strategy integrates spatial arbitrage across centralized exchanges (CEXs), cross-chain arbitrage on decentralized exchanges (DEXs), and DeFi yield optimization. It uses automated trading bots to detect and execute trades in real-time, minimizing latency and human error.

2.2. Key Components

-

Multi-Exchange Monitoring:

-

Cross-Chain Bridging:

-

Leverage cross-chain bridges (e.g., Wormhole, LayerZero) to move assets between blockchains like Ethereum, Solana, and Binance Smart Chain.

-

Identify price discrepancies for wrapped assets (e.g., wBTC on Ethereum vs. wBTC on Solana).

-

-

DeFi Yield Optimization:

-

Use DeFi protocols like Aave, Curve, or Balancer to exploit inefficiencies in liquidity pools or lending rates.

-

Combine arbitrage profits with yield farming to enhance returns.

-

-

Automation with Trading Bots:

-

Deploy a custom-built or pre-existing arbitrage bot (e.g., Hummingbot, Arbismart) to monitor price differences and execute trades.

-

Configure bots to account for transaction fees, gas costs, and slippage to ensure profitability.

-

2.3. Step-by-Step Implementation

-

Setup and Tools:

-

API Integration: Obtain API keys from target exchanges and connect them to your arbitrage bot.

-

Wallet Setup: Use a multi-chain wallet (e.g., MetaMask, Trust Wallet) to manage assets across blockchains.

-

Bot Configuration: Set thresholds for minimum profit margins (e.g., 0.5% after fees) and maximum trade size to manage risk.

-

-

Opportunity Identification:

-

Monitor price feeds for assets like ETH/USDT across CEXs and DEXs.

-

Check cross-chain price differences, e.g., SOL on Solana vs. wrapped SOL on Ethereum.

-

Analyze DeFi pools for arbitrage opportunities, such as mispriced stablecoin pairs in Curve Finance.

-

-

Execution:

-

When a price discrepancy is detected (e.g., BTC at $60,000 on Exchange A and $60,500 on Exchange B), the bot buys on Exchange A and sells on Exchange B.

-

For cross-chain arbitrage, bridge assets to the higher-priced chain and sell.

-

For DeFi arbitrage, swap tokens in mispriced pools or deposit into high-yield lending protocols.

-

-

Risk Management:

-

Account for transaction fees, network gas costs, and exchange withdrawal fees.

-

Use stop-loss mechanisms to limit losses from sudden market movements.

-

Diversify trades across multiple assets and exchanges to reduce exposure.

-

2.4. Example Scenario

-

Spatial Arbitrage: ETH is trading at $3,000 on Binance and $3,050 on Kraken. The bot buys 1 ETH on Binance and sells it on Kraken, netting $50 minus fees ($10), for a $40 profit.

-

Cross-Chain Arbitrage: wETH on Ethereum is $3,020, while wETH on Polygon is $3,080. The bot bridges 1 ETH from Ethereum to Polygon (bridge fee: $5) and sells, earning $60 minus fees ($15), for a $45 profit.

-

DeFi Arbitrage: A USDT/USDC pool on Uniswap has a temporary imbalance, allowing a swap of 1,000 USDT for 1,010 USDC. The bot swaps and converts back on another DEX, earning $10 minus gas fees ($3), for a $7 profit.

2.5. Tools and Platforms

-

Exchanges: Binance, Coinbase, Kraken, Uniswap, SushiSwap.

-

Cross-Chain Bridges: Wormhole, LayerZero, Polygon Bridge.

-

DeFi Protocols: Aave, Curve, Balancer.

-

Trading Bots: Hummingbot, 3Commas, custom Python scripts using CCXT library.

-

Price Aggregators: CoinGecko, CoinMarketCap for real-time data.

3. Conclusion

The Hybrid Automated Arbitrage (HAA) strategy offers a robust approach to crypto arbitrage in 2025, capitalizing on the inefficiencies of fragmented markets. By combining spatial, cross-chain, and DeFi arbitrage with automation, traders can achieve consistent profits while managing risks. However, success requires careful setup, continuous monitoring, and adaptation to market conditions. Start small, test your bot thoroughly, and scale gradually to optimize performance.

Read more:

Tiếng Việt

Tiếng Việt