1. What is a Bonding Curve?

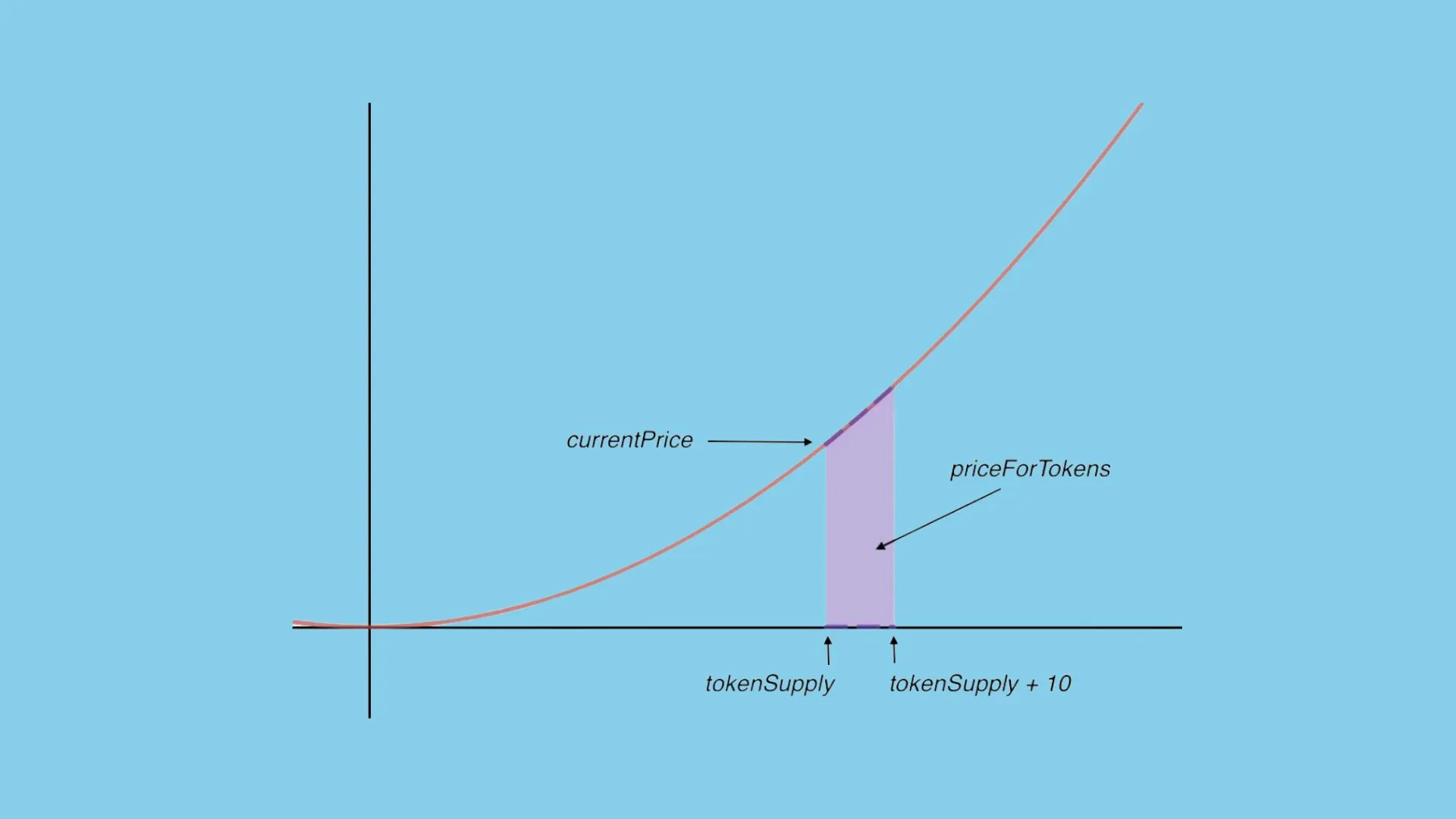

A bonding curve is a mathematical function that defines the relationship between a token's price and its supply. In traditional markets, prices are often determined by supply and demand dynamics in order books. However, bonding curves provide a programmatic, transparent, and automated way to price tokens based on their circulating supply. As more tokens are purchased, the price increases, and as tokens are sold, the price decreases, following a predefined curve.

In the case of Pump Fun, the bonding curve is used to create a predictable and fair pricing mechanism for newly launched tokens, ensuring that early adopters and later investors interact with the token in a structured way.

2. How Does the Pump Fun Bonding Curve Work?

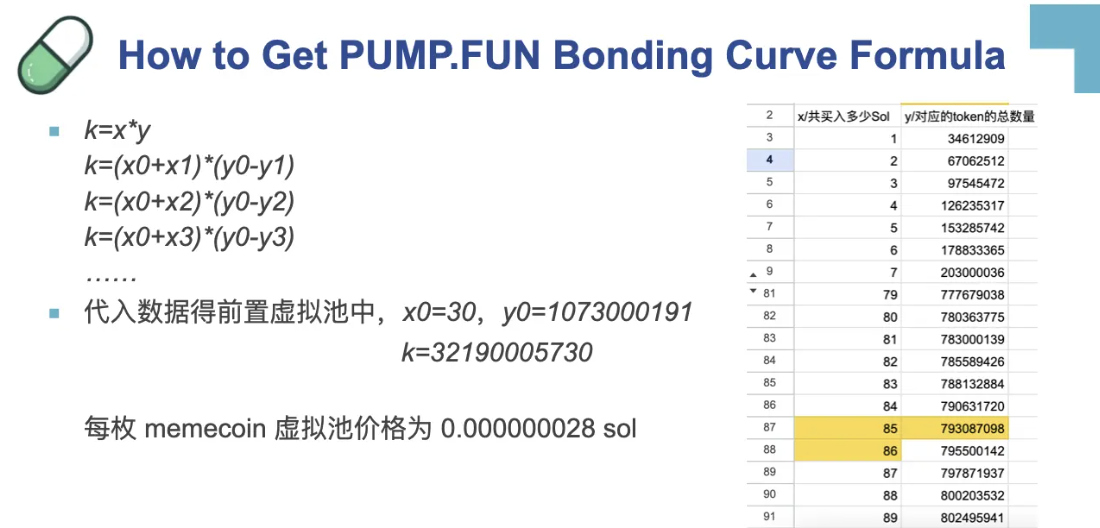

Pump Fun's bonding curve is typically implemented as a smart contract that controls the minting and burning of tokens Danh sách tokens:

-

Token Creation: When a new token is launched on Pump Fun, the bonding curve determines the initial price and supply. The curve is often a linear or exponential function, meaning the price of the token increases as more tokens are minted.

-

Buying Tokens: Users can buy tokens by sending cryptocurrency (e.g., SOL on Solana) to the bonding curve contract. The contract mints new tokens and delivers them to the buyer at a price determined by the current point on the curve. As more tokens are minted, the supply increases, pushing the price higher along the curve.

-

Selling Tokens: Users can also sell tokens back to the bonding curve contract. The contract burns the tokens (removing them from circulation), and the user receives cryptocurrency based on the current price on the curve, which is lower as the supply decreases.

-

Curve Completion: Pump Fun often sets a milestone where, once a certain amount of liquidity or token purchases is reached, the token migrates to a decentralized exchange (DEX) like Raydium, and the bonding curve is no longer used for pricing. At this point, the token transitions to traditional market-driven pricing.

3. Types of Bonding Curves

%20(2).png)

Bonding curves can take various shapes, but Pump Fun commonly uses:

-

Linear Bonding Curve: The price increases linearly with the token supply.

-

Sigmoid or Exponential Curve: The price increases gradually at first, then more steeply as supply grows, incentivizing early adoption.

The choice of curve affects how quickly the price rises and can influence investor behavior, balancing accessibility for early buyers with potential rewards for taking early risks.

4. Advantages of the Pump Fun Bonding Curve

-

Transparency: The pricing mechanism is fully transparent and coded into the smart contract, reducing reliance on intermediaries.

-

Fairness: Early adopters are rewarded with lower prices, while later buyers pay more, creating an incentive for early participation.

-

Liquidity: The bonding curve ensures there is always liquidity for buying and selling tokens, as the contract acts as a counterparty.

-

Decentralized: The entire process is managed by smart contracts, aligning with the ethos of DeFi.

5. Challenges and Risks

-

Speculative Bubbles: Rapid buying can lead to price spikes, attracting speculative investors and potentially leading to volatility.

-

Rug Pulls: Some projects on Pump Fun have been criticized as "rug pulls," where developers abandon the project after raising funds. Investors must research the credibility of projects.

-

Market Manipulation: Whales (large investors) can influence the curve by buying or selling in large volumes, impacting smaller investors.

6. Why It Matters

The Pump Fun bonding curve democratizes token launches by allowing anyone to create and trade tokens in a decentralized manner. It provides a predictable pricing model, encourages early investment, and ensures liquidity. However, it also requires users to approach investments cautiously, as the ease of token creation can attract both legitimate projects and scams.

7. Conclusion

The Pump Fun bonding curve is a powerful tool in the DeFi ecosystem, offering a structured and transparent way to launch and trade tokens. By understanding its mechanics, investors can make informed decisions, balancing the opportunities of early participation with the risks of volatility and project credibility. As DeFi continues to evolve, mechanisms like the bonding curve highlight the innovative potential of blockchain technology in reshaping financial systems.

Read more:

Tiếng Việt

Tiếng Việt