1. What is Total Value Locked (TVL)?

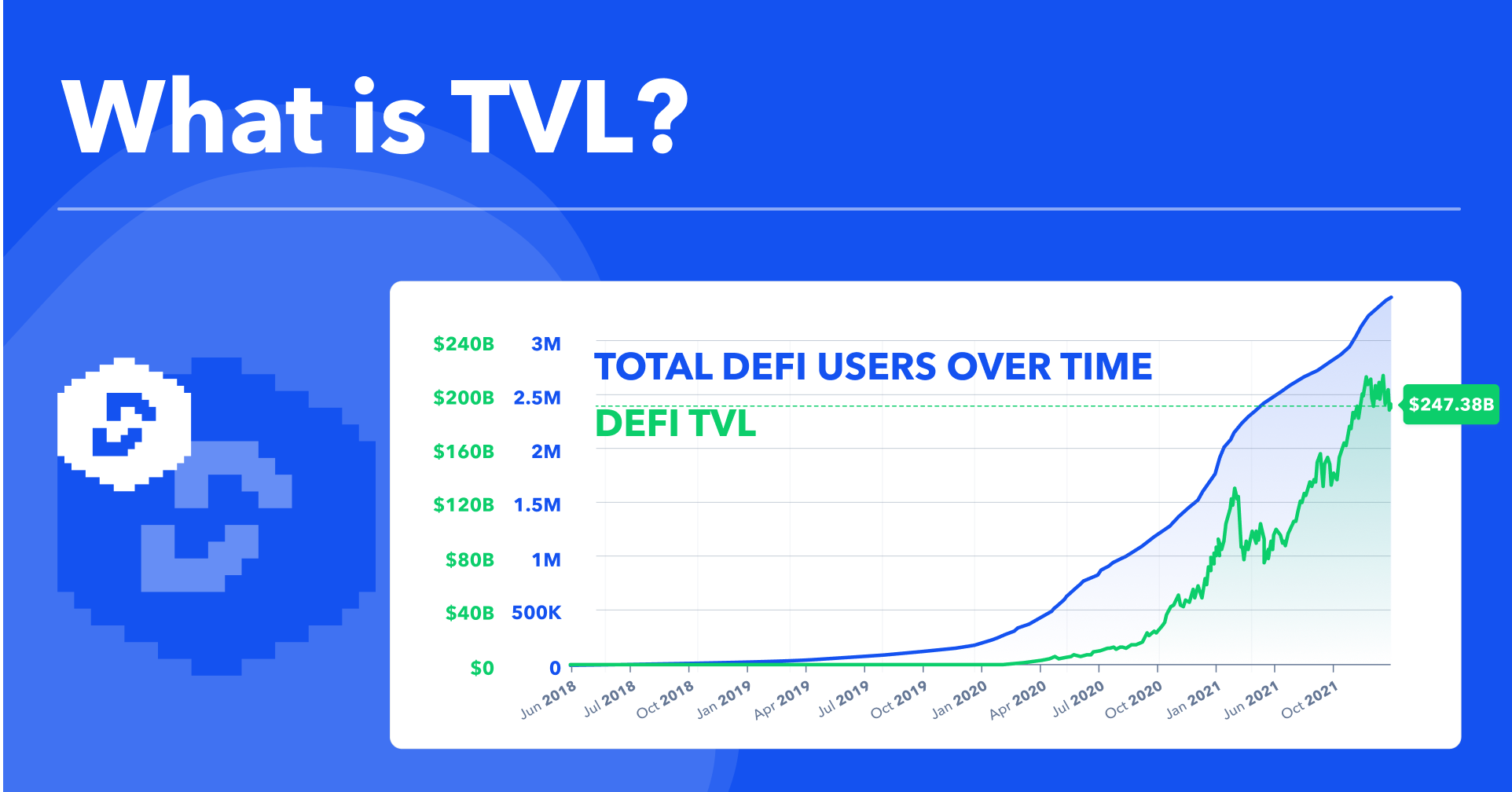

Total Value Locked (TVL) represents the total value of assets held or "locked" within a particular DeFi protocol or the entire DeFi ecosystem. It is an important metric because it reflects how much capital is being used in decentralized finance activities such as lending, borrowing, staking, and liquidity provision. TVL is generally expressed in U.S. dollars or another fiat currency, and it helps to give an indication of the size and popularity of a specific DeFi project or the market as a whole.

The higher the TVL in a DeFi protocol, the more capital is being utilized, suggesting greater trust and adoption of the platform by users. TVL also acts as a gauge for liquidity, which is crucial for the smooth operation of decentralized finance services.

2. How is TVL Calculated?

The calculation of TVL is relatively straightforward. TVL is determined by adding up the value of all assets that are locked in the platform’s smart contracts. These assets can include cryptocurrencies, stablecoins, or tokens that are deposited by users into various DeFi products like lending platforms, decentralized exchanges (DEXs), yield farming pools, and liquidity pools.

DeFi platforms can potentially provide their own data for investors to calculate their TVL. For example, if a DeFi platform said it had $1 billion worth of ether, $1 billion worth of bitcoin, and $500 million of tether locked, that would mean it has $2.5 billion of digital assets in TVL.

For example, if users have deposited 1,000 ETH into a liquidity pool, and the current price of ETH is $2,000, then the TVL from that pool would be $2,000,000 (1,000 ETH * $2,000).

TVL can fluctuate due to changes in the value of the assets locked (i.e., due to changes in cryptocurrency prices) or because of the addition or removal of assets by users.

3. Why is TVL Important in DeFi?

TVL serves as a critical indicator for evaluating the success and sustainability of DeFi protocols. Here are a few reasons why TVL is so important in the DeFi space:

-

Market Liquidity: TVL is a direct measure of liquidity in a DeFi protocol. Higher TVL generally means that more liquidity is available for users to borrow, lend, trade, and earn rewards. Liquidity is one of the most important factors that DeFi projects need to maintain in order to be competitive and functional.

-

Adoption and Trust: TVL is often seen as a reflection of the protocol’s adoption by users. A growing TVL can indicate that more people are trusting the platform with their assets, which can contribute to the protocol's reputation in the market.

-

Revenue and Fees: For DeFi projects that operate on a fee-sharing model, a higher TVL can directly impact the revenue generation of the protocol. A larger pool of locked assets can result in higher transaction volumes, which, in turn, can generate more fees for the platform and its users.

-

Security and Stability: A higher TVL can also signal more robust security for a platform. DeFi projects that attract a significant amount of capital are typically under closer scrutiny and are more likely to have passed rigorous security audits to safeguard users' funds.

4. How does TVL affect Yield Farming and Staking?

TVL plays a pivotal role in determining the yield or interest rate offered by DeFi protocols in yield farming and staking operations. In yield farming, users provide liquidity to various pools in exchange for rewards, often paid in tokens. The amount of rewards earned is frequently tied to the amount of capital a user has contributed to the pool, and the total TVL in the pool.

-

Yield Farming: If a DeFi protocol’s TVL increases, it can lead to higher liquidity in yield farming pools, which may lead to more competitive yields. On the other hand, if the TVL decreases, the yields may become less attractive, as there may be fewer assets to generate profits.

-

Staking: In staking, users lock their cryptocurrency to support a blockchain network’s operations. The TVL of the staking platform can indicate how much capital is locked up, which in turn can give potential stakers an idea of the rewards they can expect. A larger TVL could result in more stable staking rewards due to a larger pool of assets being utilized to secure the network.

5. TVL vs. Market Capitalization

While both TVL and market capitalization are indicators of a platform's size or value, they measure different things. Market capitalization is calculated by multiplying the current price of the platform's native token by the total circulating supply. In contrast, TVL measures the total value of assets locked within the protocol itself, regardless of the price of the native token.

For example:

-

A DeFi project might have a high market cap due to the value of its token, but the TVL might be low if only a small amount of the token is actually being used in its protocols.

-

Conversely, a project with a lower market cap might have a higher TVL if its protocol is actively used by a large number of people, contributing to the total value locked.

While TVL is a better indicator of active participation in DeFi platforms, market cap gives more insight into the overall market value of the project.

6. Risks and Challenges related to TVL

.jpg)

While TVL is a key metric, it is not without its limitations and potential risks:

-

Price Volatility: Since TVL is calculated based on the current market value of locked assets, it can be affected by the volatility of the underlying cryptocurrencies. A drastic drop in the price of a major asset can cause a significant reduction in TVL, even if the amount of locked capital remains the same.

-

DeFi Protocol Vulnerabilities: DeFi protocols are vulnerable to hacks, smart contract bugs, and exploits. Even with high TVL, if a protocol is not secure, the funds locked in the system may be at risk of being stolen or lost. This can cause a sudden and dramatic decline in TVL.

-

Market Trends and User Behavior: The total value locked can also be influenced by changing trends in the market, such as the rise or fall of certain DeFi sectors (e.g., lending, yield farming, decentralized exchanges). If users shift their capital to other protocols or products, it can reduce the TVL of a particular platform.

7. Tracking TVL Across the DeFi Ecosystem

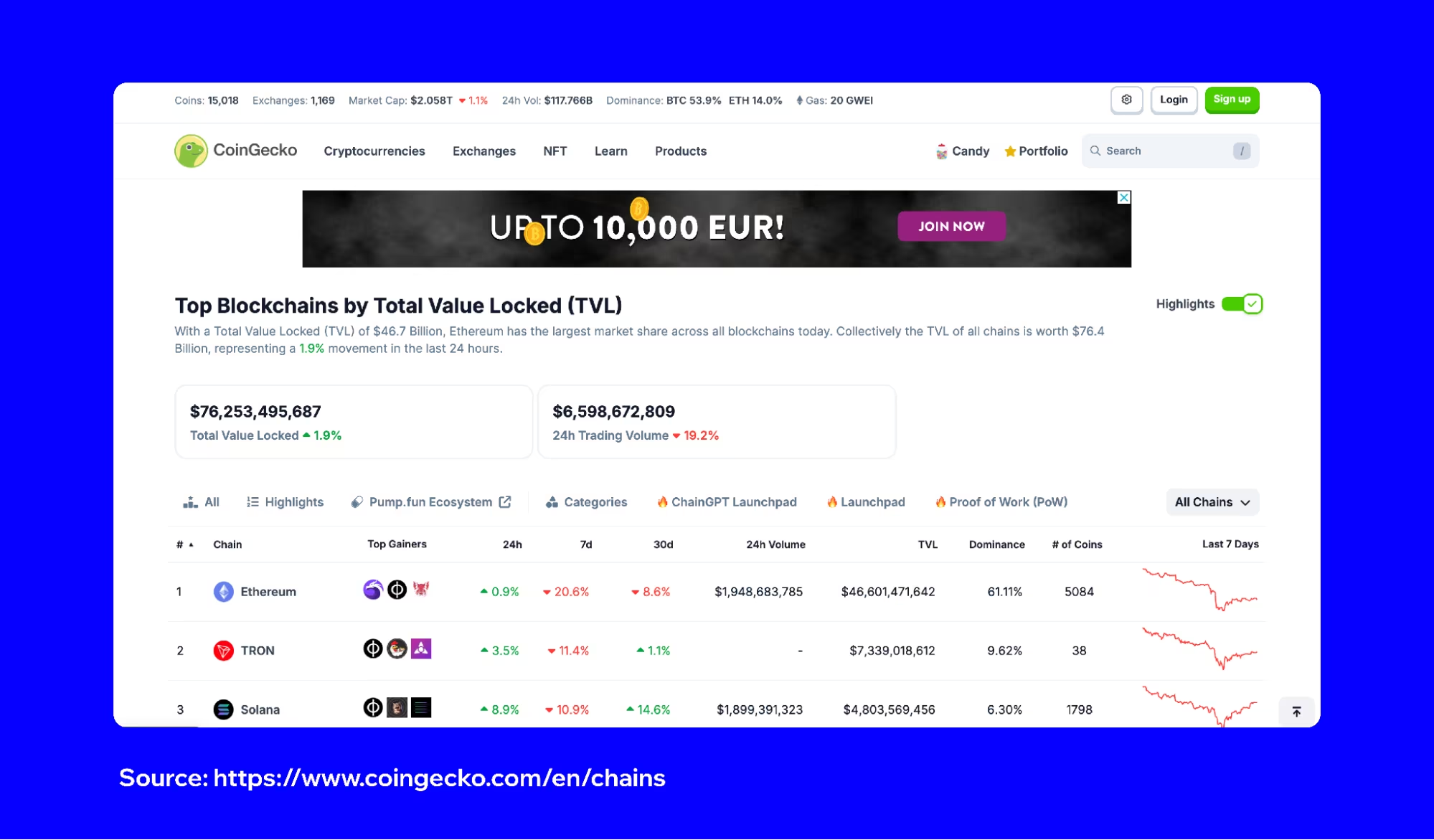

There are several platforms and websites that track and report TVL across the DeFi ecosystem, allowing users to monitor trends, assess the performance of different protocols, and make informed investment decisions. Some popular TVL tracking platforms include:

-

DeFiLlama: A comprehensive website for tracking the TVL of various DeFi protocols, offering a detailed breakdown of individual platforms and their respective TVLs.

-

DeFi Pulse: Another popular platform for tracking the overall TVL of DeFi protocols and analyzing trends in the ecosystem.

-

CoinGecko: Known for providing general cryptocurrency data, CoinGecko also offers detailed information on DeFi TVL across multiple platforms.

8. Conclusion

Total Value Locked (TVL) is a crucial metric for assessing the size, health, and activity of the DeFi space. It provides valuable insights into liquidity, adoption, and market trust in various DeFi protocols. However, while TVL is an important indicator, it should not be viewed in isolation. It is essential for investors and users to consider other factors such as platform security, yield opportunities, and market conditions when evaluating DeFi projects.

By keeping track of TVL and other relevant metrics, users can better navigate the DeFi landscape, optimize their strategies, and make informed decisions about where to invest their capital.

Read more:

English

English Tiếng Việt

Tiếng Việt.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)