1. What does total value locked (TVL) mean?

TVL represents the total U.S. dollar value of all digital assets locked in DeFi protocols, encompassing cryptocurrencies, stablecoins, and liquidity tokens. These assets are staked or deposited into lending platforms, liquidity pools, or other smart contract-based services.

-

TVL in Staking:

This metric highlights the amount of assets deposited by liquidity providers into DeFi staking protocols. It offers insights into the reward potential of staking platforms, making it especially useful for investors seeking platforms with the highest yields. -

Importance to Investors:

In addition to traditional metrics like market capitalization, trading volume, and circulating supply, TVL helps investors assess the economic activity and trust in a DeFi project. It is a powerful indicator of liquidity, usability, and the attractiveness of a protocol or the DeFi ecosystem as a whole.

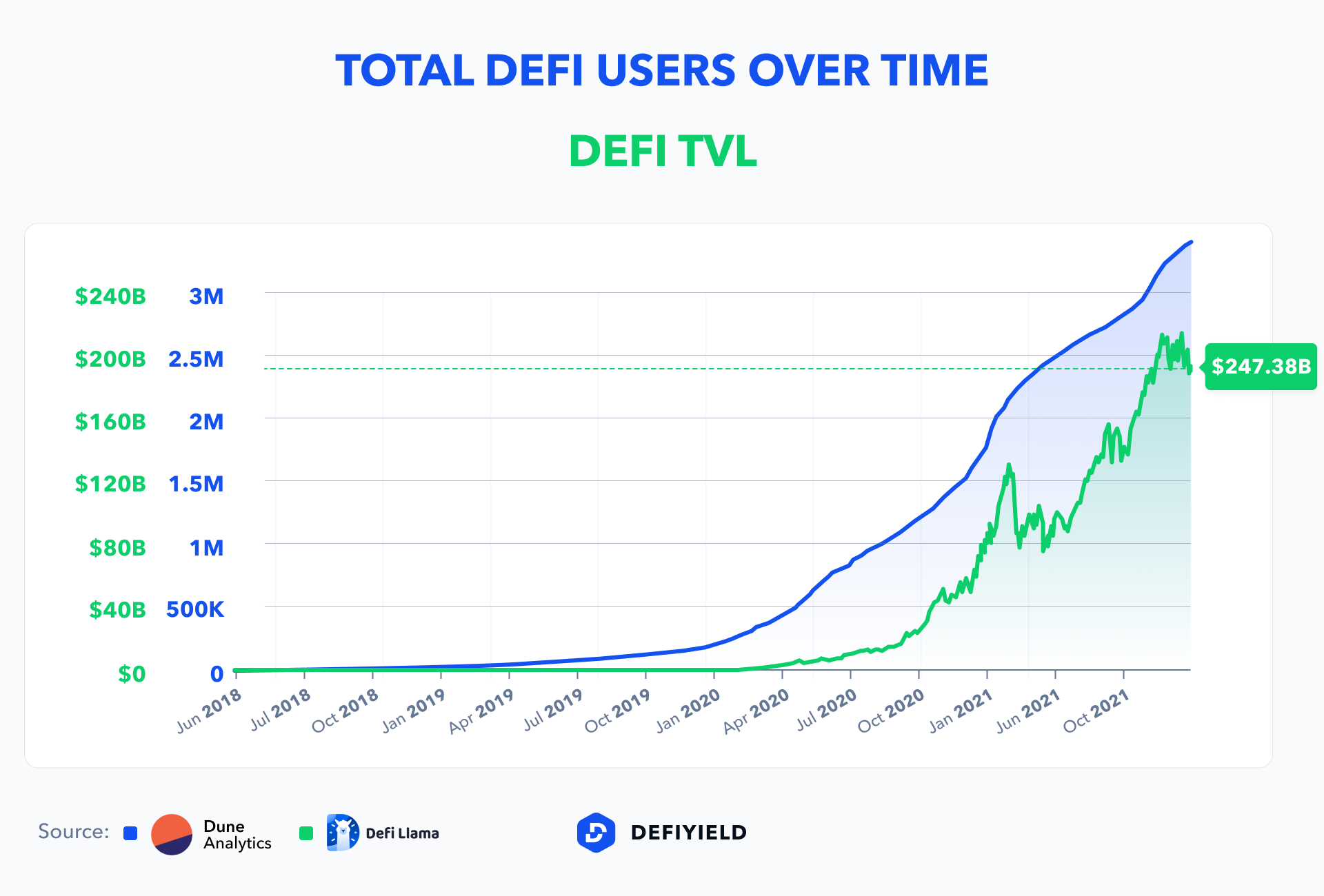

2. TVL Growth in DeFi

The rise of DeFi from 2020 onwards fueled exponential growth in TVL:

-

2020-2021 DeFi Boom: At the start of 2020, the combined TVL across DeFi platforms was approximately $630 million. By the end of 2021, this figure had skyrocketed to over $172 billion, reflecting the rapid adoption of DeFi solutions.

-

2022 Milestones: In 2022, global TVL reached nearly $2 billion, up from $400 million just two years earlier. Popular platforms such as MakerDAO, Curve, and Aave accounted for significant portions of this growth.

-

Leading Platforms and Networks: Curve holds the largest TVL share among individual protocols, commanding 9.7% of the market with $17 billion in TVL, followed by Lido ($15.4 billion), Anchor ($12.6 billion), and MakerDAO ($11.5 billion). Ethereum, with its robust ecosystem of nearly 500 protocols, remains the dominant network, accounting for approximately 64% of global DeFi TVL.

3. How Is TVL Calculated?

TVL calculations involve summing the current value of all assets locked within a protocol or blockchain.

Factors Affecting TVL:

-

Deposits and Withdrawals:

TVL changes with user activity, such as staking or withdrawing assets. -

Value of Native Tokens:

For platforms where deposits are made in native tokens, the TVL fluctuates with the token's price. For example, a rise in Ethereum (ETH) prices boosts the TVL of protocols reliant on ETH as collateral.

TVL Formula and Ratio:

To calculate TVL, multiply the total supply of locked tokens by their current market value.

The TVL ratio, derived by dividing a project’s market capitalization by its TVL, helps assess whether a DeFi asset is undervalued or overvalued.

The formula for calculating the TVL ratio is:

TVL Ratio = Market Cap / Total Value Locked

-

A ratio below 1: Indicates that the asset is undervalued, potentially making it an attractive investment opportunity.

-

A ratio above 1: Suggests the asset might be overvalued, leaving limited room for growth.

4. Why Does TVL Matter in DeFi?

For DeFi platforms to operate effectively, they require users to deposit assets as collateral or liquidity. TVL serves as a direct measure of a platform’s ability to attract and retain capital.

-

Liquidity and Usability:

Higher TVL equates to increased liquidity, which enhances the platform’s functionality for traders and investors. Conversely, a low TVL limits a platform’s ability to generate yields and may indicate reduced trust. -

Market Sentiment:

Rising TVL reflects growing investor confidence in a project, while declining TVL signals reduced engagement or concerns about platform stability.

5. TVL Limitations and Risks

While TVL is a valuable metric, it is not without flaws:

-

Market Volatility:

TVL can increase or decrease due to price fluctuations of the underlying tokens, even if no new capital enters or leaves the protocol. For instance, an ETH price surge could inflate Ethereum-based TVL metrics. -

Double Counting:

In DeFi, assets often move between platforms, leading to potential overestimation of liquidity. For example, a single ETH token used in multiple protocols might be counted multiple times in aggregated TVL metrics. -

Scams and Unsustainable Projects:

Platforms offering unrealistically high yields with low TVL may be engaging in promotional schemes or fraudulent activities. Investors should approach such projects with caution.

6. Monitoring TVL using analytics platforms

Several platforms offer comprehensive TVL data to help investors monitor DeFi activity:

-

DeFi Pulse: Tracks TVL movements of Ethereum-based protocols.

-

DefiLlama: Provides aggregated TVL data across multiple blockchains, enabling comparisons between networks and individual platforms.

Conclusion

Total Value Locked (TVL) offers a robust framework for assessing the success and reliability of DeFi platforms. By understanding its components, limitations, and applications, investors can leverage TVL as a powerful tool to navigate the rapidly evolving crypto landscape. While TVL growth is a positive sign for the market, it should be evaluated alongside other metrics to form a comprehensive investment strategy.

Read more:

English

English Tiếng Việt

Tiếng Việt.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)