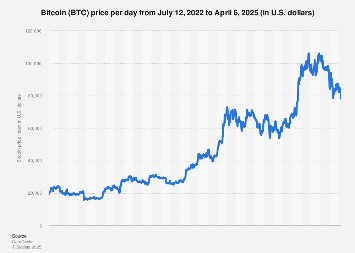

1. The current state of Bitcoin’s price

On April 3, 2025, Bitcoin’s price is approximately $83,212, according to CoinGecko, with minor differences across exchanges—$82,947 on Coinbase and $83,254 on Binance. Over the past 24 hours, it has dipped by 2.2%, yet it shows a 4.3% gain over the last seven days. This short-term turbulence is typical for Bitcoin, which boasts a market capitalization of $1.65 trillion and a 24-hour trading volume of $46 billion, per CoinGecko. With 19.85 million of its 21 million total coins in circulation, Bitcoin maintains its dominance in the crypto market.

Recent price movements follow a strong 2024, when Bitcoin briefly exceeded $100,000 in late December, as reported by Reuters. The current dip reflects profit-taking and broader economic uncertainties, yet its 27% year-over-year increase signals a sustained upward trend, according to CoinMarketCap.

2. Factors influencing Bitcoin’s price

Bitcoin’s price is driven by a multifaceted mix of forces. Institutional investment stands out as a major catalyst in 2025. The U.S. approval of spot Bitcoin ETFs has unleashed significant capital inflows, with The Block reporting 10 consecutive days of net inflows totaling $1.06 billion through late March. Companies like MicroStrategy, holding nearly 500,000 BTC, and GameStop, which recently adopted Bitcoin for its treasury, reinforce this trend, per Cointelegraph.

Regulatory shifts are equally influential. President Donald Trump’s proposal for a U.S. strategic Bitcoin reserve has sparked optimism, driving a price surge in early 2025, though fears of global trade tensions—like tariff disputes—temper gains, as noted by Reuters. Macroeconomic factors, including inflation and Federal Reserve policies, bolster Bitcoin’s appeal as a hedge against fiat devaluation, a view echoed by Forbes.

Bitcoin’s supply dynamics amplify its price potential. The 2024 halving cut miner rewards to 3.125 BTC per block, slowing new coin issuance and tightening supply amid rising demand, per CoinDesk. Technological advancements, such as the Lightning Network, enhance its utility, while market sentiment—fueled by news and social media—drives short-term swings, evident in reactions to Trump’s crypto stance, according to Bloomberg.

3. Expert predictions for 2025

.png)

Industry experts from reputable firms provide varied forecasts for Bitcoin’s 2025 price. Tom Lee of Fundstrat Global Advisors predicts a $250,000 target by year-end, citing ETF inflows and loose monetary conditions, as reported by CNBC. Bitwise Asset Management aligns with Standard Chartered at $200,000, emphasizing supply scarcity and institutional demand, per Forbes. Matrixport’s Markus Thielen forecasts $160,000, highlighting a stabilizing base of institutional buyers, according to Cointelegraph.

Cathie Wood of Ark Invest offers a long-term vision of $1 million within five years, driven by Bitcoin’s finite supply and reserve asset potential, though not specifically for 2025, as noted by Bloomberg. Peter Brandt, a veteran trader, warns of a possible drop to $78,000 if technical support fails, per FXStreet. Analysts broadly expect a peak between $150,000 and $250,000 by late 2025, contingent on favorable economic conditions, per Reuters.

4. Historical trends and their implications

Bitcoin’s price history reveals a cyclical pattern tied to halving events every four years. Post-halving years—2013, 2017, and 2021—delivered explosive growth: from $12 to $1,042, $650 to $20,000, and $29,000 to $69,000, respectively, per CoinDesk. The 2024 halving pushed Bitcoin past $100,000 in late 2024, and historical trends suggest 2025 could see a peak followed by stabilization, as outlined by Forbes.

Yet, today’s market differs from past cycles. Institutional involvement and regulatory progress in 2024-2025 contrast with earlier retail-driven rallies, per Bloomberg. While past corrections reached 70-80% from peaks, Bitcoin’s long-term rise from pennies to tens of thousands highlights its staying power, according to CoinMarketCap.

5. Risks and challenges ahead

Bitcoin’s 2025 outlook carries notable risks. Regulatory uncertainty persists—while Trump’s administration may favor crypto, global restrictions or delays could stall momentum, as warned by Reuters. Macroeconomic shifts, like persistent inflation or a Fed rate hike, might divert capital to traditional assets, per Forbes. Competition from altcoins and potential network vulnerabilities also linger as concerns, though less pressing, according to CoinDesk.

Volatility remains a core challenge. Sharp drops of 20-40% are expected, as noted by Bloomberg, while Glassnode data, cited by The Block, indicates waning new demand, suggesting the need for fresh catalysts to sustain growth.

6. The Road Ahead for Bitcoin in 2025

Bitcoin’s 2025 price will depend on adoption, policy, and economic trends. Bernstein analysts predict ETF assets could hit $190 billion, potentially pushing prices beyond $200,000 if inflows persist, per CNBC. A U.S. reserve adoption, as proposed by Trump, could further elevate its value, according to Cointelegraph. Technological upgrades and payment system integration may drive organic demand, per Bloomberg.

However, volatility is inevitable. Dips to $80,000 are possible amid trade disputes or market shocks, as cautioned by Reuters. Bitcoin’s dual nature—high reward and high risk—continues to define its appeal, with its transformative role likely enduring regardless of short-term swings.

Conclusion

At $83,000 on April 3, 2025, Bitcoin’s price reflects a saga of innovation, speculation, and endurance. Propelled by institutional support, supply limits, and global shifts, it teeters between opportunity and uncertainty. As 2025 progresses, tracking regulatory changes, economic indicators, and market trends will be crucial for those engaging with this digital pioneer. Bitcoin’s story is ongoing, and 2025 is poised to mark another defining chapter.

Read more:

English

English Tiếng Việt

Tiếng Việt.png)