1. Overview of Bitcoin Physical Coin

Bitcoin, created in 2009 by the pseudonymous Satoshi Nakamoto, is the world’s first cryptocurrency and represents a revolutionary shift in the world of finance. Operating on a decentralized blockchain technology, Bitcoin allows peer-to-peer transactions without relying on traditional intermediaries like banks. Unlike conventional currencies, Bitcoin exists solely in a digital format and has no physical form issued by any central authority or government. However, the concept of the "Bitcoin Physical Coin" emerged as a way to bring the digital asset into the physical world, blending the symbolic nature of traditional money with the digital value of Bitcoin.

2. Understanding Bitcoin Physical Coin

A Bitcoin Physical Coin is not actual Bitcoin in the digital sense; instead, it is a tangible object (usually a metal coin) designed to represent a certain amount of Bitcoin. These physical coins typically feature a private key, which is a cryptographic code that grants the holder access to a specific amount of Bitcoin stored on the blockchain. The private key is often hidden beneath a protective layer such as a hologram or QR code to ensure security.

2.1. Structure of Bitcoin Physical Coin

-

Material: These coins are often made from metals like copper, silver, or even gold to enhance their aesthetic appeal and material value. The choice of material also serves as a way to make the coins more attractive for collectors and as a store of value.

-

Private Key: The most crucial aspect of the Bitcoin Physical Coin is the private key, which links to a Bitcoin address on the blockchain. The private key grants the owner access to the corresponding Bitcoin balance.

-

Public Key: Some physical Bitcoin coins also display the public key, allowing users to verify the amount of Bitcoin stored on the blockchain. However, the primary value lies in the private key, which controls access to the Bitcoin.

-

Design: The design of Bitcoin Physical Coins usually features the iconic "₿" symbol of Bitcoin and may include intricate decorations to make the coins visually appealing. Some designs may also incorporate elements that reflect the history or philosophy behind Bitcoin.

2.2. Differentiating from Digital Bitcoin

Digital Bitcoin exists as data on the blockchain and does not have a physical form. It is an intangible asset that can be transferred, stored, and used electronically. In contrast, Bitcoin Physical Coins combine tangible materials with the digital value represented by the private key they contain. While the coin itself may have some physical value due to the material used (e.g., gold or silver), the true value of the coin comes from the Bitcoin it represents on the blockchain.

3. History and Origins

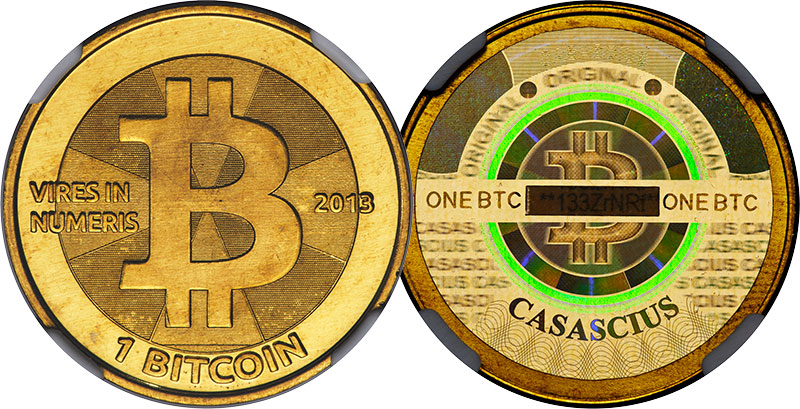

The concept of the Bitcoin Physical Coin first emerged in 2011 when the cryptocurrency community began seeking ways to make Bitcoin more accessible and relatable to the general public. One of the earliest and most well-known examples of a Bitcoin Physical Coin was created by Mike Caldwell, an American programmer. Caldwell's company, Casascius, began minting physical Bitcoins in 2011. These coins ranged in value from 0.1 BTC to 100 BTC and were embedded with a private key protected by a holographic security sticker.

Between 2011 and 2013, the Casascius coins became highly popular, not just as functional tools for Bitcoin transactions, but also as symbolic items representing the intersection of cryptocurrency and traditional money. However, in 2013, Caldwell was forced to halt production due to regulatory concerns in the United States, which classified the issuance of Bitcoin Physical Coins as an unauthorized money transmission activity. Despite this setback, the idea had already inspired other producers around the world to create similar products.

Today, companies such as Denarium, Titan Bitcoin, and BTCC Mint continue to produce physical Bitcoin coins, often with more intricate designs, but they are typically treated as collectibles or symbolic items rather than tools for everyday transactions.

4. Practical Uses of Bitcoin Physical Coins

Despite their limitations compared to digital Bitcoin, Bitcoin Physical Coins have a few practical uses:

4.1. Cold Storage

One of the most significant uses of Bitcoin Physical Coins is as a method of cold storage. By storing the private key offline in a physical coin, users can protect their Bitcoin from cyberattacks and hacking attempts. This method of storage is particularly appealing for individuals looking to safeguard large amounts of Bitcoin over the long term.

4.2. Gifts and Collectibles

Due to their appealing designs and rarity, Bitcoin Physical Coins are often used as gifts or as collectibles. They serve as a way to introduce people to the concept of cryptocurrency, particularly those who are not yet familiar with digital assets. The allure of owning a tangible piece of Bitcoin adds a layer of excitement and curiosity, helping to spread awareness about Bitcoin and blockchain technology.

4.3. Direct Transactions

In rare cases, Bitcoin Physical Coins can be exchanged directly between individuals as a form of physical Bitcoin. The owner of the coin can transfer it to another person, who can then extract the private key and access the Bitcoin stored on the blockchain. However, this method is highly reliant on trust, as there is no immediate way to verify the authenticity of the coin without scanning the private key.

5. Advantages and Disadvantages

5.1. Advantages

-

Security: As a form of cold storage, Bitcoin Physical Coins are immune to online hacks that can affect digital wallets. The private key is stored offline, reducing the risk of cyber threats.

-

Symbolic Value: Physical Bitcoins help bridge the gap between traditional currencies and digital assets. Holding a physical coin can make the concept of cryptocurrency feel more tangible, especially for those new to the space.

-

Collectible Value: Certain physical Bitcoins, such as the Casascius coins, have become highly valuable collectible items. These coins have become sought-after artifacts in the cryptocurrency community, with some selling for many times their original Bitcoin value.

5.2. Disadvantages

-

Risk of Counterfeiting: If the hologram or security features are tampered with, or if the private key is compromised before the coin is sold, the Bitcoin linked to that coin can be stolen. This makes verification of authenticity a critical issue.

-

Low Liquidity: Bitcoin Physical Coins cannot be used in digital transactions without importing the private key into a digital wallet. This limits their utility and makes them less convenient than purely digital Bitcoin.

-

Production Costs: The materials and labor required to create Bitcoin Physical Coins, particularly those made from precious metals, increase the cost of production. This is in contrast to digital Bitcoin, which can be stored for free.

-

Legal Issues: In some jurisdictions, issuing physical Bitcoins may be considered illegal or may fall under regulatory scrutiny. This can make it difficult for producers to sell these items without facing legal challenges.

6. Economic and Social Impacts

6.1. Economic Impact

-

Raising Awareness of Cryptocurrency: Bitcoin Physical Coins act as a bridge between traditional finance and the digital asset world. They serve as an introduction to Bitcoin for those unfamiliar with cryptocurrencies, helping to demystify the concept and increase adoption.

-

Collectibles Market: Rare physical Bitcoins, such as the Casascius coins, have created a secondary market where their value has appreciated significantly. For example, some Casascius coins are now worth tens of thousands of dollars, far surpassing the Bitcoin value they originally held.

-

Impact on the Blockchain: If the private key on a Bitcoin Physical Coin is lost or compromised, the Bitcoin associated with that key is effectively destroyed, reducing the available supply on the blockchain. This could have a long-term effect on the total circulating supply of Bitcoin.

6.2. Social Impact

-

Educational Tool: Bitcoin Physical Coins can be used in educational settings to teach people about Bitcoin, blockchain technology, and the principles of decentralization. They are an effective, hands-on way to engage people with cryptocurrency.

-

Ownership Psychology: Holding a physical object like a Bitcoin coin can create a stronger sense of ownership compared to owning digital Bitcoin, particularly for individuals who are unfamiliar with digital technologies.

-

Legal Controversies: The emergence of physical Bitcoins raises questions about how cryptocurrencies should be regulated in the physical world. Governments and regulatory bodies may need to reconsider how they define "currency" and how digital and physical assets should be treated under the law.

7. Conclusion

Bitcoin Physical Coins are a unique creation that blends the symbolism of traditional currency with the digital value of Bitcoin. While they cannot replace digital Bitcoin for everyday transactions, they play an important role in cold storage, educational outreach, and collectible markets. Despite their advantages, such as security and symbolic value, they face significant challenges, including counterfeiting risks, limited liquidity, and legal issues. As such, Bitcoin Physical Coins are unlikely to become a mainstream method of using Bitcoin, but they serve an important niche in the broader cryptocurrency ecosystem.

Read more:

English

English Tiếng Việt

Tiếng Việt.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)