1. What is Cryptocurrency?

Cryptocurrency (or digital currency) is a type of digital money that is not controlled and issued by a government. Instead, it is typically controlled and issued by its developers and used and accepted among members of a specific virtual community.

Some popular cryptocurrencies include: Bitcoin ($BTC), Ethereum ($ETH), Solona ($SOL)…

2. Risks to know before investing in cryptocurrency

2.1. Market Risks

The cryptocurrency market is highly volatile, with a coin potentially multiplying by 10 overnight, but also capable of losing 100 times its value in just a few hours.

The crypto market always carries significant risks, including scams, so it's essential to be mentally prepared and knowledgeable before participating in it.

2.2. Legal Issues

Currently, there is no clear legal framework to protect investors, so if you are scammed in the crypto market, it can be challenging to seek intervention from authorities.

2.3. Security Risks

This is the risk that most investors in the cryptocurrency market are most concerned about. The majority of individuals who own and use cryptocurrencies store their assets on centralized exchanges.

If you do not follow strict security measures for your account and choose a reputable cryptocurrency exchange, the risk of losing money is very high. Therefore, you need to be cautious when trading cryptocurrencies.

3.Guide to Investing in Cryptocurrency for Beginners

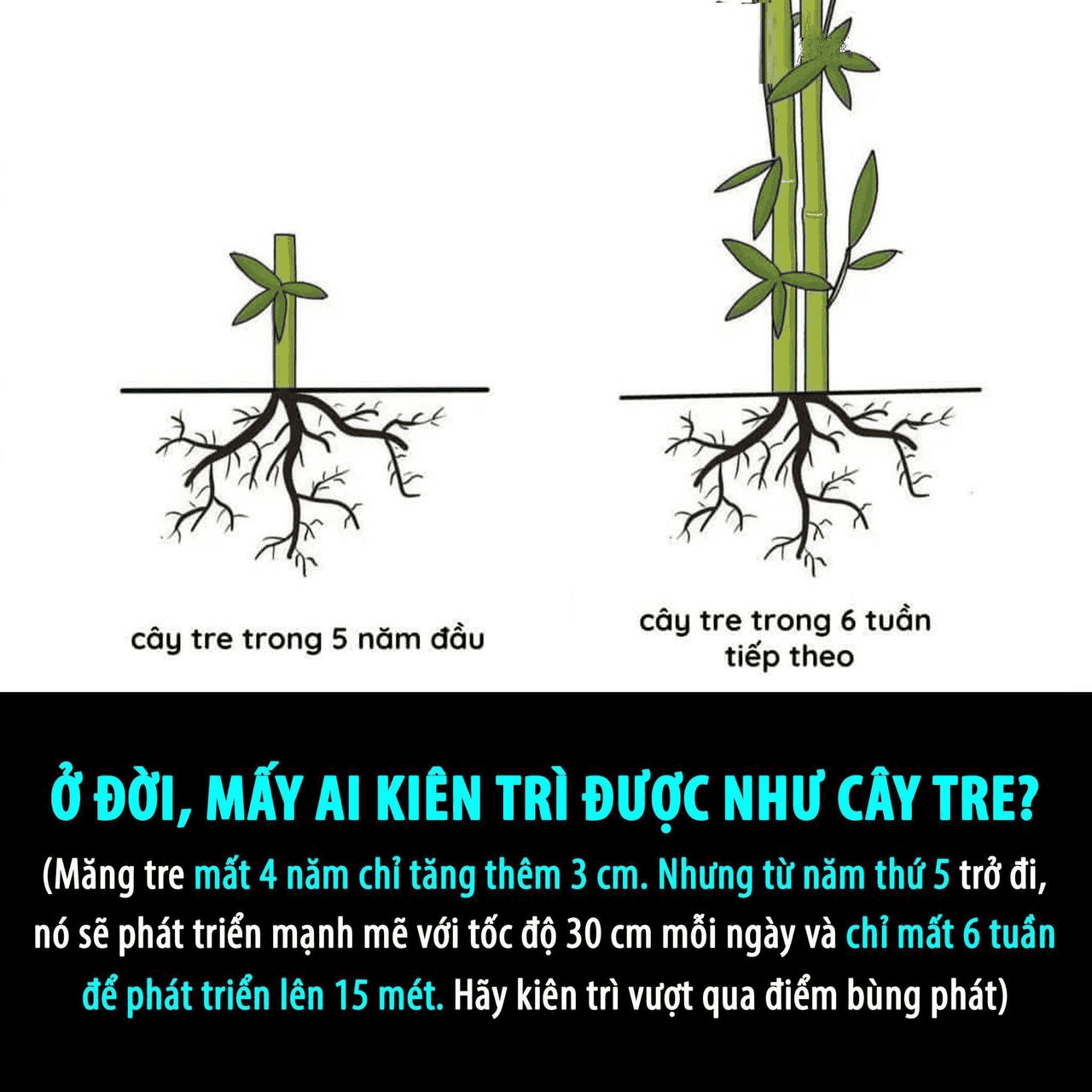

Investing is not simply about picking a stock or a cryptocurrency; it is also about endless self-discovery and decision-making. Sometimes, we encounter market fluctuations and challenges that shake our spirits.

However, what's important is that we never give up, continuously learn, and adjust our strategies.

3.1. Understand the foundational knowledge

There is a paradox where many newcomers enter the cryptocurrency market with the idea of getting rich quick without any knowledge of the market.

They invest their own money but follow the advice of others. When they lose money, they often blame others without reflecting on themselves.

To avoid falling into this trap, Theblock101 advises that before learning how to invest in cryptocurrencies, you should equip yourself with knowledge about the cryptocurrency market.

-

Understanding basic terms in the industry such as stop loss, target, resistance, support, trendline, maximum supply, circulating supply, coin, token, blockchain...

-

Choosing a reputable exchange for trading: An exchange is where you deposit funds and conduct buying and selling of cryptocurrencies. Therefore, selecting a reputable exchange is crucial.

3.2. Learn about market analysis before learning how to invest in cryptocurrencies.

There are 2 basic methods to analyze the market:

- Technical analysis

- Fundamental analysis

There is always debate about which type of analysis is more important, but the truth is that we need to understand all three types."

3.2.1. Technical analysis

Technical analysis involves traders studying price movements. The principle behind this theory is that one can examine past price movements to determine current conditions and potential future fluctuations.

The theoretical reason for using technical analysis in trading is that all market information at the current moment is reflected in the price. If the price reflects all external information, then price action is the only thing we need to trade on.

You may have heard the famous saying, "History tends to repeat itself."

This reflects what technical analysis is about. For example, if a price has historically found support or resistance at a particular level, traders will take note of these points and often place trades based on these historical price levels.

Technical analysis often seeks patterns that have manifested in the past, with the belief that these patterns will react similarly in the present as they have before.

It's important to note that technical analysis is highly subjective, meaning that the same chart can be interpreted differently by different individuals based on their personal perspectives.

What matters is that you grasp the concepts within technical analysis, so you won't be confused when you hear terms like Fibonacci, Bollinger Bands, or Pivot Points.

3.2.2. Fundamental analysis

Fundamental analysis is a method of investing in cryptocurrencies based on analyzing economic, social, and political factors to understand how news will impact the crypto market.

For example, the market may react to announcements such as the Federal Reserve's interest rate hikes.

Fundamental analysis (FA) involves analyzing the fundamental factors of a project, from internal to external factors, assessing how these factors influence the project's value.

While learning technical analysis involves studying price analysis, market price fluctuations, and the laws governing price movements, studying fundamental analysis requires understanding all other factors such as technology, cash flow, team, community, and analyzing how these factors impact the price.

Furthermore, for more advanced analysis, you need to study macroeconomic analysis and on-chain analysis.

3.3. Trading psychology in investing

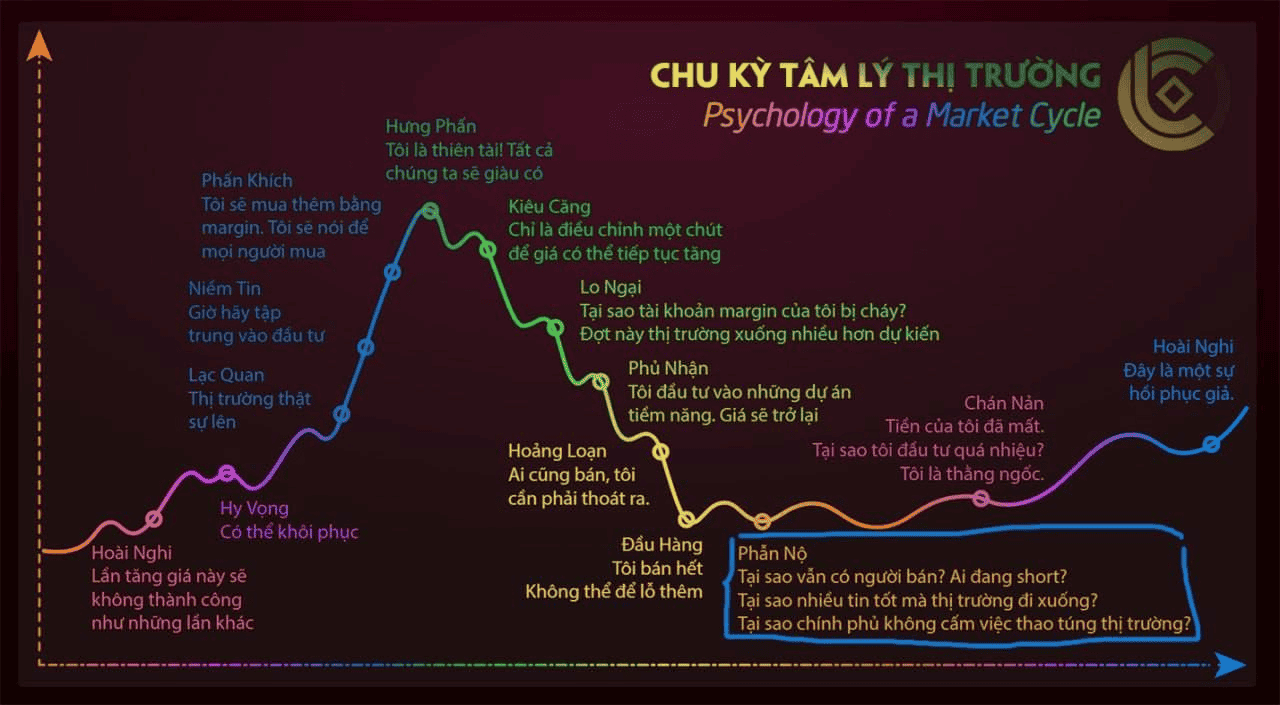

Trading psychology is the emotions and mental state of traders during the process of managing trades in the financial markets. When investing or trading, the psychology and emotions of investors can significantly influence decision-making and trading outcomes.

Each trader has a unique trading psychology, influenced by their emotions and individual experiences. Some emotions that impact trading include: doubt, hope, confidence, fear, greed, and optimism.

Trading psychology is a critical factor in cryptocurrency investment. If not well-controlled, trading psychology can lead to poor decisions and significant financial risks. Therefore, successful investors understand the importance of managing trading psychology and focus on developing their skills and experience accordingly.

3.4. Learn about capital management skills

Capital here refers to the funds you intend to invest in the cryptocurrency market. Capital management involves controlling capital expenditures to make optimal trading decisions for long-term investment plans.

Investors typically manage their capital by dividing their trading accounts, diversifying investment portfolios to control risks, and thereby optimizing profits from each trade.

Never put all your eggs in one basket; diversify your investment portfolio to minimize risk. For example, you can refer to the portfolio below:

- Long-term safe investment (30%): BTC, ETH

- Medium-term investment (20%): Layer 1, LINK, BNB…

- Short-term investment (10%): Meme coin, coin in trend.

- Stablecoin (40%): USDT, USDC, BUSD…

Always keep stablecoins in your investment portfolio for defense. If you need quick access to funds for expenses, you can cash out using stablecoins instead of selling the coins you're currently invested in. Additionally, in case the market experiences a significant downturn, having stablecoins allows you to buy cryptocurrencies at a discounted price.

3.5. Practice trading

Once you have grasped the fundamental knowledge of the cryptocurrency market, understand project analysis, and technical analysis, it's time to apply that knowledge to engage with the market. Start with small trades to gain experience and gradually build an effective trading system for yourself.

3.6. Never stop learning and improving your own knowledge.

The bird perching on a branch never fears the branch breaking, because its trust is not in the branch but in its own wings. The cryptocurrency market is rapidly evolving, with new knowledge emerging each season. To avoid being left behind, maintain a proactive mindset, always learn, and continually enrich your knowledge

Please follow the articles on Theblock101 to stay updated with valuable information about the cryptocurrency market.

4. Conclusion

Above are effective cryptocurrency investment tips for beginners. I hope with this knowledge, readers will find the right direction in their journey to learn how to invest in cryptocurrencies.

Read more:

English

English Tiếng Việt

Tiếng Việt