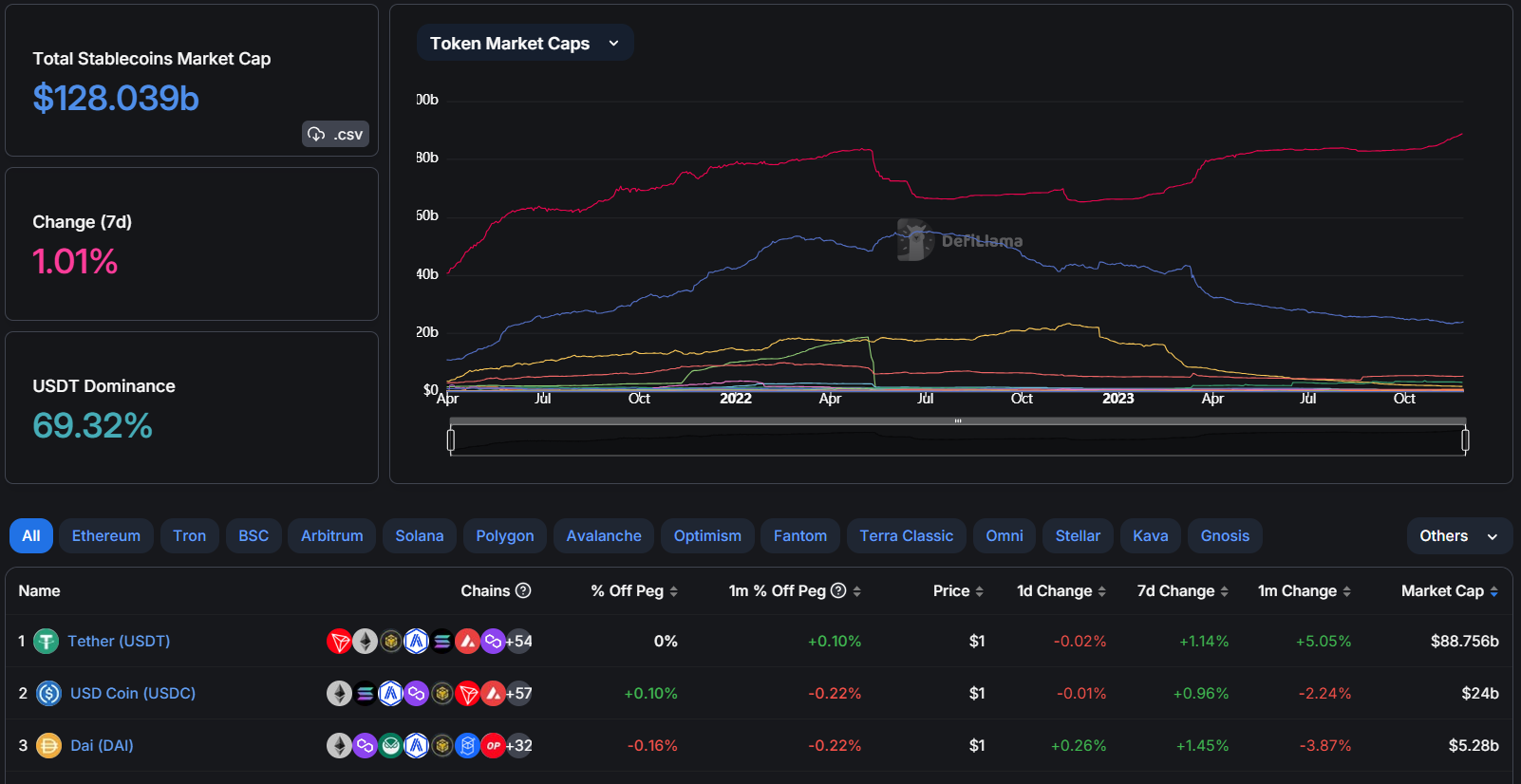

1. Total market capitalization of stablecoins

As of November 22, 2023, the total market capitalization of stablecoin is $128.02 billion. Among these, USDT holds a dominant 69.32% market share, amounting to approximately $88.756 billion. The second positions are occupied by USDC and DAI.

2. Old Stablecoin Models backed by Fiat currency

Two major players in this category are USDC and USDT. The market experienced a significant surge following news that major Wall Street firms had filed for Bitcoin ETFs. This action demonstrates that Wall Street remains interested in crypto and is increasingly integrating into this market. Naturally, stablecoins are one of the gateways that facilitate Wall Street investors' entry into the cryptocurrency market. Since the beginning of the year, the market capitalization of USDT has consistently grown, whereas USDC has seen a slowdown.

USDT and USDC have created a substantial market for investors, allowing them to diversify and rebalance their portfolios. Instead of investing all their deposits in coins/tokens, investors can hold stablecoins, stake them, and earn returns. When profits are needed from coins/tokens, they can rebalance with the desired percentage of stablecoins, thus creating a sustainable investment strategy.

For these two major players, profit is generated from two main sources. Investors use Tether USD or Circle to mint stablecoins by collateralizing fiat money. When investors convert stablecoins back to fiat, they incur a transaction fee, which constitutes the revenue for the stablecoin issuing companies. Additionally, stablecoin companies use their revenue to buy government bonds for additional profit.

For users, stablecoins remain highly demanded trading pairs. Users not only stake and lend stablecoins but also provide liquidity with various tokens to earn additional profits.

Overall, the current stablecoin market is stable and led by USDT and USDC. It is evident that whenever major players like USDT and USDC enter a new ecosystem, they bring substantial capital from their ecosystems, helping to develop new ecosystems. It is unlikely that a fiat-backed stablecoin will displace these two giants in the market.

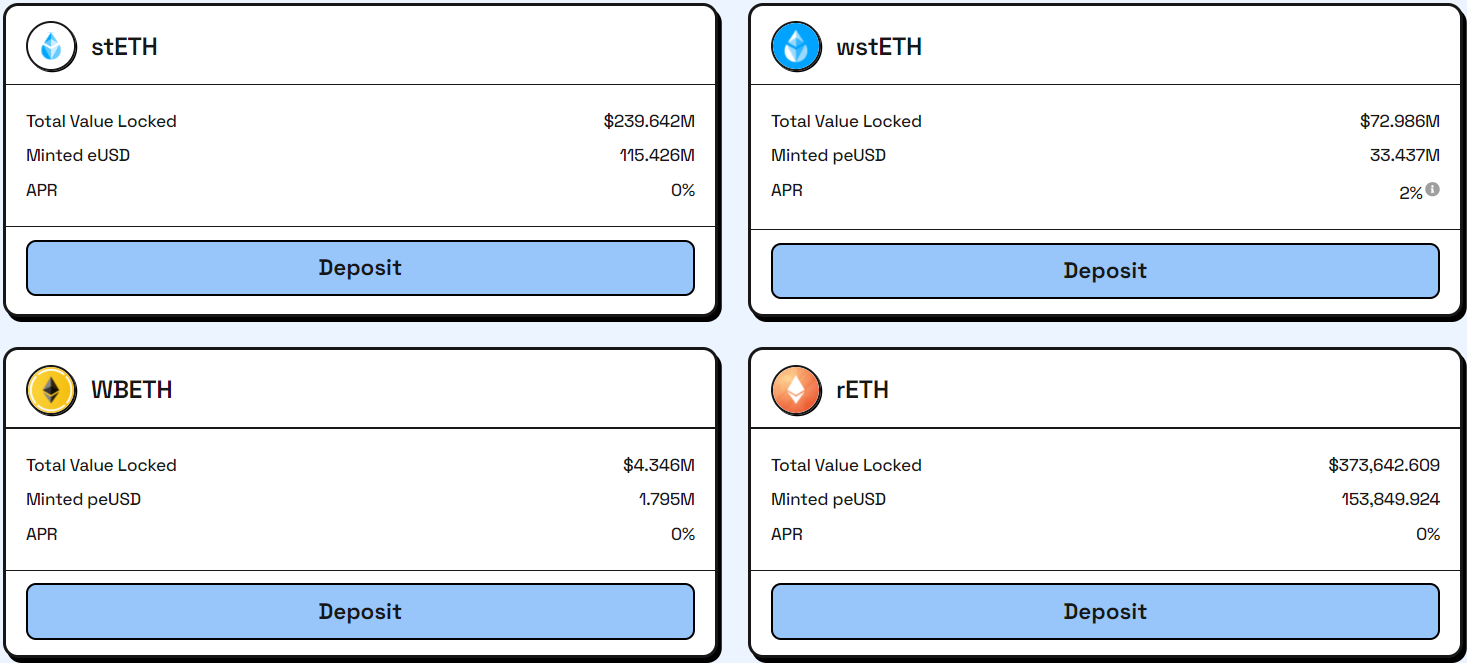

3. Stablecoin Models from LST

The LSD-Fi wave has emerged since the Ethereum Merge update. Leveraging yield from ETH has expanded significantly. Many new CDP protocols allow holders of LST assets to mint different types of stablecoins, thus generating additional profit for ETH holders.

Notable projects include Lybra Finance and Prisma Finance. Lybra and Prisma have seen significant increases in TVL over the past 30 days, at 25% and 375%, respectively (as of November 22, 2023 on Defillama).

- Lybra Finance allows the collateralization of four types of LST: stETH, wstETH, WBETH, and rETH. After collateralization, users can borrow the stablecoin eUSD.

- Prisma Finance supports the collateralization of four types of LST: wstETH, rETH, cbETH, and sfrxETH. After collateralization, users can borrow the stablecoin mkUSD.

![Prisma Finance]()

Prisma Finance

The unique aspect of eUSD and mkUSD compared to fiat-backed stablecoins like USDC and USDT is their focus on optimizing profit. Instead of requiring new capital inflows from outside the market, LST-backed stablecoins leverage existing Ethereum capitalization. This allows Ethereum holders to generate additional profit from their Ether holdings.

eUSD and mkUSD also have supporting ecosystems designed to create additional profit and utility for holders.

Currently, the TVL of the LSD-Fi market stands at 11.7M ETH (~$23.4 billion). The five largest platforms—Lido, Binance, Coinbase, Rocket Pool, and Frax Ether—account for 96.83% of the LST market share, approximately $22.64 billion.

The theoretical market size for LST-backed stablecoins is substantial. We will likely see even larger market sizes as Ethereum and the LSD-Fi sector continue to grow, not only within the Ethereum ecosystem but also across other major ecosystems.

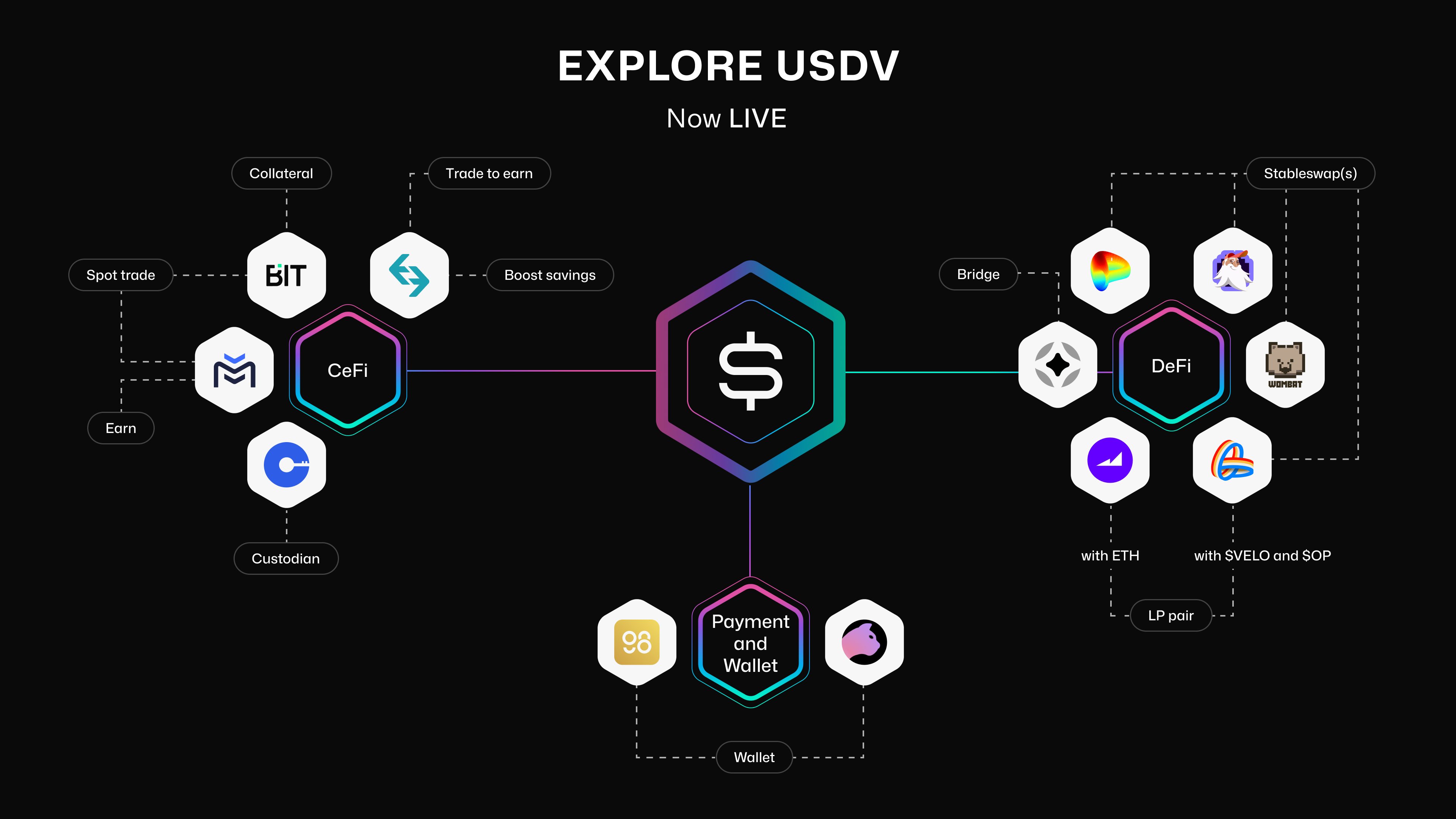

4. Stablecoin ColorTrace

ColorTrace or Color Fungible Asset is a completely new concept introduced by LayerZero. The first project to apply ColorTrace technology is USDV Money, with the stablecoin USDV being a Color Fungible Asset. The mechanism of USDV involves each unit minted being associated with a unique color and serial number for differentiation.

USDV charges fees similar to USDC or USDT, where users incur a fee when redeeming assets back into collateral. Revenue is fairly distributed among the entities that minted USDV based on identification. For more in-depth information on USDV, you can read here.

USDV has revolutionized the profit-sharing mechanism of previous stablecoins like USDT and USDC. This promotes the development of more decentralized stablecoins and leverages community power more effectively, driving the growth of USDV. A significant potential for USDV is its ability to tokenize real-world assets (RWA), which can then be used as collateral to mint USDV stablecoins.

To attract organizations and users to mint and hold USDV, this stablecoin is creating an ecosystem of stacked projects, allowing USDV to be used as collateral across various activities.

5. Conclusion

These are three stablecoin models that I believe will grow significantly in the future. However, predicting which stablecoin will lead the group is challenging; I still think USDT and USDC will remain unmatched. LST-backed stablecoins still have limitations and liquidation risks, while ColorTrace stablecoins are still restricted to certain ecosystems.

Stablecoins act as a second gateway for both large and small investors to enter the market. Therefore, monitoring the development and capitalization of stablecoins is essentially monitoring capital flows in the market.

Read more:

English

English Tiếng Việt

Tiếng Việt