1. What is a expense management app?

Expense management is the process of monitoring, controlling, and managing the money and assets of an individual or organization to ensure that funds are used effectively and sustainably. It involves budgeting, financial record-keeping, and making informed decisions about how to allocate money to achieve specific financial goals.

The key aspects of expense management include:

-

Budget Planning: Determine how much money you have and how you intend to use it over a specific period. Budget planning can include daily, monthly, and yearly income and expenses.

-

Financial Record-Keeping: Track all financial transactions, including income and expenses. This helps you understand where your money is going and where it is coming from. Tools such as financial management apps or spreadsheets can be used to record financial information.

-

Prioritizing Expenses: Identify the most important and highest-priority expenses based on personal or organizational financial goals.

-

Saving and Investing: Determine ways to save money and invest to generate returns and grow your assets.

-

Analysis and Adjustment: Regularly review your spending and adjust your budget plan if necessary to ensure you are spending money responsibly and according to plan.

-

Avoiding and Managing Debt: Avoid excessive borrowing and manage debt wisely if you have any.

Expense management plays a crucial role in maintaining personal and organizational finances, helping ensure you have enough money to meet your needs and financial goals.

2. The Role of Expense Management in Investing

Before you embark on the path of financial investment, it's essential to master four key steps: reducing expenses, increasing income, investing, and leveraging.

The Role of Expense Management in Investing

Remember, the last one standing is the winner. In the financial game, money is our lifeblood. Don’t let yourself run out of money, or you'll soon be out of the game.

Here are the "four steps of personal financial management" you should follow in order:

Reduce Expenses: This step focuses on cutting unnecessary spending and optimizing your budget. Actions you can take include:

- Reviewing and eliminating non-essential expenses.

- Finding ways to save money in daily life, such as through frugal eating, reducing travel, or eliminating unnecessary services.

- Paying off debt and limiting credit card use if applicable.

Increase Income: This step involves finding ways to boost your earnings. Some ways to do this include:

- Seeking a salary increase or additional income from your current job.

- Exploring opportunities for side jobs or freelance work.

- Developing new skills or creative ventures to generate additional income streams.

Invest: This step involves creating an investment strategy to grow your assets and generate returns. Actions to consider include:

- Researching and investing in stocks, mutual funds, or real estate.

- Building a savings fund and investing in savings accounts with fixed or variable interest rates.

- Exploring investment opportunities that align with your personal financial goals.

Leverage: Leverage involves careful planning to ensure you have sufficient savings and investments for emergencies or retirement. Actions can include:

- Establishing an emergency fund to cover unexpected financial issues or costs.

- Setting long-term savings and investment goals, such as for retirement or purchasing a home.

- Regularly reviewing and updating your personal financial plan to ensure you are meeting these goals.

These four steps can help you manage your personal finances systematically and effectively, from controlling spending to increasing income and investing to build wealth.

To excel in financial management, you need to manage your capital well. Create a monthly income and expense statement, review it, and decisively cut unnecessary expenditures. By focusing on reducing unnecessary spending, you will naturally find yourself with surplus money each month.

2. Top 5 expense management apps you should know

To help you effectively track and manage your expenses, here are 5 highly useful expense management apps:

2.1. Money Lover

Money Lover is a leading expense management app that helps you easily control both short-term and long-term personal finances.

Money Lover offers a range of tools for managing and tracking expenses on a daily, weekly, monthly, quarterly, and yearly basis.

This app provides analysis and tracking of your financial habits, helping you maintain balance in managing your money. Additionally, you can monitor your progress through monthly comparison charts of income and expenses, which aids in evaluating and tracking your financial management effectively.

What sets Money Lover apart is its integration with over 20 banks, allowing you to easily monitor balance fluctuations and transactions in your bank accounts.

Key Features of the Money Lover Expense Management App:

- Expense and Income Tracking: Monitor daily spending, income, and bills.

- Bank Integration: Connect Money Lover with accounts from over 20 banks in Vietnam.

- Financial Reports: View detailed financial reports through charts to grasp information quickly.

- Bill Reminders: Receive reminders for paying utility bills.

- Budget Planning: Easily set up and manage your spending plans.

2.2. The Misa app

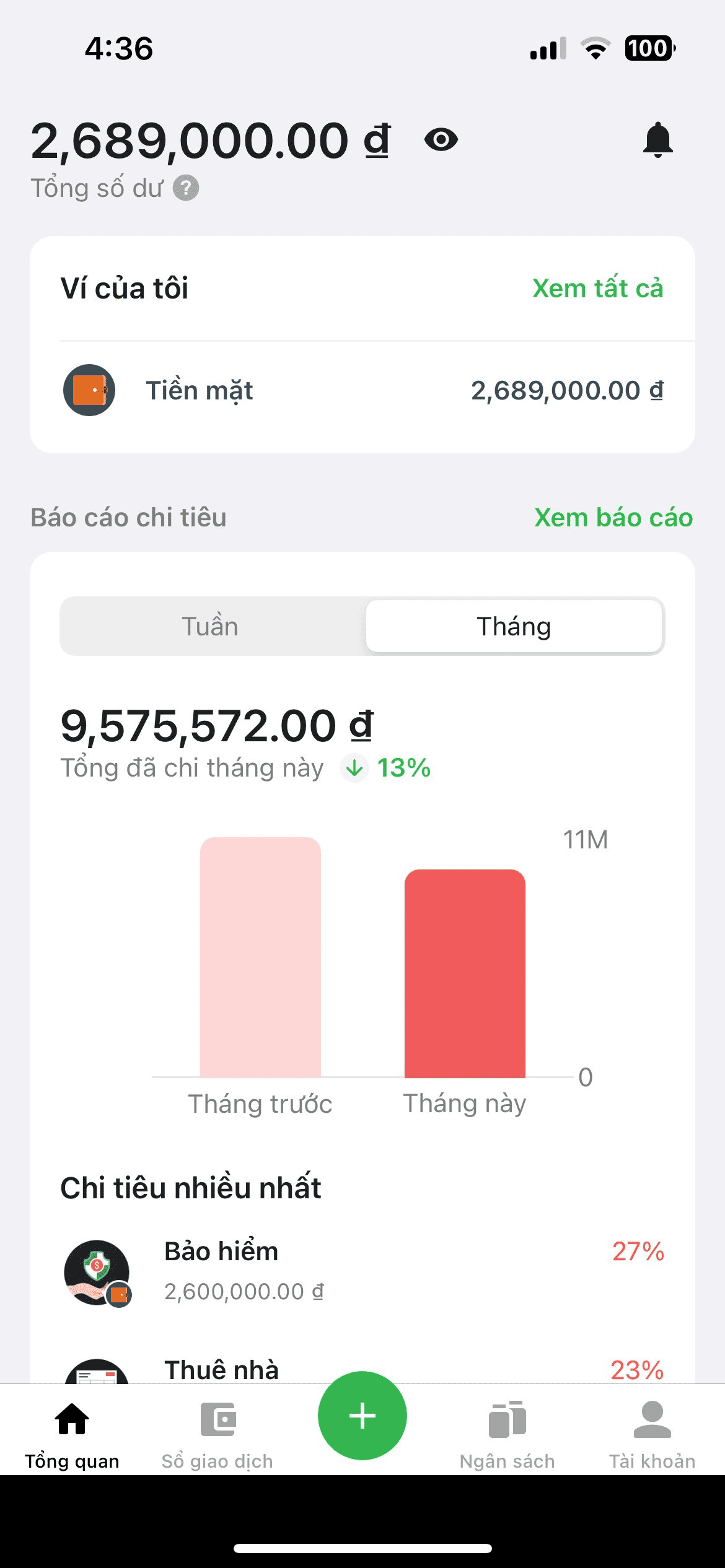

The Misa app assists in managing financial resources through multiple accounts or separate wallets, allowing you to track savings books and update gold exchange rates, which helps you make informed investment decisions.

The Misa app allows you to record income and expenses, manage loans and debts, and set reminders to keep track of your investment plans and timely payments.

Additionally, Misa helps you easily monitor and allocate funds both within and outside your accounts through clear and scientific visual charts. This allows you to compare your income and expenses monthly, quarterly, and annually with ease.

Key Features of the Misa Expense Management App:

- Quick Income/Expense Recording: MISA lets you quickly and conveniently log all your income and expenses.

- Event-Based Aggregation: The app helps aggregate expenses by specific events or projects, making it easier to track finances in different aspects.

- Loan/Debt Tracking: MISA automatically tracks your loan and debt activities and sends reminders for payment due dates, ensuring you don’t miss any important payments.

- Multi-Account Management: You can record and manage cash flow between multiple accounts, as well as convert currencies easily.

- Visual Reports: MISA provides visual reports and clear expense analysis through charts, helping you better understand your financial situation.

2.3. Spendee Money

Spendee simplifies the process of categorizing income and expenses into separate categories, making it easier to manage your finances. The app is highly rated, with a score of 4.6 on the App Store.

Spendee stands out with its vibrant color interface, making it easier to evaluate and compare spending levels through automatically analyzed charts.

The app offers effective tools for tracking daily expenses and categorizing spending into different areas such as personal, family, or special occasions. This helps you gain a comprehensive overview of your daily, weekly, and monthly financial activities, allowing for optimal expense management, saving on unnecessary costs, and efficient budget optimization.

Key Features of Spendee:

- Personal Expense Tracking: Spendee allows you to track personal expenses either manually or by syncing automatically with your bank accounts for safety and convenience.

- Easy Budget Management: Set budget goals, record expenses, and create savings plans effortlessly.

- Attractive Income-Expense Charts: View your income and expenses through visually appealing charts, making it easy to understand and monitor your financial situation.

- Family Budget Planning: Plan and manage a family budget efficiently, coordinating financial activities across household members.

- Shared Wallets: Share Spendee wallets with friends and family to manage finances together or for joint projects.

- Multi-Currency Support: Customize your wallet with multiple currencies, catering to various needs such as travel, events, shopping, and other goals.

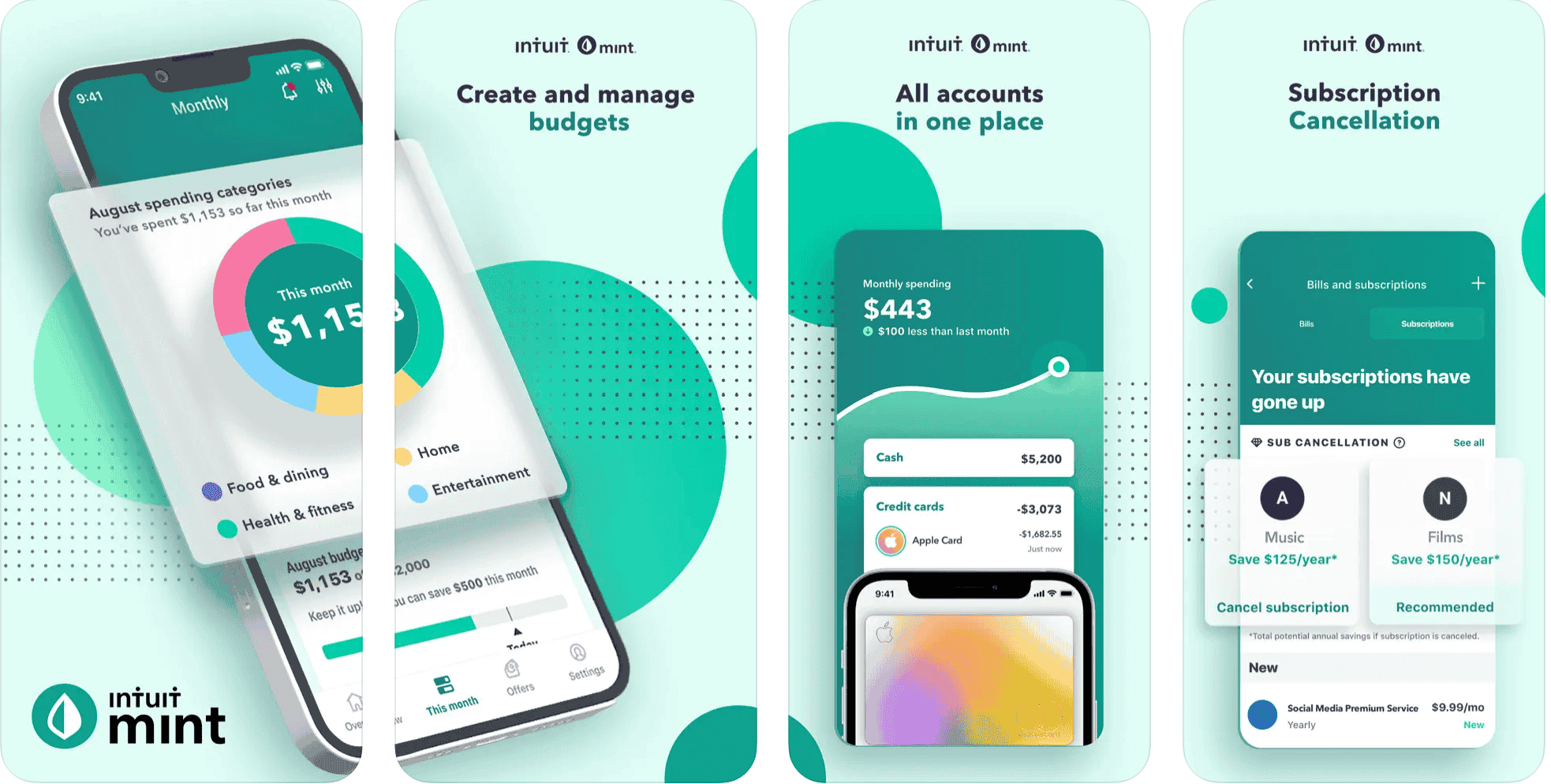

2.4. Mint

Mint is a versatile personal finance management app that caters to various device configurations, making it suitable for a wide range of users.

Mint offers several standout features:

- Easy Account Linking: Mint allows you to easily link your financial accounts and credit cards. This feature enables the app to automatically update information from your accounts, saving you time and effort.

- Bill Reminders: Mint tracks your bills and sends timely reminders to ensure you don’t miss any payments.

- Smart Advice: Mint provides intelligent recommendations on how to manage your spending. Based on your financial data, the app offers suggestions and strategies to optimize your personal financial situation.

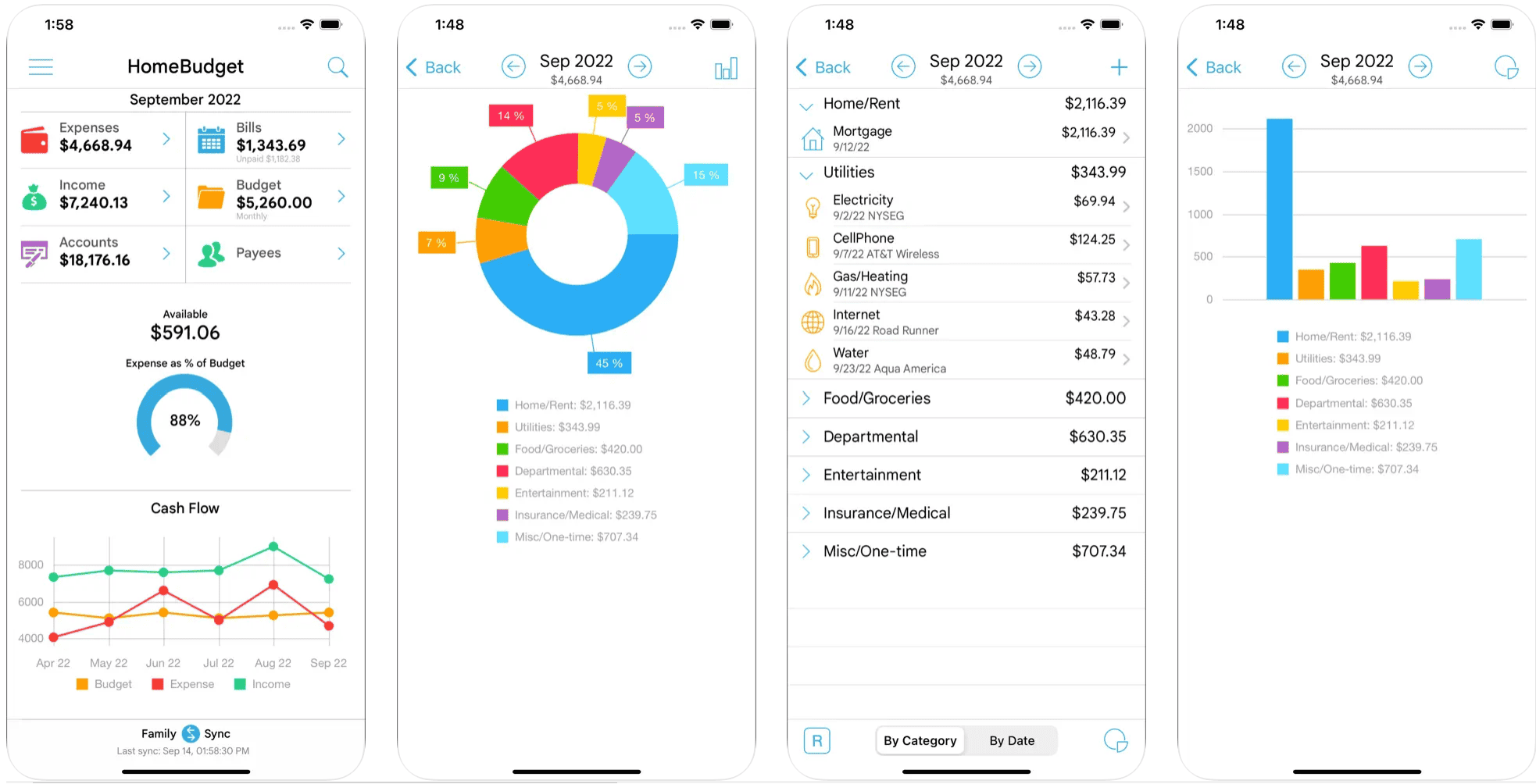

2.5. Home Budget with Sync

Home Budget with Sync is a valuable app designed to assist you in managing your daily expenses and optimizing your personal finances.

Home Budget with Syn

Key Features of Home Budget with Sync:

- Bill Management and Reminders: The app helps you effectively track and manage your bills, providing timely reminders to ensure you never miss a payment.

- Expense Categorization: Your spending information is automatically categorized and presented through clear charts and tables. This helps you understand your spending patterns better and create more accurate budgeting plans.

3. FAQs

Q1: Why is personal expense management important?

Personal expense management is crucial because it helps you control your finances, minimize debt, and save money, which in turn enables you to achieve long-term financial goals.

Q2: How do I determine a reasonable spending level for each category?

Determine a reasonable spending level by allocating a portion of your income to specific goals, such as essential expenses, savings, and entertainment. Adhere to the 50/30/20 rule (50% for essential expenses, 30% for discretionary spending, and 20% for savings).

4. Conclusion

Expense management plays a vital role in personal financial management. Here are 5 effective expense management apps; we hope this article helps you choose the right app for your expense management needs.

Read More:

English

English Tiếng Việt

Tiếng Việt