1. What is a personal financial plan?

The term "financial planning" is often more commonly associated with organizations and businesses. However, personal financial planning is considered one of the most crucial factors in helping individuals move towards their long-term life goals.

Personal financial planning involves creating a detailed plan that tracks one's income and expenses, and outlines strategies for saving and allocating personal funds.

Engaging in personal financial planning helps individuals gain a clear understanding of their financial situation, including cash flow ratios, and establishes a structured approach to manage and allocate funds to achieve personal goals, particularly long-term objectives.

2. Why do we need personal financial planning?

Reasons for personal financial planning

The benefits of personal financial planning:

-

Easier and More Specific Financial Management: Financial planning helps you gain a precise understanding of your cash flow, allowing you to detect issues promptly and make necessary adjustments.

-

Proactive Fund Allocation and Reduced Financial Stress: A detailed financial plan enables you to manage and allocate your funds across various categories actively. This approach helps prevent being overwhelmed by monthly expenses, being caught off guard by unexpected events, and experiencing ongoing financial stress. Consider using methods like the "Six Jars" or the "50-30-20 Rule" for effective fund distribution.

-

Easier Adaptation to Unforeseen Situations: Unexpected events can sometimes arise, leaving you unprepared. However, a clear financial plan and a dedicated portion of funds for such issues will help you remain calm and avoid confusion.

-

Preparation for Long-Term Goals: Long-term goals, such as buying a house, purchasing a car, or starting a business, require significant resources, time, and effort. A well-defined financial plan helps you outline detailed steps, manage your finances effectively, and know exactly what actions to take, when to take them, and how long it will take to achieve these goals.

3. 5 essential steps for creating an effective personal financial plan:

In reality, effective personal financial planning will depend on each individual's financial situation and actual goals. There is no one-size-fits-all rule for creating a perfectly accurate personal financial plan. Below are some important steps for individuals to consider when setting up their own personal financial plan:

Key Steps in Creating a Personal Financial Plan

Step 1: Detail and evaluate your current personal financial situation

First, you need to create a detailed financial statement of your income and expenses as accurately as possible, ideally over a period of at least 3 months. Then, categorize your expenses into mandatory (essential) and non-essential (discretionary) categories.

Based on this, you can visualize an overview of how your spending is allocated relative to your total income. Typically, this financial overview will include categories such as: total income, expenses, savings, assets, and liabilities.

Step 2: Set goals

After gaining a clear overview of your current financial situation, you should set specific goals and plans for the future, breaking them down into distinct phases and identifying the actions needed and the time required to achieve these goals. Goals should be categorized as follows:

- Short-Term Goals: These are objectives you want to achieve relatively quickly, typically within a short period. Examples include purchasing something for yourself or your family, gifting your parents a small trip, settling a debt, or simply saving a certain amount each month.

- Medium-Term Goals: These goals generally span over a period of 10 to 20 years and require sufficient time to accomplish. Examples include buying a house, purchasing a car, or starting a new business venture.

- Long-Term Goals: These involve plans for the distant future, requiring significant time and strategic planning. Examples include aiming for financial independence, retirement planning, or preparing for a comfortable old age.

A key factor in achieving these goals is maintaining patience and discipline.

Step 3: Allocate your finances

There are various methods for allocating personal finances, and there is no one-size-fits-all rule. You can choose to allocate your finances based on methods like the 6 Jars System or the 50-30-20 Rule, which are two of the most popular approaches.

Allocating your money into smaller categories helps you adhere to your plan more closely and implement effective strategies to optimize your funds.

6 Jars Money Management System

6 Jars Money Management System

This is perhaps the most popular rule for managing finances. Depending on an individual's financial situation and goals, the percentages can be flexibly adjusted to achieve the most optimal results. However, funds should be allocated into major categories such as: essential needs (living expenses, food, utilities, etc.), savings, personal development (courses, books, health, etc.), entertainment (enjoying life, leisure activities), profitable investments (stocks, crypto, real estate, etc.), and giving back (charity, helping others).

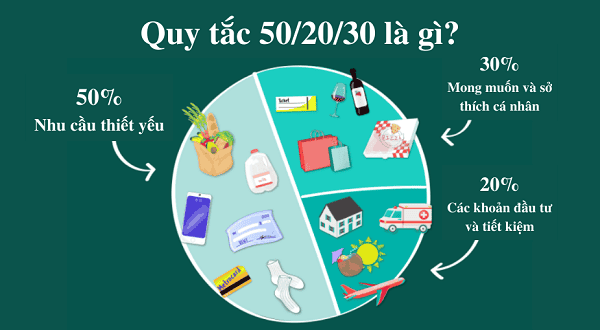

The 50-30-20 Rule

50/30/20 Rule in Personal Finance Management

In addition to the 6 Jars method mentioned earlier, you can divide your funds into three main categories: Essential Needs (Must-Haves), Wants and Personal Preferences (Desires), and Savings and Investments (Goals).

Depending on your current financial situation and personal goals, you may choose different methods as long as they fit well and seem optimal for yourself. However, regardless of the method, persistence and discipline are always the most crucial factors.

Step 4: Review Your Progress

After following your financial plan for every 3 months, you should take time to evaluate whether you are adhering to the original plan closely. Assess whether the plan is effective and still aligns with your initial goals or if adjustments and modifications are necessary.

Reviewing your progress is extremely important because the plan that was suitable at the beginning may no longer be appropriate due to changes that occurred during its implementation.

Step 5: Adjust If Necessary

If your plan is not helping you achieve the desired results or if issues arise that affect the overall process, you should revisit and adjust it accordingly.

Patience and perseverance are key to an effective financial plan, but flexibility is also essential in setting up your personal financial strategy. Avoid sticking rigidly to a plan that, after a long period of trial, does not yield the desired results or has emerging gaps.

4. Some Tips for Effective Personal Financial Planning

- Today, personal financial planning has become much simpler with the use of financial tracking and management apps on your mobile device. It is advisable to use these apps instead of manual methods like handwriting or using Excel spreadsheets.

- Always prioritize important factors during the planning process: specifically, patience, discipline, and flexibility.

- Consistently adhere to and monitor the execution of your plan, evaluating and reviewing each phase to proactively adjust and address any issues if you are not adhering to the plan as expected.

5. Conclusion

The steps outlined above are essential for starting an effective and straightforward personal financial plan. We hope the information in this article provides you with a better overview of personal financial planning, why it is necessary to establish it, and how to implement it.

Wishing you success in setting up your personal financial plan.

Follow the Bigcoin team to stay updated with more useful financial information!

Read more:

English

English Tiếng Việt

Tiếng Việt