In recent years, the use of NFTs has become popular around the world. NFT is a unique token that cannot be replaced or exchanged for any other token. With the power of blockchain technology, NFTs are being used to protect the ownership and value of digital assets such as photos, music, videos and more.

Read more: What is NFT? Applications and limitations of NFTs

While NFTs are primarily used for asset protection purposes, they also provide users with an opportunity to earn money. Here are some ways to make money from NFTs

1. Create NFT and sell on exchange

This method will be most suitable for content creators (Artists, musicians, singers, photographers...). Currently almost everyone can mint (create) NFTs quite easily.

Among the ways to make money from NFTs , creating your own content and selling it is the fastest way to make money. Among the types of NFTs, NFTs related to art will often be highly valued.

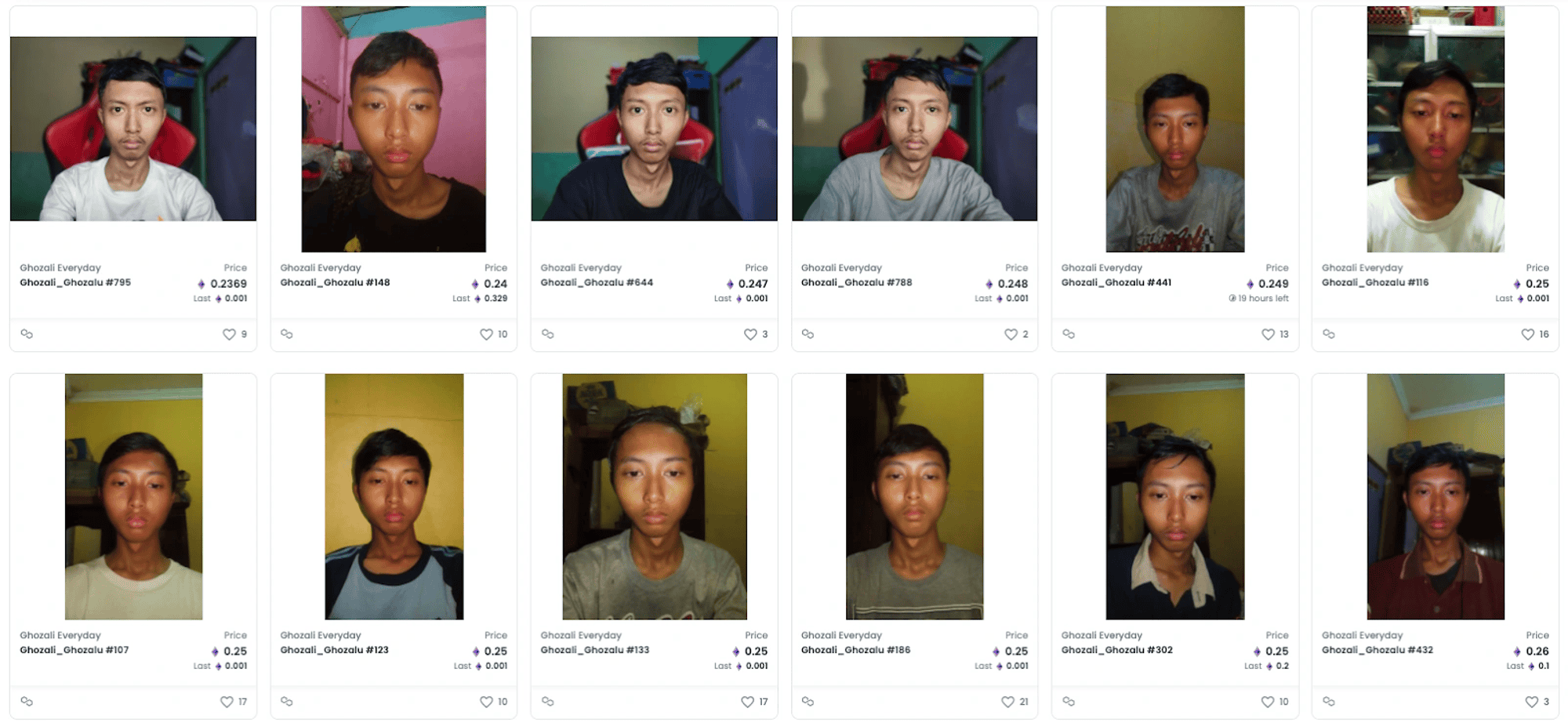

Some individuals can earn millions of dollars from NFT "works" like Indonesian guy Ghonzali who earned 321 ETH equivalent to more than 1 million USD by trading his Ghozali Everyday NFT collection. You're thinking this guy's collection is artistic photos, right? Unfortunately, this guy's NFT set is simply "selfie" images taken from 2017 to 2021.

Crazy, right? This guy is just a few rare cases in the crypto world. There are many famous artists who also make a lot of money from selling NFTs such as Scottish-born, Canadian-born artist Trevor Jones who made $21,332,063.03 from selling NFTs. "Bitcoin Angel" is his best-selling solo work. The oil on canvas painting depicts two marble statues in front of a gold Bitcoin, and sold for $188,888. Another example is JOSE DELBO, total value of artwork: $15,404,720.67. Best known for his work on Wonder Woman, Captain Planet and Little Lulu, Argentinian artist José Delbo released his first NFT in July 2020. The original, 43-page comic book, "Death" is on sale for $642.14. Since then, he has sold 4,674 works of art for an average price of $3,295.83 each.

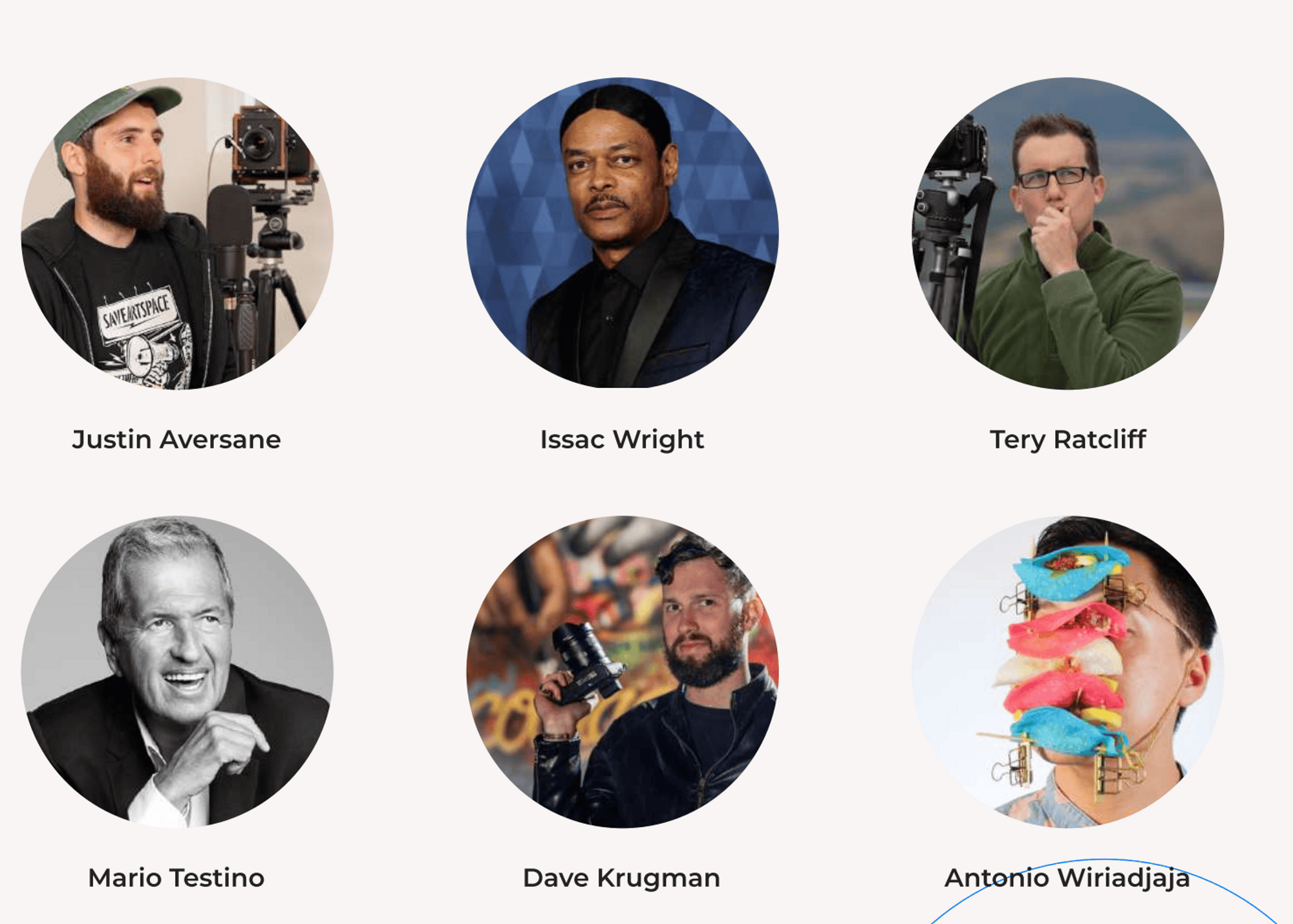

Photographers also cannot refuse the appeal of this potential piece of cake. Below are the top most successful NFT photographers in 2022:

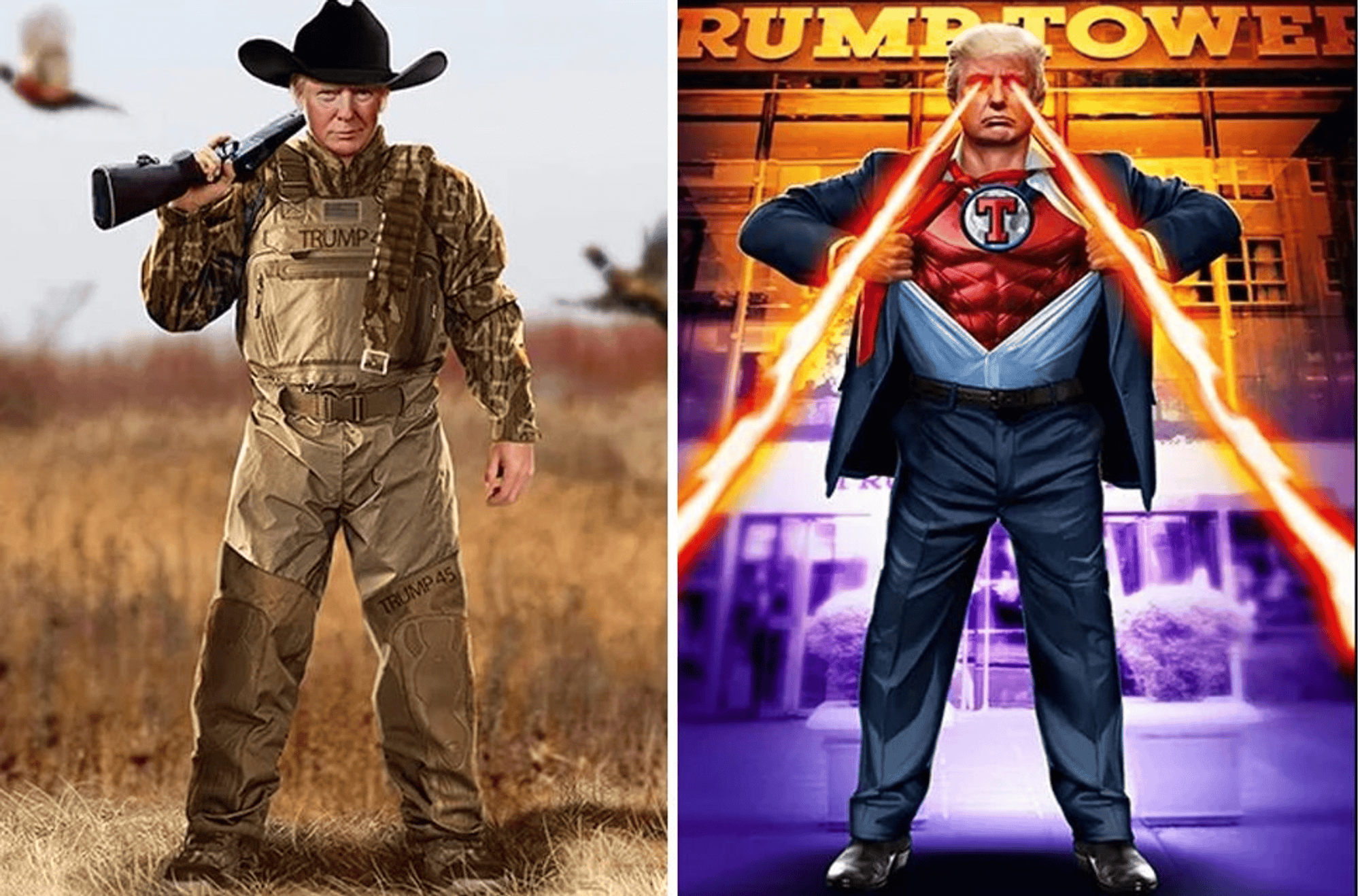

A person who has always strongly opposed crypto in 2020 and 2021 on twitter but earned 4.5 million USD from selling NFTs in 2022, surely you can guess who that person is. Exactly, that is former US president Donald Trump.

2. NFT speculation

Holding an NFT: You can buy an NFT and wait for its value to increase, then sell it at a higher price.

You can buy an NFT and wait for its value to increase, then sell it for a higher price. Hunt for potential NFT collectibles and resell them for profit. This second method is suitable for the majority of market participants.

To hunt for NFTs that have the potential to increase in price in the future, investors need to have a lot of knowledge about NFTs to evaluate and make decisions to buy coins. You can consult

5 Golden criteria for evaluating NFTs

As someone who has speculated in NFTs, I often choose NFTs with reputable backers, NFTs with functions (Use NFTs for staking, lending, borrowing...), NFT tickets (tickets to music shows, dinners with celebrities …), or the NFTs held will have the ability to be airdropped for investment.

3. Play games

Making money by playing NFT games was very popular in 2019-2020 not only in Vietnam but all over the world. NFT games (or P2E, or GameFi) are a type of game that has its own economy – players can earn items (NFTs), tokens in the game and these assets can then be traded. through exchanges. The rarer the items, the more valuable they are.

Famous NFT games with high market capitalization can be mentioned as follows: Axie, MOBOX, Gala, Wax...

4. Lending/Borrowing NFTs

There are 3 types of NFT loans: P2P NFT lending: connects potential borrowers with peer-to-peer lenders, establishes a trustless loan between 2 parties, uses NFT as collateral. Lending/CDPs: Collateralized debt positions are created by locking collateralized NFTs into smart contracts to mint stablecoins. The number of stablecoin mints issued will be determined based on the floor price at that time of the NFT collateralized.

Lending Pools: Borrowers will deposit collateral into the pool. They will borrow an amount lower than the value of the mortgaged property. Borrowing fees will be paid to those who add their NFTs to the pool to incentivize them to provide liquidity. Lending/Borrowing NFT will support providing additional liquidity to the entire NFT market.

Some Lending/Borrowing projects: Bend dao , x2y2 , NFTfi...

Read more:

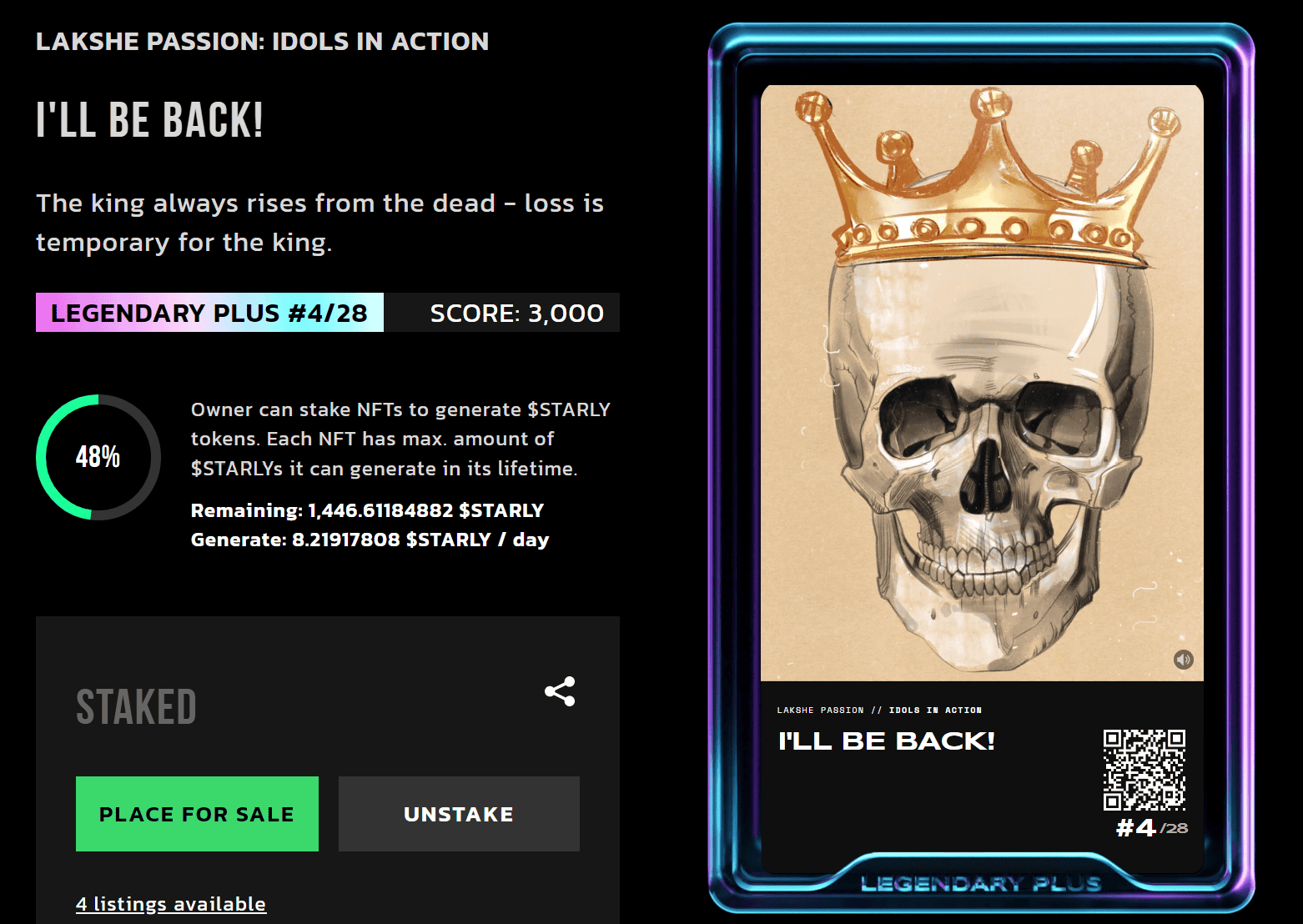

5. Staking

You can Stake your NFT in some Blockchain projects to receive interest. Some NFT projects support this feature such as: Starly, Bend dao...

6. Perpetual

NFT derivatives are a major development in NFTifi. They allow users to bet on the future price of NFT collections. NFT derivatives will help increase liquidity for NFTs. It opens up profit optimization when using leverage to trade high-value NFTs. The derivatives market in TradFi is much larger than the spot market with an estimated value of hundreds of trillions of dollars. The most famous platform providing NFT derivatives services is Synfutures' branch NFtures. Currently this platform only provides long/short services for CryptoPunks

7. Airdrop

Some NFT projects will do free NFT 'airdrops' to users. You can make money by minting NFTs and selling those NFTs. For example, the Lens dao project gave free mints and now NFTs have a floor price of $70

Read more: What is Lens protocol? Potential from socialfi

The Aptos project also airdropped 150-300 APT to their NFT mints.

8. Conclusion

NFT is a new market and many opportunities for investors. You can change your life overnight but you can also lose a lot. So please consider, calculate and plan clearly before putting down money and don't forget to always equip yourself with updated knowledge to limit losses as much as possible.

Read more:

English

English Tiếng Việt

Tiếng Việt

.jpg)

.jpg)

.jpg)