1. What is NFT Lending?

NFT lending is an NFT collateral lending model (belonging to the NFTFi niche), in which NFT holders can lend (lending) or borrow (borrowing) using NFTs as collateral. This helps increase the liquidity of NFT assets, while also opening up many new opportunities for NFT investors and users.

NFT lending platforms typically use smart contracts to set up loans and payments, with NFTs used as collateral. Users can borrow money by placing their NFTs in the system and receive an equivalent loan. Conversely, they can also lend their NFTs to earn interest.

NFT lending is a potential field and is attracting increasing interest from investors and developers. The development of NFT Lending platforms is considered necessary to create sustainable development for the NFT industry and help increase the value of NFT assets.

2. How NFT Lending works

Most NFT Lending projects operate based on two models: peer-to-peer and peer-to-pool. In addition, there are several other variations in how NFT Lending works which will be analyzed in detail below.

2.1. Peer-to-peer model

The peer-to-peer NFT Lending model is a financial system that allows lenders and borrowers to directly borrow cryptocurrency using non-fungible digital assets (NFTs) as assets. mortgaged property.

Peer-to-peer NFT lending models are built on the impossibility of valuing NFT assets due to their unique characteristics and non-fungible nature. They need lenders to separately appraise the value of NFT collateral when lending. The borrower and lender will then negotiate to find the fairest terms possible for both parties.

Steps of the peer-to-peer loan process:

- Step 1: Borrowers connect their wallet to the platform and deposit their NFTs as collateral, setting their desired loan terms such as loan amount, term, and interest rate.

- Step 2: Lenders browse NFT asset portfolios and propose term offers based on their assessment of the value of the NFT.

- Step 3: The borrower can review and accept the offer to buy wETH or stablecoin transferred from the lender's wallet.

- Step 4: The NFT will then automatically be transferred to the smart contract, which will maintain the asset for the duration of the loan.

Platforms operating this model generate revenue by charging a fee (about 5%) to the lender on the interest earned after the loan is repaid. If the borrower defaults on the loan, the lender can proceed to foreclose on the NFT collateral. This asset is then liquidated from the smart contract by the platform and cancels the promissory note, allowing the borrower to keep the borrowed amount.

Advantages and disadvantages:

| Advantage | Defect |

|

|

2.2. Peer-to-pool model

The peer-to-pool NFT lending model allows borrowers to directly receive loans from a protocol using their NFT assets as collateral. With platforms like BendDao , anyone can borrow ETH from a pool of liquidity providers. Borrowers can access up to 40% of the floor value of their NFT collateral.

They can also use these loans to purchase NFTs at a lower cost and pay later. First, borrowers use instant loans on Aave to purchase NFTs. Next, they leverage the resulting NFTs as collateral to immediately secure the NFT-backed loan. This loan can then be used to repay the initial loan quickly.

How it works:

- Step 1: Borrowers begin the process by connecting their wallet and selecting NFTs to use as collateral.

- Step 2: The protocol automatically calculates the loan amount a borrower can receive using price prediction to determine the floor price of the NFT.

- Step 3: A system algorithm will calculate interest rates based on available liquidity. It raises interest rates when liquidity is low to attract more lenders.

- Step 4: The protocol also sets out the asset condition factor, determining the conditions under which the NFT collateral can be liquidated before the loan term ends.

The process for lenders is intended to be simple and passive. They can deposit and withdraw funds from the liquidity pool at any time without limits. Loan yields will fluctuate according to lending demand.

Advantages and disadvantages:

| Advantage | Defect |

|

|

2.3. Combined model

The hybrid model is an alternative that combines peer-to-peer and peer-to-pool NFT lending with a third party, also known as a strategist, to facilitate for loan transactions between borrowers and lenders. Astaria is the first platform to implement this model, which simplifies the term agreement process.

How it works:

- Step 1: Borrowers connect their wallets and select NFTs to use as collateral.

- Step 2: Strategists, acting as third parties, create public vaults designed to attract liquidity, similar to lending pools. However, unlike lending pools that use common lending terms for every NFT, strategists customize terms for each collateral.

- Step 3: Liquidity providers search for vaults that offer terms that suit their investment strategy.

- Step 4: When borrowers declare their collateral, the strategist uses a set of estimates to automatically appraise the loan and match it to a liquid public vault.

- Step 5: The borrower then selects the loan amount, APR and term available in the selected vault.

- Step 6: Finally, the borrower reviews and approves the loan and performs the transaction.

Advantages and disadvantages:

| Advantage | Defect |

|

|

3. Outstanding NFT Lending projects

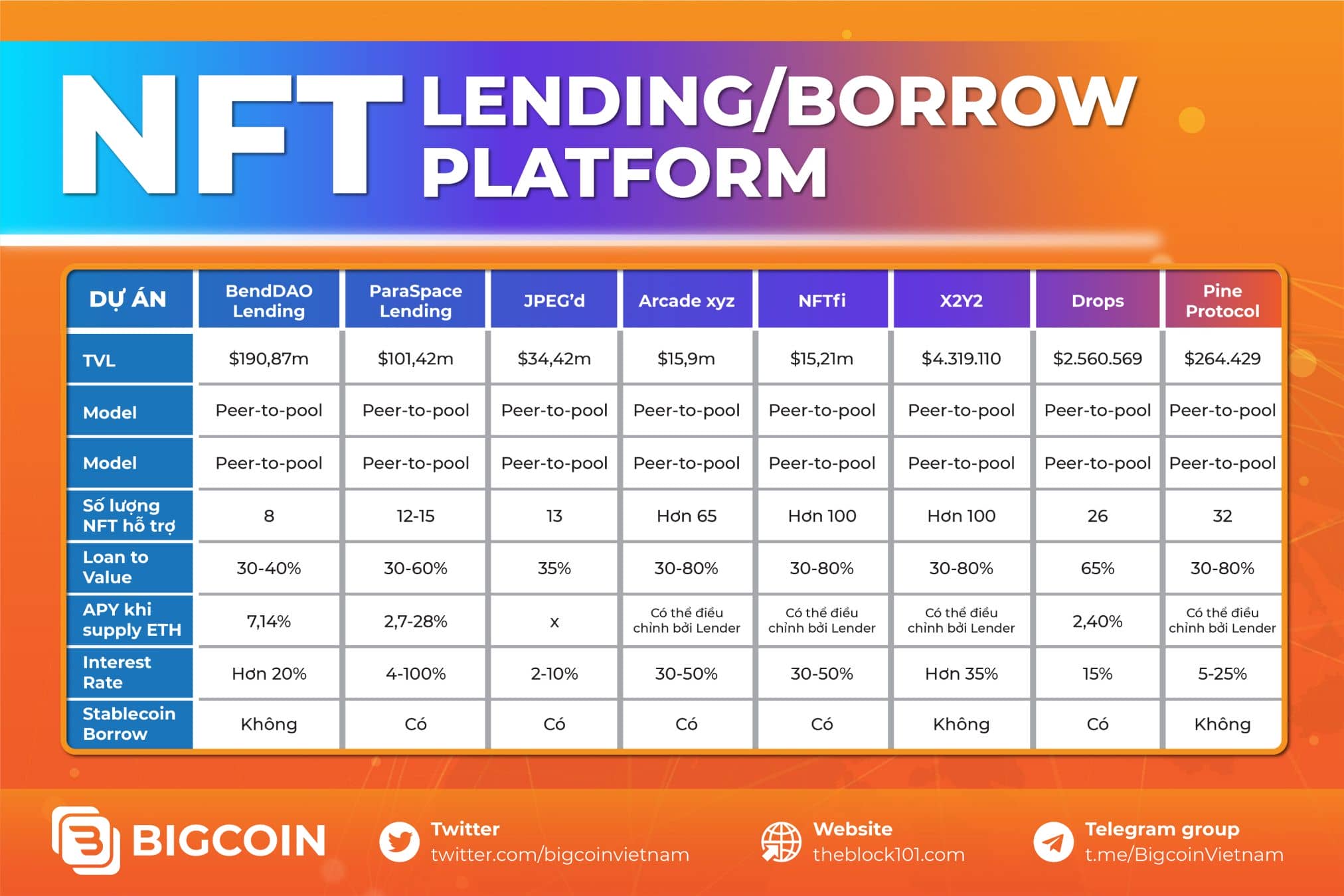

Below will be a summary and comparison of potential Lending projects on the current market such as: JPEG'd, BendDAO, ParaSpace, Arcade, NFTfi,...

Looking at this comparison table, we can see that the Peer-to-pool mechanism is the mechanism that has achieved a lot of development when the TVL of both BendDao and ParaSpace projects reached more than 100m$.

3.1. ParaSpace

Paraspace is the first Cross-Margin NFT lending protocol that allows users to mortgage all ERC20 assets, Blue-chip NFTs, LPs of Uniswap V3 together to borrow capital with the goal of increasing capital efficiency through collateralization. mortgage for many types of assets.

Learn more What is Paraspace? Here.

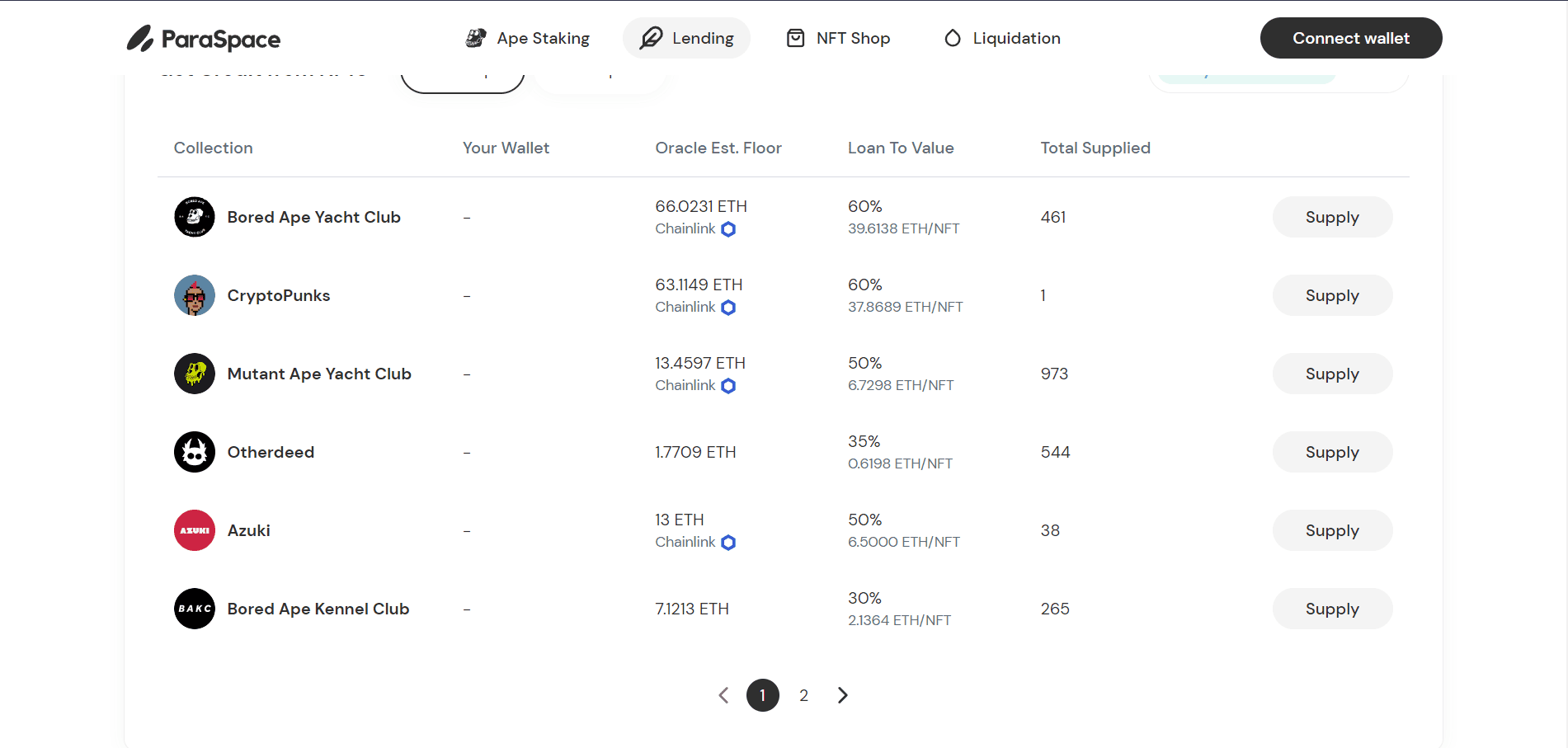

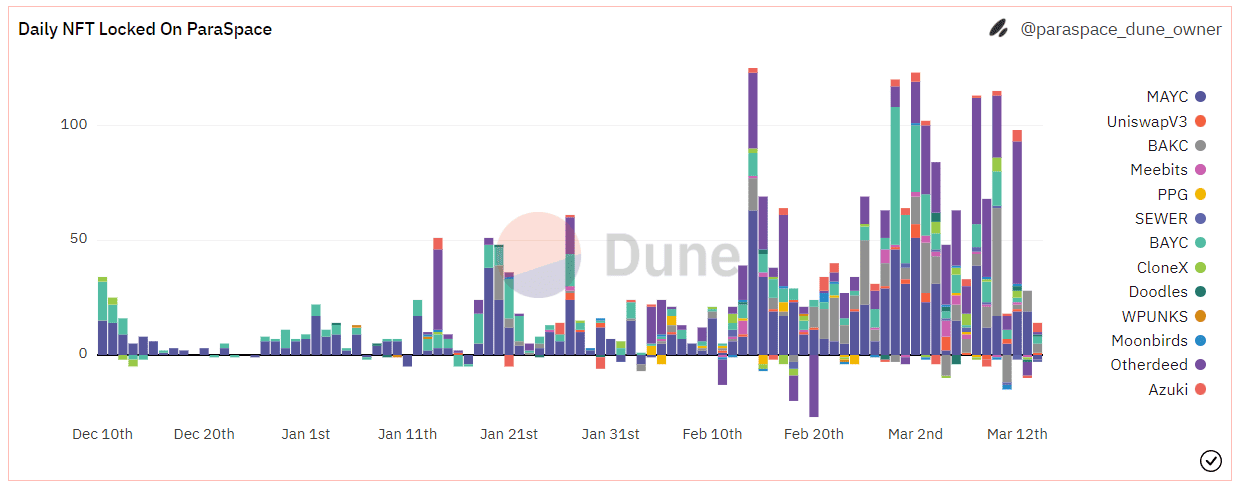

When looking at the number of NFTs used across platforms, ParaSpace is leading the way, especially for NFTs in the Yuga Labs collection.

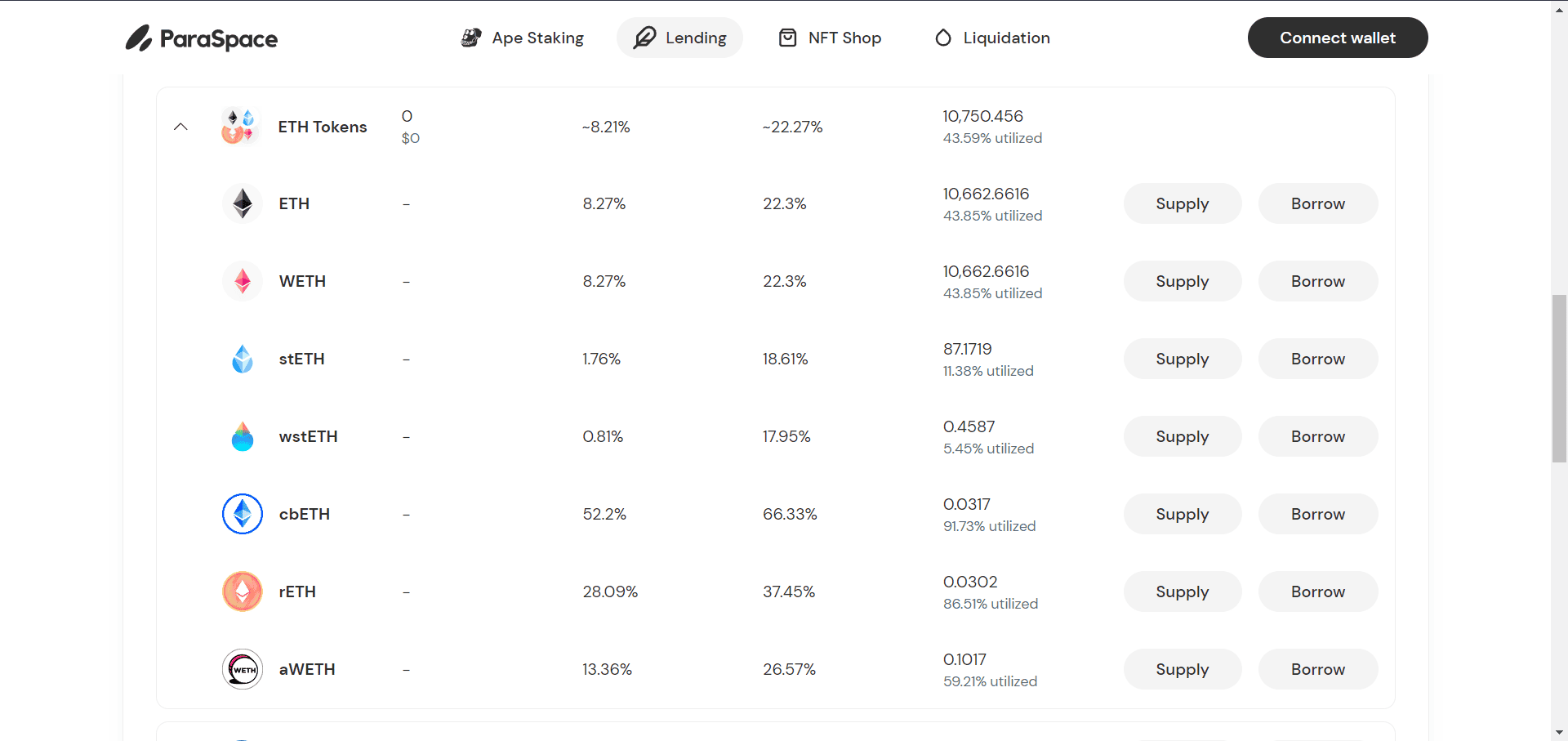

In addition, the biggest highlight that ParaSpace brings is the potential to attract holders holding ETH/Stake ETH on staking platforms such as Lido Rocket Pool. This will be a huge advantage to help ParaSpace attract more Supply from these holders to its platform.

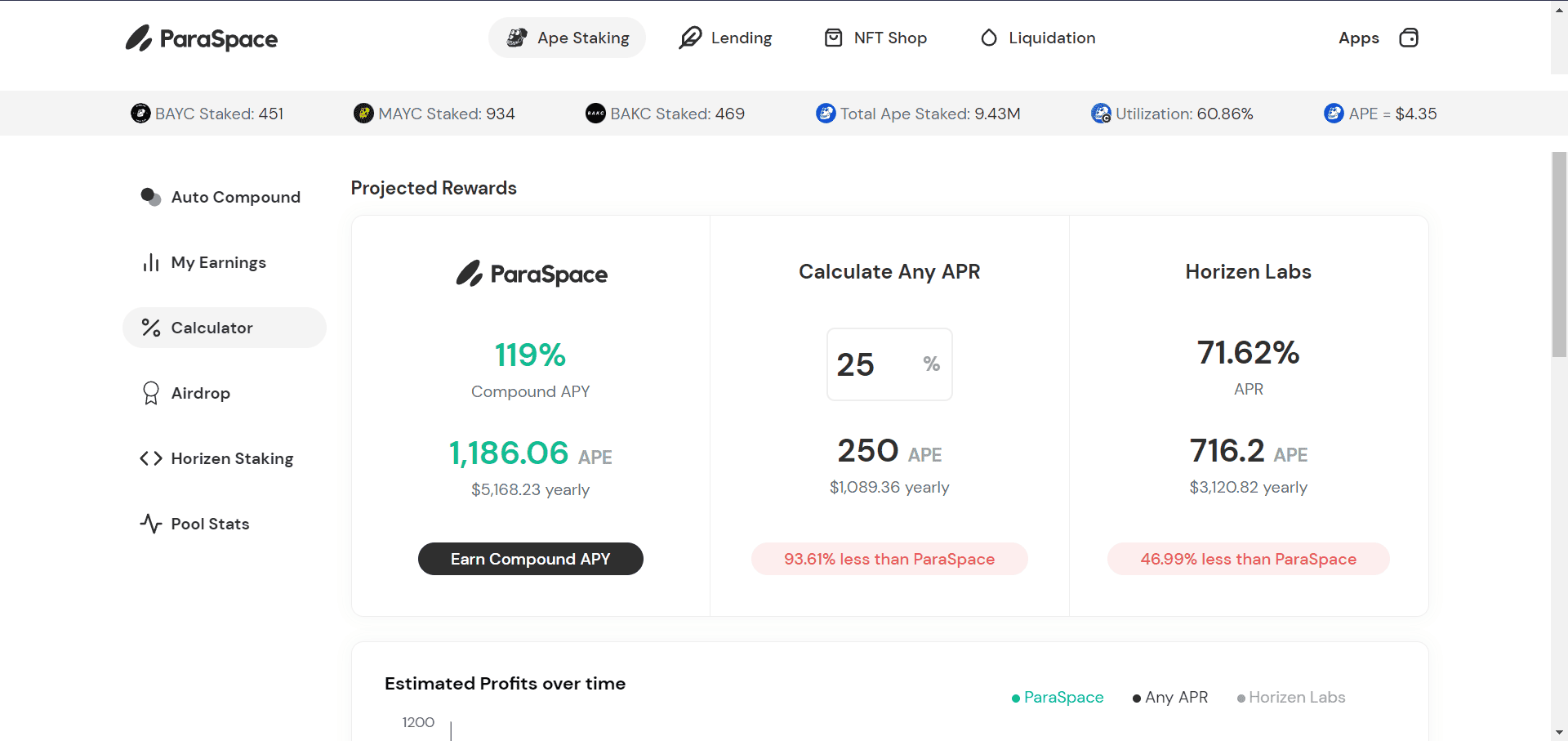

Along with ETH holders, ParaSpace also provides a Staking platform for $APE holders when this platform provides a staking mechanism of more than 100% APY, the highest among platforms that also provide this mechanism for holders.

It can be said that ParaSpace is targeting the main target group of Holders in the APE ecosystem including NFT holders and $APE tokens.

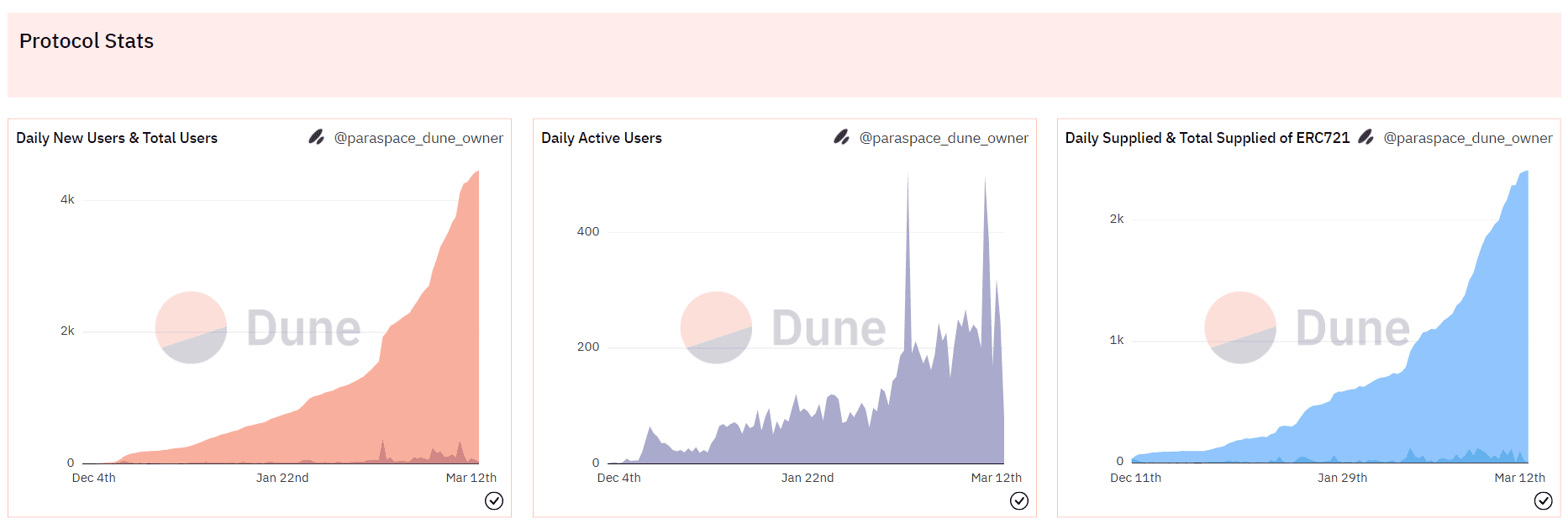

According to statistics from Dune, the number of new users and the number of NFT locks on the platform are increasing.

3.2. BendDAO

BendDAO is the leading NFT collateral lending platform and currently supports lending the 8 largest NFT sets on ETH. In particular, in the past year, TVL has grown outstandingly, reaching the 200M$ mark.

Learn more What is BendDAO? Here

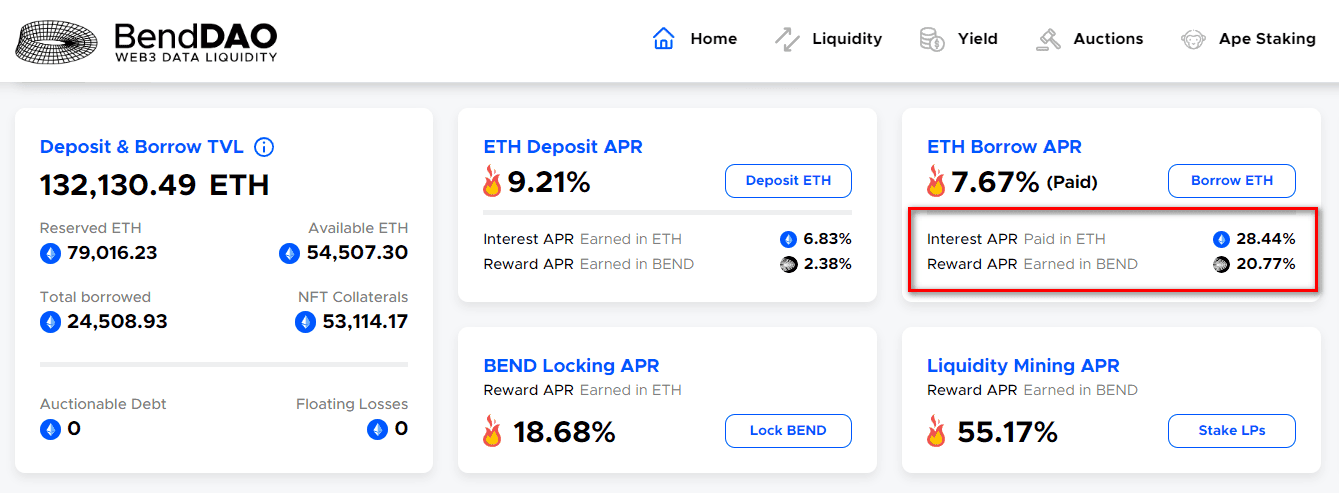

Although the APY is not as large as ParaSpace, BendDAO is providing profit sharing products for users who are using its service.

Although BendDao's Interest Rate is 28.44% annually, these Borrowers receive rewards of up to 20% in Bend tokens, so it can be seen that this Interest Rate is only about 8%, this is an extremely high number. competitive period with other platforms in this market niche.

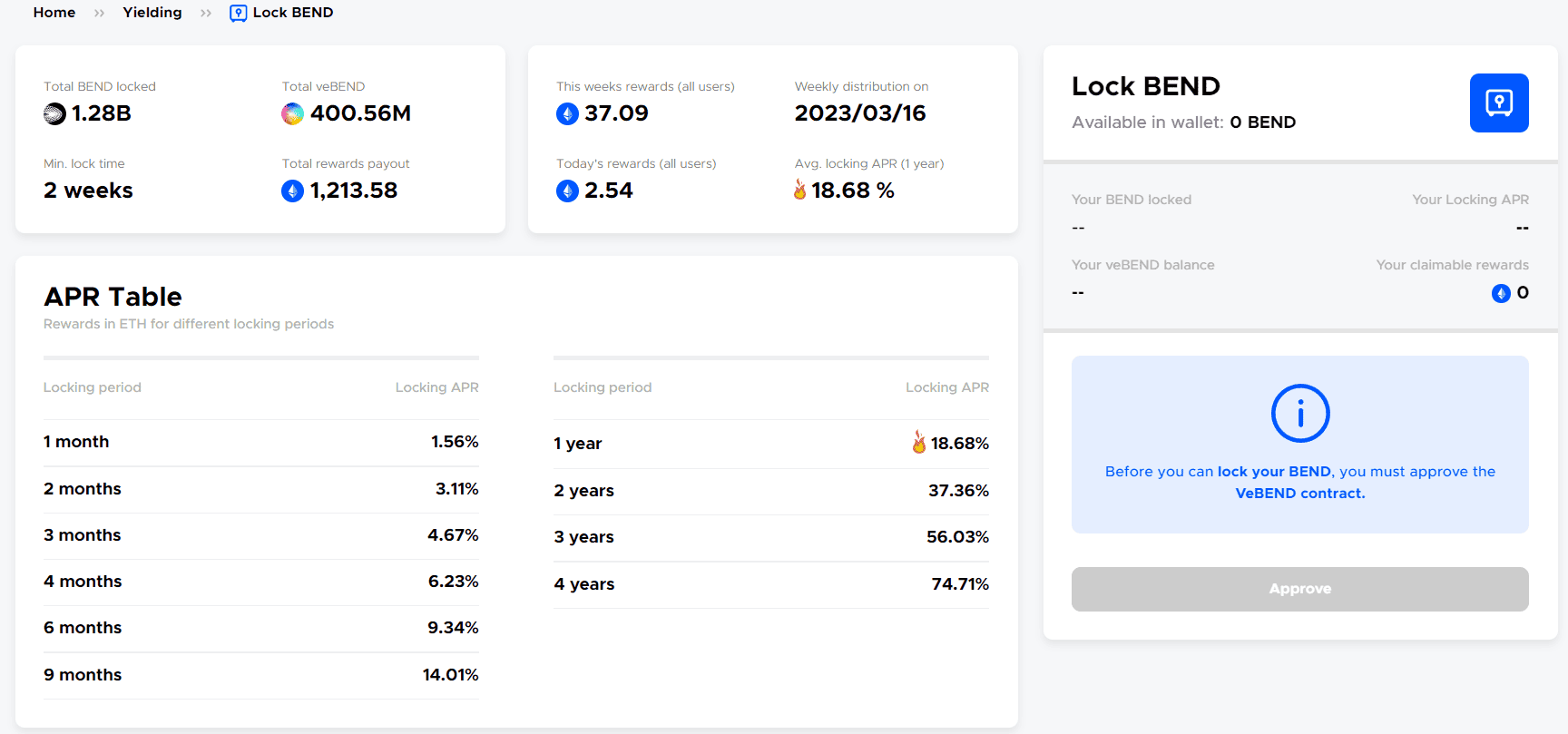

Along with that, holders of $BEND can lock their tokens and receive rewards from sharing profits from the revenue that BendDao generates on the platform. There are currently 400 million $veBEND compared to over 500 million $BEND in circulation, which means the majority of $BEND is locked up on the platform.

This profit sharing mechanism is quite good and it is quite similar to what GMX did for its token. If in the near future BendDao integrates support for more collections and increases the ultility for veBEND, it will create great heat in the NFTFI market.

3.3. JPEG'd

JPEG'd is a decentralized lending protocol for NFT holders and is among the top 10 holders of the most CVX tokens. JPEG'd's investors are mainly famous KOLs in the market, which will contribute significantly to popularizing the project to a certain user base.

Learn more about What is JPEG'd? Here.

Unlike BendDao and ParaSpace, Jpeg'd is building a defi model quite similar to what MarkerDao is doing, which is allowing NFT owners to use NFT to create a new type of asset, pUSD and pETH. To gain strong attraction, Jpeg'd will need to create more utilities for these two types of its assets and from there the attraction for users to this platform will be greater. Let's wait for Jpeg'd's upcoming developments to dominate the race in this NFTFI market.

4. Conclusion

The NFT lending model is becoming an important area of competition in the NFT market. Many projects are competing to find the leader in this field, with different features and incentives to attract investors. Although only in the early stages of NFTFi market development, these are big shots to attract cash flow and prepare for further development in the future. The development of this field will bring many attractive investment opportunities for investors in the NFT market, while also helping to create sustainable development for this market.

Read more:

English

English Tiếng Việt

Tiếng Việt

.jpg)

.jpg)

.jpg)