1. What is Asset Tokenization?

Asset tokenization refers to the process of converting a real-world or digital asset into a digital token that is recorded on a blockchain or distributed ledger. This transformation allows the ownership and rights to the asset to be represented by a token, which can then be traded, transferred, or divided among multiple owners on the blockchain. Tokenization provides a way to make physical and intangible assets more liquid, accessible, and easily tradable, enhancing efficiency in financial markets.

2. Asset Tokenization Process

Tokenizing an asset involves several key steps:

-

Creating a Digital Token: A blockchain or distributed ledger platform is used to create a digital representation of the asset, which is called a token. These tokens can be designed as fungible (each token is identical) or non-fungible (each token is unique).

-

Issuing the Token: The digital tokens are issued to represent fractional ownership of the asset. For example, a piece of real estate worth $1 million might be tokenized into 1,000 tokens, each representing 0.1% ownership in the property.

-

Recording Ownership on the Blockchain: The ownership and transaction history of each token are stored on the blockchain, ensuring that each transaction is transparent and immutable. Blockchain’s decentralized nature ensures that no central authority can alter the record, making ownership verifiable and secure.

-

Trading or Transferring Tokens: Tokenized assets can be traded or transferred through smart contracts, decentralized exchanges (DEXs), or peer-to-peer (P2P) platforms. This provides an opportunity for fractionalized ownership, which is traditionally not possible with physical assets like real estate or artwork.

This process is powered by blockchain technology, which provides a decentralized, transparent, and tamper-resistant ledger. The primary advantages of tokenization include liquidity, fractional ownership, and the ability to trade or access assets on a global scale, 24/7.

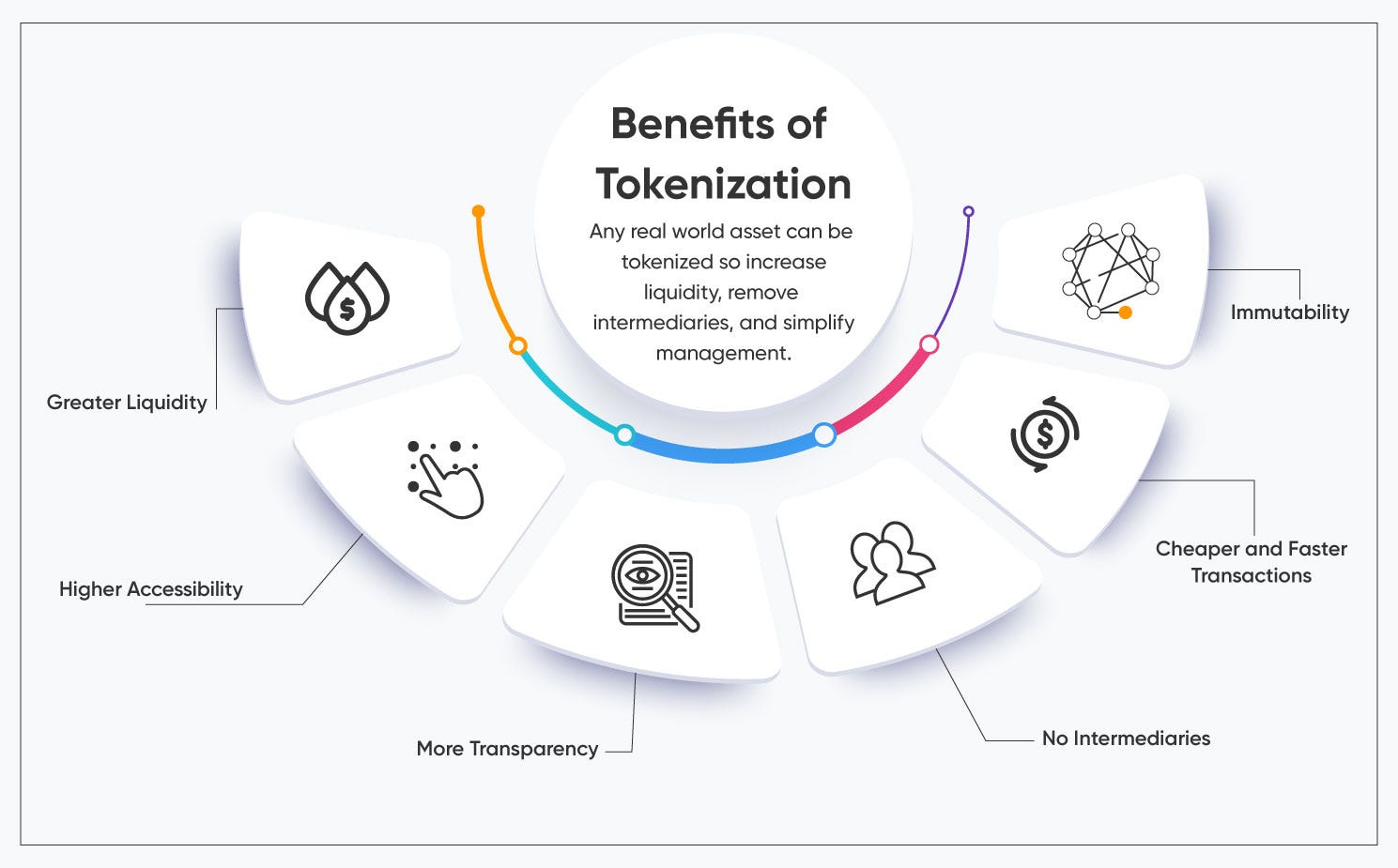

3. Key Benefits of Asset Tokenization

Tokenizing assets offers a broad range of advantages for both asset owners and investors.

3.1 Asset Owner's Perspective

-

Increased Liquidity: Traditional high-value assets, such as real estate, fine art, or private equity, are often illiquid, meaning they can be difficult to sell or trade quickly. Tokenization allows asset owners to break down their assets into smaller, tradable units (tokens), which increases liquidity and opens up the market to more potential buyers.

Example: A luxury property that could take months to sell can be tokenized and sold to hundreds of small investors in days or weeks. -

Fractional Ownership: Tokenization allows the creation of fractional ownership, meaning that asset owners can sell a portion of their asset rather than having to sell it entirely. This enables more people to invest in high-value assets that would otherwise be out of reach.

Example: A collector of rare art could sell 1% of their artwork’s value in tokens, enabling many investors to own a part of the piece. -

Fairer Pricing: Because tokenization enables fractional ownership and trading on a decentralized platform, market forces can establish fairer prices based on real-time demand and supply. The absence of intermediaries or the need for traditional valuation methods can also eliminate illiquidity discounts—the price reductions typically required to sell hard-to-liquidate assets.

-

Reduced Transaction Costs: In traditional markets, transactions often involve several intermediaries such as brokers, lawyers, and notaries, all of which add time and cost. Tokenization simplifies the process and eliminates many of these intermediaries, reducing transaction costs and increasing efficiency.

-

Automation via Smart Contracts: Smart contracts are self-executing contracts with the terms of the agreement directly written into code. Tokenizing an asset allows the use of smart contracts to automate much of the administrative work, including transfers of ownership, dividend payouts, and compliance checks. This automation reduces human error and accelerates transactions.

3.2 From an Investor’s Perspective

-

Access to Traditionally Illiquid Markets: Tokenization opens up previously inaccessible asset classes to a broader group of investors. Assets that were once reserved for institutional investors or high-net-worth individuals—like real estate, venture capital, or private equity—can now be divided into smaller, tradable tokens, making them accessible to retail investors with smaller amounts to invest.

Example: A retail investor could buy tokens representing a share of a commercial building or a share of a movie project that would have been previously limited to accredited investors or venture capital firms. -

Increased Liquidity: Traditional investments often come with lock-up periods, where investors cannot sell their holdings for a set period. Tokenized assets, on the other hand, can be bought and sold at any time, creating a more liquid market. With blockchain-enabled exchanges, assets are available for trade 24/7, unlike traditional financial markets that operate within set hours.

-

Diversification: Tokenization enables investors to diversify their portfolios more easily by allowing them to invest in a wide range of asset classes without needing large capital. With fractional ownership, investors can own small portions of multiple high-value assets, such as real estate, commodities, or art, spreading their risk across a wider array of investments.

-

Transparency and Trust: Blockchain provides a transparent, immutable ledger of all transactions. This means investors can verify ownership, track asset performance, and confirm that no one can alter the records without consent. The transparent nature of blockchain increases trust and reduces the risk of fraud.

-

Instant and Secure Transactions: Transactions on blockchain networks are settled almost instantaneously, and the security of blockchain ensures that the ownership of assets cannot be tampered with. Moreover, digital wallets and encryption protect the identity and assets of investors.

4. Types of tokenized assets

.png)

Tokenization can be applied to a wide variety of assets, and these can generally be classified into fungible and non-fungible categories.

4.1. Fungible Tokens

Fungible tokens are identical in value, meaning that each token represents an equal share of ownership in the underlying asset. They are interchangeable and can be divided into smaller units.

-

Examples of fungible tokenized assets:

-

Real estate (e.g., tokenizing a $1 million property into 1,000 tokens, each representing 0.1% ownership).

-

Commodities (e.g., tokenizing gold, oil, or agricultural products into fungible units).

-

Cryptocurrencies (e.g., Bitcoin, Ether, or other digital currencies).

4.2. Non-Fungible Tokens (NFTs)

Non-fungible tokens are unique and cannot be exchanged on a one-to-one basis. Each NFT represents a specific, one-of-a-kind asset, typically indivisible.

-

Examples of non-fungible tokenized assets:

-

Art and collectibles: Rare artwork, rare trading cards, or digital art.

-

Real estate: Individual properties or specific units within a building.

-

Digital media: Music, videos, or game assets like virtual items or characters.

-

Intellectual Property: Licensing or rights to patents, trademarks, or media rights.

NFTs are often used for digital assets because they can capture unique attributes and metadata associated with the underlying asset, making them ideal for representing digital art, music, and other creative works.

5. Challenges of Asset Tokenization

While asset tokenization offers tremendous benefits, it also faces several key challenges:

-

Regulatory Uncertainty: One of the biggest hurdles to widespread adoption is the lack of clear regulatory frameworks. Laws regarding tokenized assets vary by jurisdiction, and in many cases, regulations are still under development. Some jurisdictions, such as the United States and the European Union, are working on establishing guidelines for tokenized assets, particularly concerning securities laws and taxation.

-

Technology and Integration Challenges: Integrating tokenized assets with the physical world presents a challenge. For example, how can a digital token securely represent ownership of a piece of real estate? Or how can a smart contract account for changes in the value of an asset? Trusted oracles (services that provide real-world data to blockchain networks) are needed to bridge the gap between the digital and physical worlds.

-

Custody and Security: Ensuring the safe storage and management of tokenized assets is critical. If tokens represent physical assets, ensuring their safekeeping, including legal ownership, is important. Cybersecurity also remains a concern, as digital assets are subject to hacking risks.

-

Liquidity and Market Development:The liquidity of tokenized assets depends on the size of the market and the demand for the specific asset. If there is no market for a particular tokenized asset, it may be difficult to sell or trade the token. Developing robust marketplaces and ensuring consistent demand are key to unlocking the full potential of asset tokenization.

6. Conclusion

Asset tokenization is a transformative concept that is revolutionizing the way assets are owned, traded, and managed. By leveraging blockchain technology, tokenization makes assets more accessible, liquid, and divisible, opening up investment opportunities that were previously unavailable to many.

Whether through fungible tokens for fractional ownership or NFTs for unique assets, tokenization is reshaping industries ranging from real estate to art, commodities, and beyond.

Read more:

English

English Tiếng Việt

Tiếng Việt.png)