1. What is Pyth Network (PYTH)?

Pyth Network is an oracle solution that provides high-fidelity, low-latency data built on Solana. Pyth Network is supplying data to over 120 projects with "total value locked" of approximately $2.06 billion.

.jpg)

2. Products

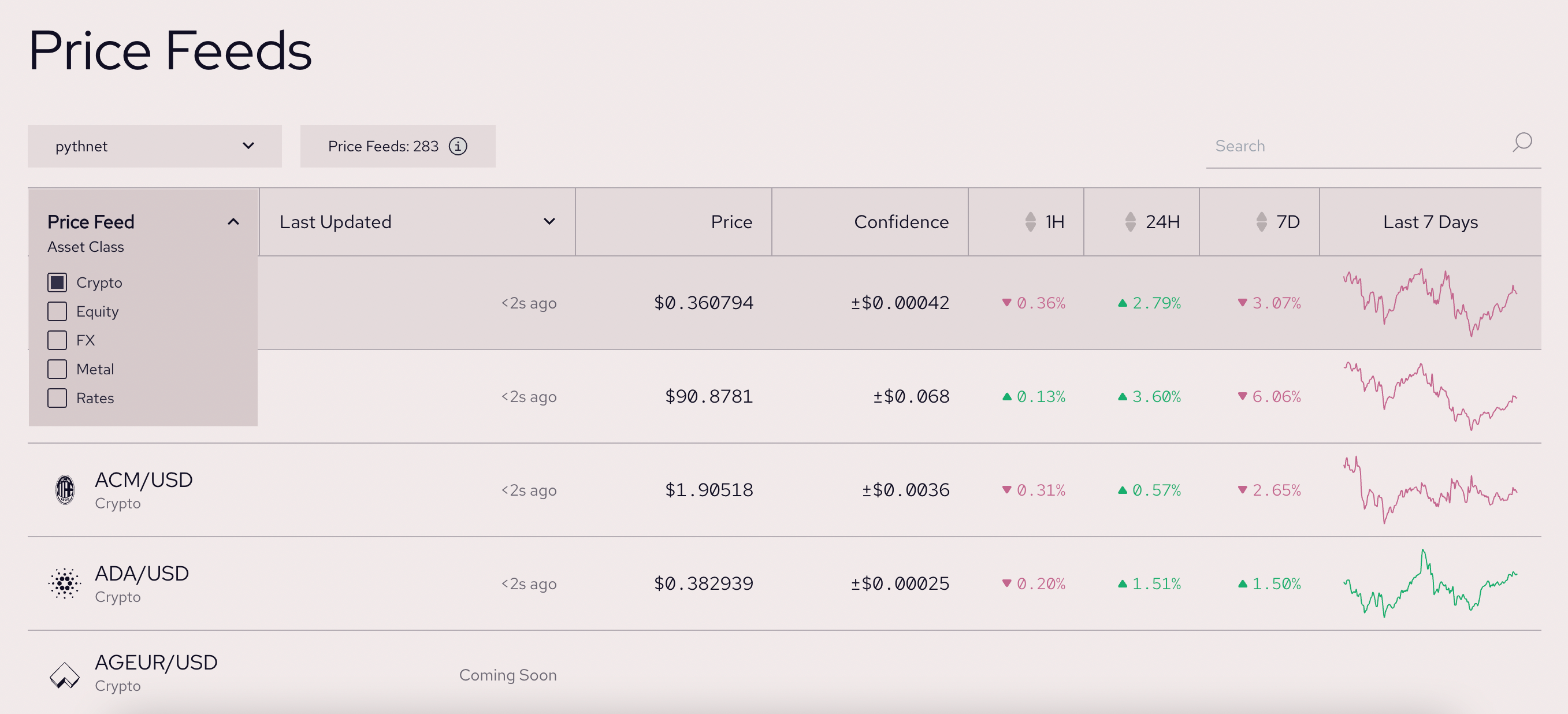

Pyth Network is developing two main products: Price Feeds and Benchmarks.

2.1. Price Feeds

Price Feeds continuously update the prices of various assets across multiple sectors, including crypto, forex, stocks, and commodities, for smart contracts..

Users can access this information for free, and the data is updated quickly and continuously (approximately every 400ms, which equates to 200,000 updates per day).

Price Feeds are divided into two types:

- Solana Price Feeds: Provides price data on the Solana mainnet.

- Pythnet Price Feeds: Provides price data on over 35 different blockchain ecosystems including Ethereum, BNB, Avalanche, Cosmos chains, Aptos, and Sui.

Some standout features of Price Feeds include:

- Secure data: Pyth Network has a data curation system and a set of standards for input data sources, requiring data providers to comply, ensuring the data sent is safe and reliable. Additionally, data sources are derived from reputable entities participating in the markets of traditional finance and crypto.

- Anti-Data copying mechanism: To prevent data providers from copying information and submitting identical prices, Pyth has designed an incentive and reward mechanism for honest data providers.

- Free to use: Pyth's Price Feeds are built on an open-source system, allowing users to access them for free. However, with its unique model, Pyth will soon allow protocols to opt to pay for data to mitigate oracle risk.

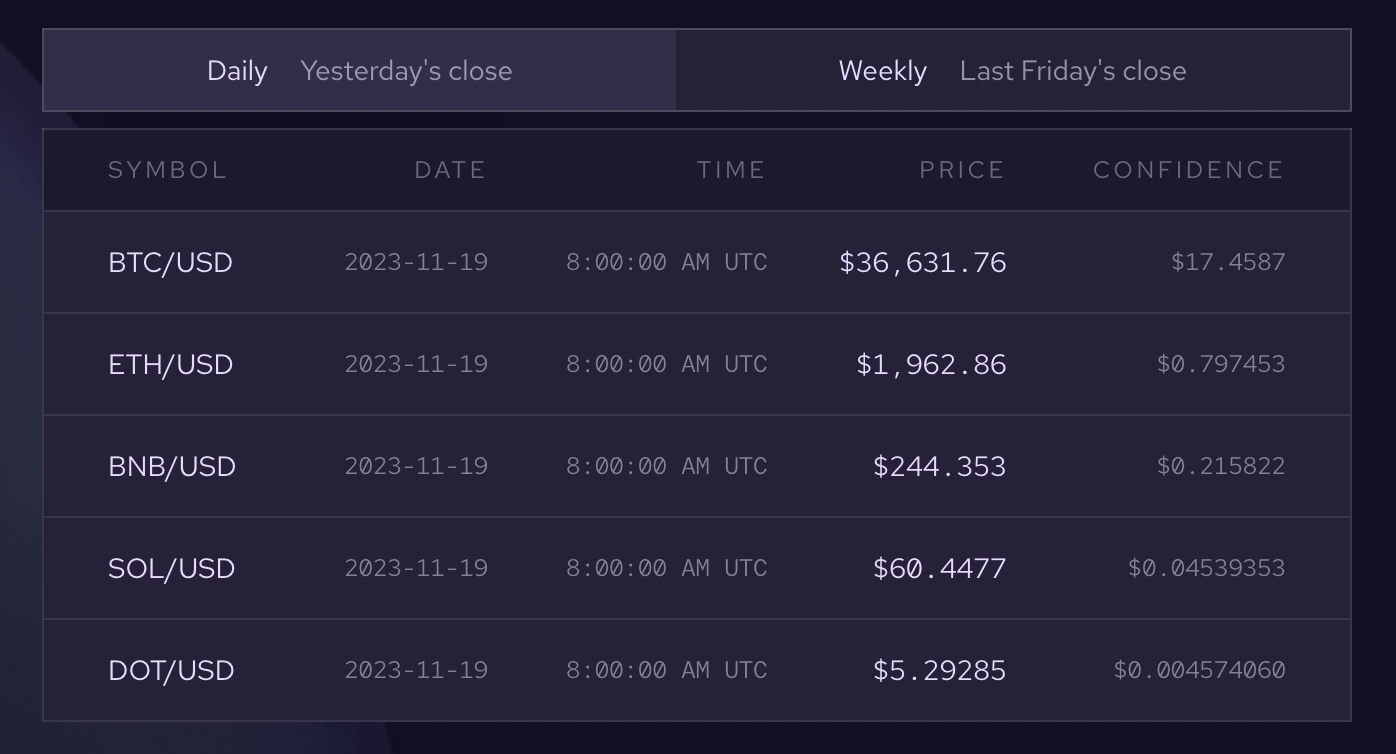

2.2. Benchmarks

Benchmarks from Pyth Network allow decentralized applications or smart contracts to access the data repository of Pythnet Price Feeds.

Example: Applications can retrieve the BTC/USD price from last Friday at 8:00 AM. This price can be used to settle contracts or for any applications that need to access historical price data.

Some features of Benchmarks include:

- Data provided on Benchmarks will be signed and confirmed on-chain to ensure accuracy and security, similar to the data protection mechanism of Price Feeds.

- To maximize the reliability of the Benchmarks API, the system will set limits on data query requests. Each IP address will be limited to a maximum of 30 requests within 10 seconds.

- However, users on TradingView will be allowed to make up to 90 requests within 10 seconds. If the limit is exceeded, the system will issue a 429 (Too Many Requests) response for the next 60 seconds.

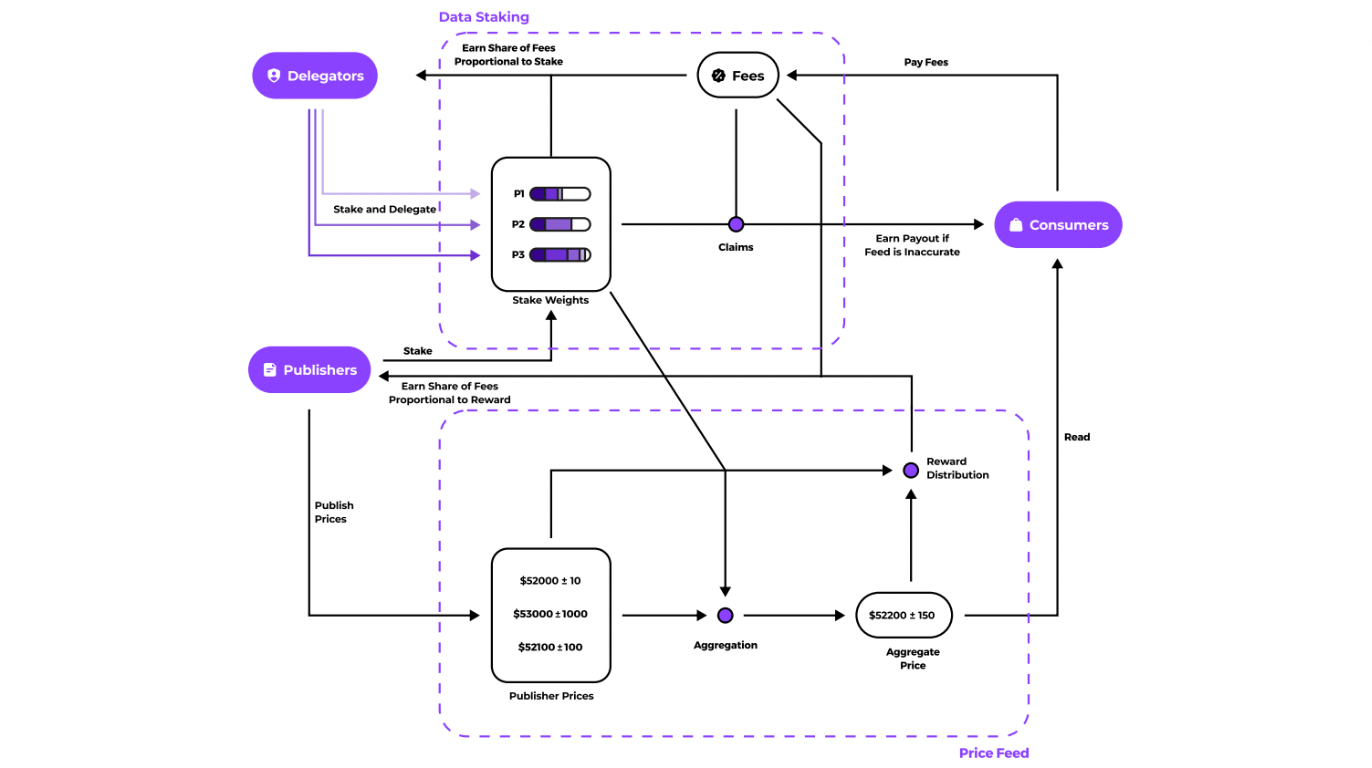

3. The operating mechanism

3.1. The main components in Pyth Network

- Publishers: These are data providers that send price information to Pyth's oracle system. Pyth has multiple data providers for every product to improve the accuracy and robustness of the system.

- Oracle program: This is Pyth's oracle system that combines data from the data providers to produce a single composite price and confidence interval. The oracle system runs on both the Solana mainnet and Pythnet.

- Consumers: These are users who read the price information generated by the oracle program.

3.2. The operational mechanism of Pyth Network

The three components participating in the Pyth Network operate as follows:

-

Oracle Program (price aggregation): It combines prices and confidence levels from data providers to create a robust and stable data source for specific products like BTC/USD. The goal is to reduce the influence of small groups of data providers.

-

Staking data (Data submission): Delegators hold tokens and stake them in the system to earn profits. These Delegators determine the influence of data providers on price data in Pyth. Profits earned on the system are allocated 80% to Delegators and 20% to Publishers.

-

Reward distribution: It determines the reward ratio for each data provider, prioritizing high-quality data sources.

-

Governance: Utilizes a voting system to decide on important parameters such as the type of token used for data fees, listed products, data fee allocation, the amount of PYTH tokens staked, and decisions regarding products.

4. Team

5. Investors and partners

5.1. Investors

Pyth Network has raised funding in 3 rounds from Tagus Capital, CTC Venture Capital, and GBV Capital with an undisclosed amount.

5.2. Partners

- Pyth Publishers: AlphaLab, Altonomy, Amber, Auros Global, Binance, Bitmart, Bitso, Bitstamp, BTSE, Bybit, CMS, Coinshares, Cumberland DRW, DWF Labs, Flowdesk, Galaxy Digital, Gate, Gemini, HRTC, Huobi, Jane Street, Jump, Kronos, Kucoin, MEXC, OKX, Orca, QCP, Raydium, Selini Capital

Learn more at: https://pyth.network/publishers

- Pyth Users: TradingView, Synthetix, Venus Protocol, Hashflow, Kwenta, Polynomial, Helium, Drift, Zeta, RibbonFi

Learn more at: https://pyth.network/consumers

6. Tokenomics

6.1. Token Informations

- Token Name: Pyth Token

- Symbol: PYTH

- Blockchain: Solana

- Token Standard: SPL

- Contract: Updating…

- Token Type: Updating…

- Total Supply: 10,000,000,000 PYTH

- Total Supply at TGE: 1,500,000,000 (15%)

6.2. Token features

- Governance: Participate in voting rights regarding protocol changes

- Fees: Determine the scale of fees on the platform

- Rewards: Reward data providers, delegators

6.3. Token allocation

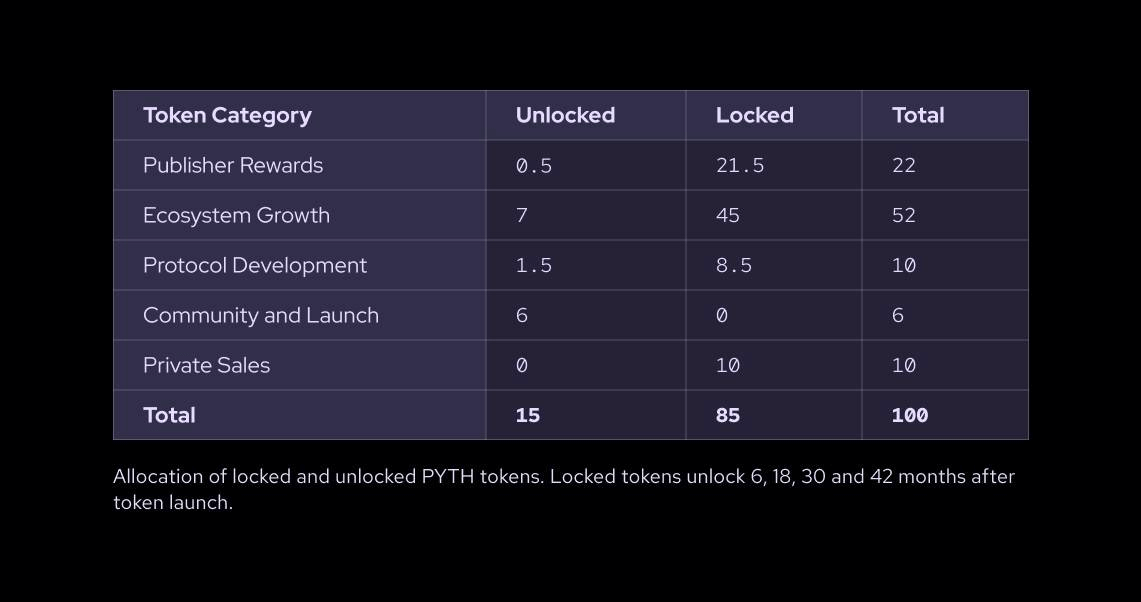

- Publisher rewards: 22% - Unlocking 0.5% at TGE and the remaining 21.5% unlocked gradually over time.

- Ecosystem development: 52% - Unlocking 7% at TGE, the remaining 45% unlocked gradually over time.

- Protocol development: 10% - Unlocking 1.5% at TGE, the remaining 8.5% unlocked gradually over time.

- Community: 6% - Entire 6% unlocked at TGE.

- Private sales: 10% - Not unlocked at TGE, unlocking 10% over time.

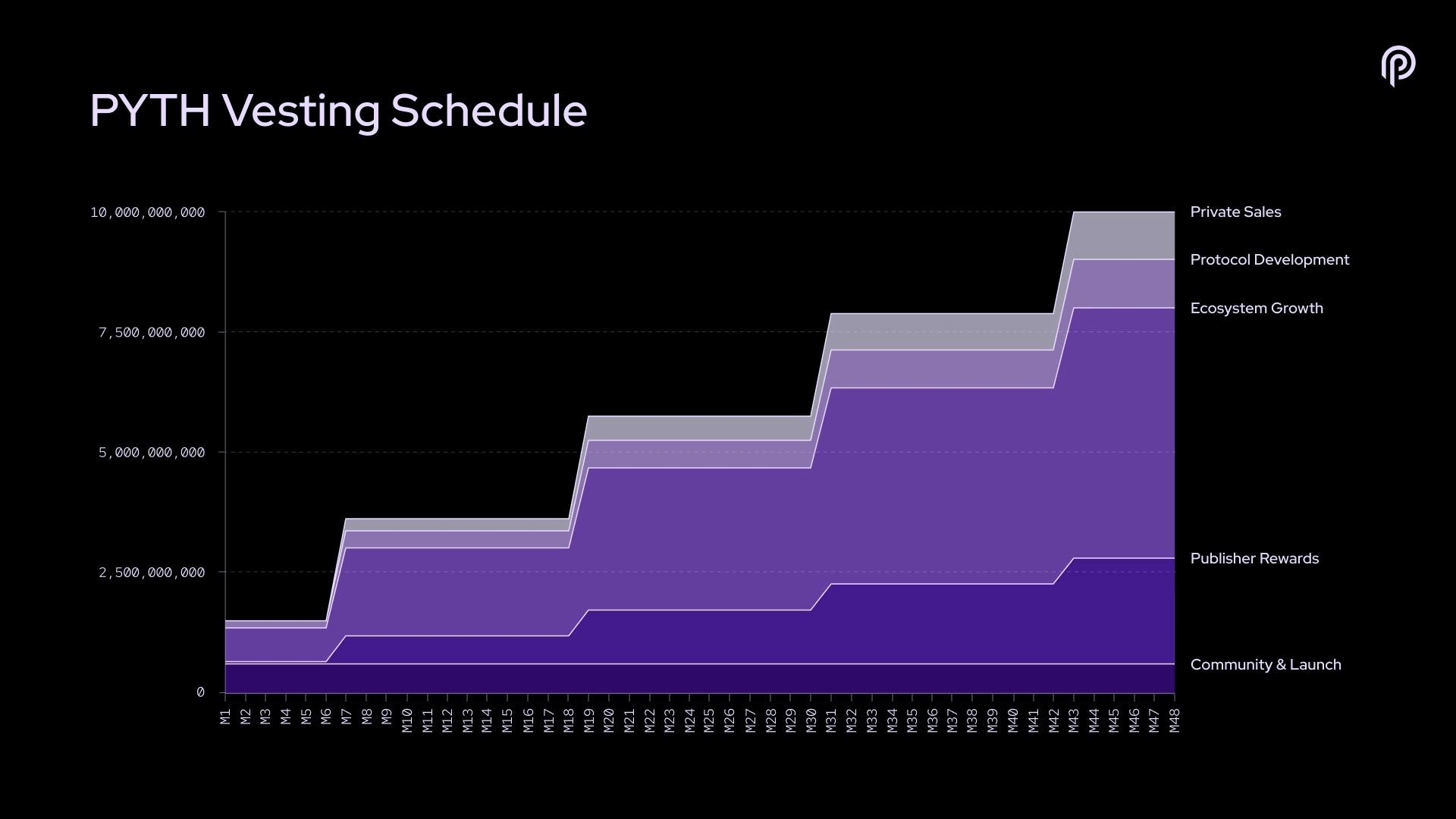

6.4. Token payment schedule

7. Pyth Network's airdrop information

Eligible users receiving the airdrop from Pyth Network will be allocated rewards in the $PYTH token (6% of total supply, equivalent to 600M $PYTH). The allocation ratio is as follows:

- Active DeFi users on dapps using Pyth (255M $PYTH)

- Active community members (10M $PYTH)

- Dapps using Pyth (100M $PYTH)

Users can check if they have received Pyth Network airdrop at: https://airdrop.pyth.network/

8. Project information

- Website: https://pyth.network/

- X (Twitter): https://twitter.com/PythNetwork

9. Similar projects

Pyth Network has similar operational model to some projects such as:

- Chainlink

- TWAP

- Internal

- DIA

- Band

10. Conclusion

Pyth Network is experiencing rapid growth in the oracle fieldby supporting over 40 blockchains, including both EVM and non-EVM blockchains. Currently, in the oracle field, Chainlink still holds the top position. However, Pyth Network's approach to non-EVM blockchains is gradually expanding its market share. The platform supports over 120 projects with assets secured valued at over $2 billion USD and is poised for further expansion in the future."

Read more:

English

English Tiếng Việt

Tiếng Việt

.jpg)

.jpg)

.jpg)