1. What Is the Annual Percentage Rate (APR)?

Annual Percentage Rate (APR) refers to the total yearly interest charged to borrowers or earned by investors, expressed as a percentage. It includes both the interest rate and any associated fees or costs, but does not account for compound interest. This makes APR a straightforward way for consumers to evaluate and compare loan and investment products.

When it comes to loans, APR represents the cost of borrowing money, and it helps consumers understand the overall cost of a loan over its term. In the context of investments, APR indicates the income earned on the principal without considering how interest compounds over time.

2. How Does APR Work?

APR works by calculating the interest percentage of the loan principal over the course of a year. It takes into account factors such as monthly payments, fees, and the loan’s term. However, APR does not consider compounding within the year. This makes it a useful tool for comparing loans and credit products, but it may not always fully reflect the cost of a loan, particularly when interest compounds frequently.

For instance, the APR on a loan or investment may be calculated by multiplying the periodic interest rate by the number of periods in a year (e.g., monthly payments x 12 months). This provides a simple yearly interest percentage, which borrowers and investors can use to compare similar financial products.

3. How Is APR Calculated?

APR is calculated using a straightforward formula:

Where:

-

Fees: The total fees paid over the term of the loan.

-

Interest: The total interest paid over the life of the loan.

-

Principal: The original loan amount.

-

n: The number of days in the loan term.

This formula shows how APR represents the cost of borrowing, factoring in fees and interest paid over time. It’s important to remember that APR doesn't include compound interest, so it may not always accurately represent the true cost of loans with frequent compounding periods.

4. Types of APRs

.jpg)

APR, or Annual Percentage Rate, is a crucial term in the world of finance that indicates the total cost of borrowing on an annual basis, including interest and any additional fees. There are several types of APRs, each designed for specific financial products and with different implications for borrowers. Understanding these types can help you make more informed decisions when taking out a loan, using a credit card, or engaging in other forms of borrowing.

-

Fixed APR: A Fixed APR means that the interest rate remains constant for the entire term of the loan or credit agreement. This type of APR provides borrowers with stability, as the interest charges won’t fluctuate, making it easier to predict monthly payments. Fixed APRs are commonly used for personal loans, mortgages, and some credit card offers.

-

Variable APR: A Variable APR, on the other hand, fluctuates with changes in an underlying benchmark interest rate, such as the prime rate. This means that the interest rate can increase or decrease during the term of the loan or credit agreement. While this type of APR may start off lower than a fixed APR, it carries the risk of rising over time, which could lead to higher monthly payments. Variable APRs are commonly found in credit cards and some types of home equity loans.

-

Promotional APR: Promotional APRs are typically offered as introductory rates to attract new customers. These rates are often significantly lower than standard APRs, but they are only available for a limited time—usually ranging from six months to a year. After the promotional period ends, the APR may increase to the regular rate. Promotional APRs are commonly offered on credit cards and sometimes on loans, particularly to encourage new customers to apply.

-

Penalty APR: A Penalty APR is a higher interest rate applied if you miss payments, make late payments, or violate other terms of your agreement. This type of APR can significantly increase your total debt and is commonly used by credit card issuers to penalize borrowers for late or missed payments. It's essential to keep track of your payments to avoid this higher rate, which can remain in effect for a long period.

-

Cash Advance: APR A Cash Advance APR is the interest rate applied when you withdraw cash using your credit card. Typically, cash advance APRs are higher than regular purchase APRs, and there’s no grace period for repayment, meaning interest starts accruing immediately. In addition, cash advances may come with additional fees, further increasing the cost of borrowing.

-

Introductory APR: An Introductory APR is similar to a promotional APR but specifically refers to the rate offered at the beginning of a new credit card agreement. It’s often offered as a way to entice new customers, typically at 0% for purchases and sometimes balance transfers. This low rate usually lasts for a short introductory period, after which the APR increases to the standard rate.

5. APR vs. Annual Percentage Yield (APY)

While both APR and APY are used to measure the cost or return on financial products, they differ in how they account for interest. APR is based solely on simple interest, while APY accounts for the effects of compounding interest. As a result, the APY is often higher than the APR.

For example, if a loan has an APR of 12%, but interest is compounded monthly, the effective interest rate over the course of the year would be slightly higher due to the compounding effect. This difference is captured in the APY, which provides a more accurate measure of how much you’ll pay in interest over time.

To calculate APY, you can use the following formula:

Where n is the number of compounding periods per year.

6. APR vs. Nominal Interest Rate vs Daily Periodic Rate

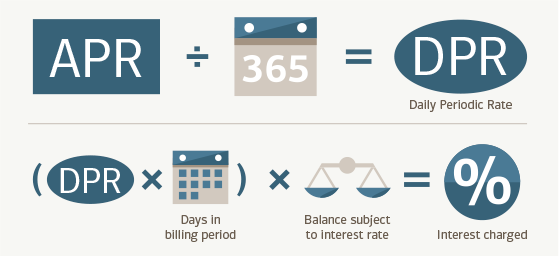

Understanding the differences between APR, nominal interest rate, and daily periodic rate can help borrowers make better financial decisions:

-

Nominal Interest Rate: This is the stated interest rate on a loan, not including any fees or other charges. It may not reflect the true cost of borrowing when additional fees are factored in.

-

Daily Periodic Rate (DPR): This is the interest charged on a loan balance daily. It is calculated by dividing the APR by 365, and is used by lenders to determine the daily interest charge on outstanding balances.

-

APR: APR reflects the total annual cost of borrowing, including both interest and any applicable fees. It provides a more comprehensive view than the nominal interest rate, but does not include compounding.

7. Disadvantages of APR

.jpg)

While APR is a valuable tool for comparing financial products, it does have its drawbacks:

-

Underestimation for Short-Term Loans: APR assumes that loans are paid back over a long period of time. For short-term loans, the APR might not reflect the true cost because fees and interest are spread thin over a shorter repayment term.

-

Adjustable-Rate Mortgages (ARMs): APR estimates for ARMs can be misleading, as they assume a constant interest rate. If the interest rate changes over time, the APR may not accurately represent the true cost of the loan.

-

Hidden Fees: Some lenders may not include certain fees, such as late fees or one-time charges, in their APR calculations. This can make it harder for consumers to make accurate comparisons.

8. Conclusion

APR provides an essential snapshot of the cost of borrowing or the return on investment over the course of a year. However, it has its limitations, especially when interest compounds or in cases where fees are not fully included in the calculation. While it is a useful tool for comparing different financial products, borrowers and investors should also consider other factors, such as APY, to get a clearer picture of the true financial impact.

By understanding how APR works, its advantages and disadvantages, and how to calculate it, you can make more informed decisions when it comes to loans, credit cards, and investment products. Always be sure to ask about all the fees involved and read the fine print before committing to any financial agreement.

Read More:

English

English Tiếng Việt

Tiếng Việt.png)

.jpg)