1. Review the whitepaper of cryptocurrency projects

The whitepaper is the cornerstone of any cryptocurrency project. It contains crucial details about the project’s goals, technology, and the problem it seeks to solve. A reputable cryptocurrency project will have a well-drafted whitepaper that explains its purpose, technical architecture, and tokenomics.

What to Look For:

-

Clear Vision: A good whitepaper should define the problem the cryptocurrency aims to solve and explain how the blockchain and tokens will work.

-

Technical Details: Pay attention to how the blockchain operates, the consensus mechanism (like Proof of Work or Proof of Stake), and how transactions are processed.

-

Transparency: Legitimate projects provide concrete details about their technology and development plans. Be wary of vague or unprofessional whitepapers, as they can indicate a potential scam.

For example, Solana’s whitepaper clearly explains the blockchain’s functionality and its token's role in the ecosystem. In contrast, projects like Cybertruck’s whitepaper are essentially marketing tools with no technical content.

2. Research the team behind the project

A cryptocurrency’s success largely depends on the experience and credibility of its development team. Before investing, research the founders, software developers, and project managers involved.

What to Look For:

-

Professional Experience: Check the team members’ backgrounds on LinkedIn or the project's official site. A team with prior experience in blockchain development or other successful tech ventures is a positive indicator.

-

Public Disclosure: A trustworthy team will be transparent about their identities and qualifications. If the team is anonymous or has no track record, that could be a red flag.

The credibility of the team behind the project can have a significant impact on the project's success. Experienced teams with proven track records are more likely to deliver on their promises.

3. Learn about the Leadership

The leadership of a cryptocurrency project is crucial to its execution, marketing, and overall success. A strong, reputable leadership team can increase a project's chances of thriving in the competitive crypto space.

What to Look For:

-

History of Success: Do the leaders have a history of successful ventures in tech or crypto?

-

Reputation: Are they respected in the cryptocurrency community, or do they have any negative past that could affect their credibility?

-

Public or Anonymous: Some projects with anonymous founders have succeeded (like Bitcoin), but it's essential to evaluate whether their anonymity is justified.

By researching leadership, you can gain insights into the project's future direction and potential for success.

4. Get to know the Crypto Community

Cryptocurrency projects are often community-driven, and a strong, supportive community can propel a project to success. Engaging with a project's community helps you gauge the project’s legitimacy and potential growth.

What to Look For:

-

Active Engagement: Join social media platforms such as Discord or Telegram to interact with other users and developers.

-

Genuine Discussion: A legitimate community will engage in discussions about the technology, challenges, and ways to improve the project.

-

Avoiding Hype: If the community only discusses price speculation or promotes hype, this could indicate a lack of genuine value.

A well-organized community is an excellent sign that the cryptocurrency has a loyal following, increasing its chances of growth and adoption.

5. Understand the Technology

While you don’t need to be a blockchain expert, it’s essential to have a basic understanding of how the cryptocurrency operates and how the blockchain works. Understanding the technology behind a cryptocurrency will help you assess its utility and potential use cases.

What to Look For:

-

Blockchain Structure: Does the project use an existing blockchain (like Ethereum) or a unique one? Understand how the blockchain supports the token's utility.

-

Transparency: Can you understand how the system works, even if you're not a programmer? Clear explanations are a good sign that the project is well-thought-out.

If you find it difficult to grasp how the blockchain functions or if the information is overly technical, it might be a sign of a project lacking proper technical foundation.

6. Understand the vision of the project

Every cryptocurrency should have a well-defined vision that explains its purpose, how it intends to achieve its goals, and the problems it plans to solve. A clear vision shows that the project has long-term potential and a roadmap to success.

What to Look For:

-

Problem Solving: Does the cryptocurrency address a real-world problem? A good project will have a clear value proposition and use case for its token.

-

Clear Goals: A solid project will outline measurable goals with specific timelines. Vague or overly ambitious claims like "cryptocurrency is the future" without clear context can be a red flag.

If the vision and purpose aren’t clear, it’s best to be cautious before investing.

7. Review the Roadmap

A roadmap is a timeline of the project's milestones and development phases. It helps investors track the project's progress and understand what goals the team plans to achieve in the future.

What to Look For:

-

Clear Milestones: A credible roadmap will have well-defined goals with realistic timelines.

-

Ongoing Updates: Check for regular updates and adjustments to the roadmap as the project evolves.

-

Avoid Generic Timelines: A roadmap that only focuses on money raised or vague milestones can indicate a lack of direction.

The roadmap is a key tool to assess whether the project is moving in the right direction and can meet its goals on time.

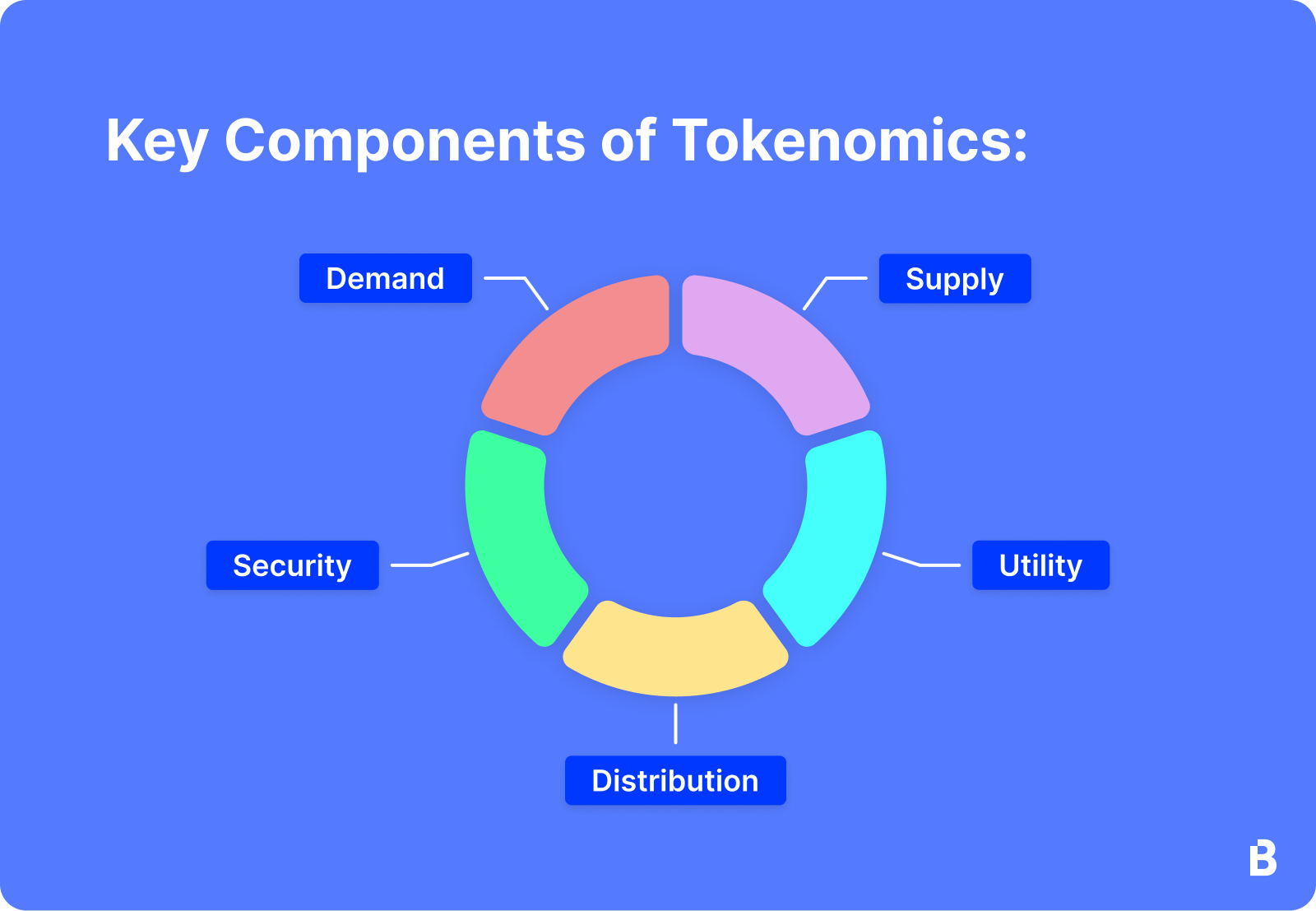

8. Learn about the Tokenomics

Tokenomics refers to the economic model of a cryptocurrency, including how the tokens are distributed, used, and how the supply impacts its price. Understanding tokenomics helps investors evaluate the project’s sustainability and potential for growth.

What to Look For:

-

Circulating Supply: The amount of cryptocurrency currently in circulation.

-

Total Supply: The total amount of cryptocurrency, including those that are burned or removed from circulation.

-

Maximum Supply: The maximum number of tokens that will ever be issued.

By understanding tokenomics, you can gauge whether the cryptocurrency’s price will increase due to scarcity or if inflationary pressures may reduce its value over time.

9. Review the Data

The value of cryptocurrencies is volatile, often experiencing wild swings in price. Reviewing price data and market trends helps you understand how the cryptocurrency has performed in the past and how external factors could affect its price in the future.

What to look for:

-

Price Trends: Historical data helps you understand the cryptocurrency's market behavior and price fluctuations.

-

External Influences: Cryptocurrency prices often react to news, events, and market sentiment, so pay attention to external factors that could influence the price.

A volatile price may indicate speculative trading, while steady growth signals a stronger long-term investment.

Conclusion

Evaluating and analyzing cryptocurrency is essential to making informed investment decisions. By carefully considering factors like the whitepaper, team, leadership, community, technology, vision, roadmap, tokenomics, and data, you can assess whether a cryptocurrency project is legitimate and has long-term potential. Always perform due diligence and seek advice from financial experts if needed before investing in any cryptocurrency.

Read more:

English

English Tiếng Việt

Tiếng Việt.png)

.jpg)

.jpg)

.jpg)