1.Understanding leverage trading

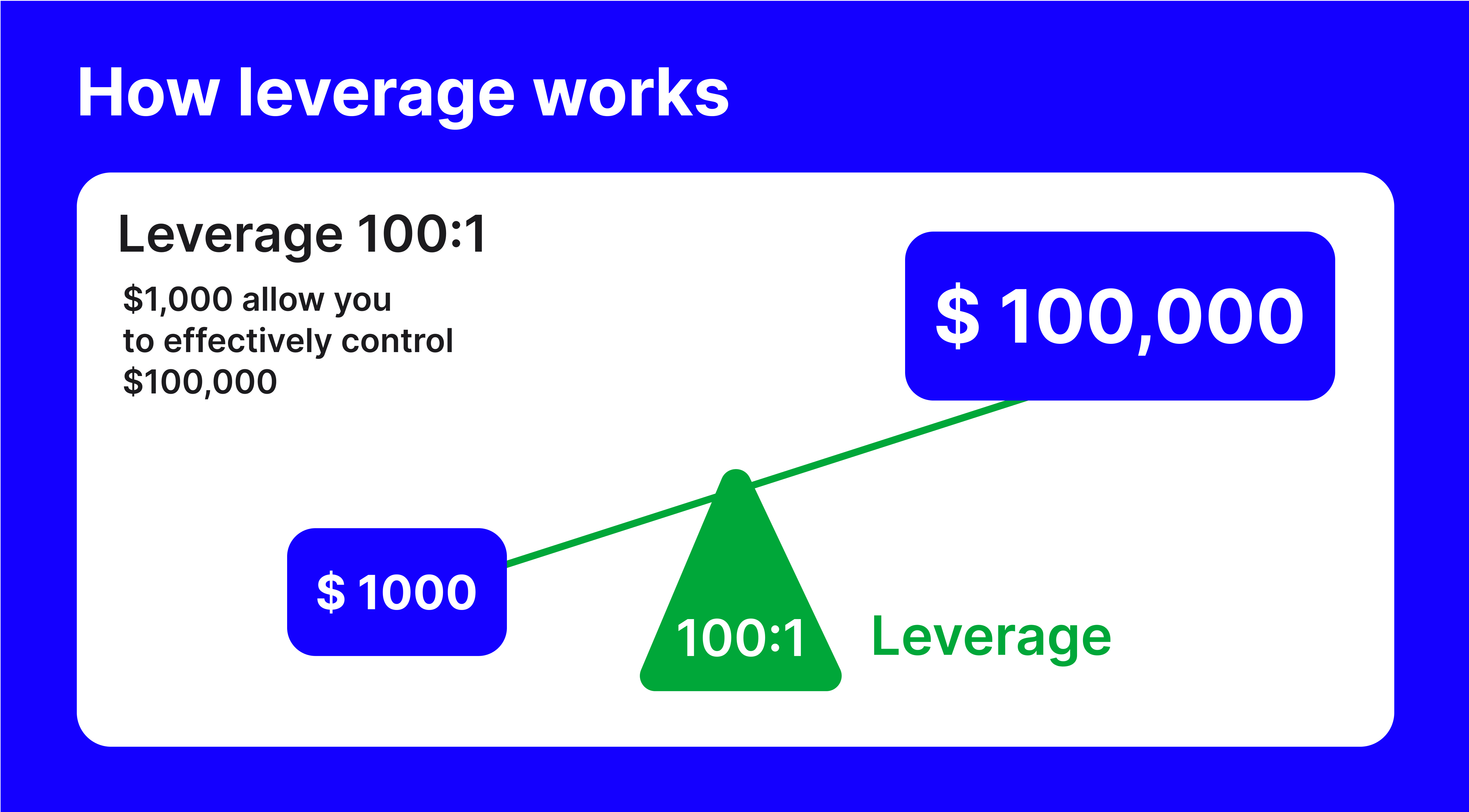

Leverage in cryptocurrency trading works by allowing you to trade with borrowed funds while using your capital as collateral, also known as margin. For example, if you choose a 10:1 leverage ratio, this means you can control a position ten times larger than your initial investment. Your margin is the percentage of the trade's total value that you provide upfront, while the remaining funds are loaned to you by the trading platform.

The critical feature of leverage trading is that your profit or loss is calculated on the total value of the position, not just the margin. While this amplifies the potential returns, it also magnifies the risks. Let’s dive into a detailed example to understand how it works.

2. How leverage works in cryptocurrency markets?

Leverage trading in crypto involves a deposit called margin, which is a fraction of the total trade value. This margin acts as collateral, while the exchange or platform lends you the remaining amount to open a position of a much larger size.

Your profits or losses are then calculated on the total size of the leveraged position, not just the margin. The ratio between your total position size and the margin is called the leverage ratio (e.g., 5:1, 10:1, or 100:1).

3. Example for operation of leverage

Let’s illustrate with a practical example:

Imagine you believe the price of Bitcoin (BTC) will rise. BTC is currently trading at $25,000, and you have $1,000 to trade. Here’s how leveraged trading would work:

-

Unleveraged trade:

Without leverage, you can buy 0.04 BTC ($1,000 / $25,000). If BTC’s price increases to $30,000 (a 20% gain), your position is now worth $1,200. Your profit would be $200 (20% of $1,000). -

Leveraged trade with 10:1 leverage:

Using 10:1 leverage, your $1,000 margin allows you to control a position worth $10,000 (0.4 BTC). If BTC’s price rises to $30,000, your position’s value becomes $12,000. After repaying the borrowed amount, your profit is $2,000—a 200% return on your $1,000 margin. -

Leveraged trade with a 20% price drop:

However, if BTC’s price falls by 20% to $20,000, your position’s value drops to $8,000. Since you borrowed $9,000 to open the position, you would lose $2,000—double your initial margin.

4. Risks associated with leverage trading

While leverage trading can generate significant profits, it also comes with heightened risks. Cryptocurrency markets are highly volatile, and even small price fluctuations can lead to substantial gains or losses. Traders must be prepared to manage these risks effectively:

-

Liquidation risks:

If the market moves against your position, the platform may liquidate your assets to recover the borrowed funds. The level at which this occurs depends on your leverage ratio and the platform’s requirements. -

Unpredictable volatility:

Cryptocurrencies are known for sudden and unpredictable price movements. A sharp price drop could trigger a margin call or liquidation before you have a chance to react. -

Emotional decision-making:

The amplified stakes in leveraged trading can lead to emotional decision-making, such as panic-selling or over-trading, which can further increase losses.

5. Key points about leverage in crypto trading

-

Amplified profits and losses:

While leverage magnifies gains, it also amplifies losses. In highly volatile markets like cryptocurrency, a small price movement can result in significant profit or loss. -

Liquidation risk:

Most crypto platforms have a liquidation threshold. If your losses approach your margin amount, the platform may liquidate your position automatically to recover the borrowed funds. For instance, if you used 10:1 leverage, a 10% price drop could wipe out your margin. -

Margin calls:

If your position is nearing liquidation, the platform might issue a margin call, asking you to deposit additional funds to keep the position open. -

Managing risk:

Use tools like stop-loss orders and careful position sizing to limit potential losses.

6. Tips for Successful Leverage Trading

Leverage trading in crypto markets offers the potential for substantial gains but comes with significant risks. To trade successfully, start with low leverage ratios (e.g., 2x or 5x) and always use stop-loss and take-profit orders to manage risk. Diversify your positions to avoid concentrating funds on a single trade and maintain a buffer in your account to prevent liquidation during market swings. Familiarize yourself with margin requirements on your platform and avoid over-leveraging, as crypto’s volatility can lead to substantial losses. Develop a clear trading strategy with defined entry and exit points, and stick to it to avoid emotional decision-making.

Focus on risk-reward ratios, such as 1:3, and use technical analysis to identify market trends and key levels. Keep a trading journal to learn from past trades and refine your strategy. Be cautious during periods of extreme volatility and account for platform fees that could impact profitability. Most importantly, never trade with money you cannot afford to lose. By combining disciplined risk management, informed decision-making, and patience, you can navigate the high-stakes world of leverage trading more effectively.

7. Conclusion

Leverage trading in cryptocurrency markets is a powerful tool that can enhance potential profits but also magnify risks. Understanding how leverage works, practicing risk management, and maintaining emotional discipline are essential for navigating this high-stakes strategy. By approaching leverage trading with caution and preparation, you can take advantage of the opportunities it offers while minimizing potential downsides.

Read more:

English

English Tiếng Việt

Tiếng Việt.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)