1. What is Liquidation in Crypto?

Crypto liquidation refers to the process of closing a leveraged trading position by converting a cryptocurrency asset into cash or stablecoins. This typically occurs when the trader can no longer meet the margin requirements, and the position is forcibly closed, often at a loss. Liquidation can be triggered voluntarily by the trader or involuntarily by the broker or exchange.

In cryptocurrency, liquidation is often seen in futures trading, where a trader borrows funds to amplify their position. If the value of the asset moves in the opposite direction of the trade, the trader may not have enough funds to maintain the position, resulting in liquidation.

2. Types of Crypto Liquidation

There are two primary types of liquidation in cryptocurrency trading:

-

Voluntary Liquidation: Voluntary liquidation happens when the trader decides to close their position to minimize losses. This may be a proactive decision to salvage capital before losses worsen. In some cases, this may involve partial liquidation, where only a portion of the position is closed to avoid total loss.

-

Forced Liquidation: Forced liquidation occurs when the exchange or broker closes the trader's position to prevent further losses and protect their capital. This happens when the trader’s margin balance falls below the required maintenance margin. Forced liquidation may lead to a total liquidation, where the entire position is sold off, and the trader loses their initial margin.

3. How does Crypto Liquidation happen?

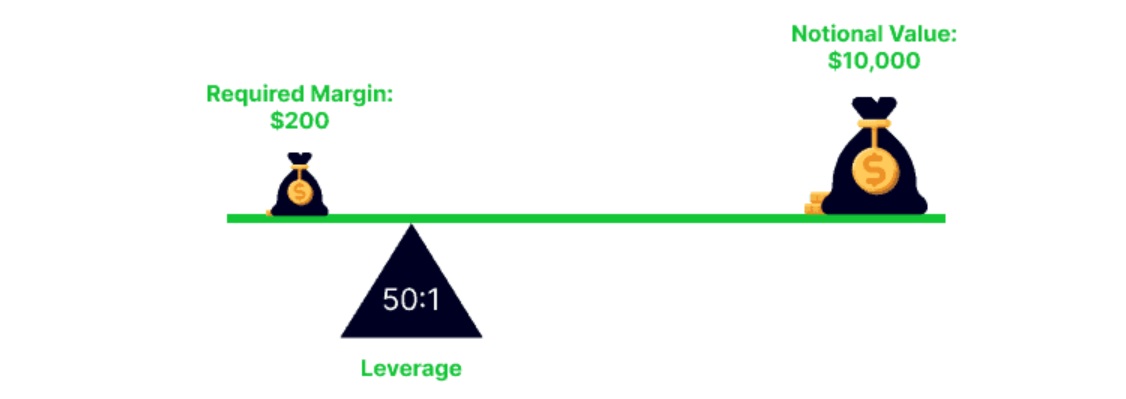

Liquidation in cryptocurrency trading is typically triggered when a trader’s margin balance falls below a specific threshold. In futures trading, leverage allows traders to control larger positions, but it also amplifies both potential gains and losses. If the market moves against the trader’s position and the margin is insufficient to cover the losses, the position is automatically closed to avoid further risk.

There are two common scenarios for liquidation:

-

Partial Liquidation: Occurs when the trader opts to close a portion of their position to preserve some capital. This can be voluntary or based on contract terms.

-

Total Liquidation: Happens when the position is completely closed by the exchange or broker due to a lack of margin, often resulting in the trader losing their entire investment.

4. Factors That Influence Liquidation

Several factors can lead to liquidation in crypto trading:

-

Market Volatility: The cryptocurrency market is known for its high volatility. Large price swings can result in sudden changes to a trader’s position, making liquidation more likely.

-

Margin Trading Risks: When using margin trading (borrowing funds to trade), the trader is required to maintain a certain margin ratio. If the balance falls below this threshold, the position will be liquidated to protect the lender (exchange or broker).

-

Liquidity: In highly liquid markets, liquidation may occur more smoothly, but in less liquid markets, forced liquidation can have a larger impact on prices and could result in larger losses.

5. How to prevent Liquidation in Crypto Trading?

To minimize the risk of liquidation, traders can adopt several strategies to manage their positions effectively:

- Set Stop-Loss Orders: A stop-loss order is an automatic instruction to sell an asset when it reaches a predetermined price. By setting a stop-loss, traders can limit their losses and reduce the chances of liquidation. However, it’s important to note that stop-loss orders do not guarantee complete protection in volatile markets, where price fluctuations may happen rapidly.

- Maintain a Sufficient Margin Balance: Regularly monitor your margin balance to ensure it is sufficient to maintain your leveraged position. If the margin balance falls below the maintenance level, the position could be liquidated. A good practice is to always keep some extra margin in your account as a buffer against market fluctuations.

- Risk Management and Position Sizing: Traders should only risk a small percentage of their capital per trade (typically 1-3%). By controlling position sizes and avoiding excessive leverage, you can reduce the likelihood of liquidation and protect your overall portfolio.

- Use Conservative Leverage: The higher the leverage, the higher the risk. By using lower leverage, traders can decrease the potential for liquidation. A safer approach is to use leverage conservatively, allowing more room for market fluctuations without triggering liquidation.

- Regularly Monitor Market Conditions: Keep an eye on the market and be aware of any major price movements or events that could affect your positions. In volatile markets, it may be prudent to close or reduce leveraged positions to limit exposure.

6. Conclusion

Crypto liquidation is an inevitable risk that traders face, especially when using leverage. Understanding how liquidation works and employing strategies such as stop-loss orders, maintaining a sufficient margin balance, and practicing good risk management can help minimize this risk.

While liquidation cannot be completely avoided, these strategies can reduce its likelihood and help traders navigate the unpredictable cryptocurrency market more effectively. Always remember, the best way to avoid liquidation is to trade responsibly and never invest more than you can afford to lose.

Read More:

English

English Tiếng Việt

Tiếng Việt.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)