1. Why implement Retroactive strategies on the Sui network?

Retroactive signifies the distribution of tokens to users who actively participated in and experienced projects during their early phases.

Beyond serving as a marketing initiative, this approach is also a chosen method by exchanges and projects to educate users about their offerings and functionalities.

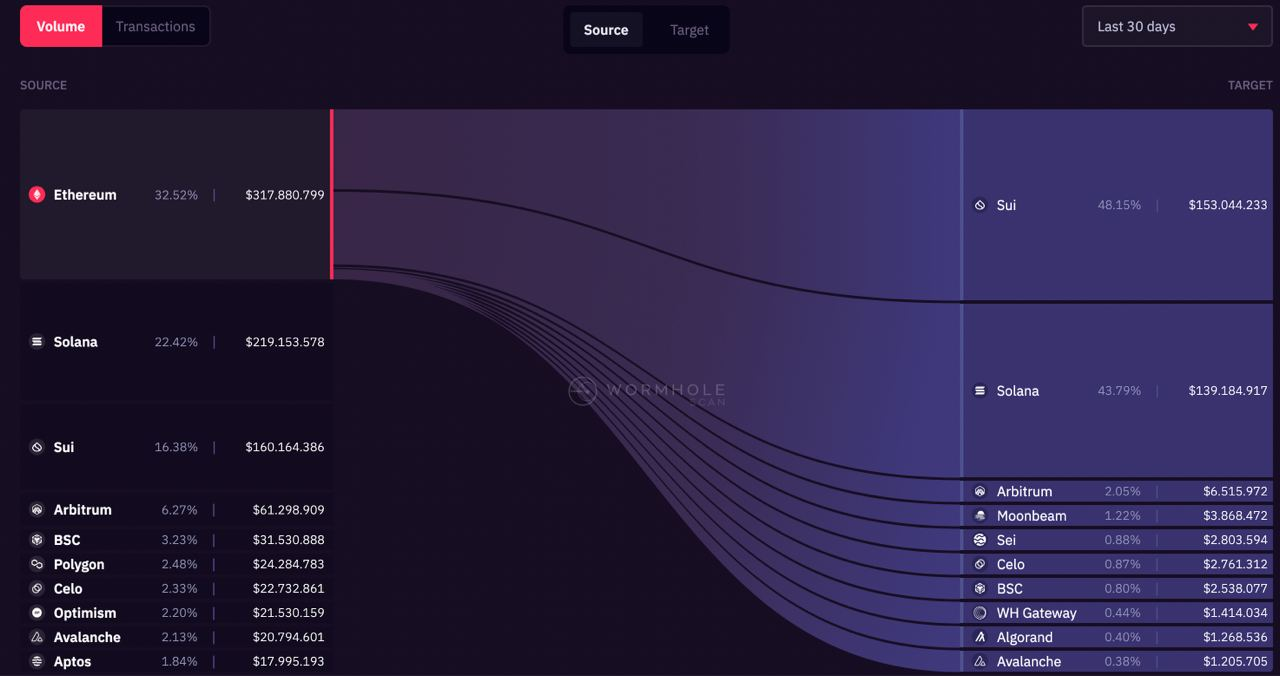

According to data from Wormhole, the majority of funds transferred from the Ethereum network to Sui constitute 48.15%, surpassing even Solana. The Total Value Locked (TVL) within the Sui network has witnessed remarkable growth. The TVL for Sui has surged nearly 20 times, reaching an impressive $293 million within 5 months.

These data highlight that the current period is favorable for exploring retroactive strategies within this ecosystem.

2. Opportunity to make profits from the previous Sui system

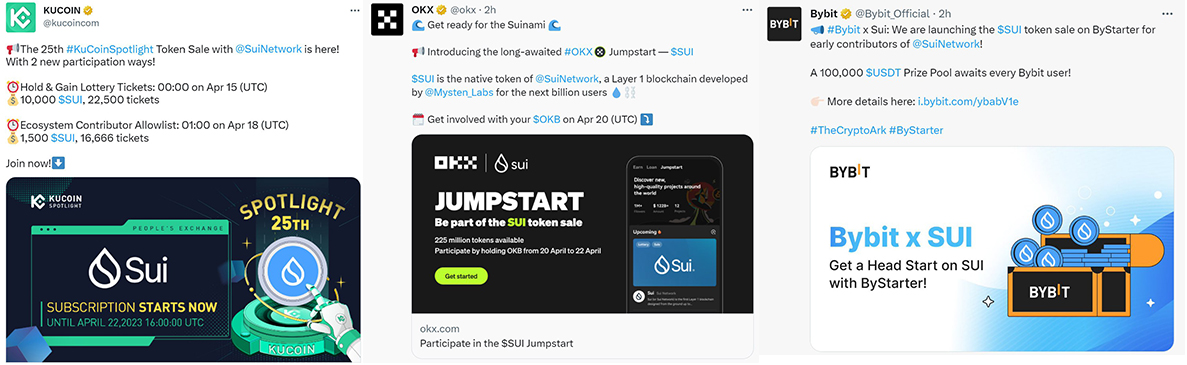

In April 2023, Sui initiated an early token sale on three prominent exchanges: Bybit, Kucoin, and OKX, offering tokens at prices ranging from $0.03 to $0.1. Users fortunate enough to secure slots in these sales experienced substantial profits. Tokens from projects within the Sui ecosystem have demonstrated impressive growth over the past 7 days. Users holding these tokens from their early stages are reaping significant rewards.

The NFT sector has also witnessed notable expansion within the Sui ecosystem. NFT projects highlighted by Theblock101 as having potential have shown substantial progress in the last 6 months. For instance, Fuddies has seen a remarkable increase from 94 $SUI to 408 $SUI, Cosmocadia has witnessed a rise from 34 $SUI to 129 $SUI, and Gommies has progressed from 24 $SUI to 97 $SUI.

3. Instructions for hunting retroactives on the Sui system

3.1. Experience the KriyaDEX DEX exchange

If you are holding $SUI on a centralized exchange (CEX), you can withdraw $SUI to either the Sui Wallet or Suiet wallet and then swap it to USDC on KriyaDEX. This will facilitate your engagement with this platform.

For those who do not currently possess $SUI, you can use USDC to deposit into the Sui Wallet and acquire $SUI through KriyaDEX.

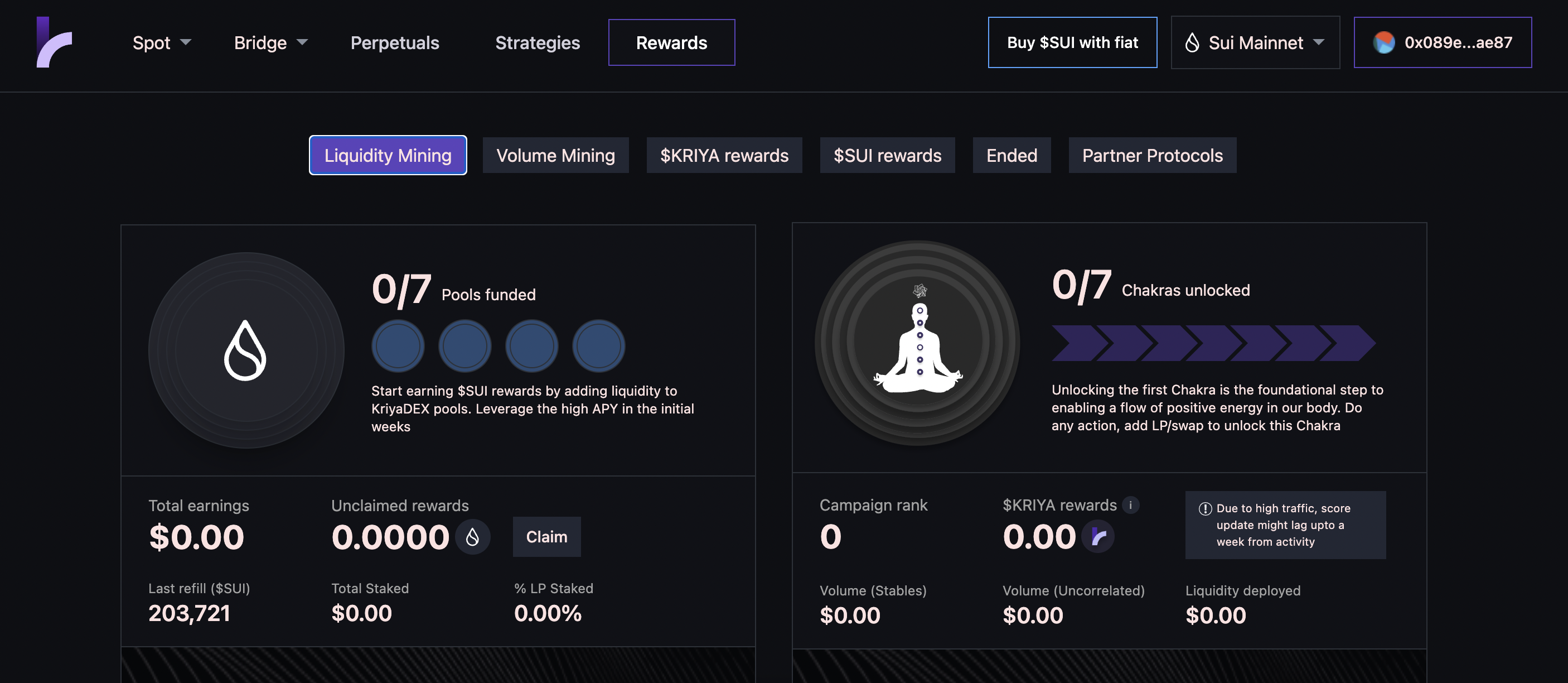

KriyaDEX is currently hosting two incentive programs designed to encourage user engagement:

-

Liquidity Mining Program

-

Volume Mining Program

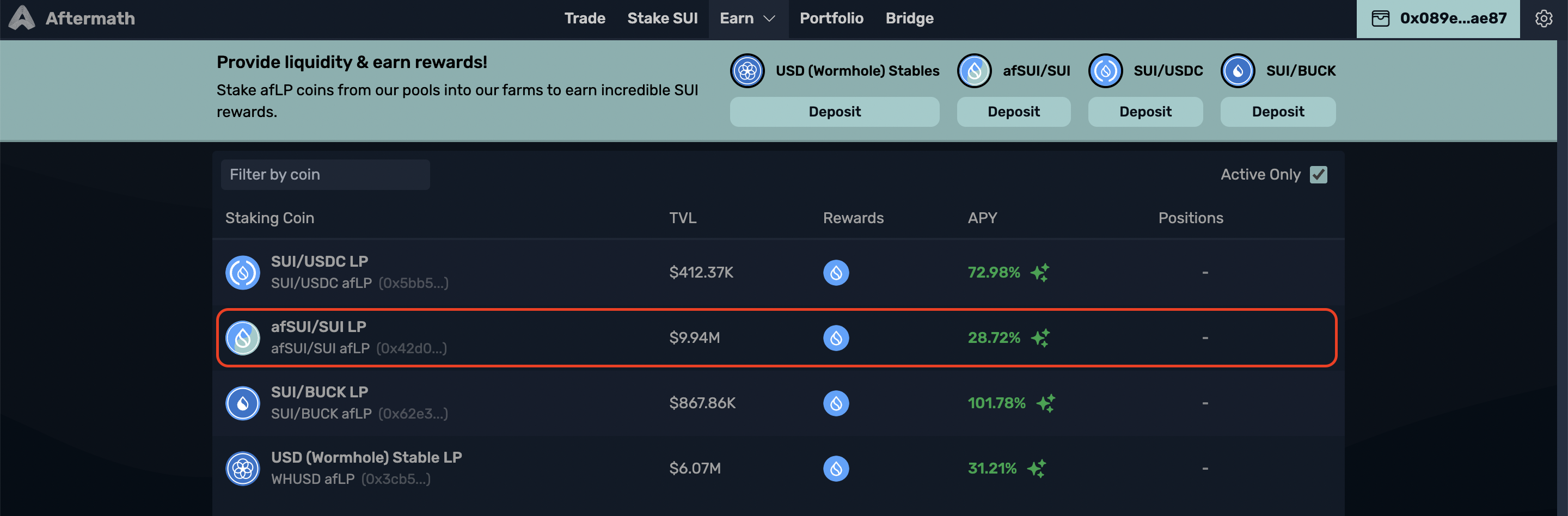

3.2. Experience the DEX Aftermath Finance exchange

You can extend your involvement in the Sui ecosystem by participating in Aftermath Finance, a decentralized exchange (DEX) supported by Mysten Labs. You have the opportunity to explore the Liquid Staking platform provided by Aftermath by following the acquisition of $SUI from KriyaDEX. To experience Aftermath, you initially need to deposit $SUI into Aftermath to receive $AfSUI. Subsequently, you can participate in farming the AfSUI/SUI pair without locking, yielding a 30% Annual Percentage Rate (APR). Opting to lock the assets for 11 days enhances the APR to 56%.

While other asset pairs may boast higher Annual Percentage Yields (APY), it's important to acknowledge the heightened risk associated with fluctuations in the exchange rates of each asset.

3.3. Participate in the airdrop program of the Lending Scallop project

The subsequent project worth exploring is Scallop. Originally developed on the Solana network, it has migrated to the Sui ecosystem and stands as the inaugural DeFi project to be awarded a grant by the Sui Foundation.

Scallop has structured its airdrop program into two distinct phases:

Phase 1: Participants earn rewards in the form of XP points, contingent upon various activities such as engagement with Zealy, assuming the Sui Scallop Role on Discord, and involvement in lending and borrowing activities on the platform.

Phase 2:

-

Lenders earn points by supplying assets valued at over $100 before Phase 2.

-

Borrowers accumulate points by borrowing assets worth more than $100 before Phase 2.

3.4. Experience the Lending Navi Protocol project

Navi Protocol has secured its position as the second-ranking lending project within the Sui ecosystem. Allocating a portion of your $SUI to lend on Navi Protocol presents an opportunity to potentially qualify for an airdrop.

The project currently elucidated its scoring mechanism for users on the platform. Lending amounts are specially stratified into distinct percentage groups, and each group is subsequently translated into corresponding activity points.

To enhance your point accumulation on Navi, consider implementing the following strategies:

-

Consistently claim rewards to bolster activity points.

-

Prolong your interaction duration by supplying more without immediate withdrawals.

-

Borrow more without immediate repayments to achieve outcomes akin to the second approach.

-

Contribute collateral assets to pools, such as vSui, Cetus, and wETH.

Important to note: The more extended your usage of Navi, the greater the accumulation of points, even for users with lower capital.

For a firsthand experience of Navi, deposit USDC into Navi to receive a 19% Annual Percentage Yield (APY). Subsequently, borrow $SUI with an APY of approximately 14%.

3.5. Experience Bluefin V2 exchange

Concluding our examination is Bluefin V2, the second version of the derivative decentralized exchange (DEX) developed on the Arbitrum network, boasting a commendable total transaction volume of 1 billion dollars.

Users have the prospect of participating in the trading program on Bluefin V2 until March 2024, providing an opportunity to partake in the distribution of rewards, constituting 6% of the total supply of the BLUE token - the native token of the platform.

Users are required to bridge USDC to their Sui Wallet through Wormhole and deposit funds into the Sui Wallet to initiate trading on Bluefin V2 to engage in this program. In terms of trading, users can open either long or short positions involving four asset types: ETH, BTC, SOL, and SUI, offering a chance to receive rewards from the exchange.

4. Conclusion

The article has elaborated on the strategy of retroactive engagement across five projects and exchanges within the Sui ecosystem. However, to secure rewards through retroactive participation, it is essential to adopt a genuine user perspective, placing emphasis on being an authentic participant in the project rather than overly fixating on reward acquisition. It’s also advised to maintain a composed mindset and exercise effective capital management when partaking in experiential activities associated with the project's product offerings.

Read more:

English

English Tiếng Việt

Tiếng Việt

.jpg)