1. What Is a Bitcoin Layer 2?

A Bitcoin Layer 2 refers to any off-chain network, system, or technology built on top of the Bitcoin blockchain to enhance its capabilities. Since Bitcoin’s launch in 2008, it has remained the largest cryptocurrency by market capitalization, becoming a cornerstone of the decentralized financial ecosystem. However, Bitcoin faces scalability challenges, including high transaction fees and congestion, especially during peak times.

With the rise of on-chain applications such as ordinals and BRC-20 tokens, these scalability issues have become more pronounced. As a result, there is an increasing demand for Bitcoin scaling solutions like Layer 2 networks, which provide alternative ways to increase transaction throughput, reduce fees, and enable more flexible functionalities like smart contracts.

2. How do Bitcoin Layer 2s work?

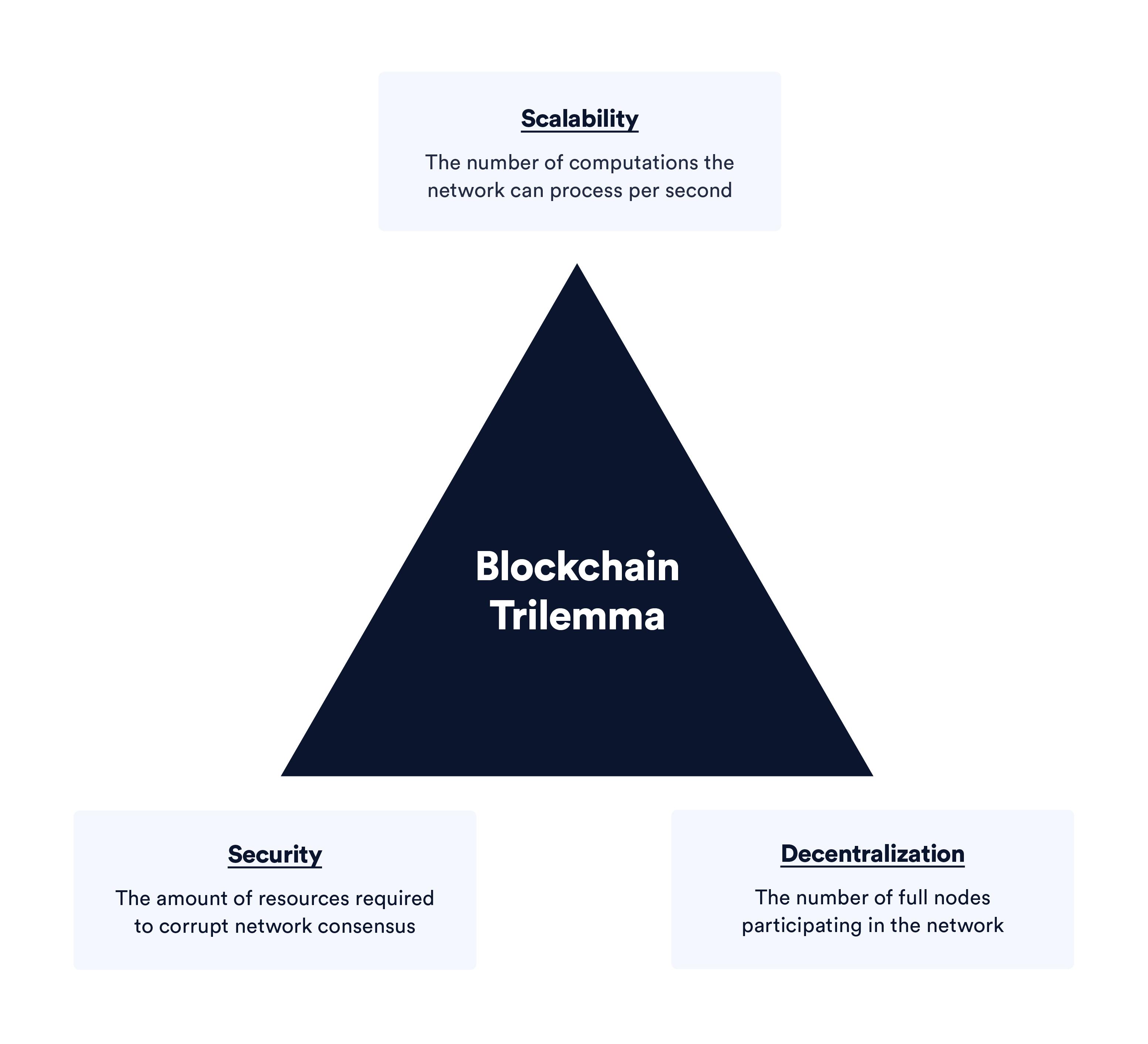

Bitcoin’s core blockchain is known for its security and decentralization, but it processes transactions slowly (about 7 transactions per second) and can become congested during high demand. Scaling Bitcoin directly would compromise either security or decentralization, so solutions like Layer 2 networks are being developed to address this.

A Bitcoin Layer 2 operates off-chain while still leveraging Bitcoin’s security. Transactions and data are handled off the main chain, which reduces congestion and increases scalability. However, when Layer 2 networks settle on the Bitcoin blockchain, they provide cryptographic proof to ensure integrity and security.

3. Types of Bitcoin Layer 2s

There are various types of Bitcoin scalability solutions, each with its unique approach to enhancing Bitcoin’s functionality.

-

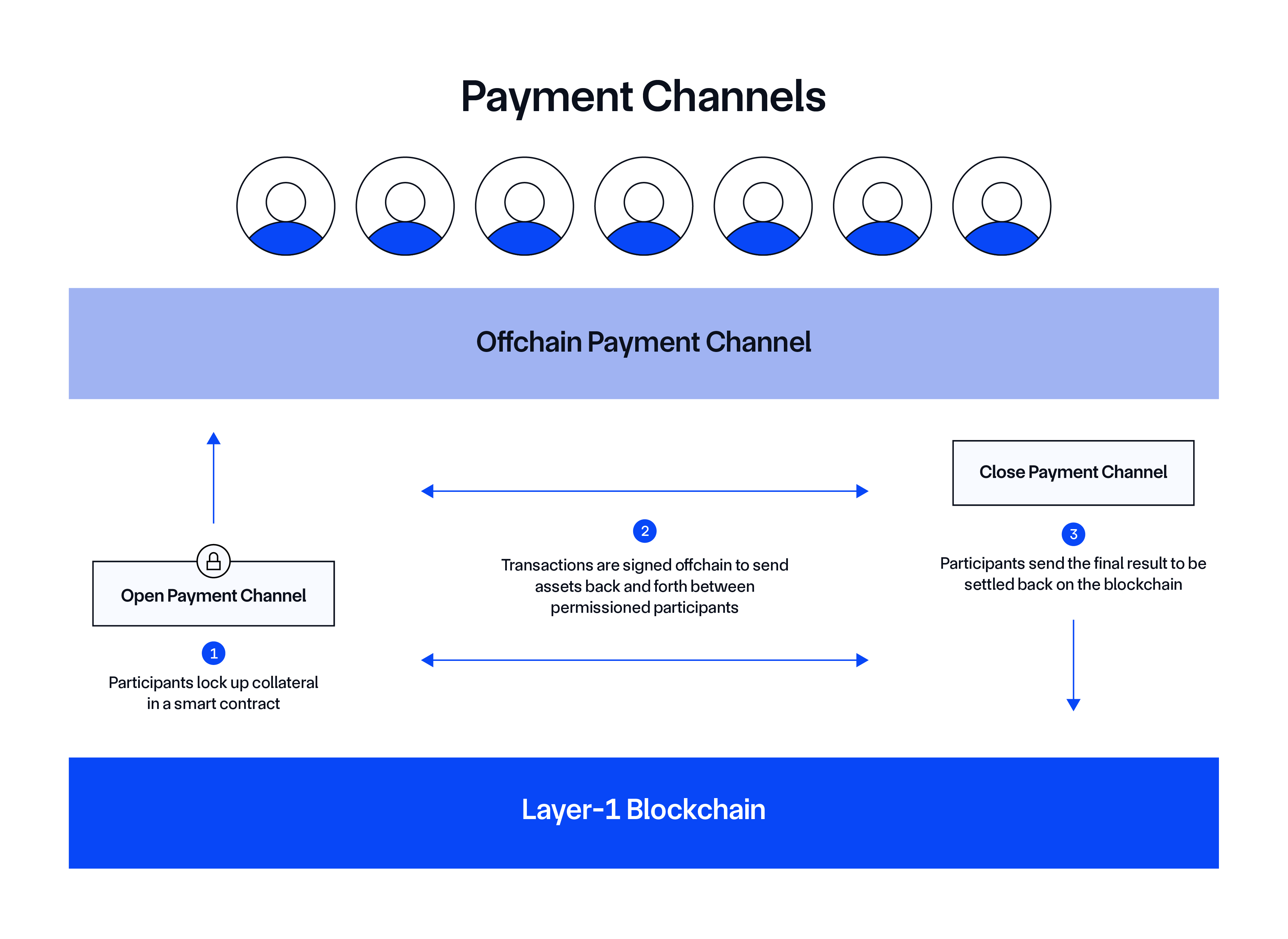

State Channels: State channels allow two parties to lock a set amount of Bitcoin in a multisig wallet to conduct off-chain transactions. These channels enable instant payments without paying Bitcoin’s mainnet fees for each transaction. The participants only broadcast the final state of their channel to the Bitcoin blockchain when they’re done. This is a more advanced version of payment channels used in the Bitcoin Lightning Network.

-

Sidechains: A sidechain is an independent blockchain that is linked to Bitcoin via a two-way peg, allowing the transfer of assets between the two chains. While sidechains have their own consensus mechanisms and validator sets, some may periodically settle transactions on the Bitcoin mainnet. Sidechains can also enable additional features, like faster transaction speeds and the use of smart contracts.

-

Rollups: Rollups move transaction execution off the main Bitcoin blockchain but still anchor data to Bitcoin for verification. Transactions are processed on a separate rollup chain and then compressed into a single cryptographic proof, which is submitted to the Bitcoin blockchain. This allows rollups to handle large batches of transactions while maintaining the security of the Bitcoin network.

4. Benefits of Bitcoin Layer 2s

Bitcoin Layer 2 networks offer several advantages:

-

Increased Scalability: By offloading transactions from the main Bitcoin blockchain, Layer 2s enhance Bitcoin’s transaction throughput and speed.

-

Reduced Transaction Fees: With fewer transactions processed directly on the Bitcoin network, fees are significantly lower, enabling use cases like micropayments that would be impractical on the mainnet.

-

Programmable Smart Contracts: Although Bitcoin wasn't initially designed for smart contracts, Layer 2 solutions enable these features, allowing developers to create complex decentralized applications (dApps) and financial instruments.

-

Improved Liquidity: Bitcoin Layer 2s increase liquidity and facilitate decentralized finance (DeFi) applications on Bitcoin, making it more accessible and capital-efficient.

As Layer 2s evolve, they promise to make Bitcoin more scalable, affordable, and functional, opening the door to more use cases and adoption.

5. Challenges of Bitcoin Layer 2 Solutions

While Bitcoin Layer-2 (L2) solutions offer significant scalability advantages, they also face several key challenges that need to be addressed for widespread adoption and effective integration with the Bitcoin ecosystem. These challenges primarily stem from technical limitations, security concerns, and operational inefficiencies.

- Secure Bridging Between Bitcoin and L2 Networks

One of the fundamental challenges for Bitcoin L2 solutions, especially sidechains, is the need for secure bridging between Bitcoin's mainchain and L2 networks. Bridges are used to lock assets on Bitcoin and issue equivalent tokens on the L2 chain. However, these bridges are often vulnerable to attacks, as seen in several high-profile cryptocurrency hacks. The security of cross-chain bridges remains a significant concern, with vulnerabilities allowing hackers to exploit flaws and steal funds, undermining user trust and the overall security of the system.

- Speed and Cost of Settling on the Bitcoin Network

Although L2 solutions process transactions off-chain, they still need to settle the final state on the Bitcoin mainchain. The time and cost required to settle these transactions on Bitcoin’s base layer can be a bottleneck for L2 solutions. Bitcoin’s transaction finality takes about 10 minutes per block, and with limited throughput, this settlement process can become slow and costly, particularly during periods of high network congestion. Optimizing the speed and reducing the cost of settling L2 transactions on Bitcoin is critical to improving the overall efficiency of Bitcoin L2 solutions.

- Maintaining Security Without Direct Bitcoin Validation

Unlike Ethereum L2 solutions, which typically rely on Ethereum’s validators to verify transactions, Bitcoin L2 solutions do not directly inherit security from Bitcoin’s base layer. Bitcoin L2 networks must rely on their own security protocols to validate transactions, which can result in security risks. This is particularly challenging when trying to replicate Bitcoin’s high level of security on L2 networks. Ensuring the integrity of transactions on Bitcoin L2s while maintaining the same security standards as the Bitcoin mainchain is a delicate balance.

- Increased Centralization Risks

Some Bitcoin L2 solutions, such as payment channels or networks with relay nodes, may inadvertently introduce centralization risks. For example, certain L2 systems might require a small number of entities to run the consensus mechanism or maintain the relay infrastructure. This concentration of control can undermine the decentralization ethos of Bitcoin and create a single point of failure, reducing the system’s resilience and security. Mitigating these risks requires designing decentralized mechanisms that distribute control and power across a broad network of participants.

- Technical Complexities and Integration Challenges

Integrating Bitcoin L2 solutions with the existing Bitcoin infrastructure presents significant technical hurdles. These include ensuring compatibility with the Bitcoin protocol, maintaining high-security standards, and achieving consensus within the Bitcoin community on proposed upgrades and changes. As the Bitcoin ecosystem evolves, the integration of L2 solutions must be done in a way that aligns with Bitcoin’s decentralized and secure nature, which often requires navigating disagreements and technical debates within the community.

6. Bitcoin Layer 2 vs. Ethereum Layer 2

Both Bitcoin and Ethereum face scalability issues, leading to the development of Layer-2 (L2) solutions that extend the capabilities of each network while maintaining the security of the base layer. Though their ultimate goal is similar—enhancing scalability without modifying the core blockchain—Bitcoin and Ethereum Layer 2s differ significantly in how they are implemented. This divergence stems from the distinct purposes and designs of Bitcoin and Ethereum themselves.

6.1 Bitcoin Layer 2 Solutions

Bitcoin, the world’s first decentralized cryptocurrency, was primarily designed as a store of value and a secure, censorship-resistant digital currency. Its limited transaction throughput (around 7 transactions per second) makes it less practical for everyday transactions, especially during periods of high demand. Bitcoin Layer-2 solutions, such as state channels, sidechains, and rollups, aim to solve these scalability issues by offloading transactions from the Bitcoin mainchain while still benefiting from its security.

Bitcoin Layer 2s include:

-

State Channels: Enable fast, off-chain transactions with only the opening and closing balance being recorded on the Bitcoin blockchain.

-

Sidechains: Independent blockchains pegged to Bitcoin, allowing asset transfers between Bitcoin and other chains.

-

Rollups: Transactions are processed off-chain, but proofs are periodically posted to the Bitcoin main chain to ensure security and consensus.

These solutions enable Bitcoin to scale while maintaining its strong security features, making it a more viable option for a broader range of use cases.

6.2 Ethereum Layer 2 Solutions

Ethereum, on the other hand, is designed as a platform for decentralized applications (dApps) and smart contracts. Unlike Bitcoin, Ethereum is intended for more complex use cases, including decentralized finance (DeFi), token issuance, and NFT markets. Ethereum’s scalability challenges stem from high gas fees and slower transaction speeds as the network becomes congested.

Ethereum Layer-2 solutions, such as Optimistic Rollups, zk-Rollups, and Plasma, aim to offload transaction processing from Ethereum’s base layer, improving throughput and reducing fees. Ethereum’s Layer 2 ecosystem is more focused on enabling complex smart contract functionality, decentralized finance, and other advanced applications.

Ethereum Layer 2s include:

-

Optimistic Rollups: Use optimistic assumptions about transaction validity, reducing the need for computational resources to check each transaction.

-

zk-Rollups: Use zero-knowledge proofs to efficiently verify batches of transactions, ensuring scalability and security.

-

Plasma: A framework that allows for the creation of child chains that handle transactions off the main Ethereum chain.

Ethereum's focus on complex applications requires Layer-2 solutions that offer programmability, while Bitcoin Layer-2 solutions prioritize simplicity and scalability.

7. Conclusion

Bitcoin Layer 2 solutions represent a critical evolution in addressing the scalability and efficiency challenges of the Bitcoin network. By enabling faster transactions, reducing costs, and introducing functionalities like smart contracts, these off-chain solutions expand Bitcoin's potential beyond its original design as a store of value.

Despite their advantages, Bitcoin Layer 2 technologies still face challenges such as secure bridging, settlement delays, and risks of centralization. Overcoming these hurdles will be essential for their widespread adoption and long-term viability.

Read more:

English

English Tiếng Việt

Tiếng Việt.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)