1. What are ColorTrace and Color Fungible Asset?

1.1. What is ColorTrace?

ColorTrace is a technological solution from LayerZero, empowers entities to mint assets, each uniquely associated with a specific "color." These minted assets inherit the color of the entity, providing a distinctive series number to differentiate assets minted by different entities.

1.2. What is Color Fungible Asset?

The ColorTrace protocol introduces a concept known as Color Fungible Assets, denoting the assets minted through the protocol.

Color Fungible Asset involves assigning a unique series number to stablecoins produced, using a specific "color" identification. Each participant engaged in the minting process receives a distinct color, facilitating the tracking of origin and assessment of the value of individual stablecoin units.

As exemplified in Coinbase's ColorTrace system, individual units of the USDV stablecoin could be associated with a specific color. When users opt to convert their USDV stablecoins back into USD or other collateralized assets, they incur a transaction fee. A portion of this fee is then allocated back to Coinbase, serving as a reward for the development and upkeep of their ecosystem.

Color Fungible Asset is an innovative approach to make each unit of stablecoin unique and easily traceable during transactions and conversions.

2. Why was ColorTrace created?

The inception of ColorTrace addresses a historical challenge associated with distinguishing individual units of stablecoins such as USDT and USDC. This distinction was intricate. ColorTrace introduces a system wherein each minted stablecoin unit is assigned a unique color and serial number, enhancing clarity in identification.

Significance of this Innovation:

Large organizations often face challenges when they intend to utilize stablecoins and need to acquire substantial quantities directly from exchanges. They engage with companies like Tether or Circle for over-the-counter (OTC) transactions. These entities mint stablecoins at no cost, but when users decide to convert them back into fiat currency or collateral assets, fees are incurred.

Given Tether USD's revenue exceeding $1 billion in Q3, profit-sharing from units like USDT and USDC holds substantial importance. While major entities like Binance and Coinbase receive a share, many contributors to stablecoin development do not partake in profit-sharing.

ColorTrace resolves this issue by assigning a unique color to each stablecoin unit. During conversion to fiat currency or collateral assets, the project can distribute profits equitably and transparently based on the color code. This not only introduces differentiation and flexibility in stablecoin management but also optimizes information retrieval and enhances community engagement effectively.

3. ColorTrace application

The implementation of ColorTrace for stablecoins, potentially extending to Fungible Tokens and Non-Fungible Tokens, allows for better tracking and management of contributed units supporting a project. Consequently, the allocation of support rewards and revenue sharing becomes more straightforward and equitable.

This introduces a novel referral method, eliminating the need for referral links and relying solely on tokens.

4. ColorTrace applied projects

The project USDV Money, introduced by LayerZero, stands as the pioneering initiative utilizing ColorTrace technology to issue the $USDV stablecoin. The operational mechanism of $USDV is underpinned by real-world assets (RWA) such as bonds, the Dollar, and even crypto market assets like USDT, USDC.

The project may expand and accept a broader range of collateralized assets for USDV, with each unit being assigned a unique color. The $USDV tokens minted will also exhibit distinct colors and series numbers.

The process of redeeming stablecoins back to their original assets incurs a transaction fee, and a portion of the profits generated by USDV is distributed among the issuers of USDV.

The conversion of USDV into cryptocurrency is exclusively facilitated through another stablecoin, specifically 3CRV's $STBT. The exchange ratio is set at 100 USDV = 99.9 STBT, resulting in a 0.1% redemption fee.

A parallel fee is levied when redeeming back into Real World Assets (RWA).

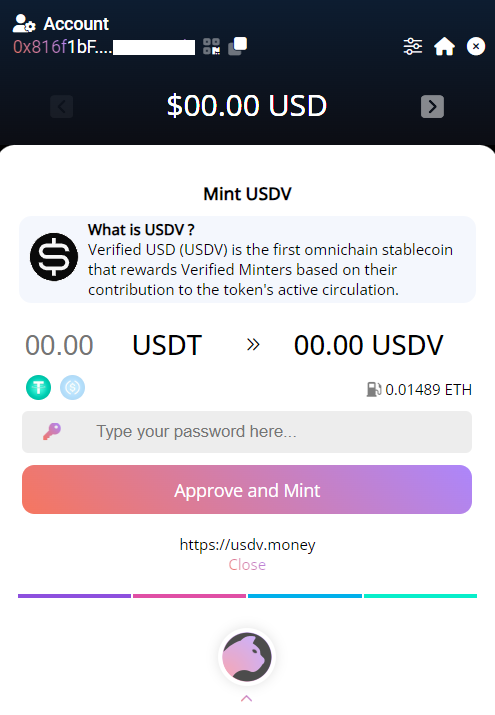

USDV, since its inception, is compatible with five blockchain networks: Ethereum, Arbitrum, Optimsm, Avalanche, and BnBChain. The Reunit wallet on these five networks must be employed to mint USDV using cryptocurrency assets, with collateral restricted to USDT and USDC.

Instructions for minting USDV:

Step 1: Deposit gas fees into your account, using a cost-effective chain like Arbitrum or Optimsm. Then deposit the desired amount of stablecoins, either USDT or USDC, depending on the chosen network for gas payment.

Step 2: On the wallet's main menu, select "Mint."

Step 3: Enter the quantity, input the password, and initiate the minting process.

If you wish to transfer USDV across different networks upon completion of minting, you can utilize the Stargate bridge or bridge directly within the Reunit wallet. The bridging procedure aligns with other asset types.

4. Conclusion

ColorTrace serves as a pivotal tool for managing and equitably distributing profits among contributors in the ecosystem, notably the $USDV stablecoin. ColorTrace stimulates community participation and project development by employing its profit-sharing mechanism. It brings fundamental blockchain values to a project: decentralization, fairness, transparency, and more. This model can be applied to various project types beyond stablecoins. Stay tuned for LayerZero's development and the evolution of products like Omnichain and ColorTrace.

Read more:

English

English Tiếng Việt

Tiếng Việt